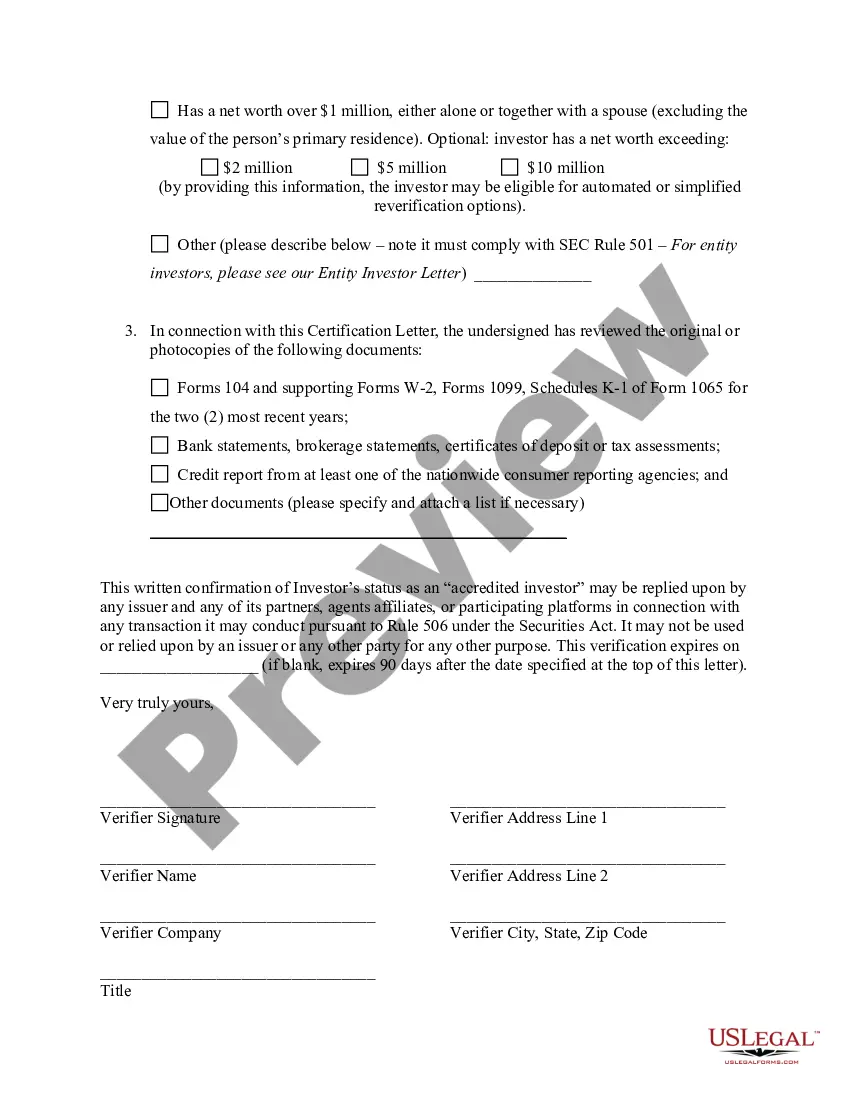

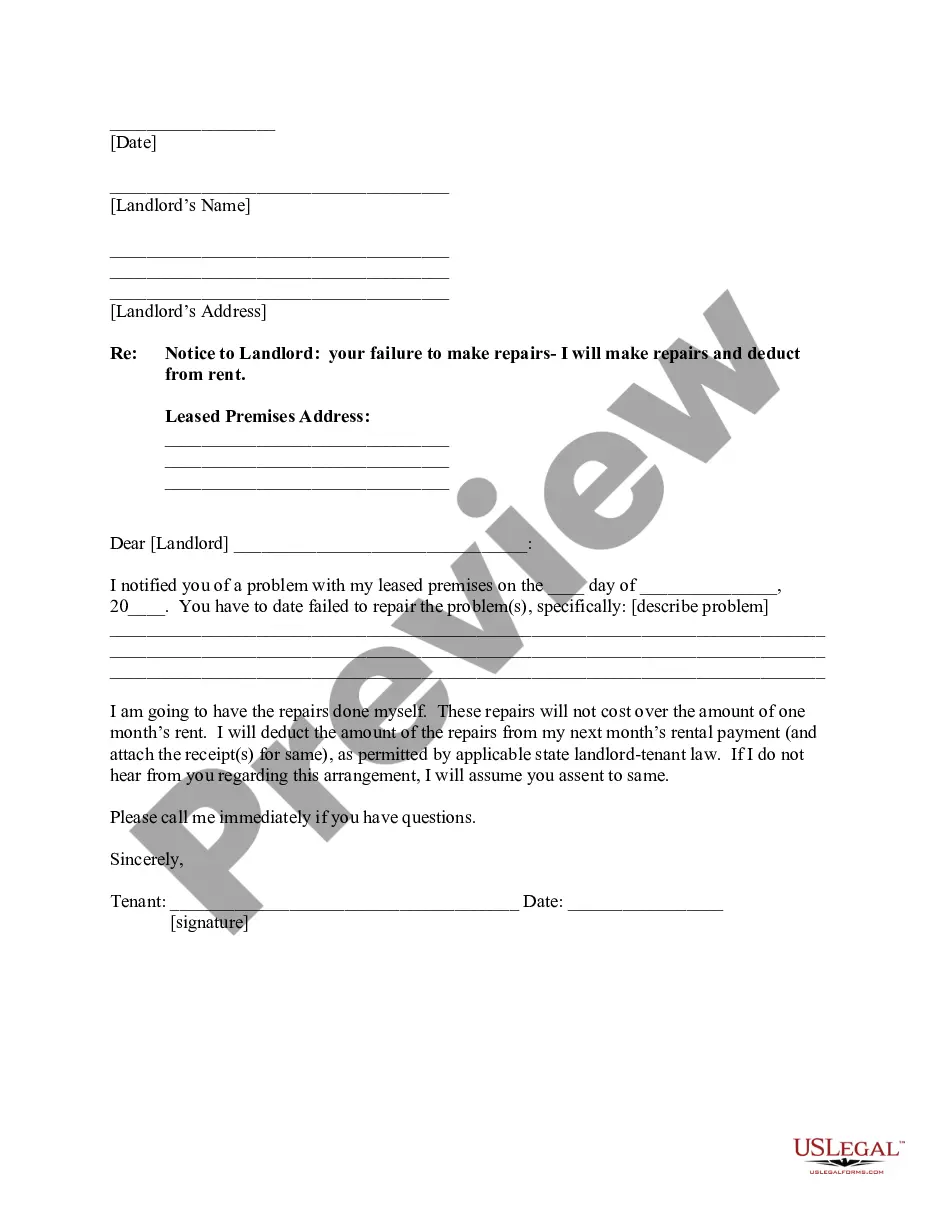

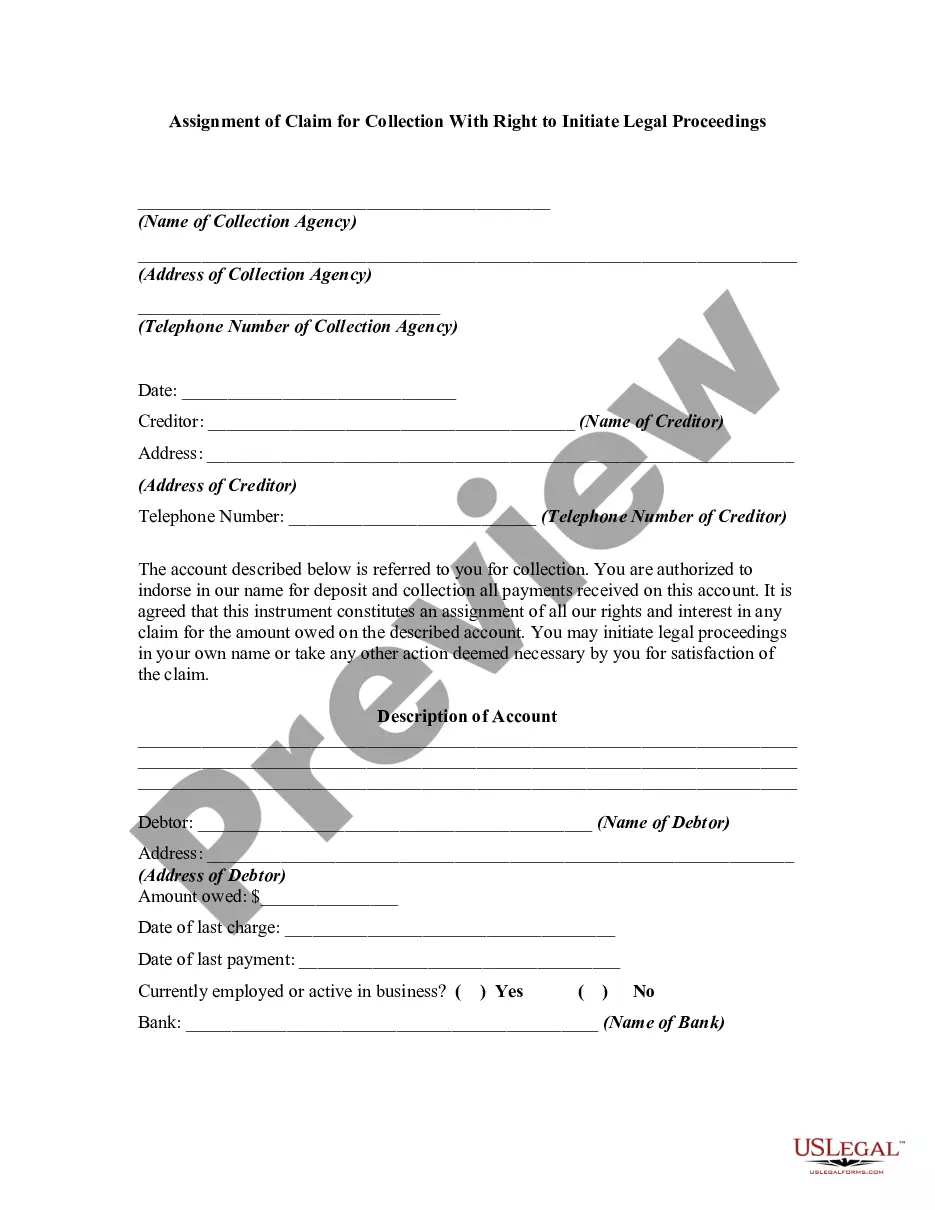

Contra Costa California Accredited Investor Verification Letter — Individual Investor In Contra Costa County, California, individuals seeking to invest in private offerings often need to provide a Contra Costa California Accredited Investor Verification Letter to demonstrate their status as an accredited investor. This letter serves as a proof that the individual meets the requirements set by the Securities and Exchange Commission (SEC) to invest in certain types of securities. An accredited investor is someone who meets specific income or net worth criteria outlined by the SEC. This classification allows individuals to participate in investments that are not available to non-accredited investors, such as private equity offerings, hedge funds, venture capital investments, and other opportunities that may carry higher risk but also higher potential returns. The Contra Costa California Accredited Investor Verification Letter — Individual Investor is a document submitted by an individual investor residing in Contra Costa County, California. The purpose of this letter is to provide evidence to the issuing party, typically the private securities issuer or their legal representative, that the investor meets the criteria to be classified as an accredited investor. The verification letter usually includes: 1. Contact Information: The investor's full name, address, phone number, and email address. 2. Accredited Investor Criteria: A statement indicating the specific criteria that the investor satisfies to be considered an accredited investor, which may include income, net worth, or professional experience requirements. 3. Documentation Proof: Any necessary supporting documents required by the issuing party to verify the investor's claim of accreditation. This may include tax returns, bank statements, investment account statements, or other financial records that demonstrate the investor's financial standing. 