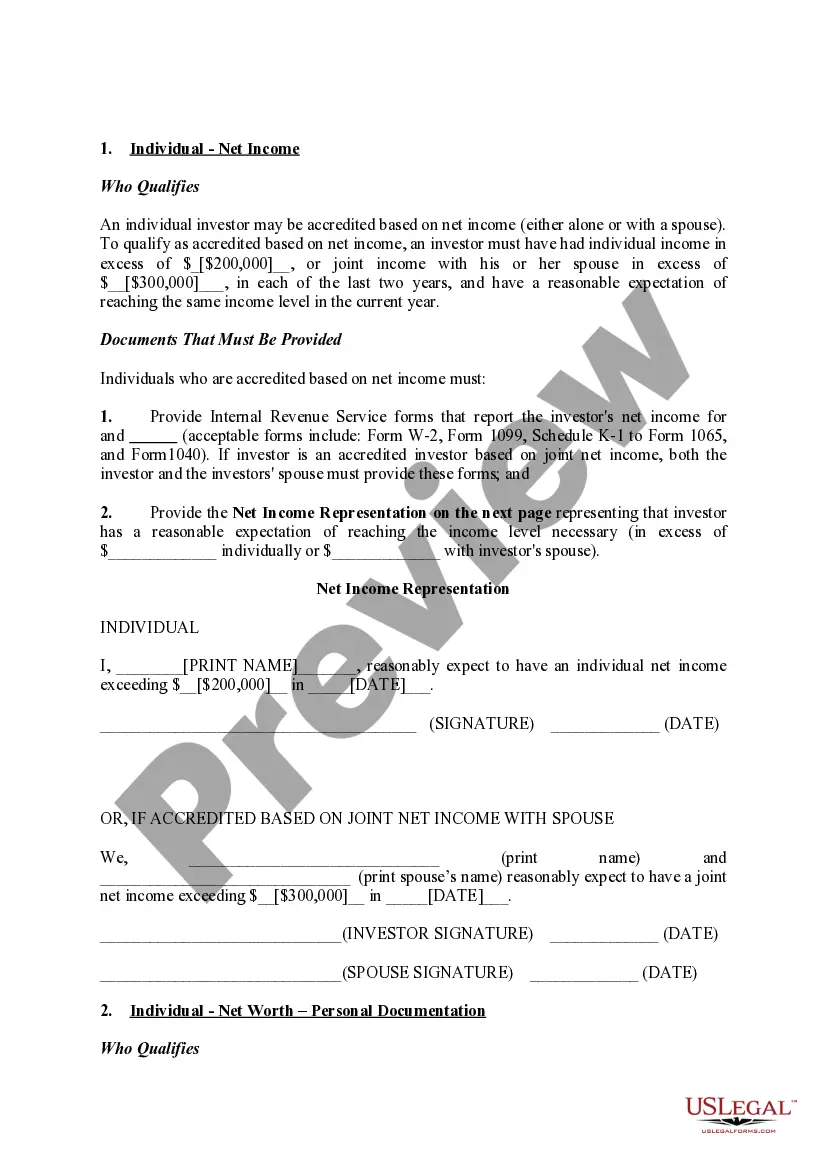

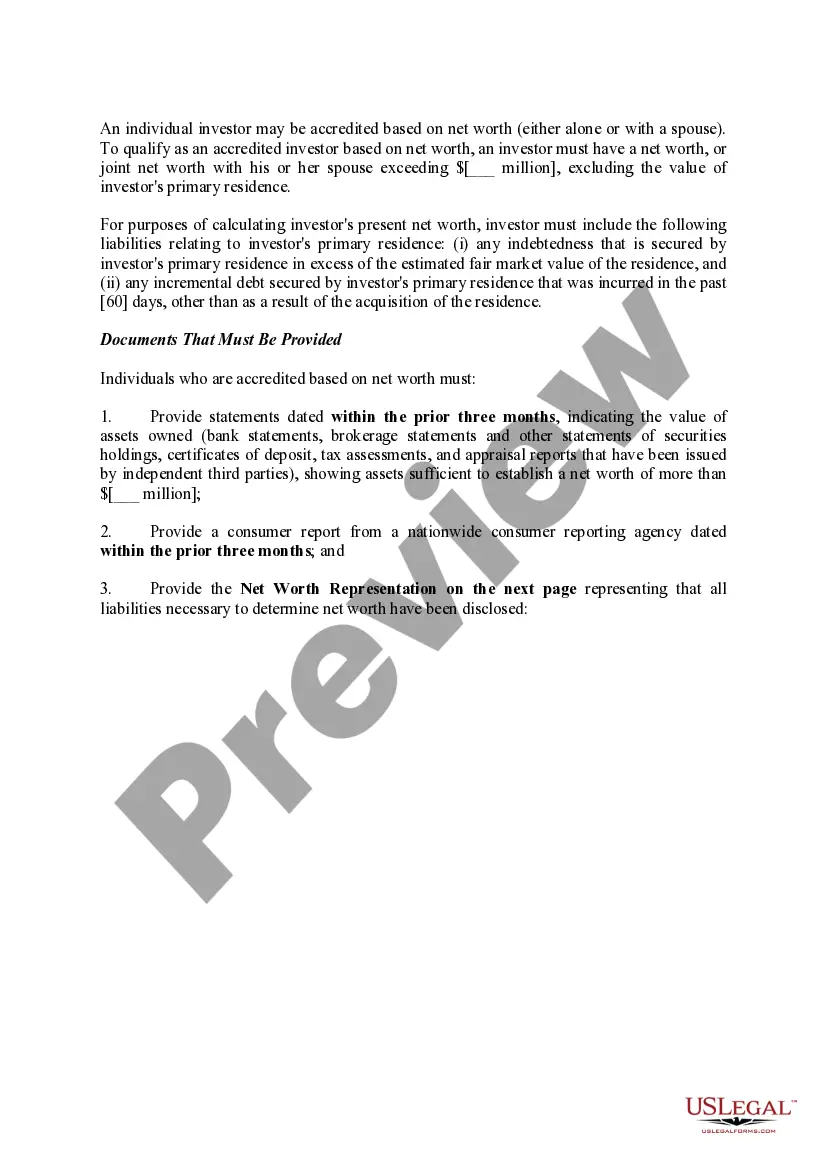

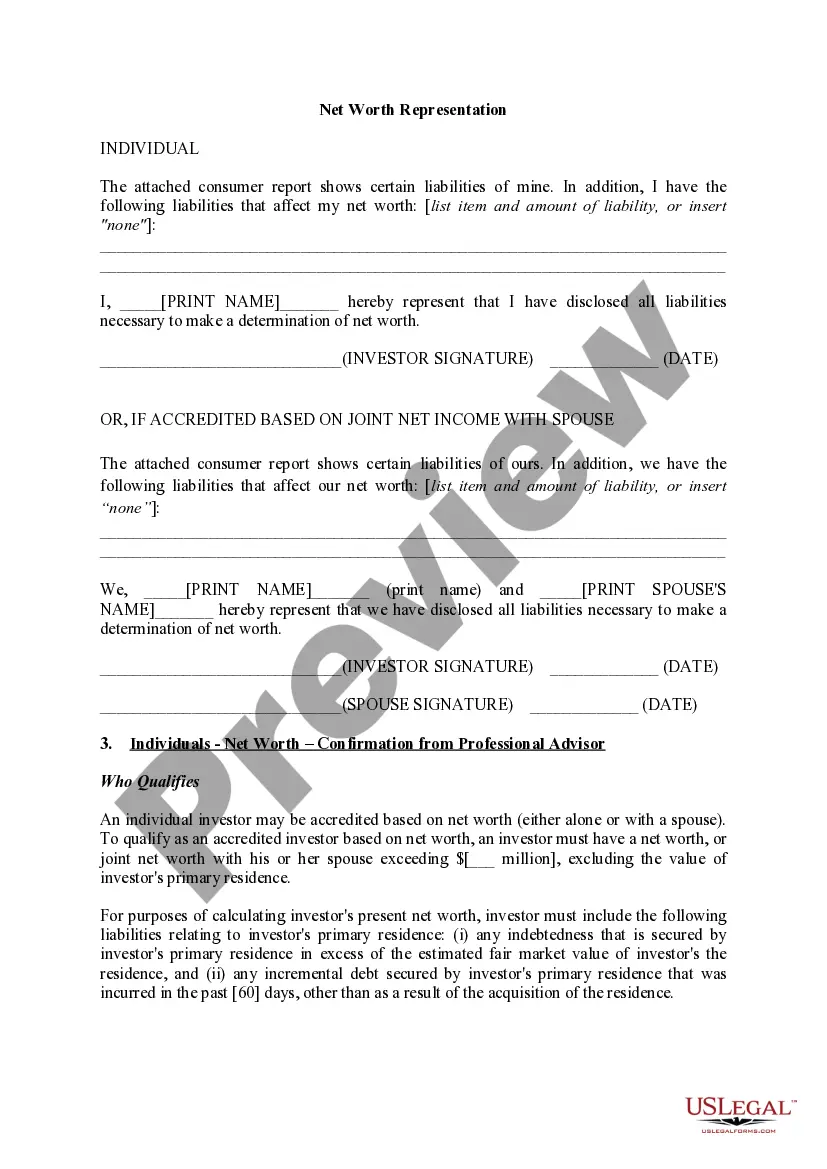

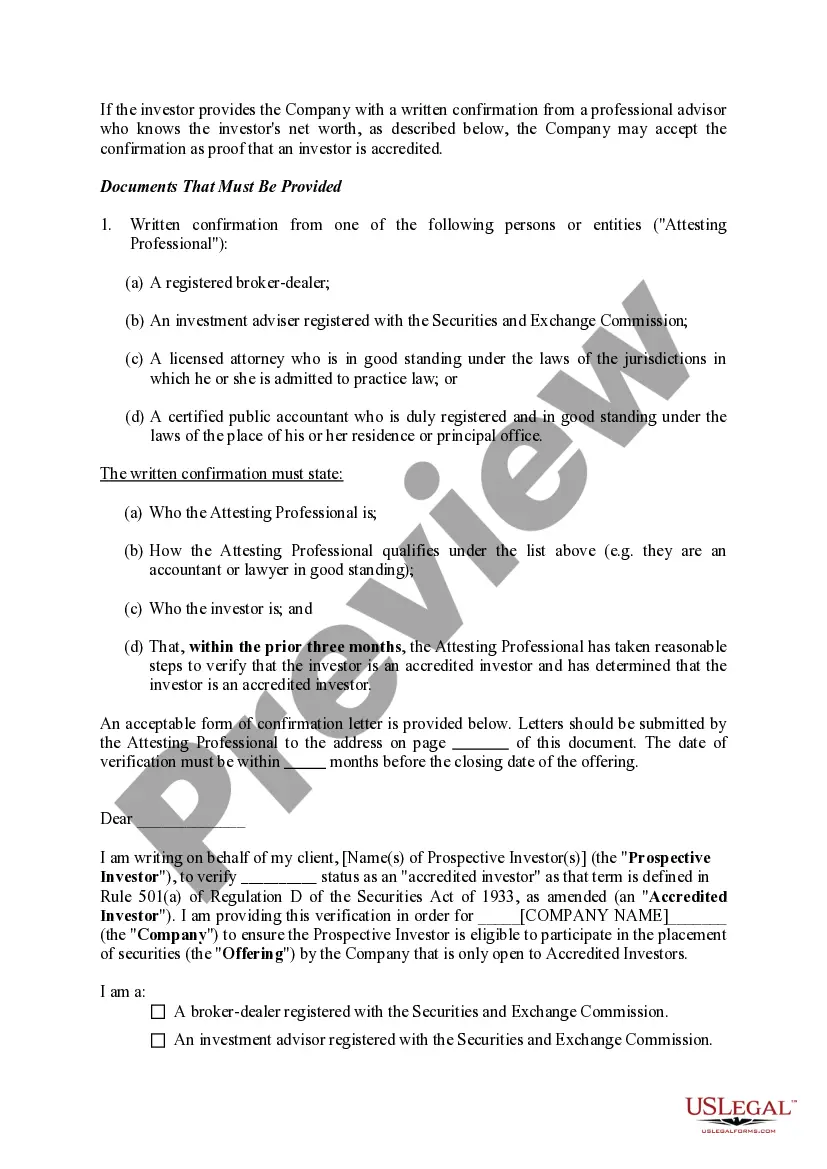

Title: Contra Costa California: Documentation Required to Confirm Accredited Investor Status Introduction: Understanding the documentation required to confirm accredited investor status in Contra Costa County, California is crucial for individuals seeking to participate in private investments and access exclusive investment opportunities. This article will provide a detailed description of the necessary documentation, ensuring compliance with securities regulations while facilitating investment opportunities. I. What is an Accredited Investor? An accredited investor, as defined by the U.S. Securities and Exchange Commission (SEC), is an individual or entity that meets specific criteria