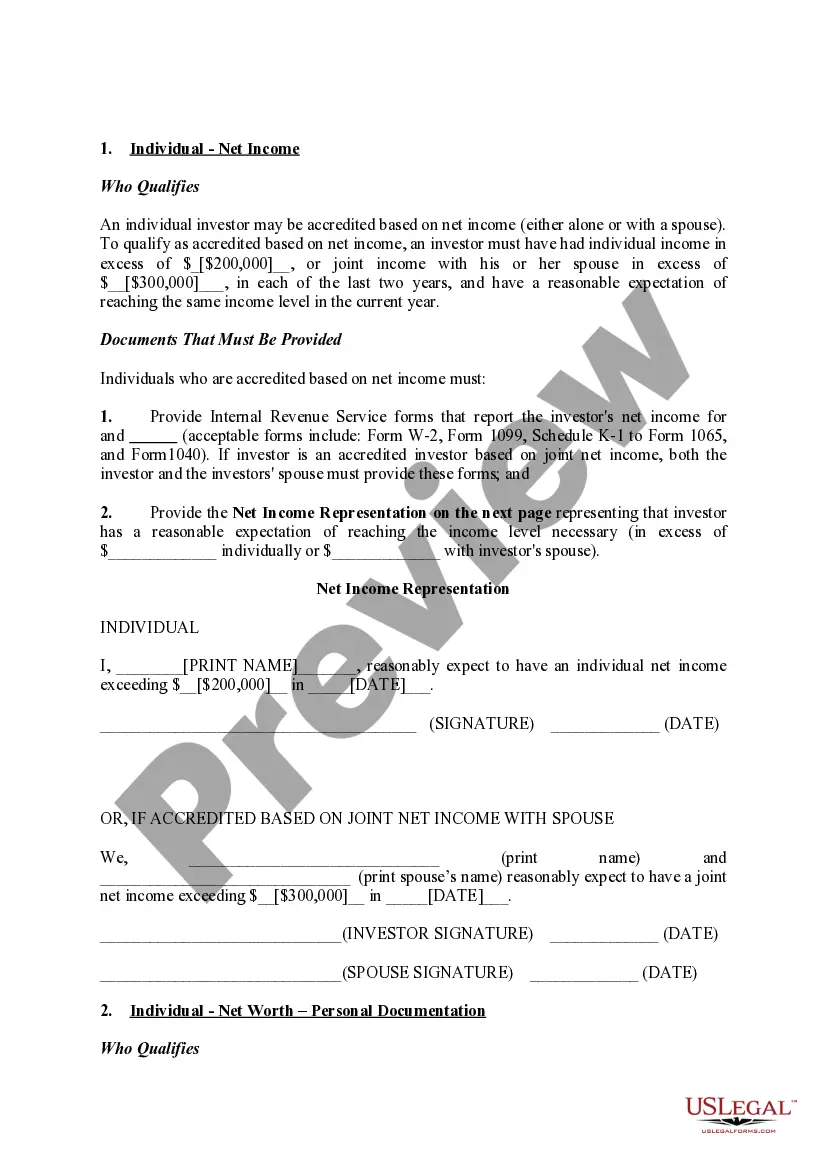

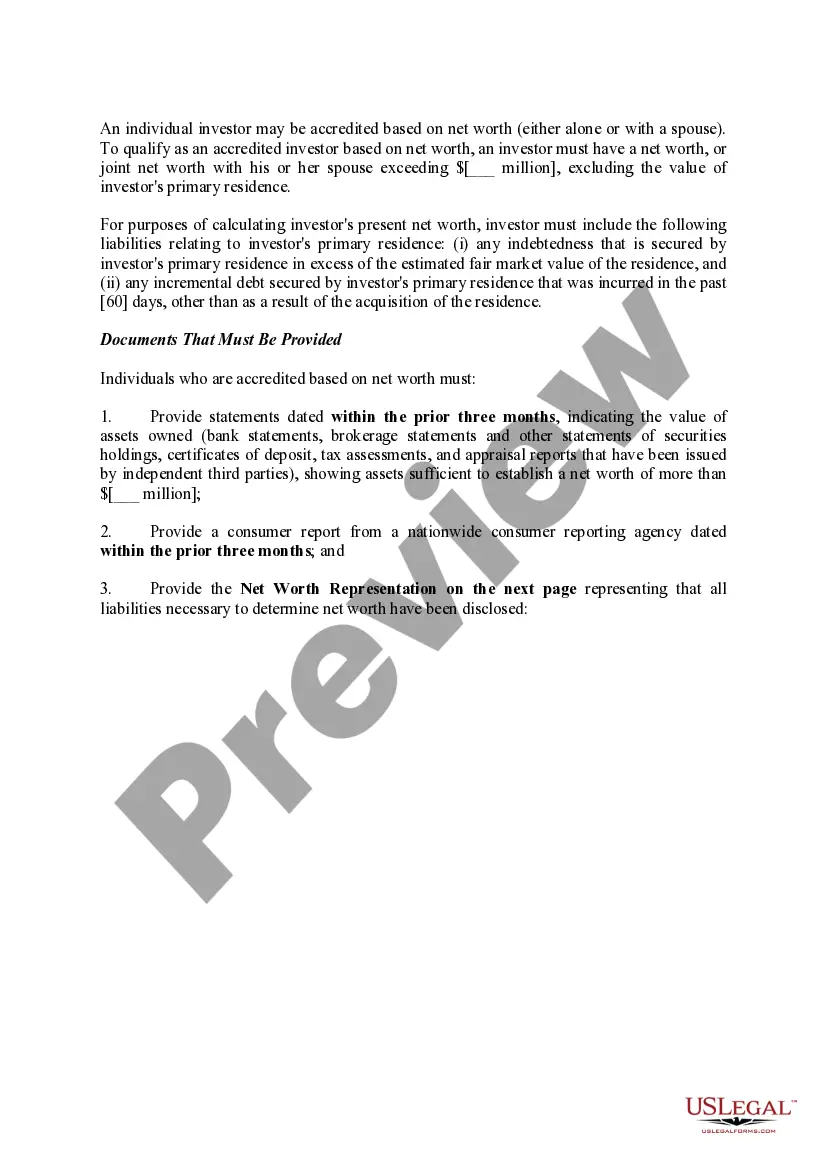

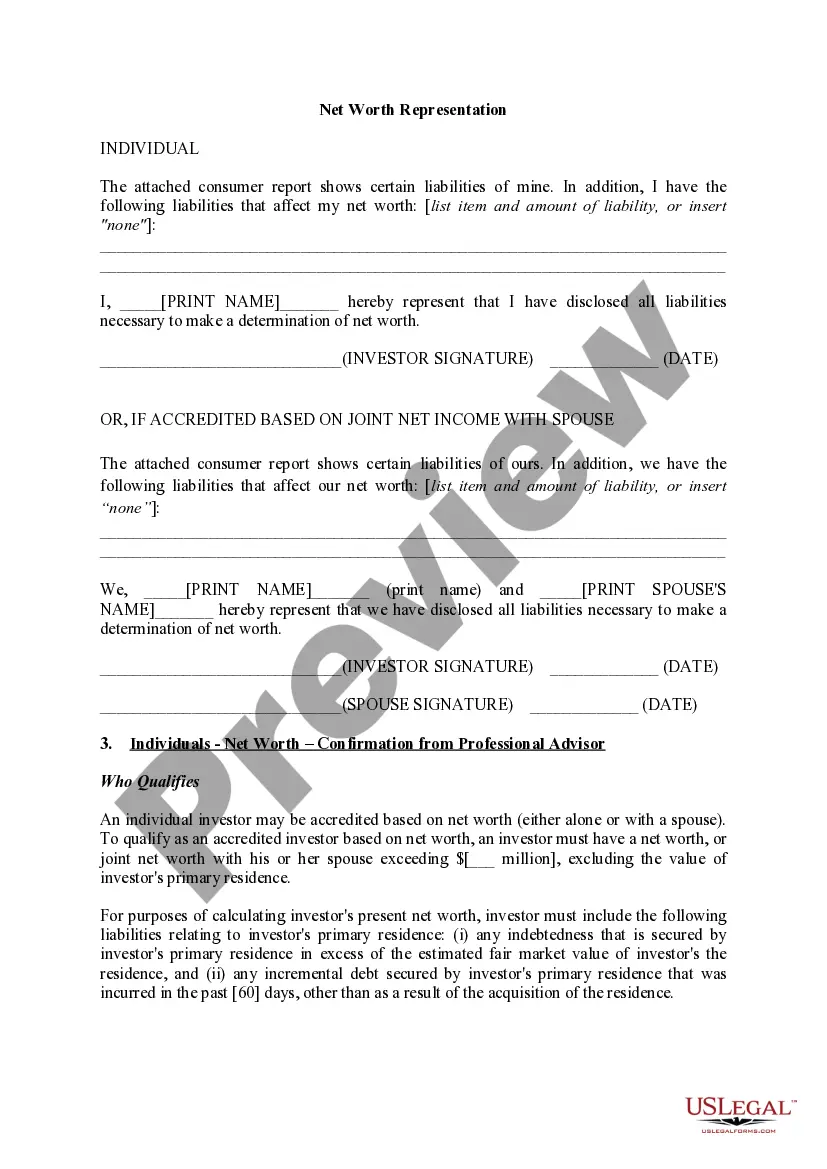

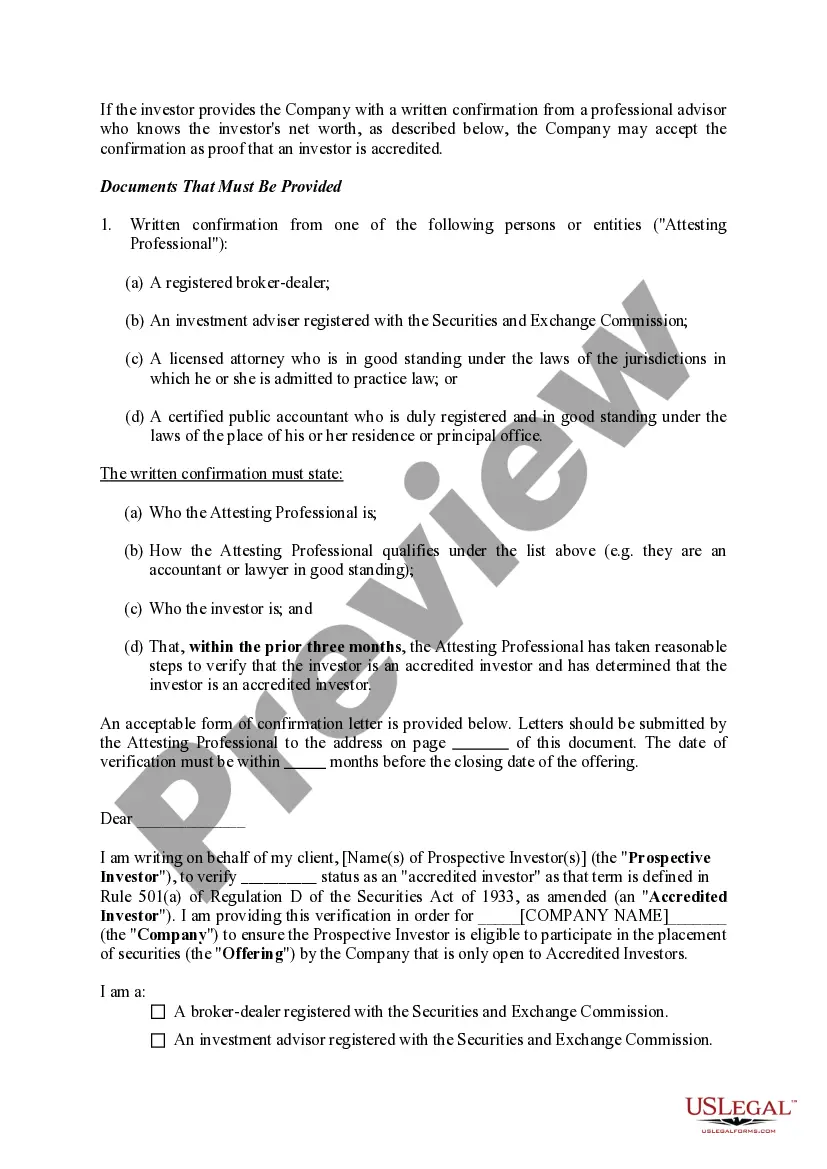

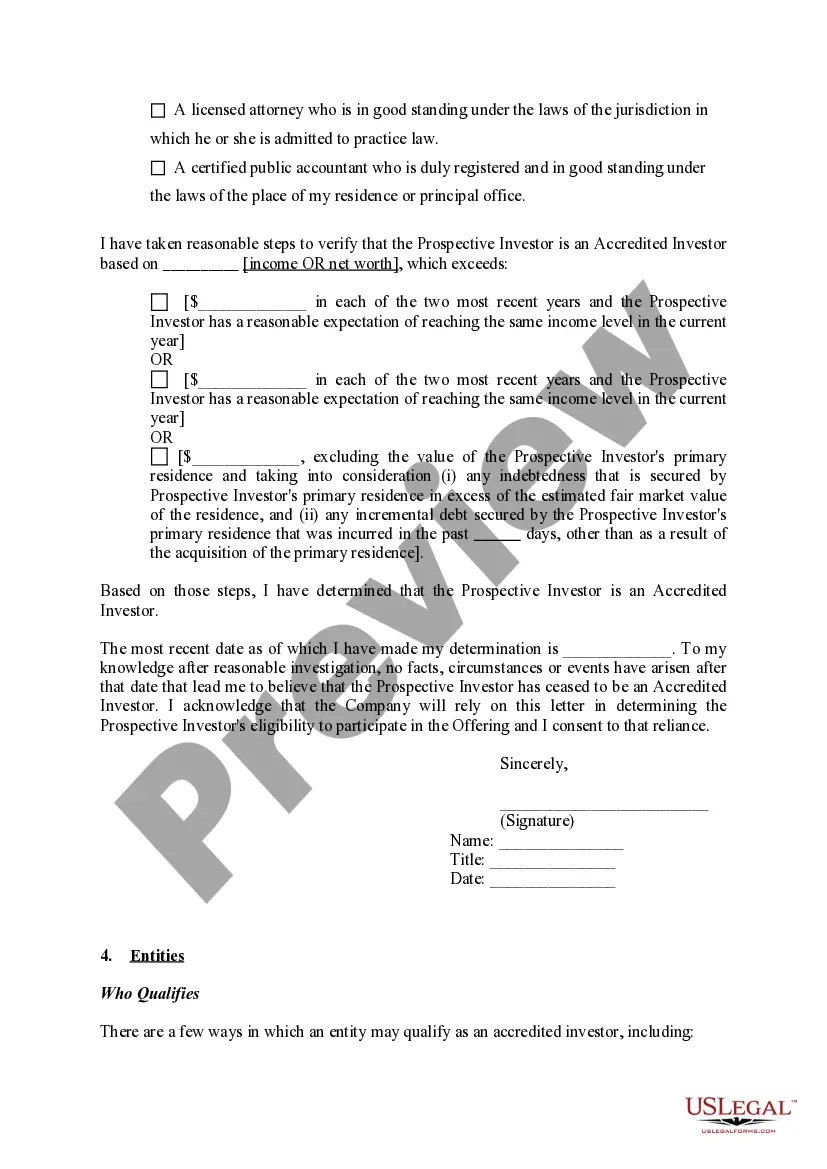

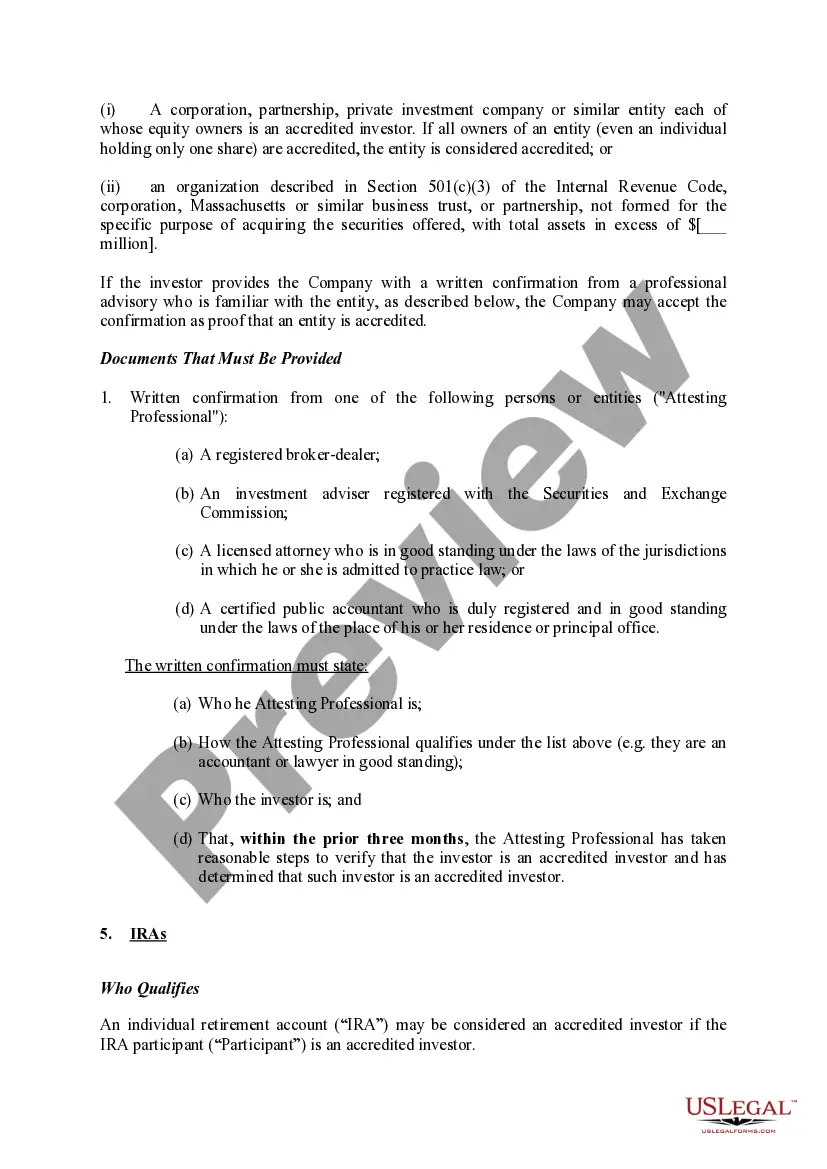

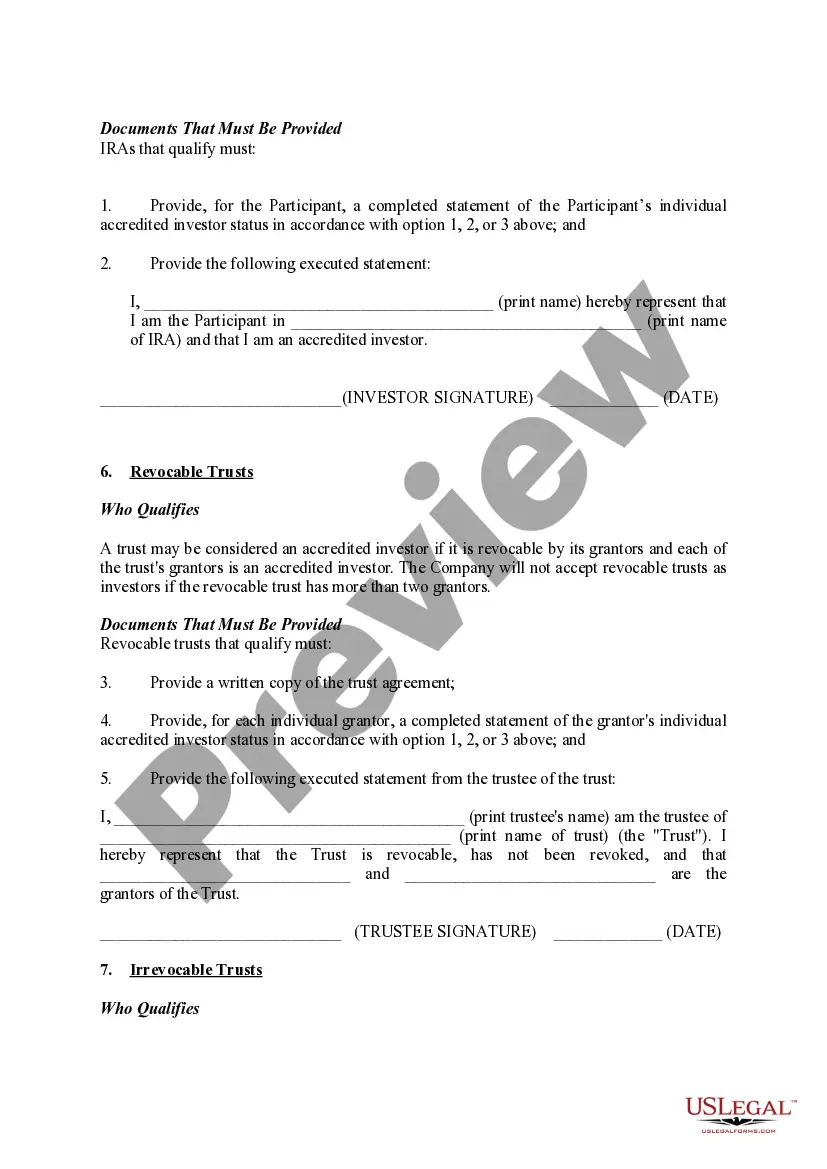

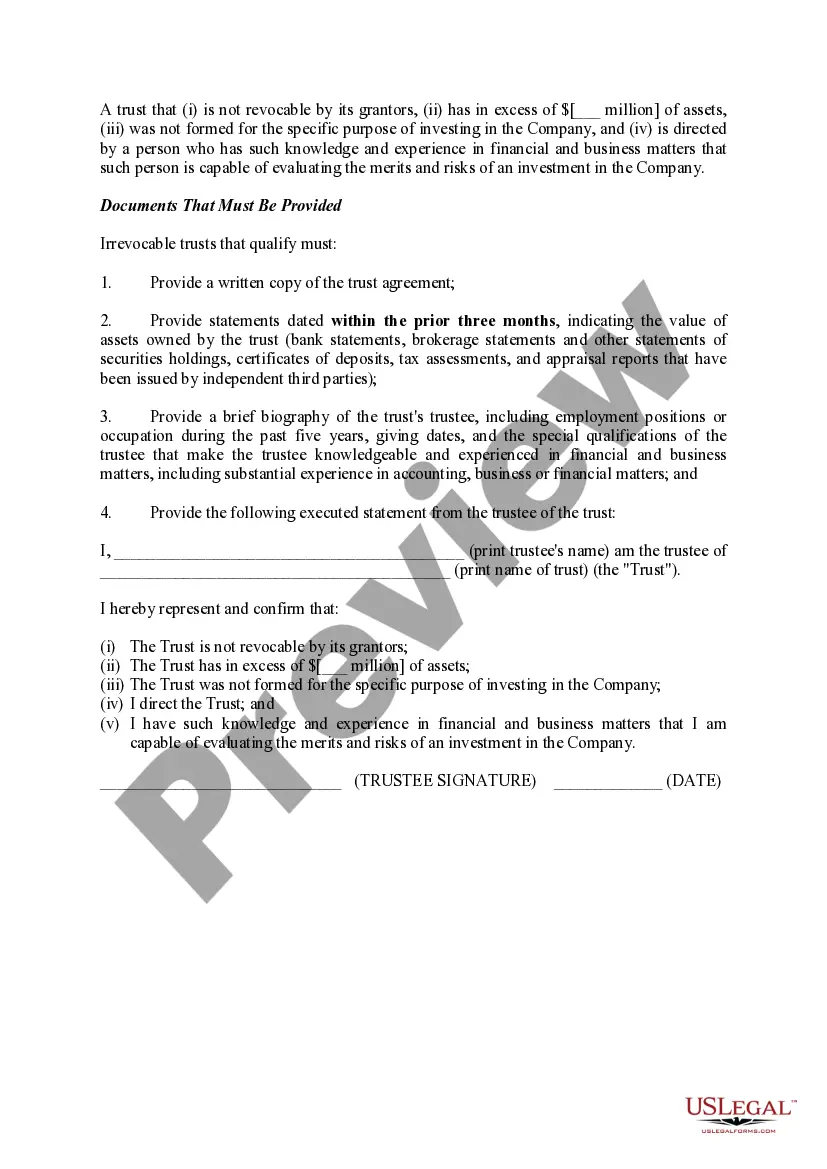

San Bernardino, California is a vibrant city situated in the heart of the Inland Empire, within San Bernardino County. Known for its rich history, stunning landscapes, and diverse population, San Bernardino is an attractive destination for both residents and visitors alike. It offers a range of activities, from exploring beautiful parks and scenic mountain trails to enjoying cultural events and historical