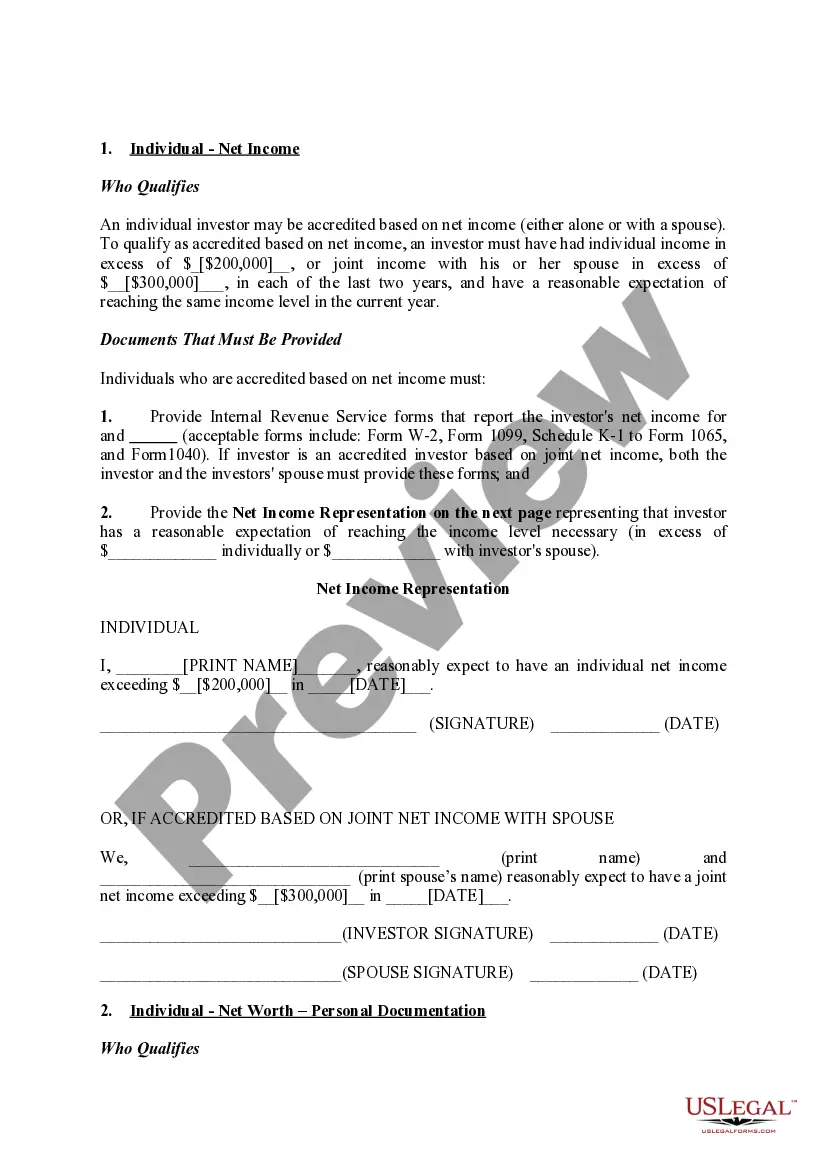

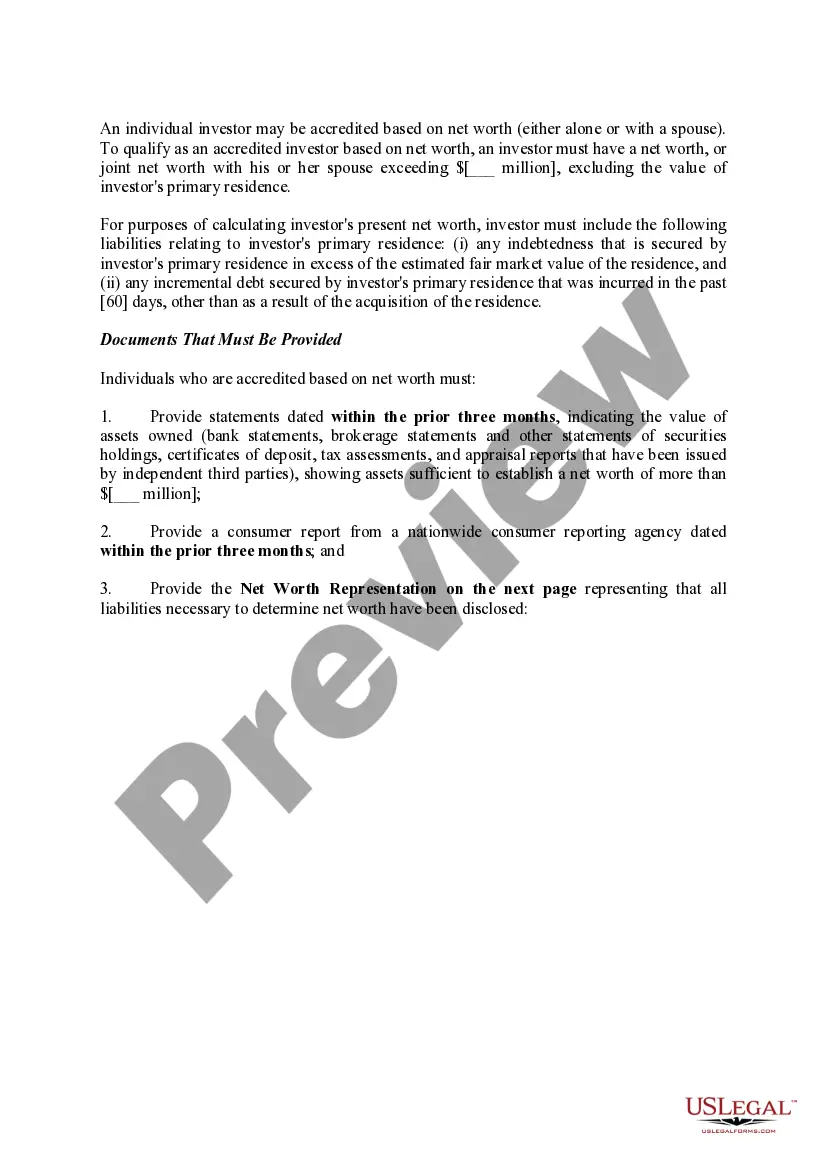

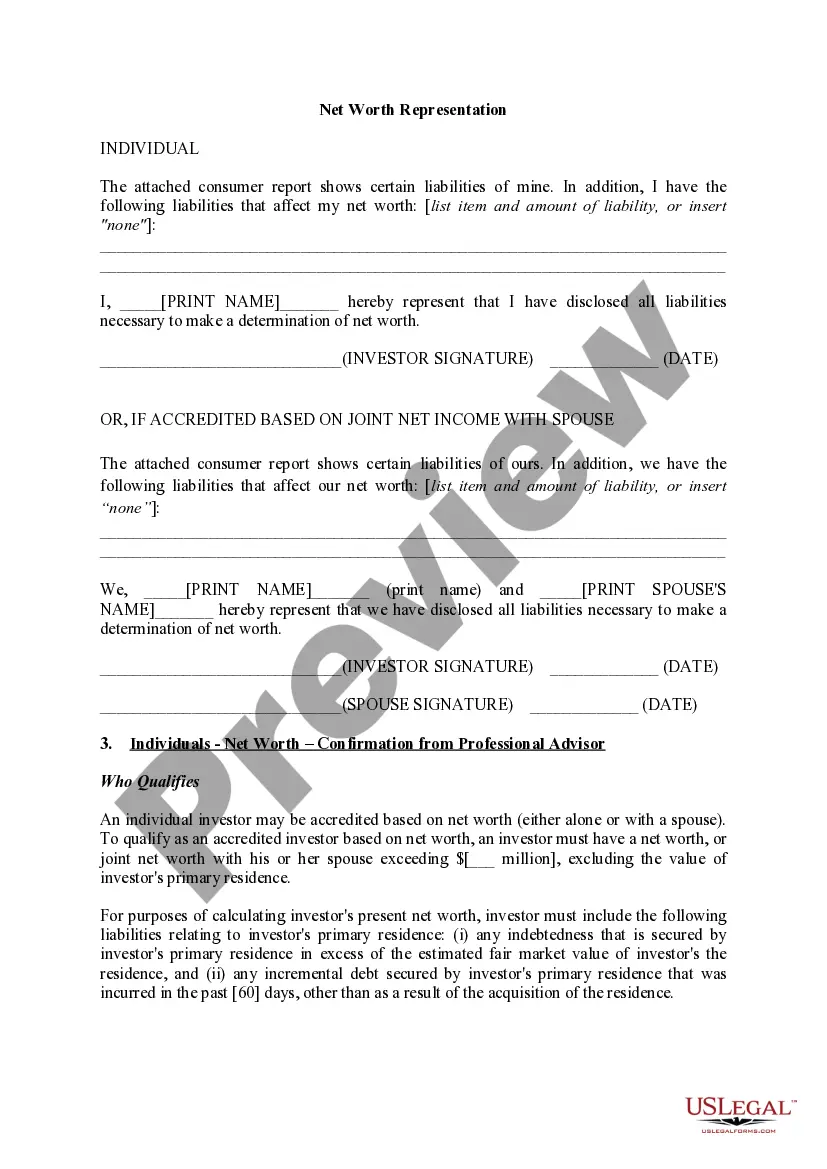

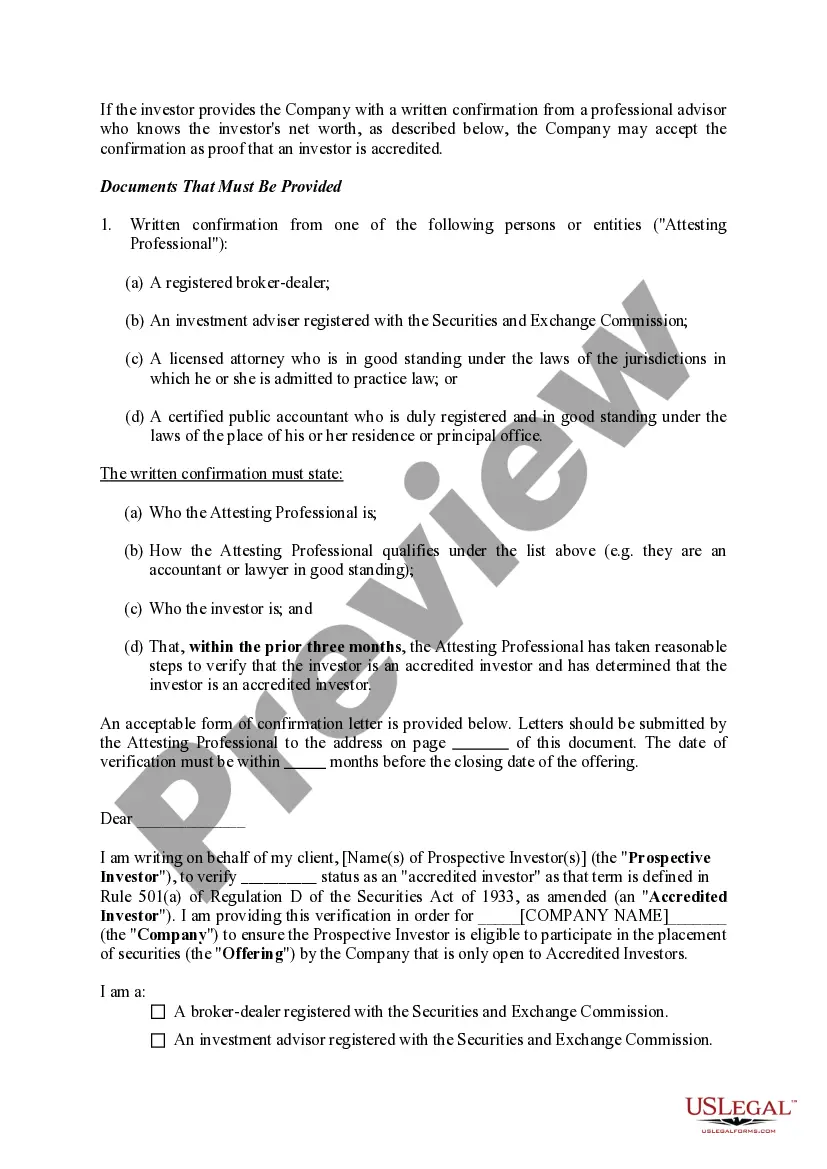

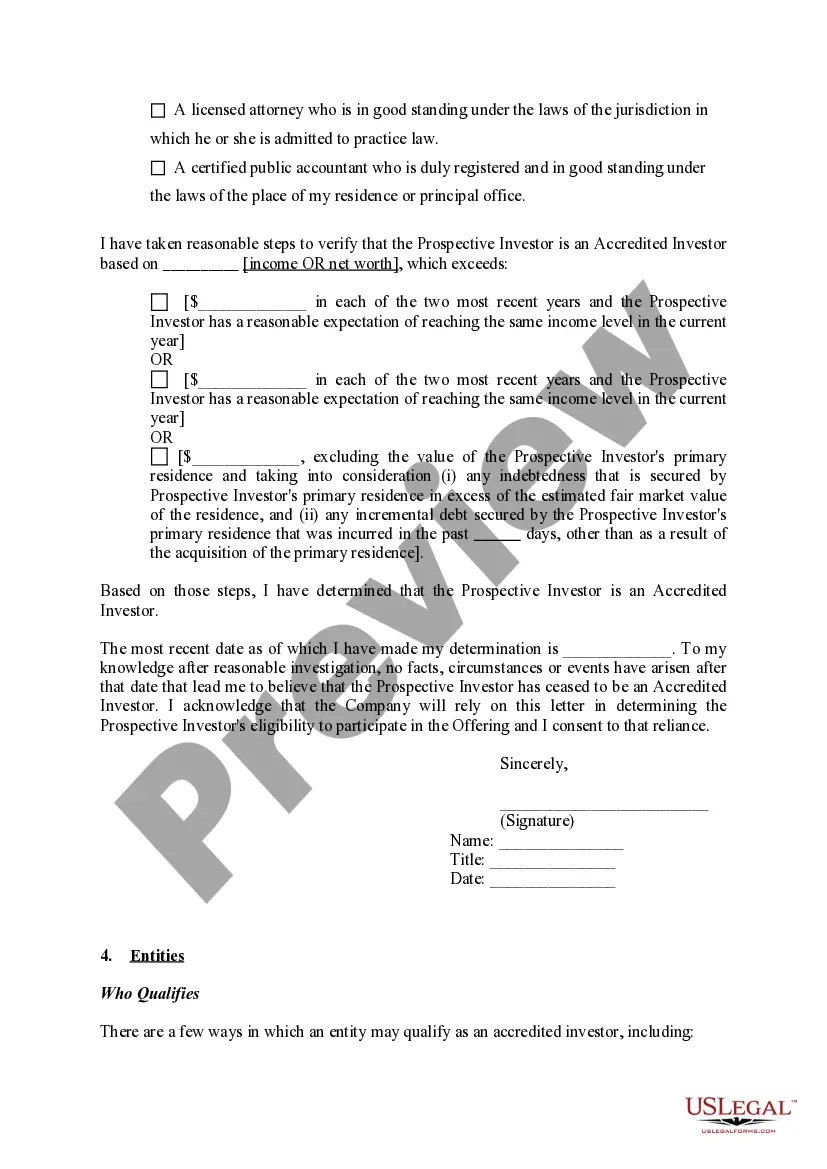

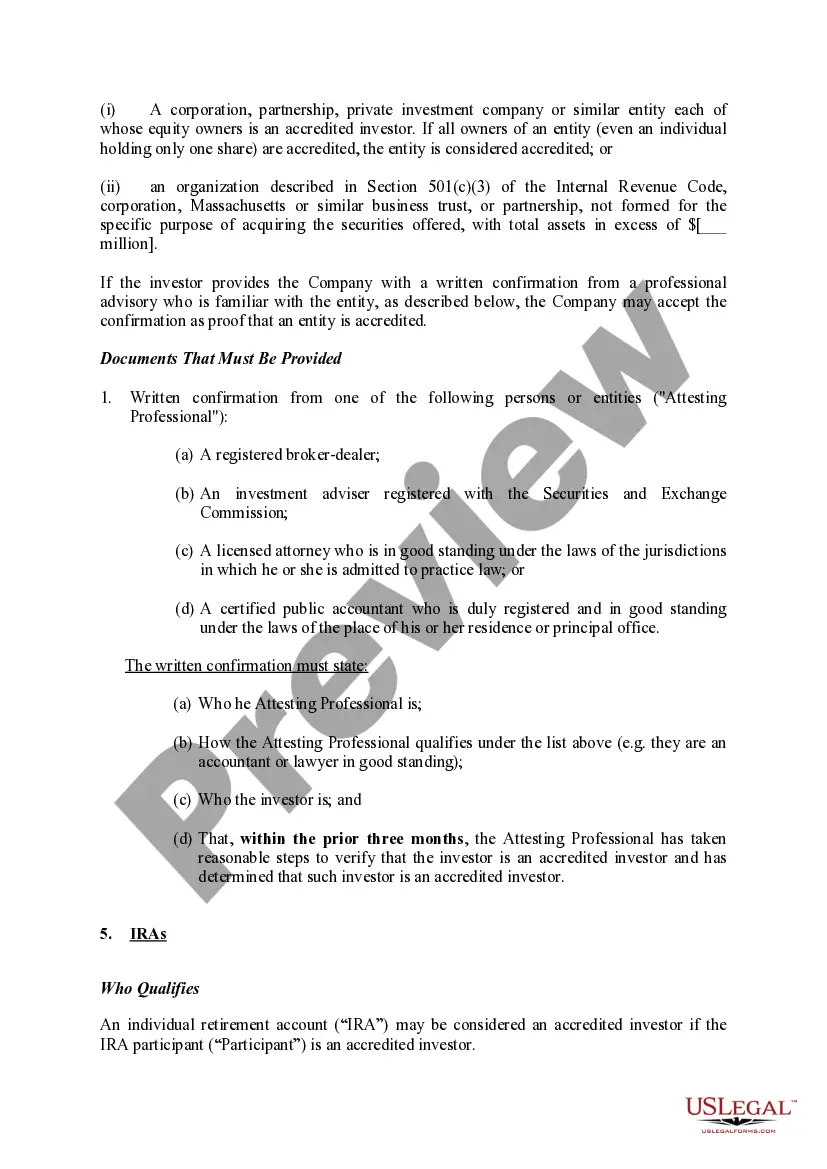

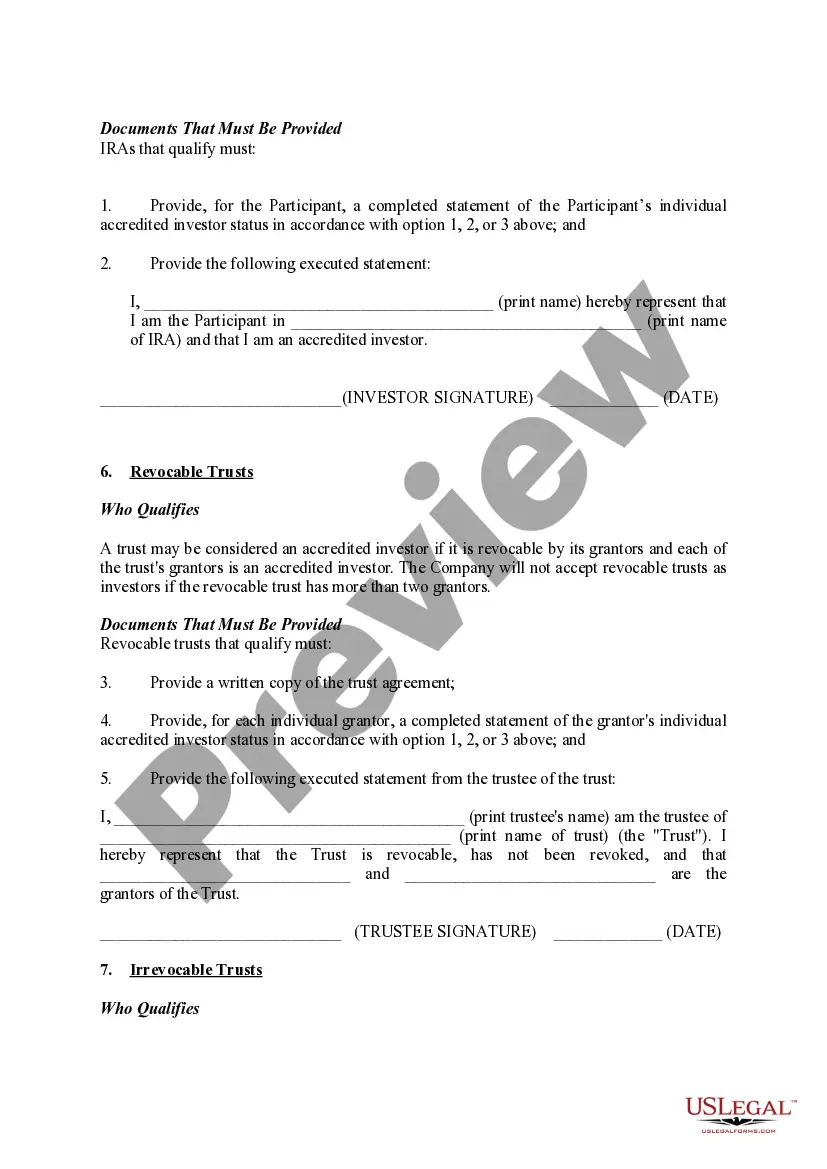

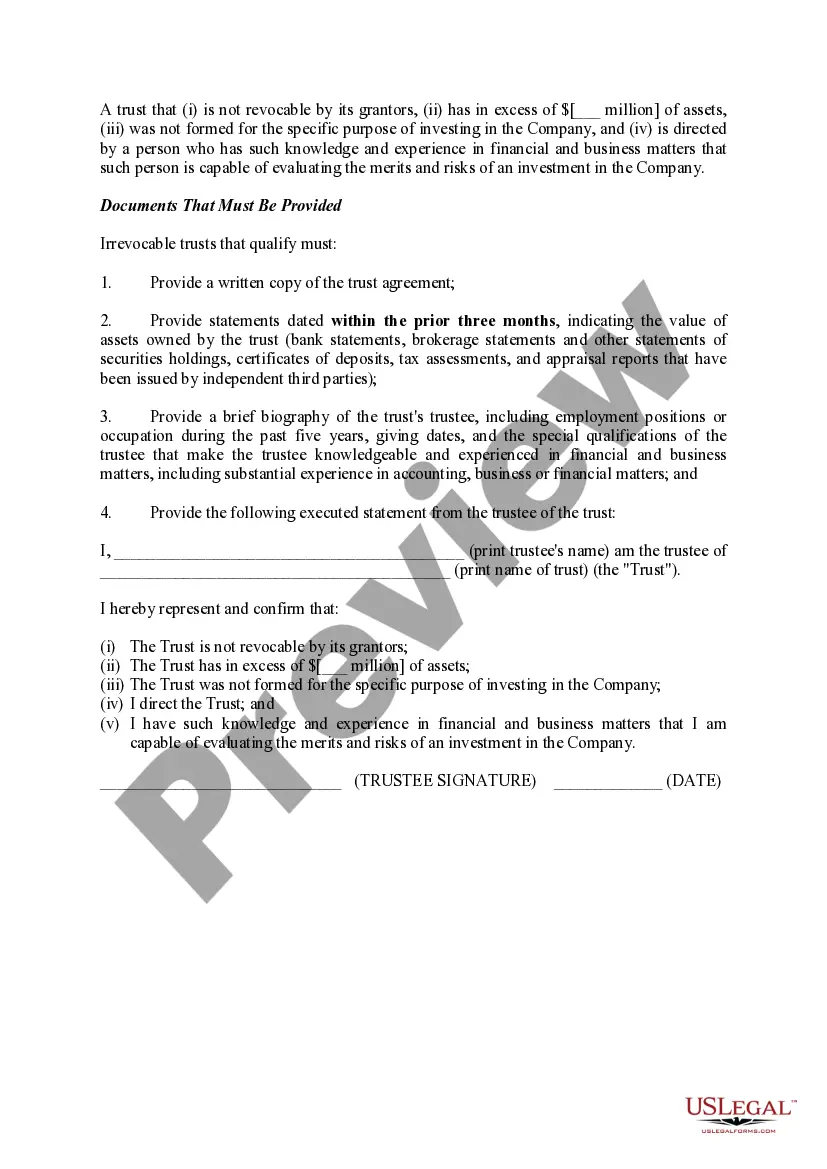

Mecklenburg North Carolina is a county located in the southern part of the state, encompassing the city of Charlotte. As an investor, understanding the documentation required to confirm accredited investor status is crucial when engaging in various financial opportunities. To ensure compliance with security laws and regulations, individuals must meet specific criteria, such as income or net worth thresholds, to be considered an accredited investor. 