Nassau New York Accredited Investor Verification Letter — Individual Investor: Nassau New York Accredited Investor Verification Letter is a formal document used to confirm an individual's status as an accredited investor in the state of Nassau, New York. This letter serves as proof of eligibility for participating in various investment opportunities that are exclusively available to accredited investors. The purpose of the Accredited Investor Verification Letter is to ensure compliance with strict regulatory standards set forth by organizations such as the Securities and Exchange Commission (SEC) and the New York State Department of Financial Services (NY DFS). By obtaining this letter, individual investors can demonstrate their financial sophistication and meet the criteria necessary to access certain investment options that are typically restricted to non-accredited individuals. The Accredited Investor Verification Letter is a vital document for individuals seeking to engage in private placements, venture capital investments, hedge funds, and other high-risk investment ventures. It provides assurance to investment issuers and institutions that the individual has the necessary financial means, knowledge, and experience to evaluate potential opportunities and bear the associated risks. Types of Nassau New York Accredited Investor Verification Letters — Individual Investor: 1. Net Worth Verification: This type of verification letter validates an individual's net worth, usually exceeding $1 million, excluding the value of their primary residence. It considers various financial assets such as cash, stocks, bonds, real estate, and other investments to assess an individual's financial standing. 2. Income Verification: This variation of the verification letter focuses on an individual's annual income, verifying that they have consistently earned at least $200,000 annually (or $300,000 jointly with a spouse) in the past two years, with a high likelihood of maintaining a similar level of income in the future. 3. Professional Designation Verification: This category involves verifying an individual's professional certifications, licenses, or registrations that demonstrate their expertise or familiarity with specific investment-related fields, such as accounting, finance, law, or investment advisory. 4. Self-Certification: This is a less formal method of verification where the individual Investor provides a signed statement affirming their accredited investor status and assuming legal responsibility for any misrepresentations. However, this type of verification may not be accepted by all investment issuers and institutions. It is important for individual investors to consult with legal and financial professionals to determine the appropriate type of Accredited Investor Verification Letter that suits their specific circumstances and investment goals.

Nassau New York Accredited Investor Veri?cation Letter - Individual Investor

Description

How to fill out Nassau New York Accredited Investor Veri?cation Letter - Individual Investor?

Whether you plan to start your business, enter into an agreement, apply for your ID renewal, or resolve family-related legal concerns, you need to prepare specific paperwork meeting your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and verified legal templates for any individual or business occurrence. All files are grouped by state and area of use, so picking a copy like Nassau Accredited Investor Veri?cation Letter - Individual Investor is fast and easy.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you several more steps to obtain the Nassau Accredited Investor Veri?cation Letter - Individual Investor. Adhere to the guide below:

- Make sure the sample fulfills your individual needs and state law regulations.

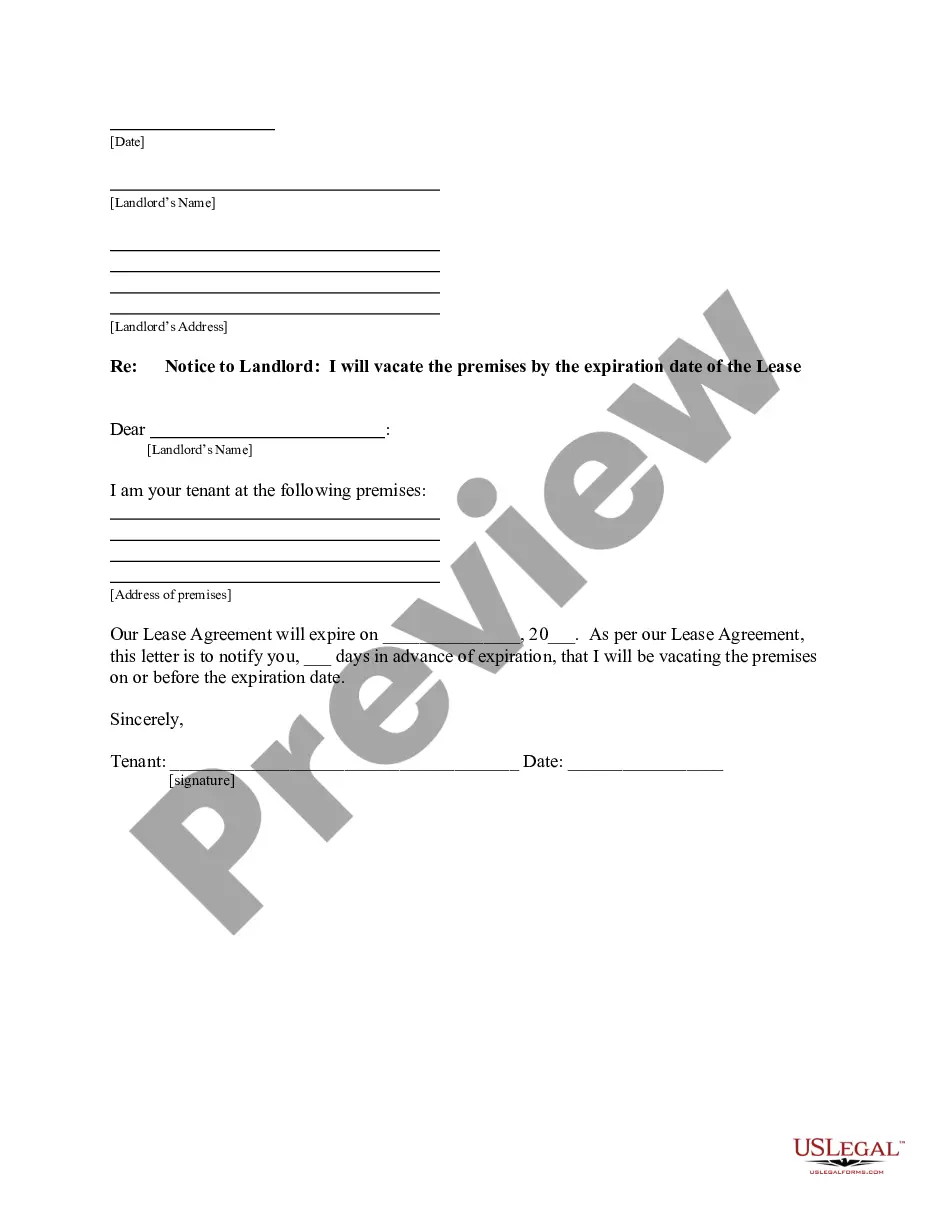

- Look through the form description and check the Preview if available on the page.

- Make use of the search tab specifying your state above to locate another template.

- Click Buy Now to obtain the sample once you find the proper one.

- Choose the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Nassau Accredited Investor Veri?cation Letter - Individual Investor in the file format you require.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our library are reusable. Having an active subscription, you can access all of your earlier acquired paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documents. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!