outlined to participate in certain investment offerings, typically those restricted to high-net-worth individuals or sophisticated investors. II. Documentation Requirements for Accredited Investor Status: To confirm accredited investor status in Contra Costa County, California, individuals must provide the following documentation: 1. Net Income and Net Worth Documentation: Prospective investors may need to provide financial statements, tax returns, or bank statements to demonstrate their net income or net worth. The net worth threshold for an accredited investor is typically set at $1 million or more, excluding the value of their primary residence. 2. Income Verification: Proof of income, such as W-2 forms, pay stubs, or other relevant documents, may be required to validate an individual's annual income. Accredited investors must have an individual income exceeding $200,000 (or joint income exceeding $300,000) for the last two years with a reasonable expectation of maintaining the same level of income in the current year. 3. Professional Certifications: Certain professional certifications, such as Certified Public Accountant (CPA), Chartered Financial Analyst (CFA), or Series 7 or 65 licenses, may also be considered when confirming accredited investor status. These certifications can indicate a level of expertise and sophistication in financial matters. 4. Business Verification: If an individual seeks accredited investor status based on their ownership in a business entity or partnership, supporting documentation like financial statements, tax returns, and partnership agreements may be necessary to establish their eligibility. 5. Accredited Investor Questionnaire: Investment platforms or firms may require prospective investors to complete an accredited investor questionnaire, which may encompass specific questions about finances, investments, and risk tolerance. This questionnaire helps verify an individual's understanding of investment risks and compliance with regulations. III. Conclusion: Contra Costa County residents aspiring to become accredited investors should gather and organize the required documentation to confirm their eligibility. Providing accurate and complete information ensures compliance with securities regulations and opens doors to a wide range of exclusive investment opportunities. Consulting with a qualified financial advisor or legal professional can help guide individuals through the process and ensure adherence to applicable laws and regulations.

Contra Costa California Documentation Required to Confirm Accredited Investor Status

