To become an accredited investor the (SEC) requires certain wealth, income or knowledge requirements. The investor must fall into one of three categories. Firms selling unregistered securities must put investors through their own screening process to determine if investors can be considered an accredited investor.

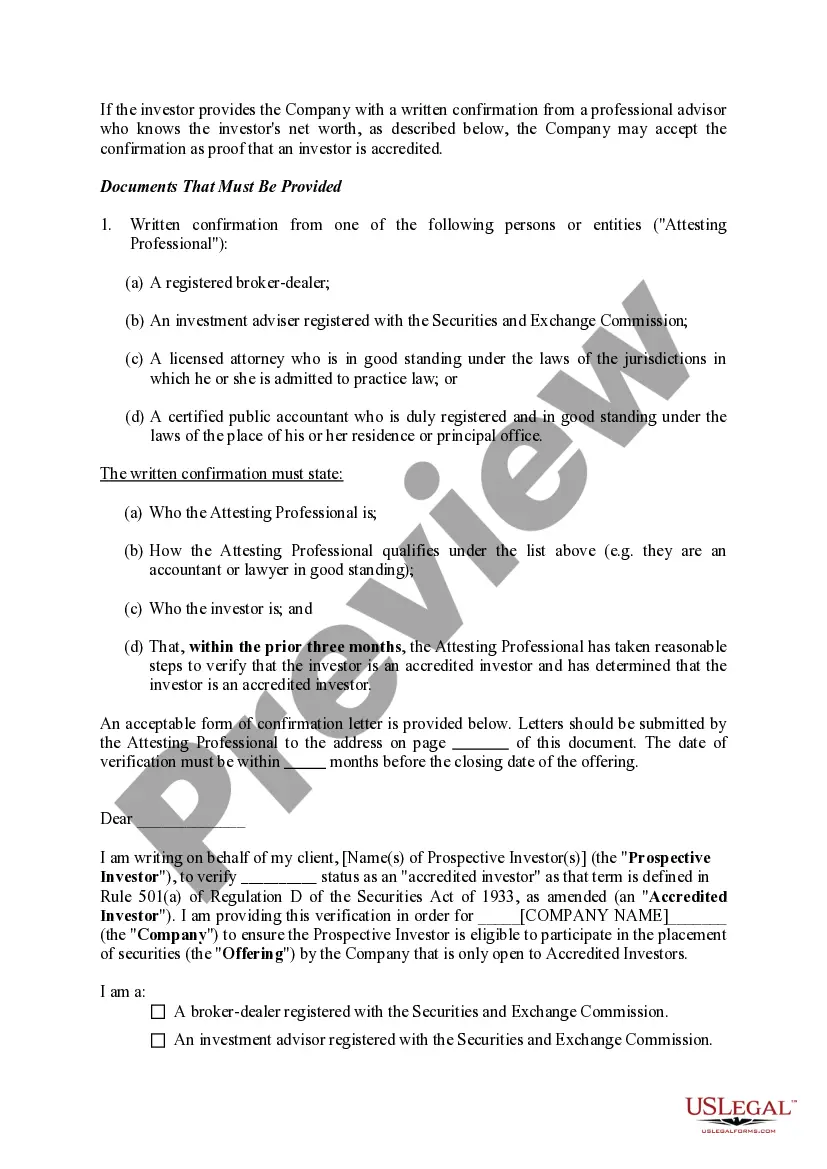

