Montgomery County, located in the state of Maryland, is recognized for its thriving business environment and vibrant investment opportunities. As part of the investment process, the Montgomery Maryland Accredited Investor Verification Letter plays a crucial role in verifying an individual's eligibility to participate in certain investment opportunities or financial transactions. An Accredited Investor Verification Letter is a formal document issued by an authorized entity or financial institution that certifies an individual's status as an accredited investor. This letter serves as confirmation that the investor meets specific criteria set forth by the U.S. Securities and Exchange Commission (SEC) to engage in certain investments that are typically reserved for individuals with a higher net worth or extensive investment experience. The letter often includes detailed information about the investor's financial background, such as their income, net worth, and professional experience in managing financial matters. It aims to provide reliable evidence that the investor meets one or more of the SEC's accredited investor requirements, including: 1. Income Criteria: This type of verification letter confirms that the investor has an annual income exceeding a specific threshold, such as $200,000 for individuals or $300,000 for married couples. This income level demonstrates the investor's ability to bear the potential risks associated with higher-risk investment opportunities. 2. Net Worth Criteria: Another type of verification letter focuses on an investor's net worth, verifying that they possess a certain level of financial assets or liabilities. Typically, this criterion requires an individual's net worth to exceed $1 million, excluding the value of their primary residence. These two main types of Montgomery Maryland Accredited Investor Verification Letters are often requested by individuals seeking to invest in private equity, venture capital, hedge funds, real estate syndication, and other investment opportunities traditionally restricted to accredited investors. By providing proof of their accredited investor status, individuals can gain access to exclusive investment opportunities that may offer potentially higher returns. It is important to note that the content of the Accredited Investor Verification Letters may vary depending on the requirements of the issuing entity or financial institution. Some additional information that might be included in the letter could be the investor's contact details, the name of the issuing authority, a statement regarding the purpose of the letter, and any other relevant details to facilitate the verification process. Ultimately, the Montgomery Maryland Accredited Investor Verification Letter serves as a valuable document for investors looking to pursue potentially lucrative investment opportunities. It provides the necessary proof of an individual's accredited investor status, allowing them to engage in exclusive financial transactions and capitalize on Montgomery County's thriving investment landscape.

Montgomery Maryland Accredited Investor Verification Letter

Description

How to fill out Montgomery Maryland Accredited Investor Verification Letter?

How much time does it normally take you to create a legal document? Because every state has its laws and regulations for every life scenario, finding a Montgomery Accredited Investor Verification Letter meeting all regional requirements can be exhausting, and ordering it from a professional lawyer is often costly. Many online services offer the most common state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive online catalog of templates, collected by states and areas of use. Aside from the Montgomery Accredited Investor Verification Letter, here you can get any specific form to run your business or personal deeds, complying with your county requirements. Specialists verify all samples for their actuality, so you can be sure to prepare your documentation properly.

Using the service is remarkably simple. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the required form, and download it. You can get the file in your profile at any moment in the future. Otherwise, if you are new to the platform, there will be a few more steps to complete before you get your Montgomery Accredited Investor Verification Letter:

- Examine the content of the page you’re on.

