San Antonio, Texas Accredited Investor Verification Letter — Individual Investor Keywords: San Antonio, Texas, Accredited Investor, Verification Letter, Individual Investor. Description: The San Antonio, Texas Accredited Investor Verification Letter for Individual Investors is an essential document used in financial transactions and investments. This letter serves the purpose of verifying an individual's accredited investor status, as defined by the U.S. Securities and Exchange Commission (SEC), within the city of San Antonio, Texas. Accredited Investor Verification: An Accredited Investor is an individual who meets specific criteria set by the SEC, demonstrating their financial sophistication and ability to bear the risks associated with certain investment opportunities. This verification letter is typically required by financial institutions, investment firms, and private companies to ensure compliance with SEC regulations. Types of San Antonio Texas Accredited Investor Verification Letter — Individual Investor: 1. Standard Accredited Investor Verification Letter: This type of letter is commonly used by individuals to confirm their accredited investor status. It includes essential information such as the individual's name, contact details, net worth, annual income, and any additional assets or liabilities. The letter typically includes a declaration by the individual, signed and dated, asserting their accredited investor status. 2. Self-Certified Accredited Investor Verification Letter: In certain cases, individuals who meet the accredited investor criteria may be able to self-certify their status. This type of letter can be used by individuals without the need for third-party verification. It is still a legally binding document, requiring accurate self-reporting of one's financial status. 3. Accredited Investor Verification Letter for Specific Investments: Sometimes, certain investments or financial opportunities may require a more specific verification letter. For instance, real estate projects, private equity firms, or hedge funds may have their own unique verification letter requirements. These letters may have additional sections to gather specific information relevant to the investment opportunity in question. Importance of Accredited Investor Verification: Accredited Investor Verification is crucial for various reasons: a) Compliance: Financial institutions and investment firms must comply with SEC regulations by ensuring they only offer investment opportunities to accredited investors. This verification letter helps confirm an individual's eligibility. b) Investor Protection: Verification ensures that individuals have the necessary financial knowledge and resources to minimize risks associated with alternative investments. c) Legal Protection: The verification letter acts as proof for both the investor and the investment offering entity, protecting them in case of any legal disputes. d) Transparency: By confirming an individual's accredited investor status, transparency is enhanced in investment transactions, fostering trust between investors and the investment community. In conclusion, the San Antonio, Texas Accredited Investor Verification Letter for Individual Investors is a vital document used to verify an individual's accredited investor status. It ensures compliance with SEC regulations, protects both the investor and investment firms, and promotes transparency in financial transactions.

San Antonio Texas Accredited Investor Veri?cation Letter - Individual Investor

Description

How to fill out San Antonio Texas Accredited Investor Veri?cation Letter - Individual Investor?

Dealing with legal forms is a necessity in today's world. Nevertheless, you don't always need to look for qualified assistance to create some of them from the ground up, including San Antonio Accredited Investor Veri?cation Letter - Individual Investor, with a service like US Legal Forms.

US Legal Forms has over 85,000 templates to pick from in various categories ranging from living wills to real estate paperwork to divorce documents. All forms are arranged according to their valid state, making the searching process less frustrating. You can also find detailed materials and tutorials on the website to make any tasks related to paperwork execution simple.

Here's how to purchase and download San Antonio Accredited Investor Veri?cation Letter - Individual Investor.