1. Income Verification: One common type of documentation required to confirm accredited investor status is income verification. This involves providing proof of the individual's annual income for the previous two years, such as pay stubs, tax returns, or W-2 forms. Accredited investors must have an annual income exceeding $200,000 individually or $300,000 jointly with a spouse for the past two years, with a reasonable expectation of meeting the same income level in the current year. 2. Net Worth Verification: Another type of documentation required to confirm accredited investor status is net worth verification. Accredited investors can qualify by demonstrating a net worth of at least $1 million, excluding the value of their primary residence. To verify net worth, individuals may provide various documents, including bank statements, brokerage account statements, appraisals of investments, property valuations, or tax assessments. 3. Statements from Financial Professionals: Accredited investors may also provide documentation from licensed financial professionals to confirm their accredited status. This can include a letter or statement from a registered investment advisor, certified public accountant, attorney, or broker-dealer. These professionals can verify the investor's financial knowledge, experience, and understanding of investment risks. 4. Recent Financial Statements: Some investment opportunities may require accredited investors to submit recent financial statements, such as balance sheets, income statements, or cash flow statements, to confirm their financial stability and ability to sustain potential investment risks. 5. Certification by Registered Broker-Dealer or Legal Entity: Individuals who are affiliated with a registered broker-dealer or a specific legal entity (e.g., banks, insurance companies, business development companies) recognized as accredited investors within Mecklenburg North Carolina may be exempt from providing additional documentation. Instead, their membership or association with the registered entity serves as