Salt Lake Utah Documentation Required to Confirm Accredited Investor Status

Description

To become an accredited investor the (SEC) requires certain wealth, income or knowledge requirements. The investor must fall into one of three categories. Firms selling unregistered securities must put investors through their own screening process to determine if investors can be considered an accredited investor.

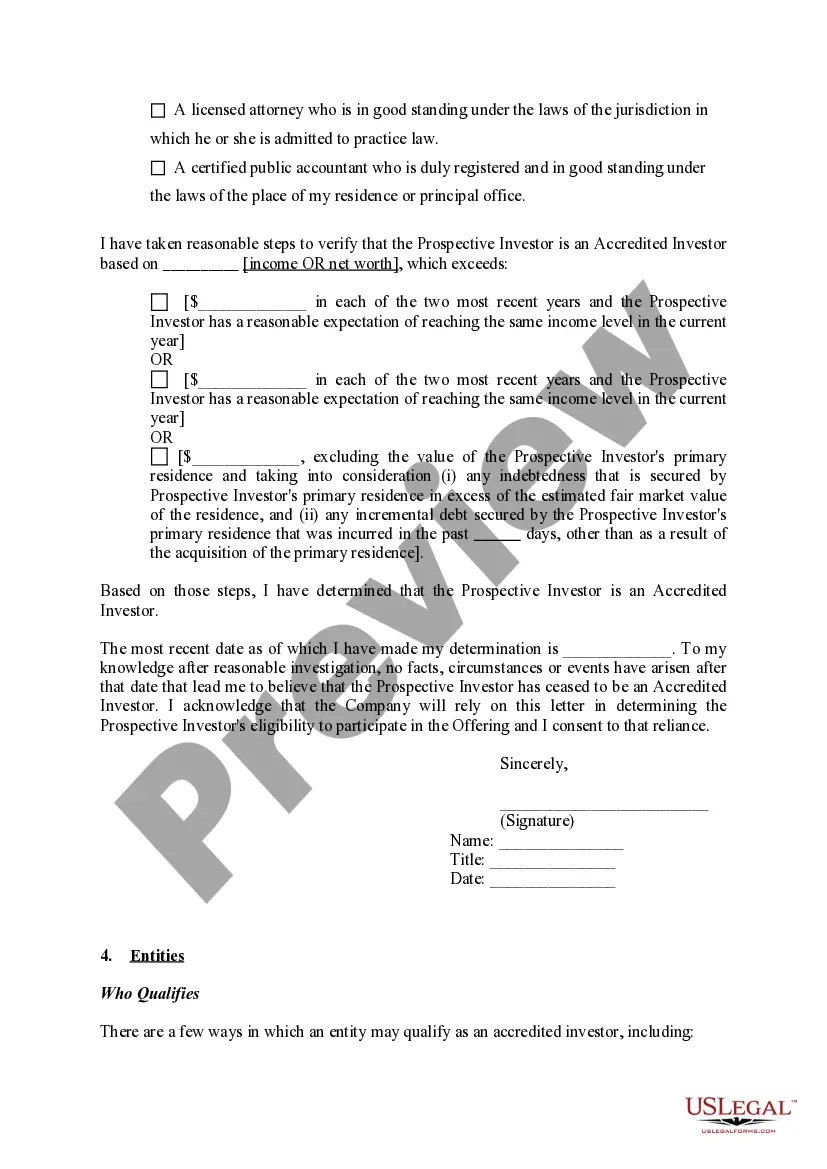

The Verifying Individual or Entity should take reasonable steps to verify and determined that an Investor is an "accredited investor" as such term is defined in Rule 501 of the Securities Act, and hereby provides written confirmation. This letter serves to help the Entity determine status.

How to fill out Documentation Required To Confirm Accredited Investor Status?

How long does it generally take for you to draft a legal document? Due to the fact that every state possesses its own laws and regulations for various life circumstances, finding a Salt Lake Documentation Required to Verify Accredited Investor Status that meets all local regulations can be exhausting, and obtaining it from a professional attorney is frequently expensive.

Various online platforms provide the most frequently needed state-specific documents for download, but utilizing the US Legal Forms library is the most beneficial option.