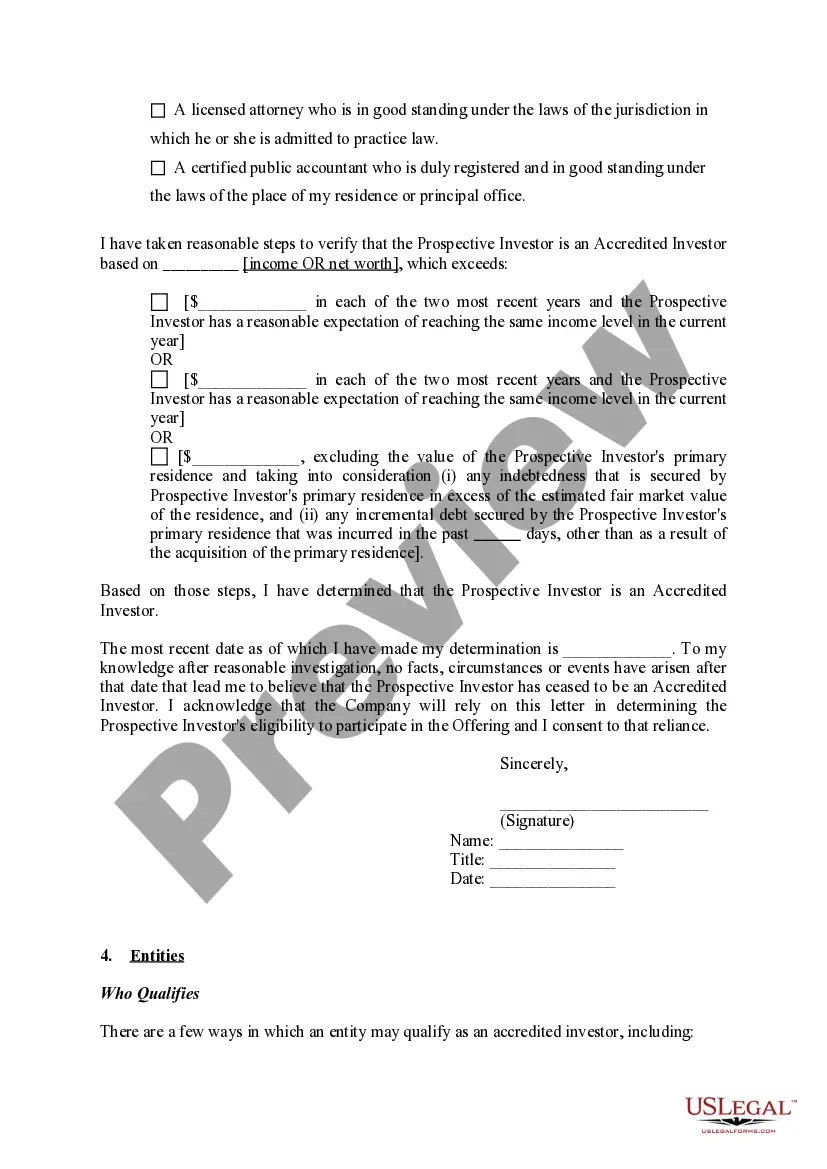

The Verifying Individual or Entity should take reasonable steps to verify and determined that an Investor is an "accredited investor" as such term is defined in Rule 501 of the Securities Act, and hereby provides written confirmation. This letter serves to help the Entity determine status.

