Title: Chicago Illinois Documentation Required to Confirm Accredited Investor Status: A Comprehensive Guide Keywords: Chicago Illinois, documentation, accredited investor, requirements, types Introduction: Understanding the accreditation process for investors in Chicago, Illinois is crucial for those seeking to participate in certain investment opportunities. This guide will provide a detailed description of the documentation required to confirm accredited investor status, enabling individuals to navigate the process effectively. 1. Personal Identification: To confirm accredited investor status, individuals are typically required to submit specific personal identification documents. These may include a valid government-issued ID such as a driver's license, passport, or social security card. Proof of residency in Chicago, Illinois, through utility bills or lease agreements, may also be requested. 2. Income Verification Documentation: One of the primary requirements for accredited investor status is meeting certain income thresholds. Documentation related to income verification may include: a) W-2 Forms: Providing recent W-2 forms can validate an individual's earning potential. These documents demonstrate consistent income and can support accredited investor status. b) Tax Returns: Submitting copies of recent tax returns provides a comprehensive overview of an individual's income, allowing for assessment and confirmation of accredited investor status. c) Pay Stubs: Presenting recent pay stubs validates current employment and income status. This documentation helps assess an individual's financial ability to participate in specific investment opportunities. 3. Net Worth Documentation: Another criterion to determine accredited investor status is based on an individual's net worth. Documentation validating net worth may include: a) Bank Statements: Provide.

Chicago Illinois Documentation Required to Confirm Accredited Investor Status

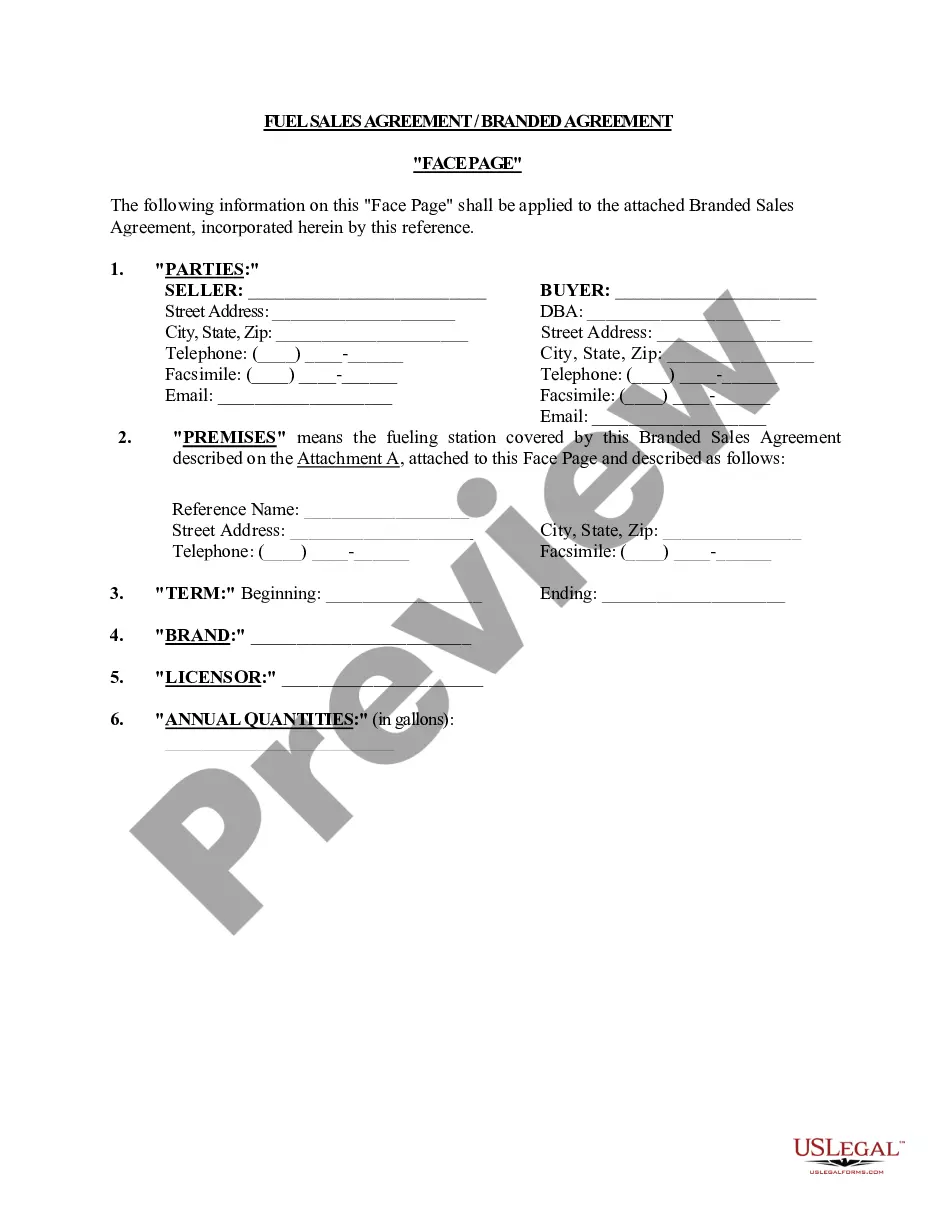

Description

How to fill out Chicago Illinois Documentation Required To Confirm Accredited Investor Status?

Laws and regulations in every sphere vary from state to state. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal documents. To avoid costly legal assistance when preparing the Chicago Documentation Required to Confirm Accredited Investor Status, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal forms. It's a perfect solution for professionals and individuals looking for do-it-yourself templates for various life and business scenarios. All the documents can be used many times: once you pick a sample, it remains available in your profile for subsequent use. Thus, if you have an account with a valid subscription, you can simply log in and re-download the Chicago Documentation Required to Confirm Accredited Investor Status from the My Forms tab.

For new users, it's necessary to make several more steps to get the Chicago Documentation Required to Confirm Accredited Investor Status:

- Take a look at the page content to ensure you found the right sample.

- Take advantage of the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to get the template when you find the correct one.

- Choose one of the subscription plans and log in or create an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Fill out and sign the template on paper after printing it or do it all electronically.

That's the simplest and most cost-effective way to get up-to-date templates for any legal reasons. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!