US Legal Forms boasts the most extensive online directory of templates, organized by states and areas of application. In addition to the Salt Lake Documentation Required to Verify Accredited Investor Status, you can access any particular document to facilitate your business or personal activities, adhering to your local standards. Specialists validate all templates for their accuracy, ensuring you prepare your documents correctly.

Print the template or utilize any preferred online editor to finalize it electronically. Regardless of the number of times you need to access the purchased template, you can locate all the files you’ve ever downloaded in your profile by accessing the My documents tab. Give it a try!

- If you already possess an account on the site and your subscription is current, you simply need to Log In, select the required template, and download it.

- You can keep the document in your profile at any time in the future.

- On the other hand, if you’re new to the platform, there will be a few additional steps to complete before you obtain your Salt Lake Documentation Required to Verify Accredited Investor Status.

- Review the content of the page you’re currently on.

- Read the description of the template or Preview it (if available).

- Look for another document using the appropriate option in the header.

- Click Buy Now once you are confident about the chosen document.

- Select the subscription plan that best fits your needs.

- Create an account on the platform or Log In to continue to payment methods.

- Complete the payment through PayPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Salt Lake Documentation Required to Verify Accredited Investor Status.

Form popularity

FAQ

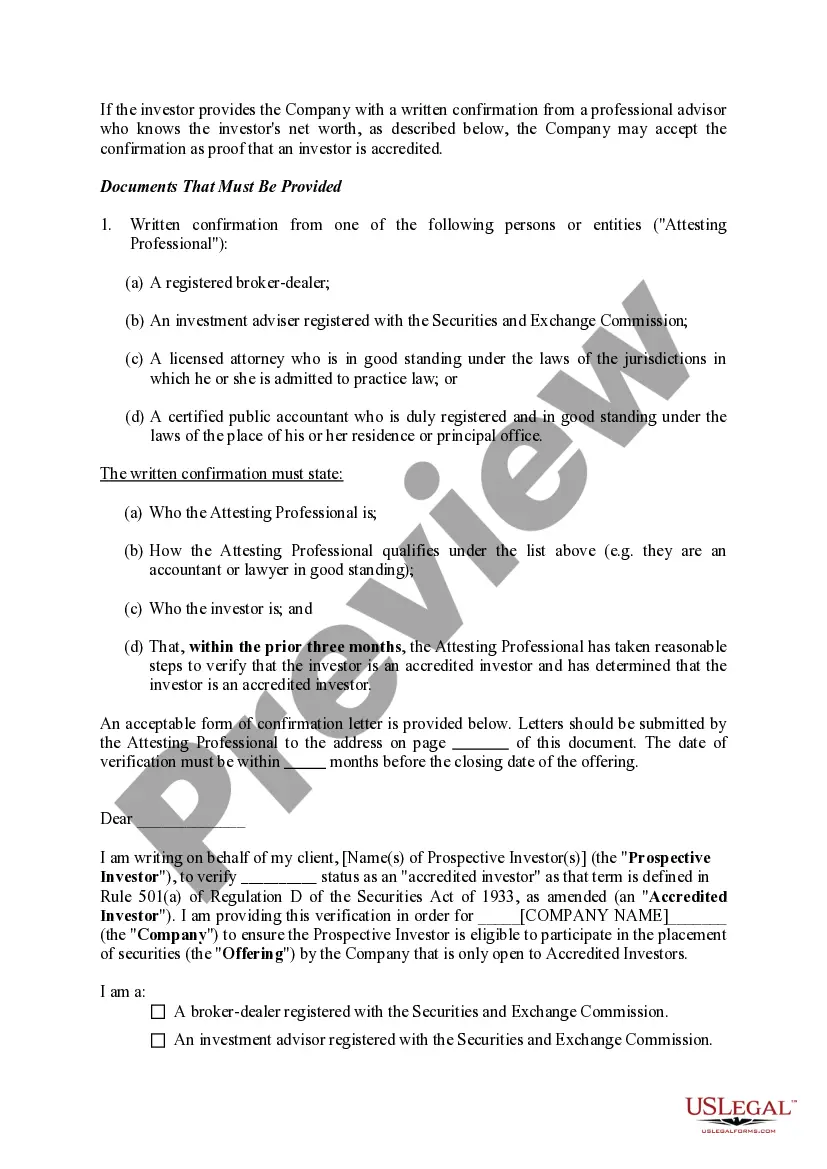

A letter from the investor's accountant, employer, licensed securities broker or registered investment advisor that confirms their accredited status will also suffice. There are a number of reliable third-party service providers that can verify an accredited investor meets SEC criteria on your behalf.