4. Signature: The investor's signature to affirm the accuracy of the provided information and documents. It's important to note that there may be different types or purposes of Contra Costa California Accredited Investor Verification Letters tailored for specific situations, such as: 1. Real Estate Investment: This verification letter may be required when an individual seeks to invest in real estate offerings available only to accredited investors, such as real estate syndication, crowdfunding, or private placements in the Contra Costa County area. 2. Venture Capital Investment: Startups and venture capital firms may require a verification letter from individual investors who wish to participate in funding rounds or private investments in Contra Costa County's emerging companies and innovative ventures. 3. Private Equity Offerings: Certain private equity firms operating in Contra Costa California may request an individual investor to submit a verification letter before participating in private equity investments or funds. 4. Hedge Fund Investment: Some hedge funds in the Contra Costa County area may have specific requirements to verify an individual's accredited investor status, necessitating the submission of a verification letter. Ensuring that the Contra Costa California Accredited Investor Verification Letter is accurate and complete is crucial for investors seeking access to exclusive investment opportunities. It is essential to consult with legal and financial professionals to confirm the specific requirements of the issuing party and to ensure compliance with relevant regulations.

Contra Costa California Accredited Investor Veri?cation Letter - Individual Investor

Description

How to fill out Contra Costa California Accredited Investor Veri?cation Letter - Individual Investor?

A document routine always accompanies any legal activity you make. Opening a business, applying or accepting a job offer, transferring ownership, and lots of other life situations require you prepare formal documentation that varies throughout the country. That's why having it all collected in one place is so beneficial.

US Legal Forms is the largest online collection of up-to-date federal and state-specific legal forms. On this platform, you can easily find and get a document for any personal or business purpose utilized in your county, including the Contra Costa Accredited Investor Veri?cation Letter - Individual Investor.

Locating templates on the platform is remarkably straightforward. If you already have a subscription to our library, log in to your account, find the sample using the search bar, and click Download to save it on your device. Following that, the Contra Costa Accredited Investor Veri?cation Letter - Individual Investor will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this quick guideline to obtain the Contra Costa Accredited Investor Veri?cation Letter - Individual Investor:

- Make sure you have opened the proper page with your regional form.

- Utilize the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the template corresponds to your requirements.

- Look for another document via the search option in case the sample doesn't fit you.

- Click Buy Now when you find the required template.

- Select the suitable subscription plan, then sign in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and download the Contra Costa Accredited Investor Veri?cation Letter - Individual Investor on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most reliable way to obtain legal documents. All the templates provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs efficiently with the US Legal Forms!