King Washington Accredited Investor Verification Letter is a document designed to validate the status of an individual or entity as an accredited investor. The term "accredited investor" refers to an individual or entity that meets specific criteria set by the Securities and Exchange Commission (SEC) in the United States, allowing them to invest in certain securities that may not be available to non-accredited investors. This letter is often requested by investment opportunities, such as private placements, hedge funds, or venture capital firms, to ensure compliance with SEC regulations and protect all parties involved. The King Washington Accredited Investor Verification Letter serves as a proof of accreditation and provides necessary information to confirm an investor's eligibility. It includes various key elements such as the investor's name, address, contact details, and endorsement of their accredited status. The document typically states that the investor has met the income, net worth, or professional qualification requirements set by the SEC. Different types of King Washington Accredited Investor Verification Letters may vary based on the particular accreditation standards applied. Common categories include: 1. Income Verification Letter: This type of letter confirms an investor's eligibility based on their annual income. To qualify as an accredited investor through income verification, an individual needs to demonstrate a consistent income level surpassing a certain threshold, such as $200,000 per year for individuals or $300,000 for joint filers. 2. Net Worth Verification Letter: This type of letter verifies an investor's qualification based on their net worth. To be considered accredited through net worth verification, an individual or joint applicants must showcase a net worth exceeding $1 million (excluding the value of their primary residence) or have an individual income of at least $200,000 in the most recent two years with the expectation of reaching the same level in the current year. 3. Professional Verification Letter: This type of letter validates an individual's accredited investor status based on their professional experience, certifications, or licenses. Certain professions, like lawyers, doctors, or accountants, may qualify as accredited investors due to their specialized knowledge or expertise. 4. Entity Verification Letter: This category encompasses letters issued to verify an entity's accreditation, such as corporate entities, partnerships, limited liability companies (LCS), or trusts. The letter verifies that the entity meets the necessary qualifications for an investment opportunity. It is crucial to note that the specifications of the King Washington Accredited Investor Verification Letter may differ based on applicable regulations, jurisdictions, or legal requirements. Thus, it is advisable to consult legal and financial professionals for customized and accurate verification letters to ensure compliance with the relevant laws and regulations.

King Washington Accredited Investor Verification Letter

Description

How to fill out King Washington Accredited Investor Verification Letter?

Preparing legal paperwork can be burdensome. In addition, if you decide to ask a legal professional to write a commercial contract, documents for proprietorship transfer, pre-marital agreement, divorce paperwork, or the King Accredited Investor Verification Letter, it may cost you a lot of money. So what is the best way to save time and money and draw up legitimate documents in total compliance with your state and local regulations? US Legal Forms is a perfect solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is biggest online collection of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any use case accumulated all in one place. Therefore, if you need the latest version of the King Accredited Investor Verification Letter, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the King Accredited Investor Verification Letter:

- Glance through the page and verify there is a sample for your area.

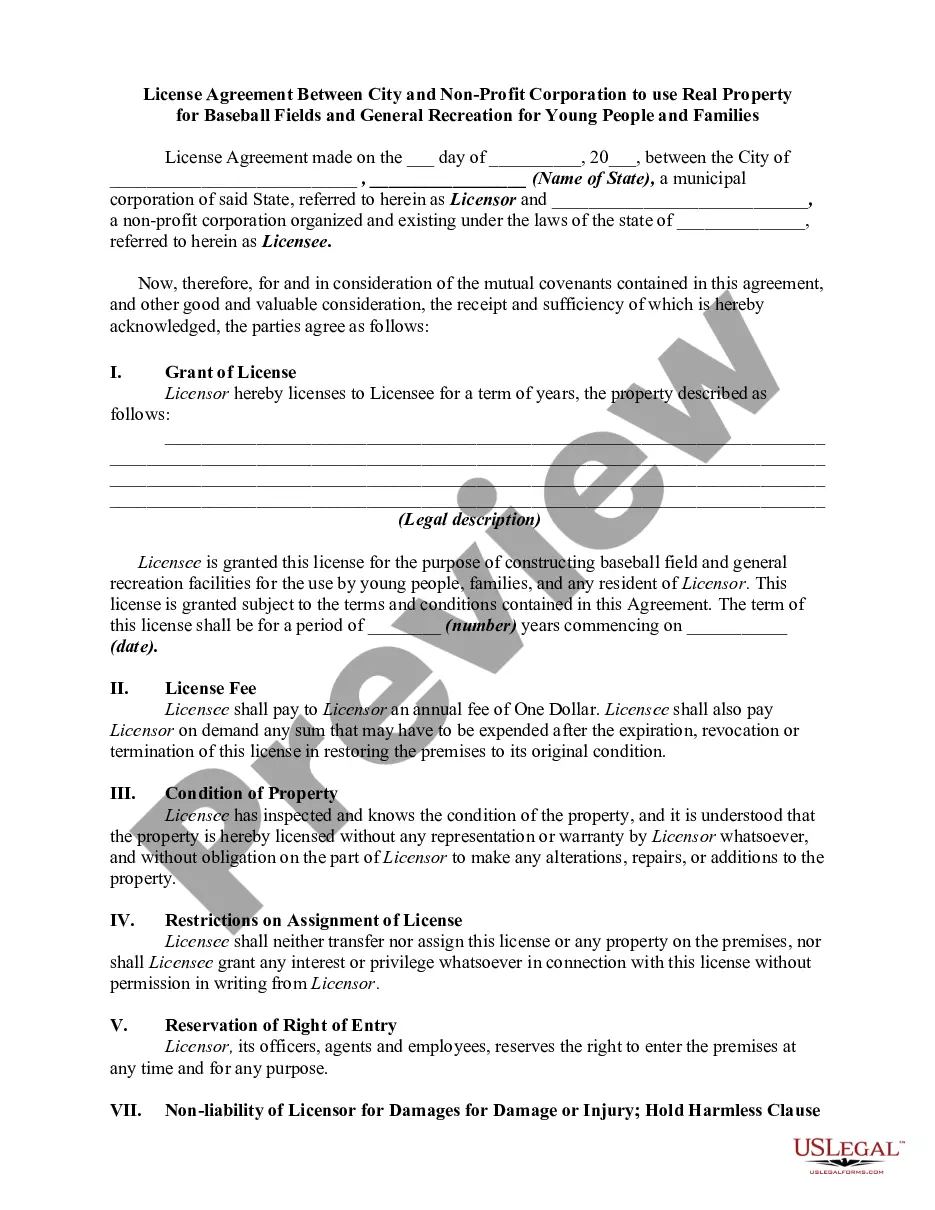

- Examine the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - search for the right one in the header.

- Click Buy Now once you find the required sample and select the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a transaction with a credit card or via PayPal.

- Choose the file format for your King Accredited Investor Verification Letter and save it.

Once finished, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the paperwork ever purchased multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!