Title: Documentation Required to Confirm Accredited Investor Status in Houston, Texas: A Detailed Overview Introduction: As an investor looking to participate in certain investment opportunities, confirming your status as an accredited investor is often a prerequisite. This article aims to provide a comprehensive description of the documentation required in Houston, Texas, to confirm accredited investor status, outlining various types of documentation recognized in this jurisdiction. 1. Individual Investor Documentation: a. Income Verification: — Federal Tax Returns: Providing copies of the most recent three years' federal income tax returns. — W-2 Forms: Presenting copies of the W-2 forms for the past two years, validating total annual income. — Pay Stubs: Displaying pay stubs for the last three months. — Certified Financial Statements: Furnishing audited financial statements showing income for the latest two years. b. Net Worth Verification: — Bank and Brokerage Statements: Providing statements from banks and brokerage accounts indicating cash, stocks, bonds, and other investments. — Property Valuation: Presenting estimated property values and mortgage or debt information. — Appraisals: Providing professional property appraisals for real estate holdings. — Statement of Liabilities: Disclosing liabilities including mortgages, loans, and outstanding debts. 2. Joint Investor Documentation: When multiple individuals, such as spouses or business partners, aim to be acknowledged as accredited investors jointly, the following documentation can be required: — Joint Tax Returns: Furnishing copies of the most recent three years' joint federal income tax returns. — Joint Bank and Brokerage Statements: Providing account statements that demonstrate joint ownership and net worth. 3. Corporate Entity Documentation: a. Corporation: — Accredited Investor Certification: Filing a properly executed Form of Certification as an Accredited Investor. — Organizational Documents: Submitting documents such as the Articles of Incorporation, Bylaws, and Certificate of Good Standing from the Secretary of State. — Audited Financial Statements: Providing the latest audited financial statements showing the corporation's financial condition. — List of Shareholders: Presenting a list of shareholders eligible to purchase securities based on accredited investor status. b. Limited Liability Company (LLC) or Limited Partnership (LP): — Operating Agreement or Partnership Agreement: Submitting a copy of the agreement, clearly stating the accredited investor status of the entity. — Certificate of Formation or Certificate of Limited Partnership: Providing a copy of the official certificate indicating the entity's formation dates and authorized signatories. 4. Other Documentation: — Professional Verification: Providing proof of relevant professional certifications or licenses from recognized regulatory bodies. — Verification Letter: Obtaining a letter from a licensed attorney, CPA, or registered investment adviser confirming the accredited investor status based on their examination of relevant financial information. Conclusion: To confirm accredited investor status in Houston, Texas, prospective investors must compile and submit various types of documentation. The specific requirements may vary depending on the investor type (individual, joint, or corporate entity). Precise adherence to these documentation requirements ensures compliance with securities laws and creates opportunities for participation in exclusive investment opportunities restricted to accredited investors.