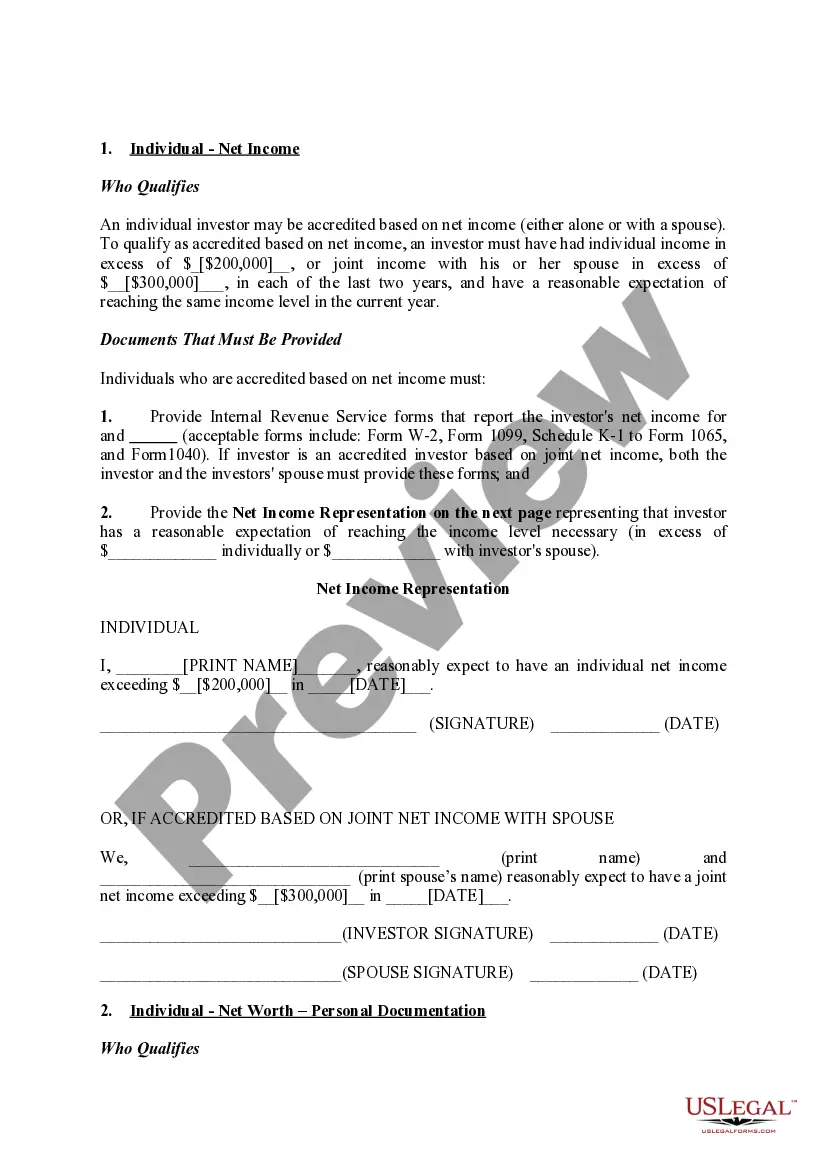

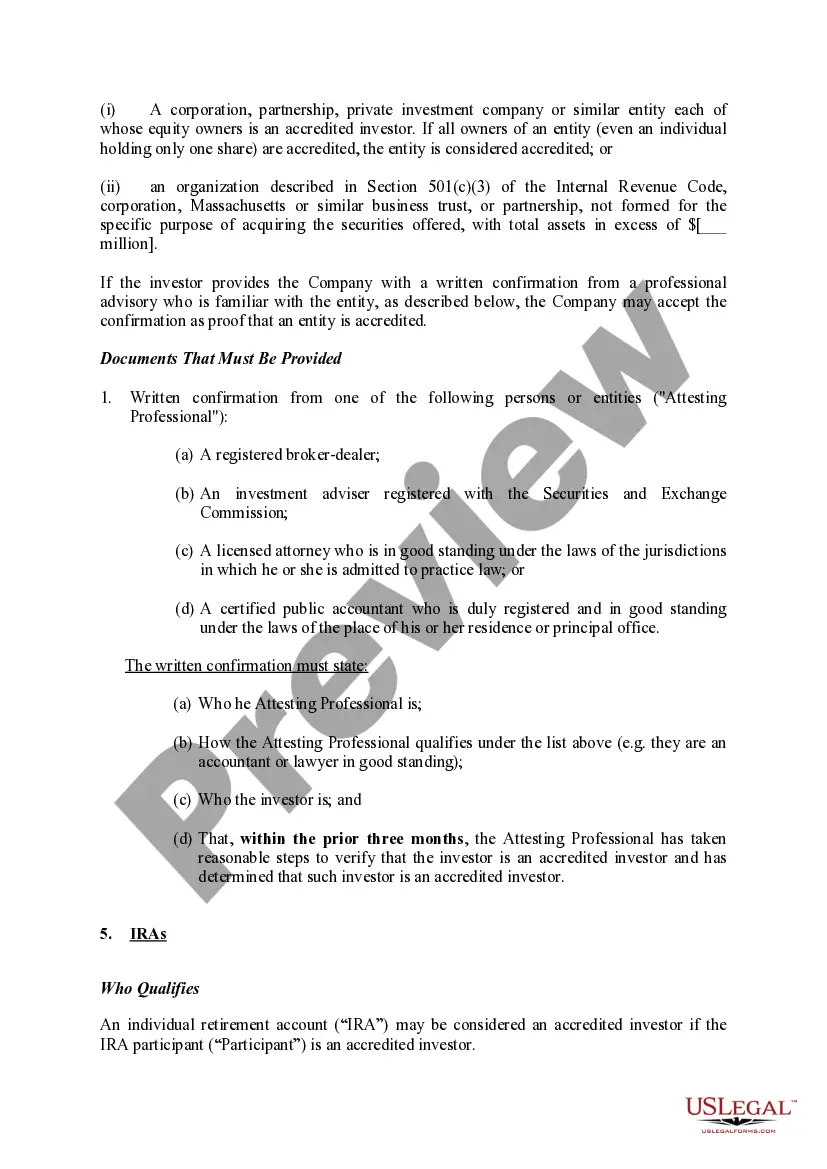

Some documents that can prove an investor's accredited status include: Tax filings or pay stubs; A letter from an accountant or employer confirming their actual and expected annual income; or. IRS Forms like W-2s, 1040s, 1099s, K-1s or other tax documentation that report income.