sufficient proof of accredited status. It is essential to note that the documentation required to confirm accredited investor status may vary depending on the specific investment opportunity, legal jurisdiction, and the involved parties. Therefore, investors must consult with experienced professionals, such as attorneys or financial advisors, to ensure compliance and provide the appropriate documentation.

Mecklenburg North Carolina Documentation Required to Confirm Accredited Investor Status

Description

How to fill out Mecklenburg North Carolina Documentation Required To Confirm Accredited Investor Status?

Laws and regulations in every sphere vary around the country. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal documentation. To avoid expensive legal assistance when preparing the Mecklenburg Documentation Required to Confirm Accredited Investor Status, you need a verified template valid for your region. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions web catalog of more than 85,000 state-specific legal templates. It's a great solution for specialists and individuals looking for do-it-yourself templates for different life and business situations. All the documents can be used multiple times: once you obtain a sample, it remains available in your profile for further use. Therefore, when you have an account with a valid subscription, you can simply log in and re-download the Mecklenburg Documentation Required to Confirm Accredited Investor Status from the My Forms tab.

For new users, it's necessary to make a few more steps to obtain the Mecklenburg Documentation Required to Confirm Accredited Investor Status:

- Analyze the page content to ensure you found the right sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to obtain the template when you find the appropriate one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Fill out and sign the template on paper after printing it or do it all electronically.

That's the easiest and most cost-effective way to get up-to-date templates for any legal purposes. Find them all in clicks and keep your paperwork in order with the US Legal Forms!