Houston Texas Documentation Required to Confirm Accredited Investor Status

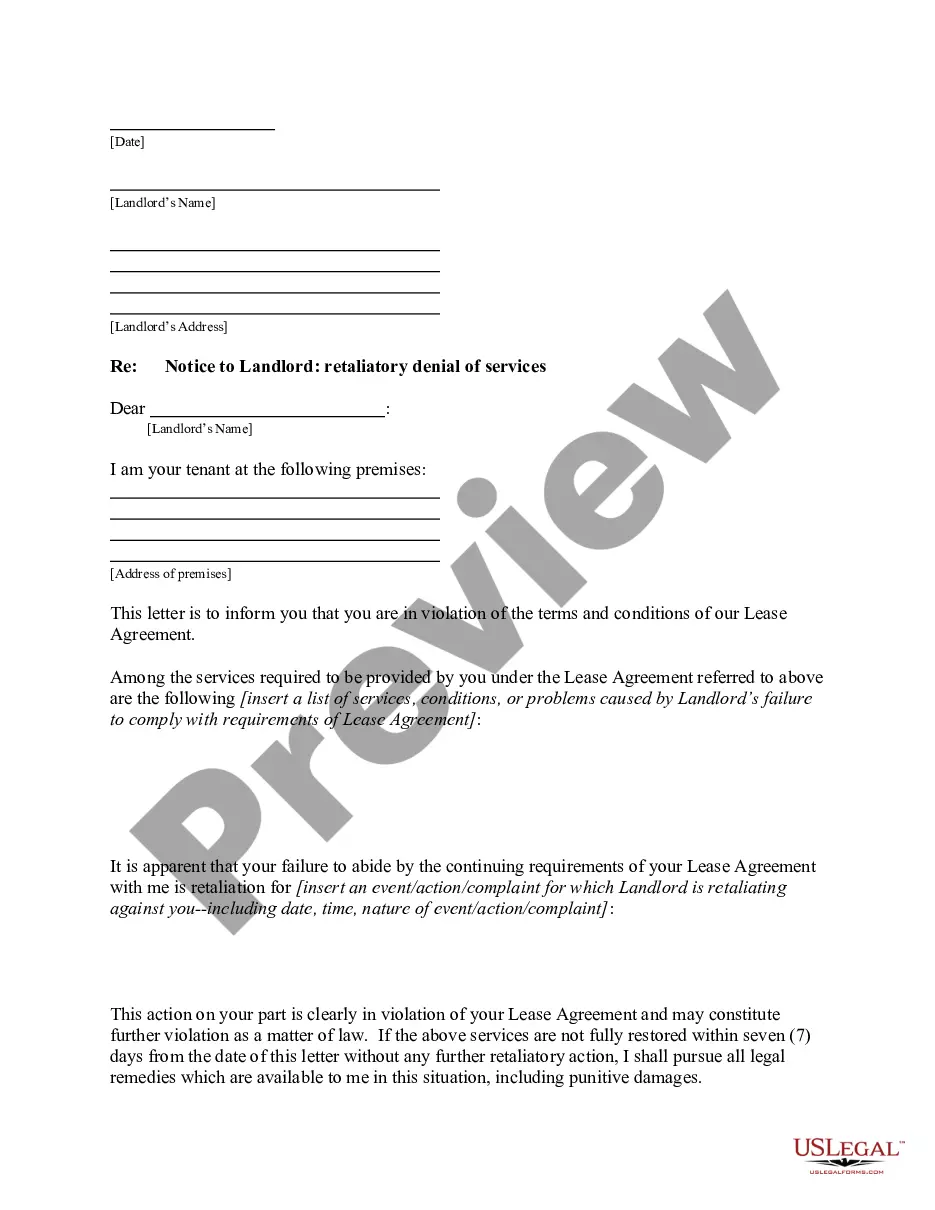

Description

How to fill out Houston Texas Documentation Required To Confirm Accredited Investor Status?

How much time does it usually take you to draft a legal document? Since every state has its laws and regulations for every life sphere, locating a Houston Documentation Required to Confirm Accredited Investor Status meeting all regional requirements can be exhausting, and ordering it from a professional attorney is often costly. Many web services offer the most popular state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive web collection of templates, gathered by states and areas of use. In addition to the Houston Documentation Required to Confirm Accredited Investor Status, here you can get any specific form to run your business or individual deeds, complying with your county requirements. Specialists verify all samples for their actuality, so you can be certain to prepare your paperwork properly.

Using the service is fairly easy. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the needed sample, and download it. You can pick the document in your profile at any moment in the future. Otherwise, if you are new to the platform, there will be some extra actions to complete before you obtain your Houston Documentation Required to Confirm Accredited Investor Status:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Search for another form using the related option in the header.

- Click Buy Now once you’re certain in the chosen document.

- Choose the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Houston Documentation Required to Confirm Accredited Investor Status.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired document, you can find all the files you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!