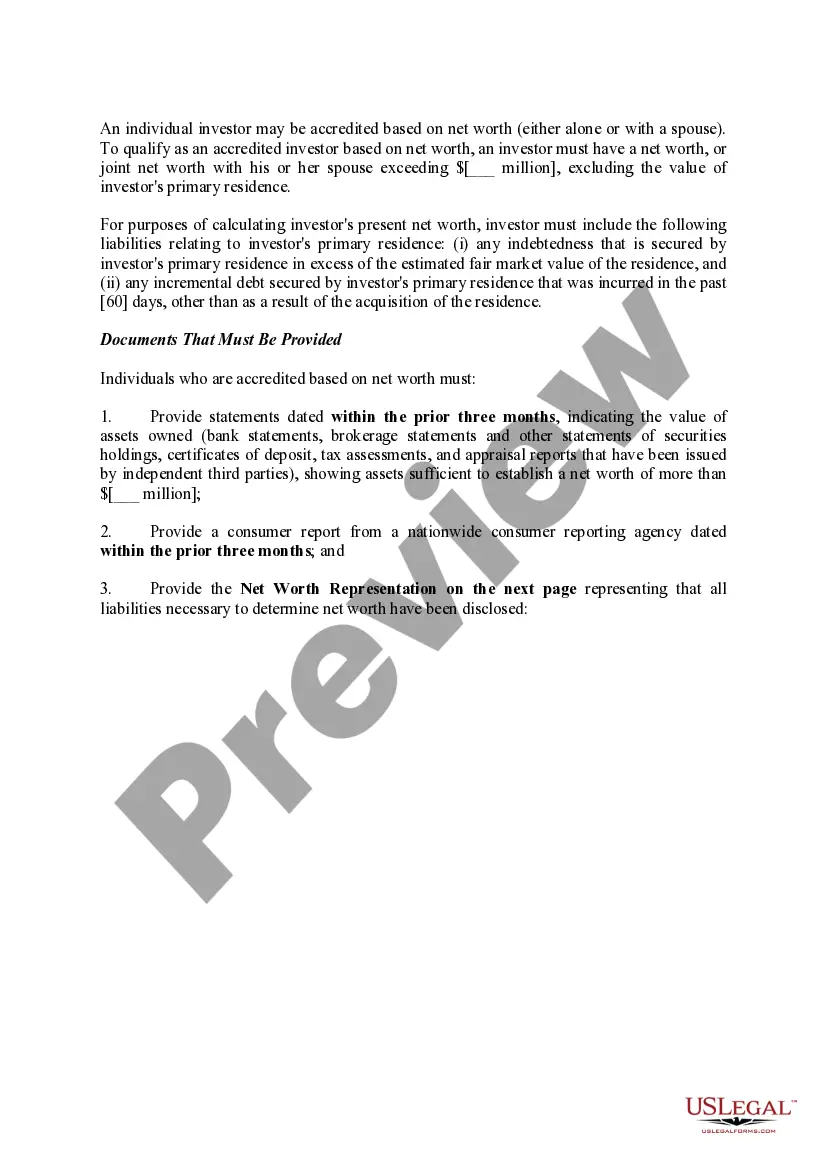

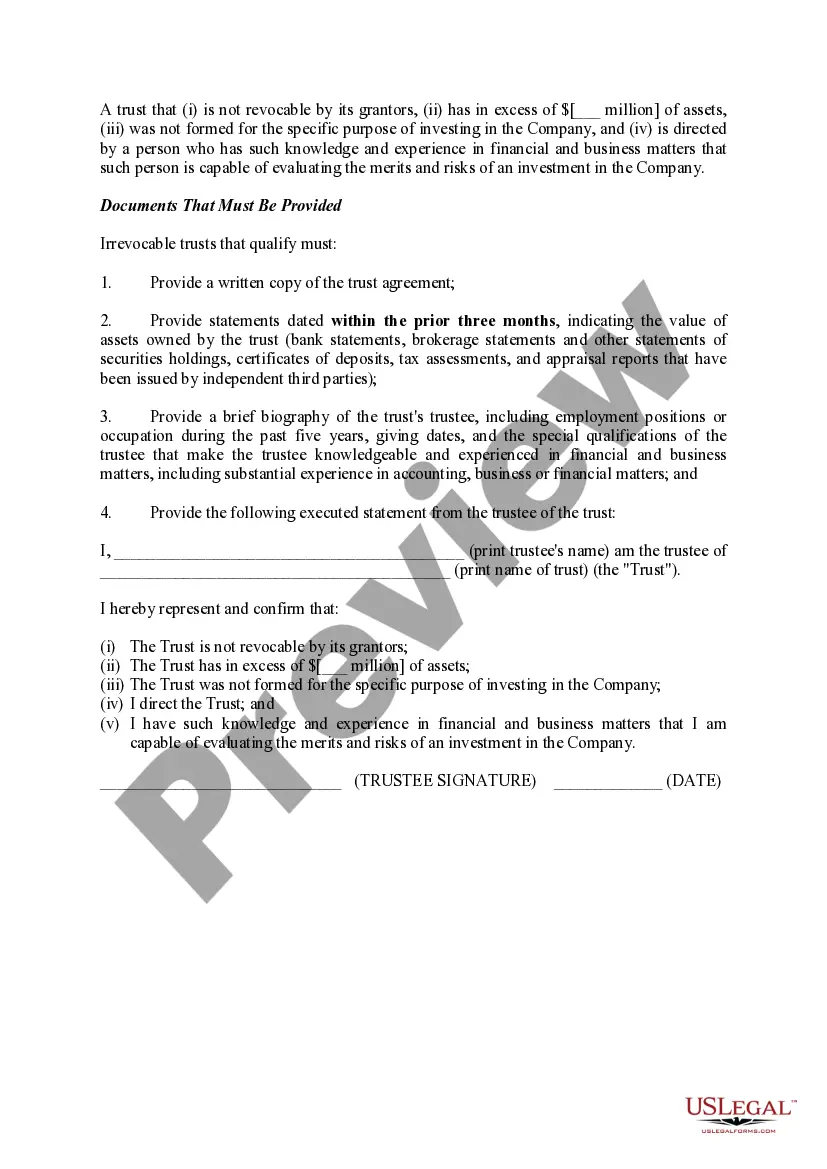

To evidence your assets, you would upload bank statements, brokerage statements and other statements of securities holdings, certificates of deposit, tax assessments and appraisal reports. All documentation must be no more than 90 days old.