landmarks. For individuals seeking to confirm their accredited investor status, various documentation is required. These documents are necessary to demonstrate that an individual meets the criteria set by the U.S. Securities and Exchange Commission (SEC) to invest in certain high-risk investments. The SEC defines an accredited investor as an individual or entity that has a certain level of income, net worth, or professional experience, thus potentially being able to bear the risks involved in unregistered securities. Some key documentation required to confirm accredited investor status may include: 1. Income Verification: Individuals may be required to submit their tax returns, W-2 forms, or other related documents that validate their income level. The SEC typically sets specific income thresholds to qualify as an accredited investor. 2. Net Worth Verification: Individuals may need to provide documentation regarding their net worth, such as bank statements, investment account statements, real estate appraisals, or valuation reports. Net worth is determined by calculating the difference between one's assets and liabilities. 3. Professional Certifications: In certain cases, individuals may qualify as accredited investors based on their professional experience or certifications. For instance, licensed brokers, attorneys, and certified public accountants (CPA's) may be exempted from meeting specific income or net worth criteria. 4. Financial Statements: Some investment opportunities may require individuals to present audited financial statements prepared by an independent certified public accountant. These statements provide a comprehensive overview of an individual's financial position. 5. Legal Documentation: Depending on the specific investment opportunity, additional legal documentation might be necessary to prove accredited investor status. This could include agreements, contracts, or other legal forms that verify compliance with SEC regulations. It is crucial for individuals to consult with legal and financial professionals to ensure compliance with the required documentation for confirming accredited investor status in San Bernardino, California, or any other jurisdiction. The