Description

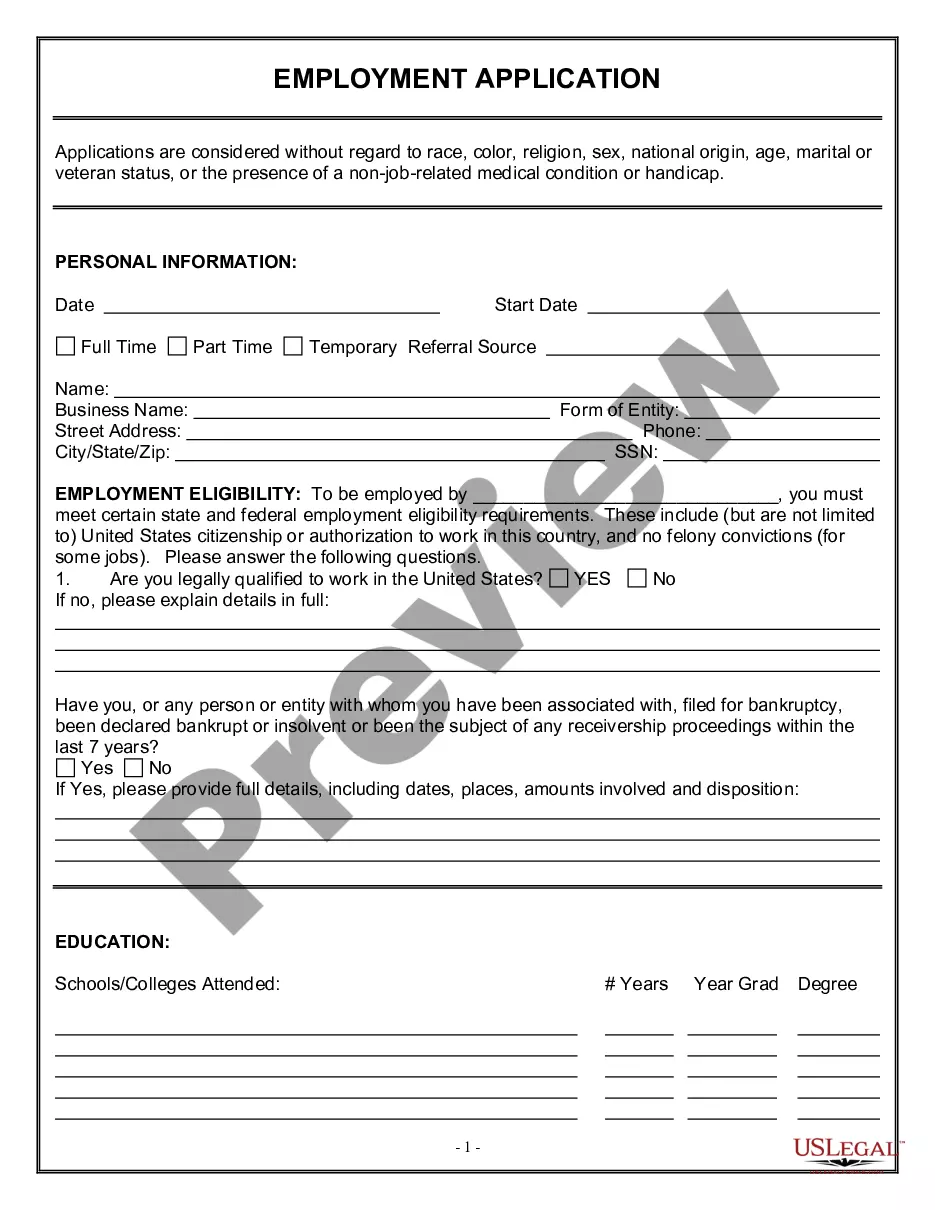

How to fill out Contra Costa California Documentation Required To Confirm Accredited Investor Status?

If you need to get a reliable legal form supplier to get the Contra Costa Documentation Required to Confirm Accredited Investor Status, look no further than US Legal Forms. No matter if you need to start your LLC business or take care of your belongings distribution, we got you covered. You don't need to be well-versed in in law to find and download the needed template.

- You can browse from over 85,000 forms arranged by state/county and case.

- The intuitive interface, number of learning materials, and dedicated support team make it simple to get and complete different papers.

- US Legal Forms is a reliable service offering legal forms to millions of users since 1997.

Simply type to look for or browse Contra Costa Documentation Required to Confirm Accredited Investor Status, either by a keyword or by the state/county the document is created for. After finding the necessary template, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's simple to start! Simply locate the Contra Costa Documentation Required to Confirm Accredited Investor Status template and take a look at the form's preview and description (if available). If you're confident about the template’s terminology, go ahead and click Buy now. Create an account and choose a subscription plan. The template will be immediately ready for download once the payment is completed. Now you can complete the form.

Taking care of your law-related matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our rich collection of legal forms makes these tasks less costly and more reasonably priced. Set up your first company, arrange your advance care planning, draft a real estate agreement, or complete the Contra Costa Documentation Required to Confirm Accredited Investor Status - all from the convenience of your sofa.

Join US Legal Forms now!