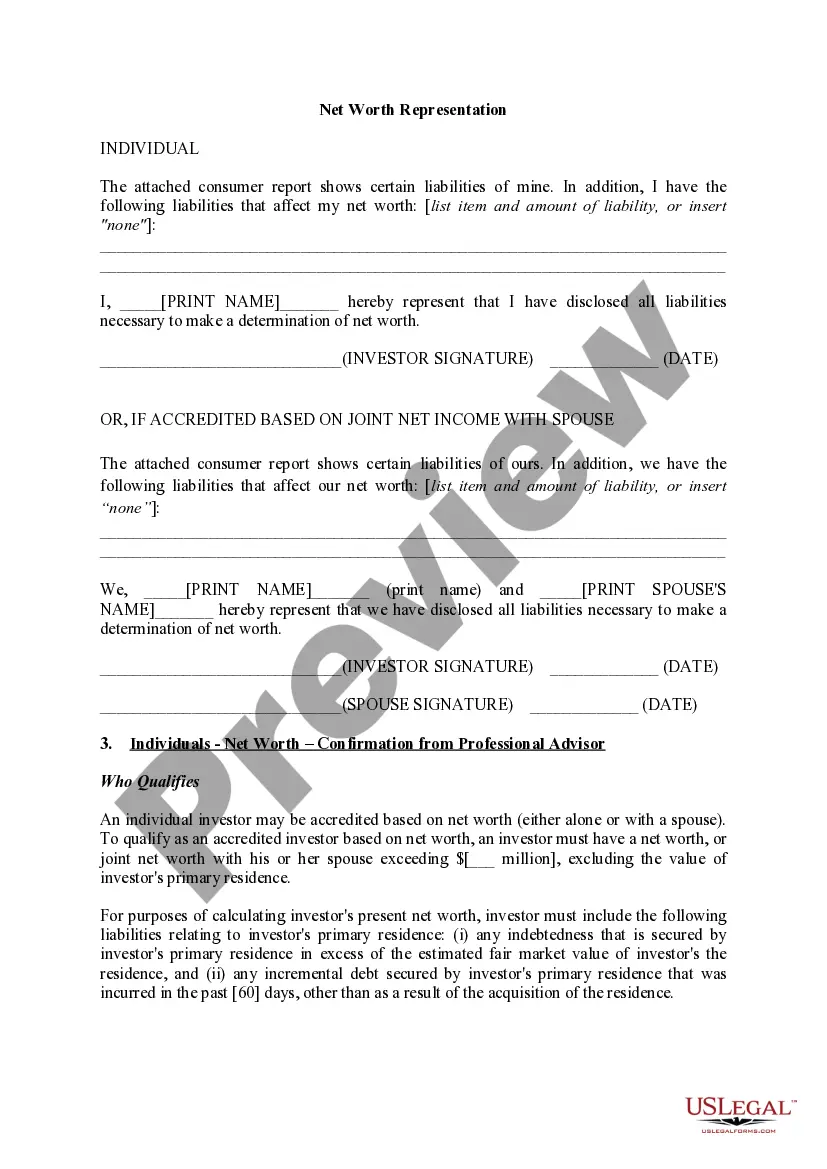

There are essentially three approaches: (1) the issuer itself can verify each investor's status, (2) the investor's accountant, lawyer, or another professional can verify the investor's status, or (3) the issuer can hire a third-party verification service to verify each investor's status.

