To become an accredited investor the (SEC) requires certain wealth, income or knowledge requirements. The investor must fall into one of three categories. Firms selling unregistered securities must put investors through their own screening process to determine if investors can be considered an accredited investor.

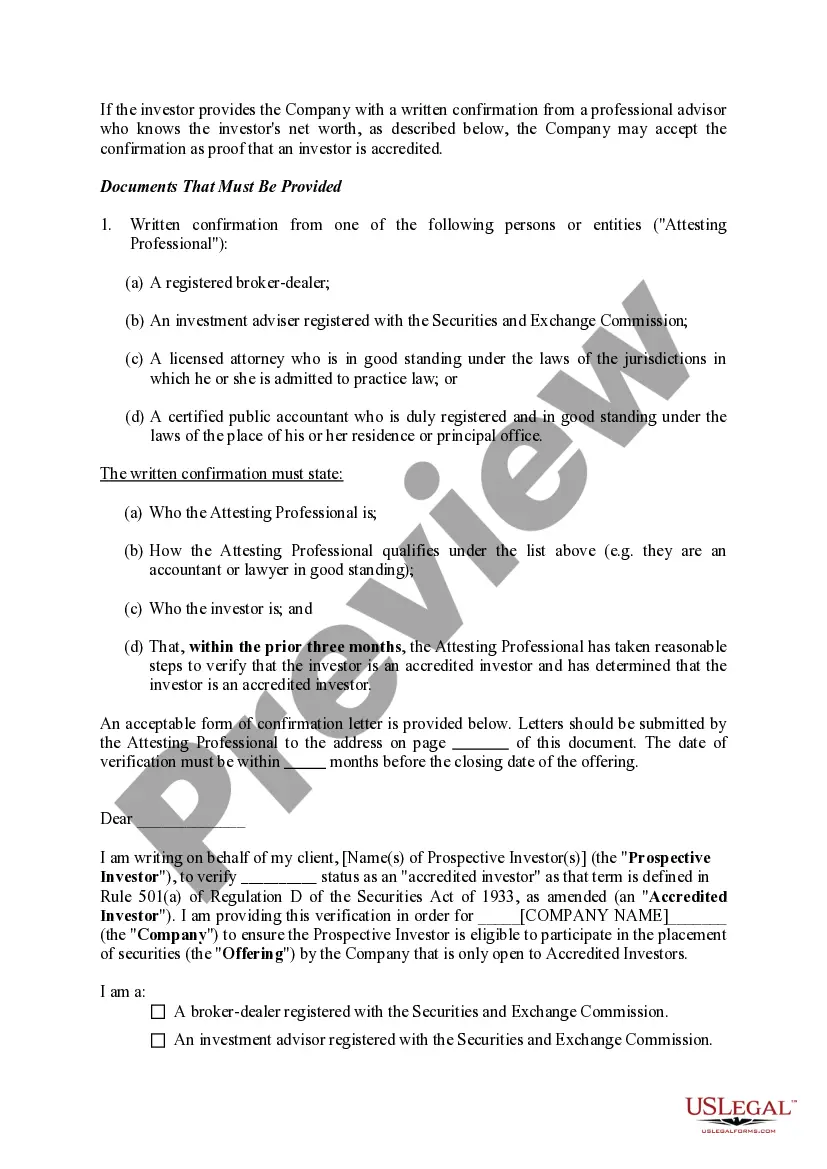

The Verifying Individual or Entity should take reasonable steps to verify and determined that an Investor is an "accredited investor" as such term is defined in Rule 501 of the Securities Act, and hereby provides written confirmation. This letter serves to help the Entity determine status.