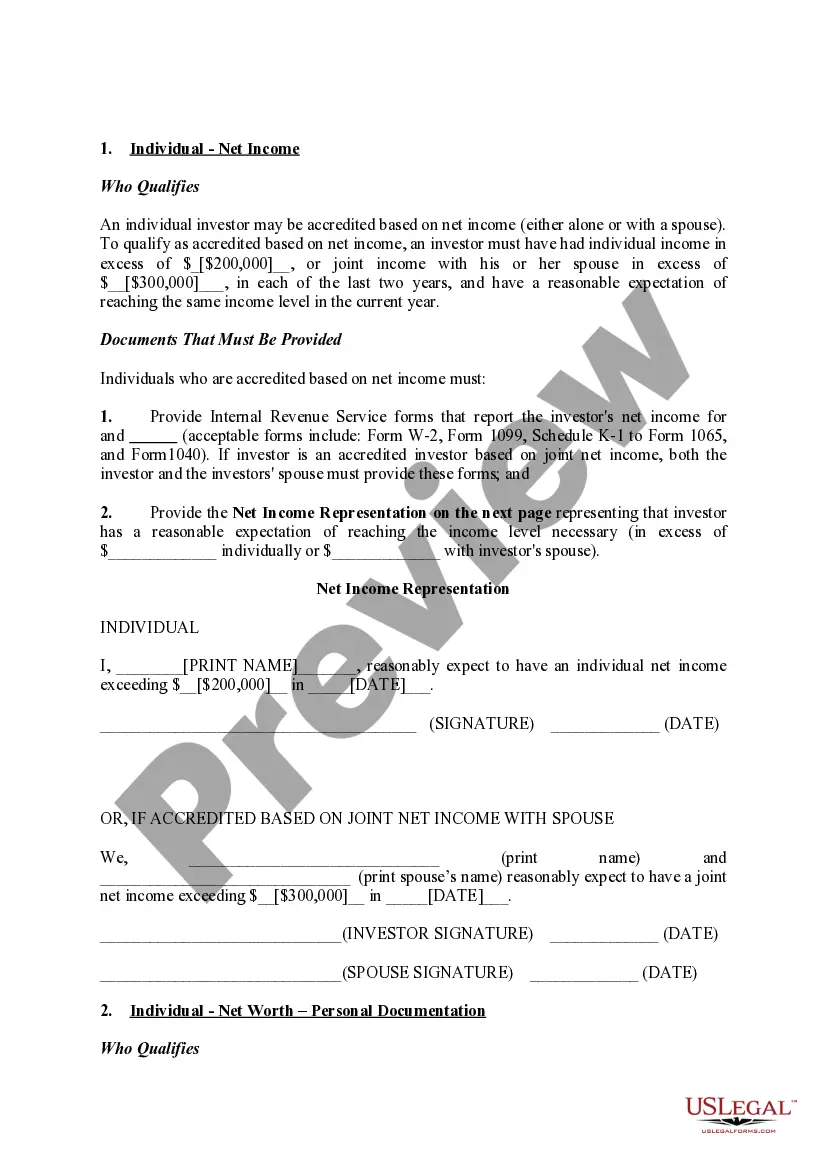

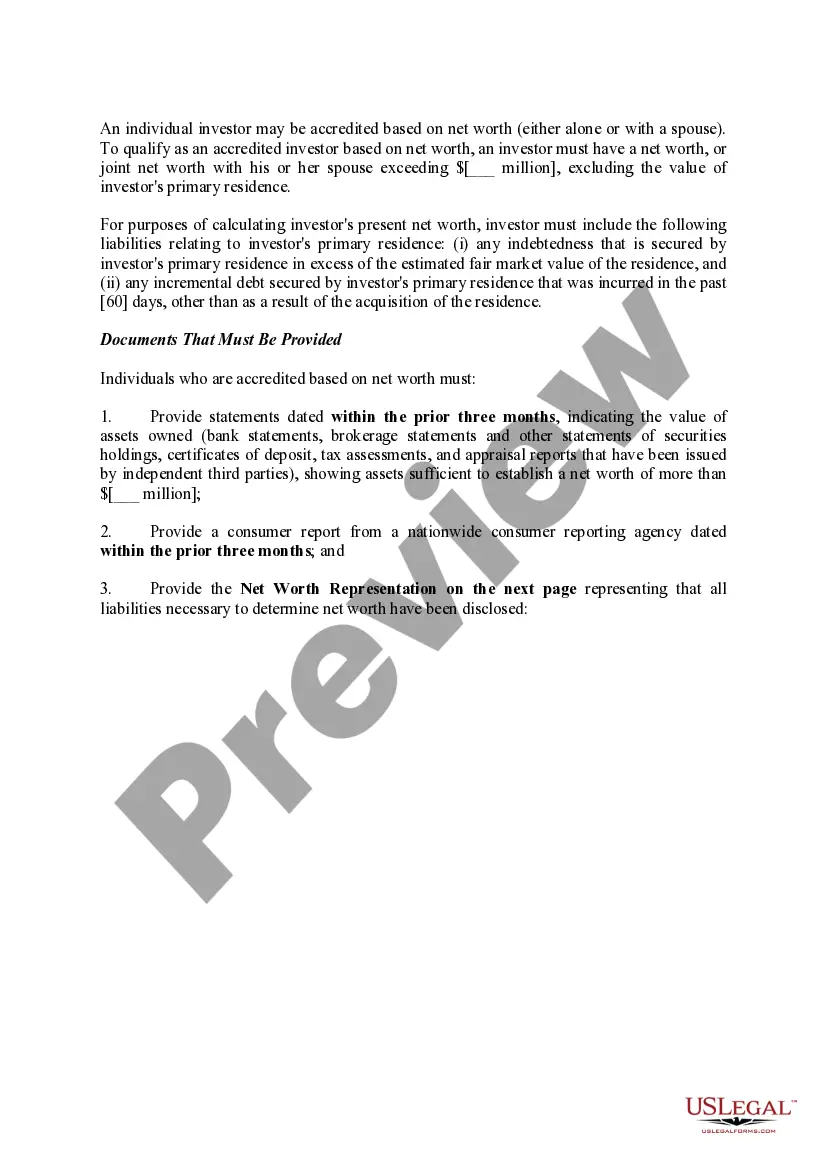

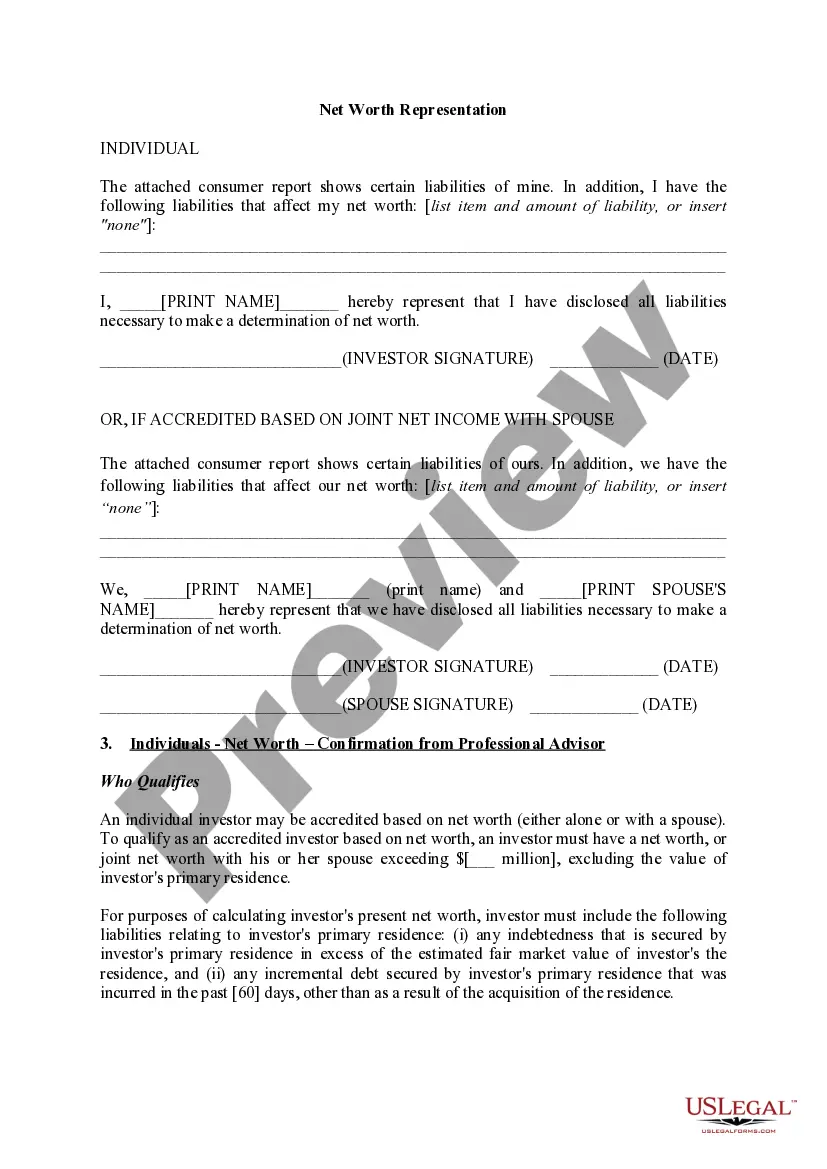

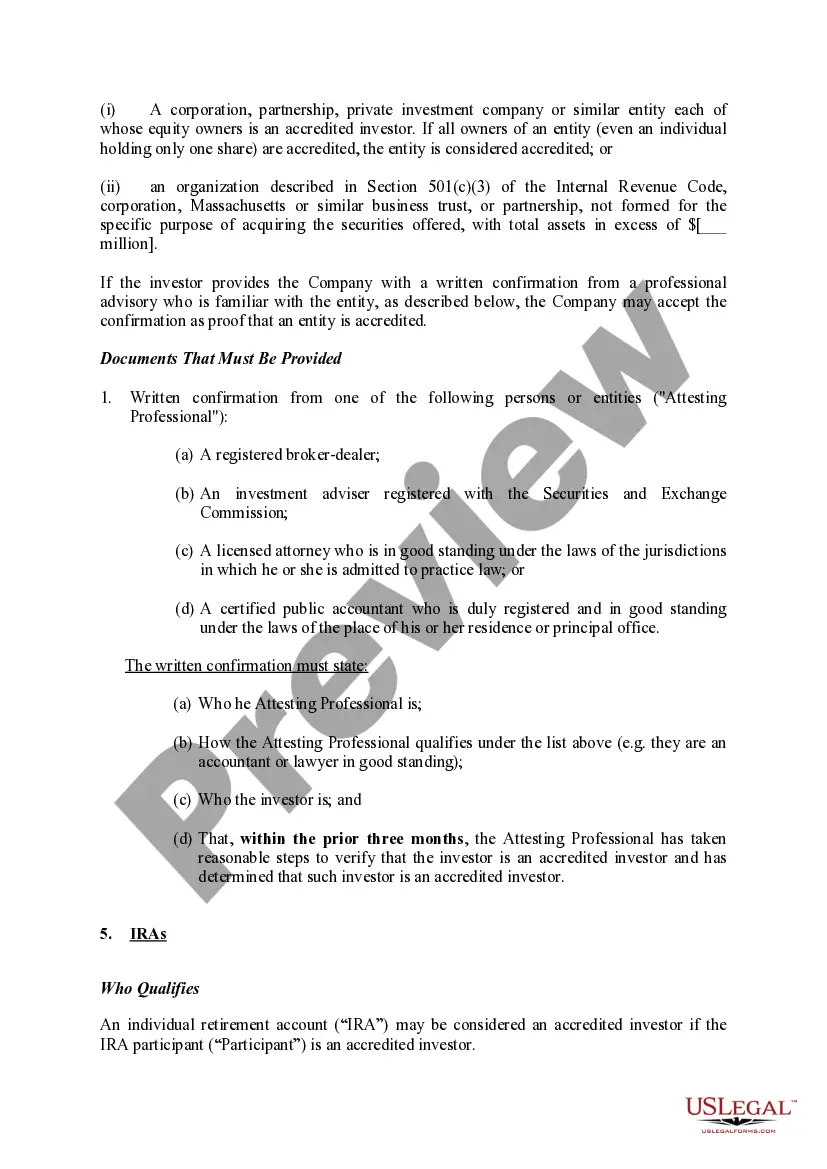

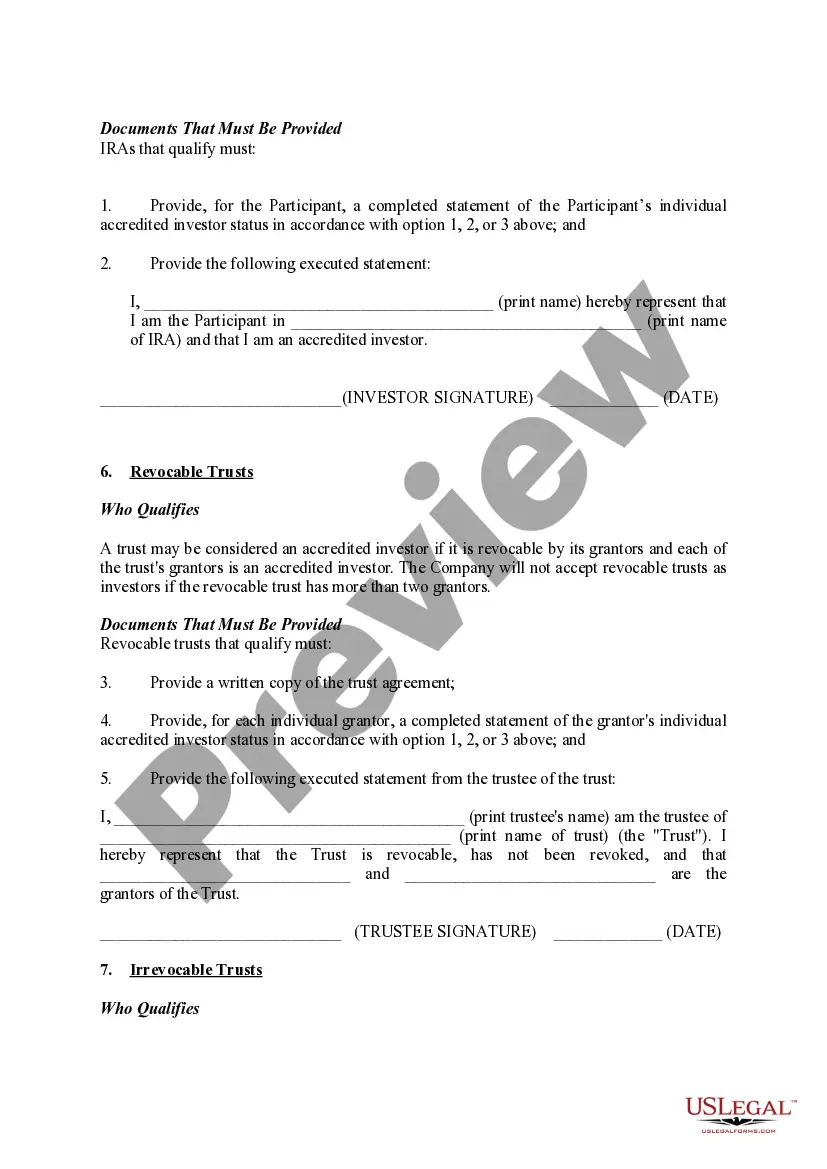

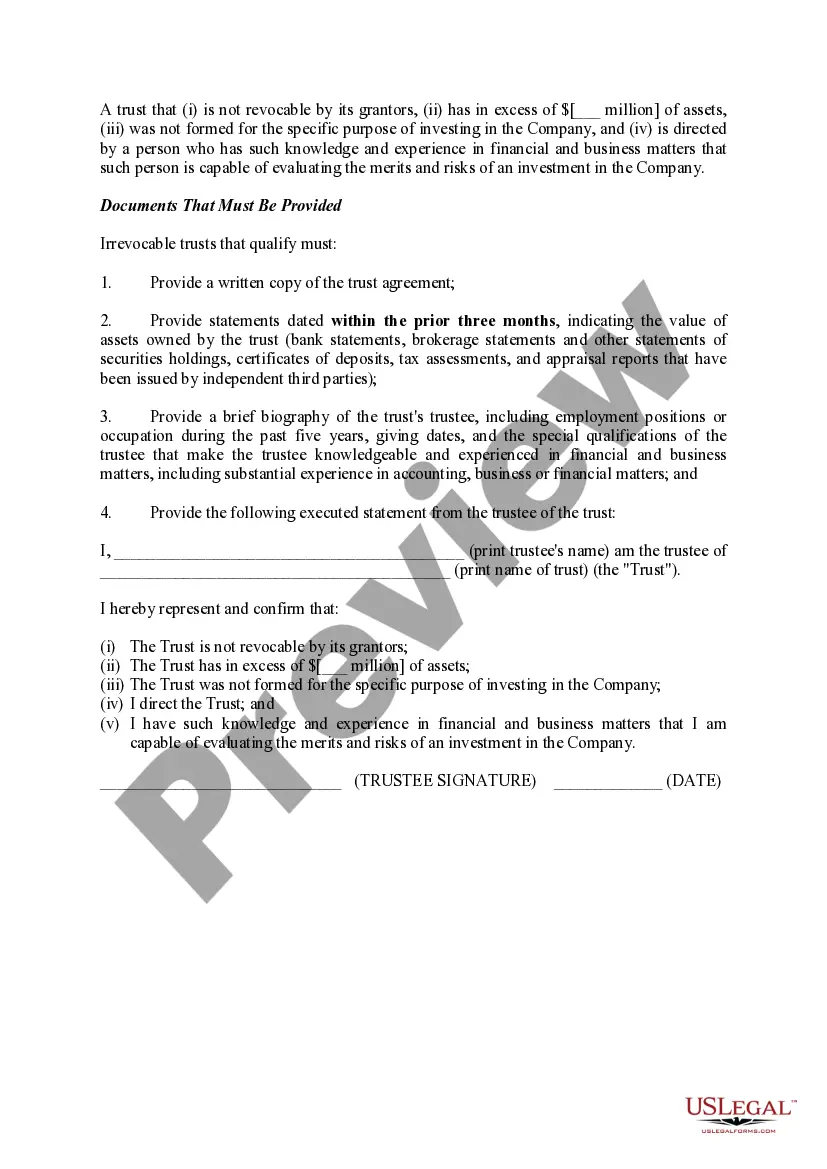

San Jose, California, is a bustling city located in the heart of Silicon Valley, known for its technological advancements and thriving startup culture. When it comes to confirming accredited investor status, certain documentation is required to ensure compliance with legal regulations. These documents play a crucial role in assessing an individual's eligibility to invest in certain types of securities and private investment opportunities. Below, we will discuss the various types of documentation that may be required to confirm accredited investor status in San Jose, California. 1. Income Verification: One of the primary methods to ascertain accredited investor status is through income verification. Individuals must provide appropriate documentation to prove that they meet specific income thresholds defined by the Securities and Exchange Commission (SEC). This usually involves submitting tax returns, payroll statements, or other official documents that verify income earned over the past few years. 