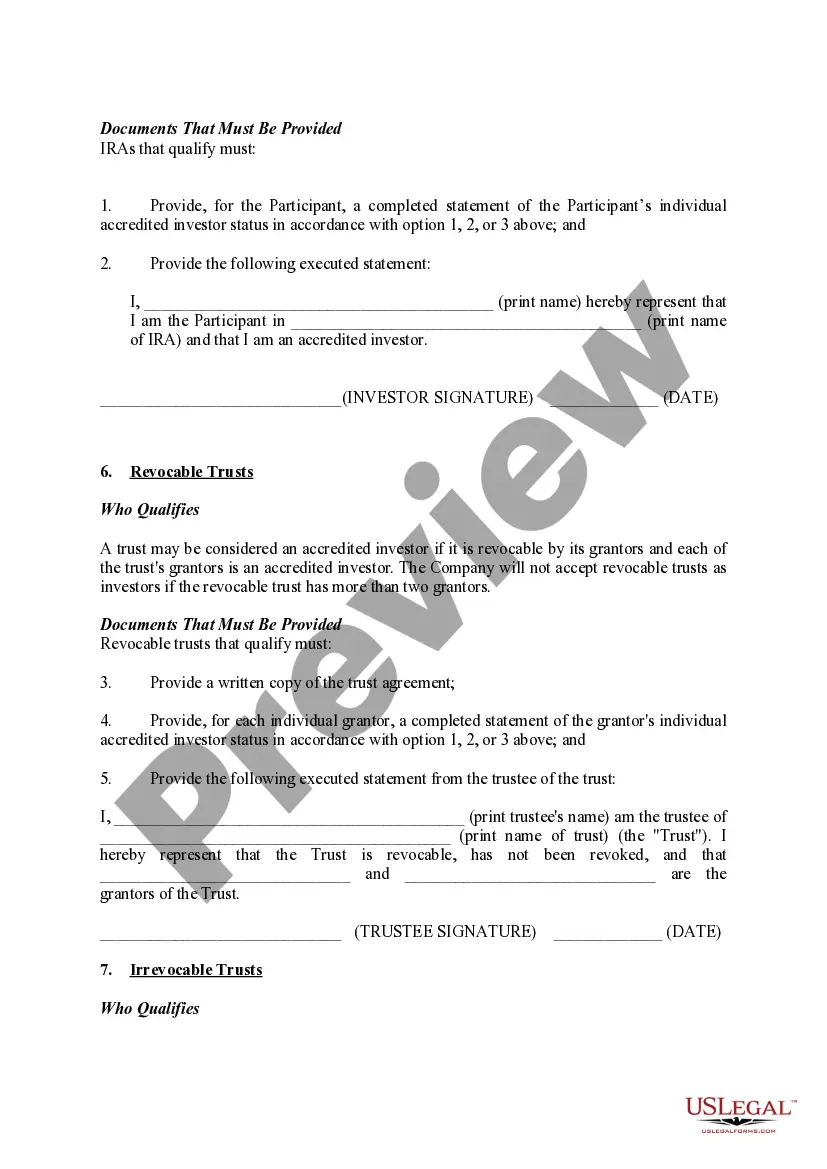

Do You Have to Prove You Are an Accredited Investor? The burden of proving that you are an accredited investor does not fall directly on you but rather the investment vehicle you would like to invest in. An investment vehicle, such as a fund, would have to determine that you qualify as an accredited investor.

Some documents that can prove an investor's accredited status include: Tax filings or pay stubs; A letter from an accountant or employer confirming their actual and expected annual income; or. IRS Forms like W-2s, 1040s, 1099s, K-1s or other tax documentation that report income.

Accredited Investor Financial Criteria. Net worth over $1 million, excluding primary residence (individually or with spouse or partner)Professional Criteria.Investments.Assets.Owners as Accredited.Investment Advisers.Financial Entities.

An Accreditation Investor Verification Letter is an official document provided by North Capital Private Securities Corporation, through the Accredited.AM website, that you can provide to third parties to satisfy the Accredited Investor verification requirement under Section 506(c) of Regulation D of the Securities Act

There are essentially three approaches: (1) the issuer itself can verify each investor's status, (2) the investor's accountant, lawyer, or another professional can verify the investor's status, or (3) the issuer can hire a third-party verification service to verify each investor's status.

Do You Have to Prove You Are an Accredited Investor? The burden of proving that you are an accredited investor does not fall directly on you but rather the investment vehicle you would like to invest in. An investment vehicle, such as a fund, would have to determine that you qualify as an accredited investor.