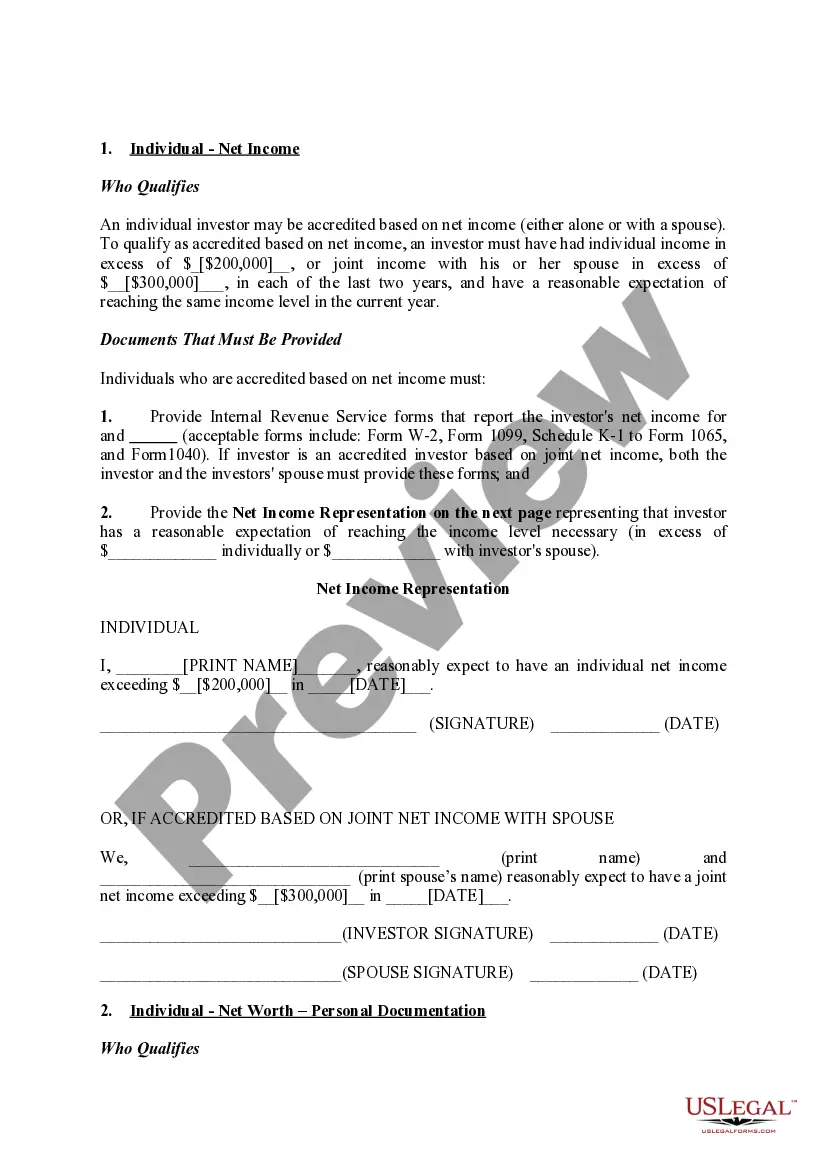

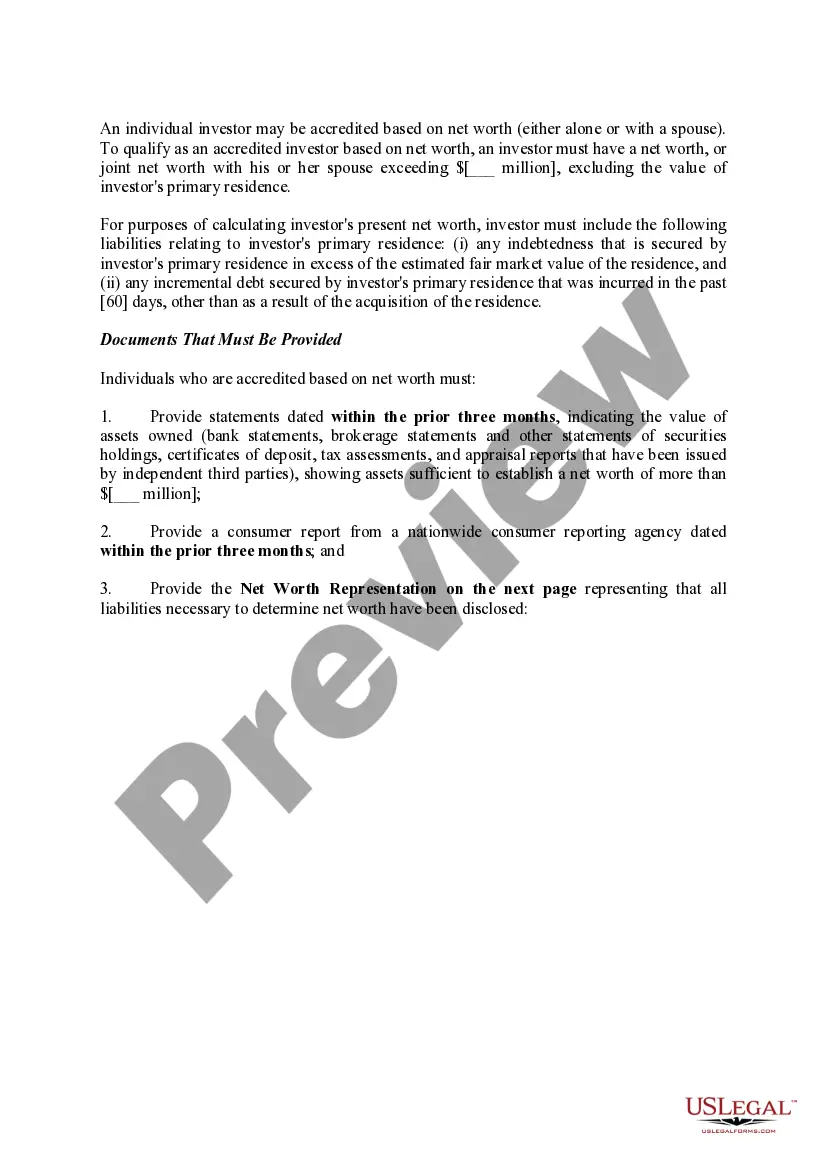

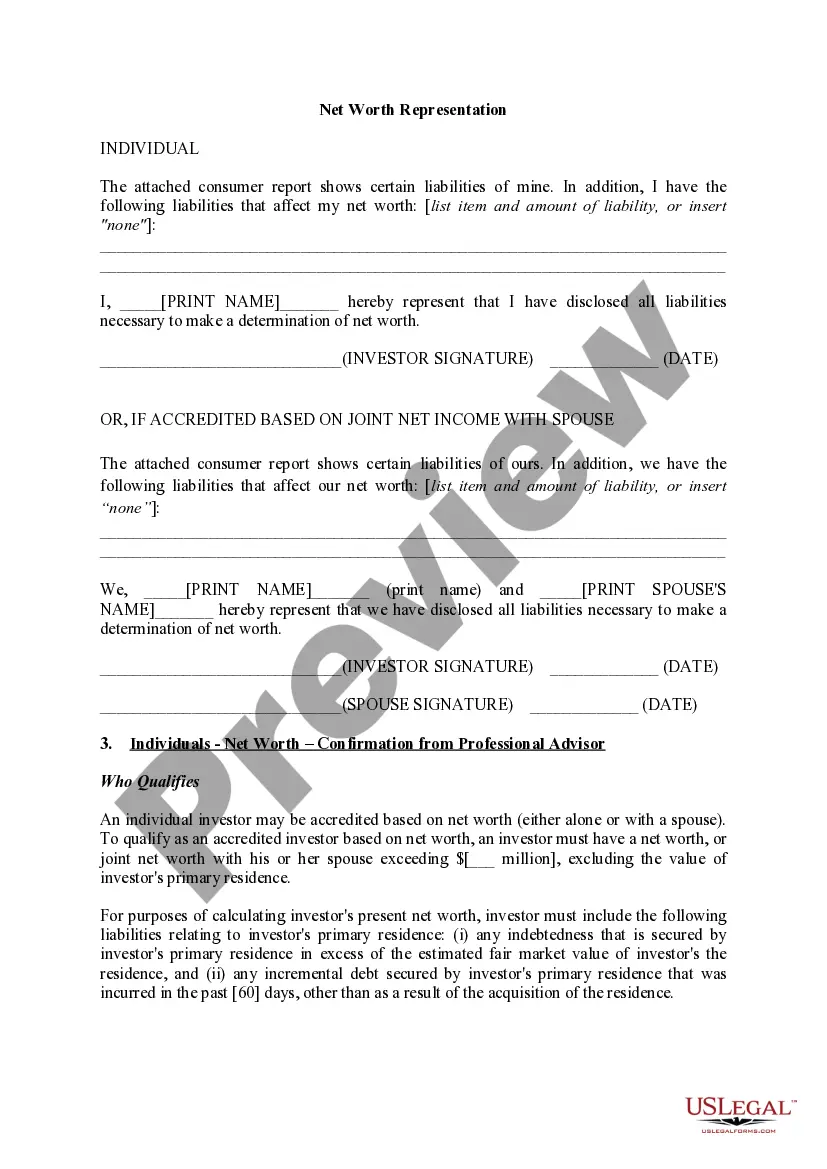

Nassau, New York is a county located in the state of New York, United States. As an aspiring accredited investor, it is crucial to understand the specific documentation required in order to confirm one's accredited investor status. The Securities and Exchange Commission (SEC) has established guidelines to determine if an individual meets the criteria to be considered an accredited investor. Primarily, the SEC defines an accredited investor as an individual who meets certain income or net worth requirements, allowing them to participate in investment opportunities that are typically limited to sophisticated investors. To confirm accredited investor status in Nassau, New York, several types of documentation may be required, depending on the specific investment opportunity or the investment firm's policies. These may include: 1. Income Verification: Documentation such as tax returns, W-2 forms, or pay stubs can be used as proof of income. This helps illustrate an individual's financial capacity to meet the income requirement set by the SEC. 2. Net Worth Verification: To confirm net worth, individuals may need to provide statements of their bank accounts, brokerage accounts, or investment portfolios. Real estate appraisals, mortgage statements, and loan balances also serve to establish one's net worth. 3. Financial Statements: If an individual holds a position as a director, executive officer, or general partner of the issuer offering the securities, financial statements might be necessary to verify the claim. These statements should provide a comprehensive overview of the individual's financial position. 4. Certification by a Professional: Some investment opportunities may require a certification or letter from a certified public accountant, attorney, or investment advisor to validate accredited investor status. These professionals may evaluate an individual's financial situation and provide their professional expertise. 5. Self-Certification: In certain cases, a self-certification statement on an investment agreement or subscription agreement might suffice. This document typically asks the investor to confirm their accredited investor status by meeting the income or net worth requirements outlined by the SEC. It is essential to understand that the specific documents required can vary depending on the investment opportunity, the investment firm, and the SEC's regulations for accredited investor verification. In Nassau, New York, it is advisable to consult with an attorney or financial professional who specializes in securities law to clarify the precise documentation needed for confirming accredited investor status. By adhering to the necessary documentation requirements, individuals aspiring to be accredited investors can unlock various investment opportunities that are typically unavailable to non-accredited investors.