2. Net Worth Statement: Another way to establish accredited investor status is by demonstrating a substantial net worth. Investors need to provide a comprehensive net worth statement that includes the valuation of their assets and liabilities. This statement should be supported by official documents such as property deeds, bank statements, investment account statements, and insurance policies. 3. Accredited Investor Certification Letter: Some investment opportunities may require individuals to obtain an accredited investor certification letter from a qualified professional, such as a lawyer or certified public accountant. This letter affirms that the investor meets the necessary requirements to be classified as an accredited investor. 4. Professional Certifications: Certain professionals may qualify as accredited investors based on their field of expertise. For example, licensed brokers, registered investment advisers, and financial professionals with specific certifications like Series 7 or CFA (Chartered Financial Analyst) designation may be considered accredited investors. Relevant certifications and licenses should be provided to confirm this professional status. 5. Proof of Entity: In situations where investments are made through an entity such as a corporation, partnership, or limited liability company (LLC), supporting documentation should be submitted to confirm accredited investor status. This may include copies of the entity's articles of incorporation, operating agreements, partnership agreements, or any other relevant legal documents. 6. Trust Documentation: If an investor is operating through a trust, additional documentation will be required to verify the trust's accredited investor status. This includes providing trust agreements, trustee appointments, and supporting financial statements of the trust's assets and liabilities. 7. Relevant Forms and Questionnaires: Apart from the aforementioned documents, investors may be required to complete various forms and questionnaires specific to the investment opportunity or the company offering the investment. These forms help gather additional information and confirm compliance with legal and regulatory requirements. In conclusion, confirming accredited investor status in San Jose, California, involves providing various types of documentation to solidify an individual's eligibility to partake in private investment opportunities. Income verification, net worth statements, accredited investor certification letters, professional certifications, proof of entity, trust documentation, and completed forms/questionnaires are all potential elements needed to establish accredited investor status. It's essential to consult with legal professionals or investment advisers to ensure compliance with specific requirements based on the investment opportunity.