SEC regulations continuously evolve, so staying up to date with the current requirements is essential for investment opportunities.

San Bernardino California Documentation Required to Confirm Accredited Investor Status

Description

How to fill out San Bernardino California Documentation Required To Confirm Accredited Investor Status?

If you need to get a trustworthy legal document provider to obtain the San Bernardino Documentation Required to Confirm Accredited Investor Status, consider US Legal Forms. Whether you need to launch your LLC business or manage your belongings distribution, we got you covered. You don't need to be knowledgeable about in law to find and download the needed template.

- You can select from more than 85,000 forms arranged by state/county and case.

- The self-explanatory interface, variety of learning materials, and dedicated support team make it simple to find and complete different papers.

- US Legal Forms is a trusted service providing legal forms to millions of customers since 1997.

You can simply select to look for or browse San Bernardino Documentation Required to Confirm Accredited Investor Status, either by a keyword or by the state/county the form is intended for. After finding the needed template, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's easy to start! Simply locate the San Bernardino Documentation Required to Confirm Accredited Investor Status template and take a look at the form's preview and short introductory information (if available). If you're comfortable with the template’s legalese, go ahead and click Buy now. Register an account and select a subscription option. The template will be immediately ready for download as soon as the payment is processed. Now you can complete the form.

Taking care of your legal affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to prove it. Our extensive collection of legal forms makes these tasks less costly and more affordable. Set up your first business, organize your advance care planning, create a real estate agreement, or execute the San Bernardino Documentation Required to Confirm Accredited Investor Status - all from the convenience of your home.

Join US Legal Forms now!