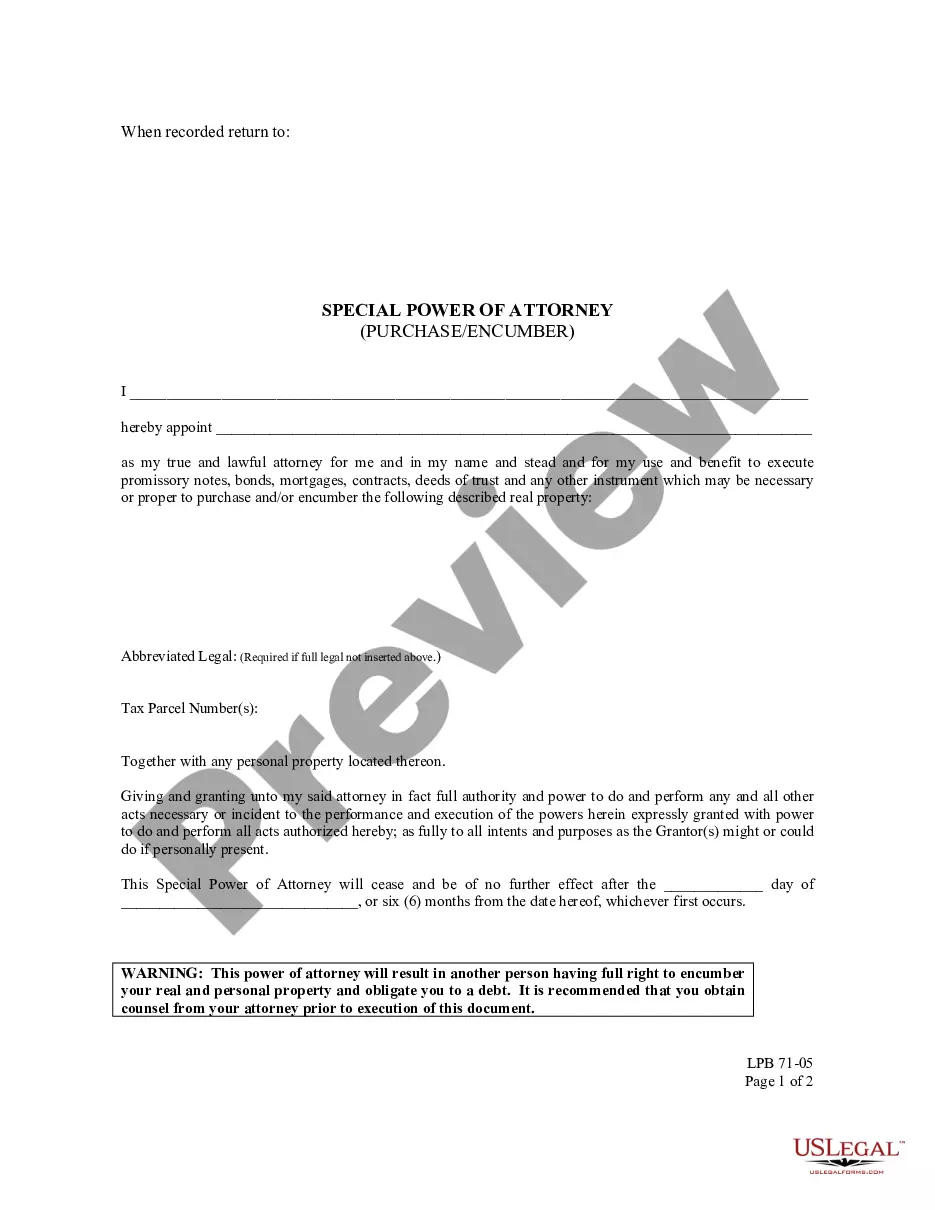

- Go over the document's preview and outline (if available) to get a general idea of what you’ll get after getting the document.

- Ensure that the document of your choice is adapted to your state/county/area since state laws can impact the legality of some records.

- Check the similar forms or start the search over to locate the correct file.

- Hit Buy now and register your account. If you already have an existing one, select to log in.

- Choose the pricing {plan, then a suitable payment gateway, and buy San Antonio Accredited Investor Veri?cation Letter - Individual Investor.

- Choose to save the form template in any available format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the needed San Antonio Accredited Investor Veri?cation Letter - Individual Investor, log in to your account, and download it. Needless to say, our platform can’t replace an attorney entirely. If you have to cope with an extremely complicated situation, we advise getting a lawyer to check your form before signing and submitting it.

With over 25 years on the market, US Legal Forms proved to be a go-to platform for various legal forms for millions of users. Become one of them today and get your state-compliant paperwork effortlessly!