San Jose, California, is a bustling city located in the heart of Silicon Valley, known for its technological advancements and thriving startup culture. When it comes to confirming accredited investor status, certain documentation is required to ensure compliance with legal regulations. These documents play a crucial role in assessing an individual's eligibility to invest in certain types of securities and private investment opportunities. Below, we will discuss the various types of documentation that may be required to confirm accredited investor status in San Jose, California. 1. Income Verification: One of the primary methods to ascertain accredited investor status is through income verification. Individuals must provide appropriate documentation to prove that they meet specific income thresholds defined by the Securities and Exchange Commission (SEC). This usually involves submitting tax returns, payroll statements, or other official documents that verify income earned over the past few years. 2. Net Worth Statement: Another way to establish accredited investor status is by demonstrating a substantial net worth. Investors need to provide a comprehensive net worth statement that includes the valuation of their assets and liabilities. This statement should be supported by official documents such as property deeds, bank statements, investment account statements, and insurance policies. 3. Accredited Investor Certification Letter: Some investment opportunities may require individuals to obtain an accredited investor certification letter from a qualified professional, such as a lawyer or certified public accountant. This letter affirms that the investor meets the necessary requirements to be classified as an accredited investor. 4. Professional Certifications: Certain professionals may qualify as accredited investors based on their field of expertise. For example, licensed brokers, registered investment advisers, and financial professionals with specific certifications like Series 7 or CFA (Chartered Financial Analyst) designation may be considered accredited investors. Relevant certifications and licenses should be provided to confirm this professional status. 5. Proof of Entity: In situations where investments are made through an entity such as a corporation, partnership, or limited liability company (LLC), supporting documentation should be submitted to confirm accredited investor status. This may include copies of the entity's articles of incorporation, operating agreements, partnership agreements, or any other relevant legal documents. 6. Trust Documentation: If an investor is operating through a trust, additional documentation will be required to verify the trust's accredited investor status. This includes providing trust agreements, trustee appointments, and supporting financial statements of the trust's assets and liabilities. 7. Relevant Forms and Questionnaires: Apart from the aforementioned documents, investors may be required to complete various forms and questionnaires specific to the investment opportunity or the company offering the investment. These forms help gather additional information and confirm compliance with legal and regulatory requirements. In conclusion, confirming accredited investor status in San Jose, California, involves providing various types of documentation to solidify an individual's eligibility to partake in private investment opportunities. Income verification, net worth statements, accredited investor certification letters, professional certifications, proof of entity, trust documentation, and completed forms/questionnaires are all potential elements needed to establish accredited investor status. It's essential to consult with legal professionals or investment advisers to ensure compliance with specific requirements based on the investment opportunity.