Bexar Texas Accredited Investor Very?cation Letter — Individual Investor: A Bexar Texas Accredited Investor Verification Letter is a formal document used to confirm an individual investor's status as an accredited investor in compliance with the accredited investor requirements set forth by the United States Securities and Exchange Commission (SEC). Accredited investors are individuals who meet specific financial criteria and are considered to have the necessary financial sophistication and expertise to invest in certain private offerings that are not available to the public. By undergoing this verification process, individuals can gain access to investment opportunities that are typically restricted only to accredited investors. The Bexar Texas Accredited Investor Verification Letter — Individual Investor typically includes the following key details: 1. Personal Information: The letter starts with the individual investor's name, contact details, and information related to their financial background. 2. Accredited Investor Criteria: The letter outlines the specific criteria that the individual meets to be considered an accredited investor. These criteria typically include minimum income or net worth thresholds, as defined by the SEC. 3. Verification Process: The letter describes the due diligence process conducted by a qualified entity or organization to verify the investor's status. This may involve reviewing financial statements, tax returns, bank statements, or other supporting documentation. 4. Compliance Statement: The letter includes a compliance statement affirming that the investor's information is accurate and that they understand the responsibilities of being an accredited investor. Different types of Bexar Texas Accredited Investor Verification Letters for Individual Investors may include variations based on specific investor categories, such as: 1. Income-Based Verification: This letter is used to verify an individual's status as an accredited investor based on meeting the minimum income thresholds set by the SEC. 2. Net Worth-Based Verification: This letter confirms an individual's status as an accredited investor based on meeting specific net worth requirements as outlined by the SEC. 3. Joint Income Verification: When a couple applies for accredited investor status together, a joint income verification letter may be required to verify their combined income level. 4. Trust or Entity Verification: In cases where an individual investor operates under a trust or entity, a verification letter may be needed to confirm the status of the trust or entity as an accredited investor. In summary, the Bexar Texas Accredited Investor Verification Letter — Individual Investor is a vital document used to ascertain an investor's eligibility for participation in private investment opportunities. It serves as an official confirmation of an individual's accredited investor status, allowing them access to lucrative investment options typically unavailable to non-accredited investors.

Bexar Texas Accredited Investor Veri?cation Letter - Individual Investor

Description

How to fill out Bexar Texas Accredited Investor Veri?cation Letter - Individual Investor?

A document routine always accompanies any legal activity you make. Opening a business, applying or accepting a job offer, transferring property, and lots of other life situations require you prepare official documentation that differs throughout the country. That's why having it all collected in one place is so valuable.

US Legal Forms is the largest online library of up-to-date federal and state-specific legal templates. On this platform, you can easily find and get a document for any individual or business purpose utilized in your region, including the Bexar Accredited Investor Veri?cation Letter - Individual Investor.

Locating samples on the platform is remarkably simple. If you already have a subscription to our service, log in to your account, find the sample through the search field, and click Download to save it on your device. Afterward, the Bexar Accredited Investor Veri?cation Letter - Individual Investor will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this quick guide to obtain the Bexar Accredited Investor Veri?cation Letter - Individual Investor:

- Ensure you have opened the correct page with your regional form.

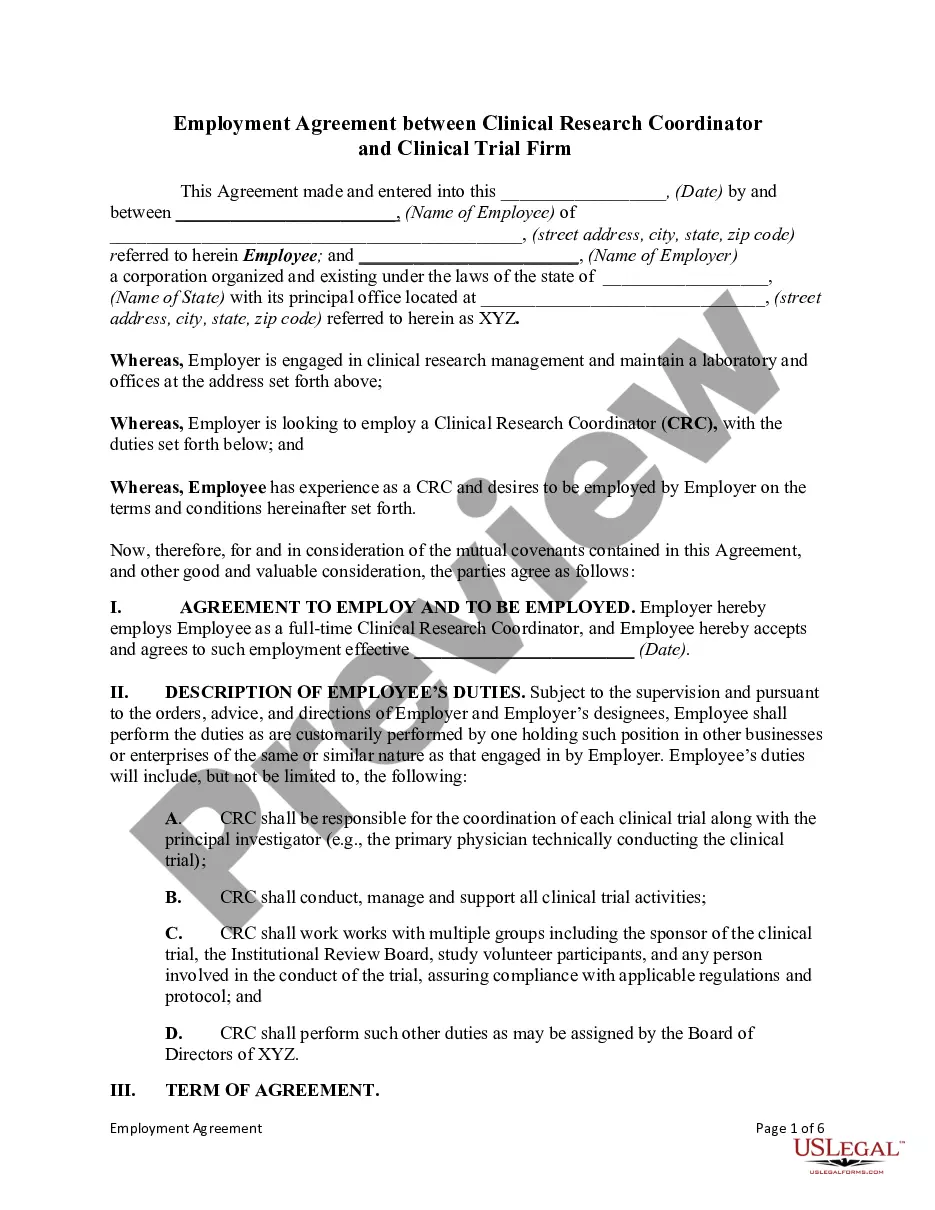

- Utilize the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the form satisfies your requirements.

- Search for another document using the search tab if the sample doesn't fit you.

- Click Buy Now once you locate the required template.

- Decide on the appropriate subscription plan, then sign in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and download the Bexar Accredited Investor Veri?cation Letter - Individual Investor on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most reliable way to obtain legal documents. All the templates available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs effectively with the US Legal Forms!