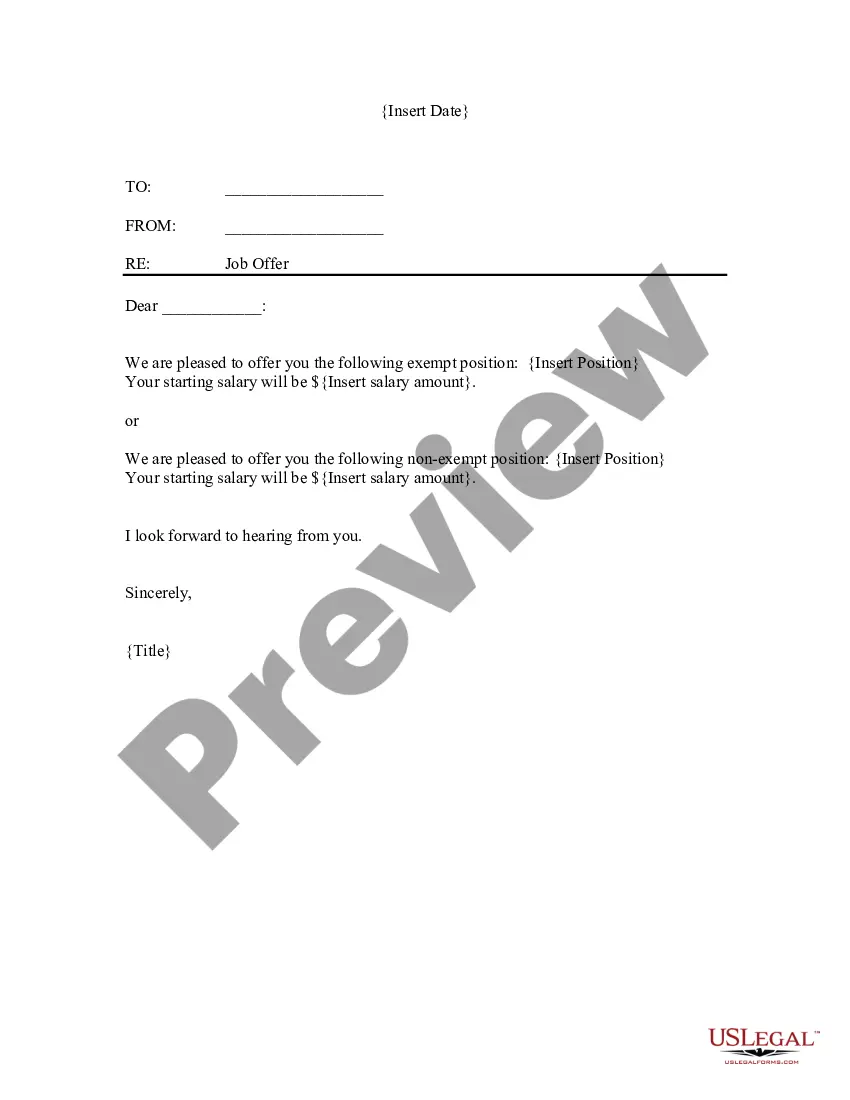

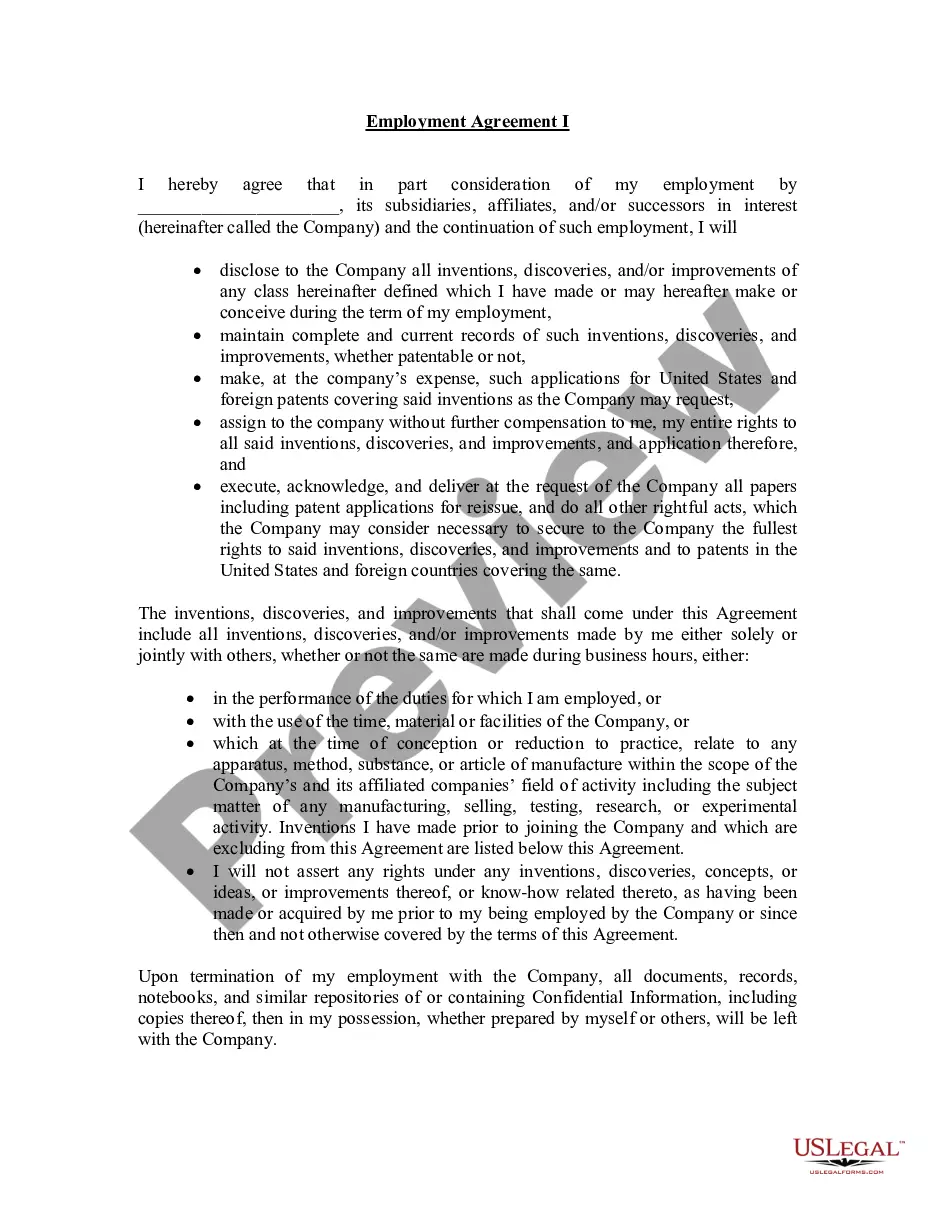

- Read the description of the template or Preview it (if available).

- Search for another form using the corresponding option in the header.

- Click Buy Now once you’re certain in the chosen file.

- Select the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Montgomery Accredited Investor Verification Letter.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired document, you can locate all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!