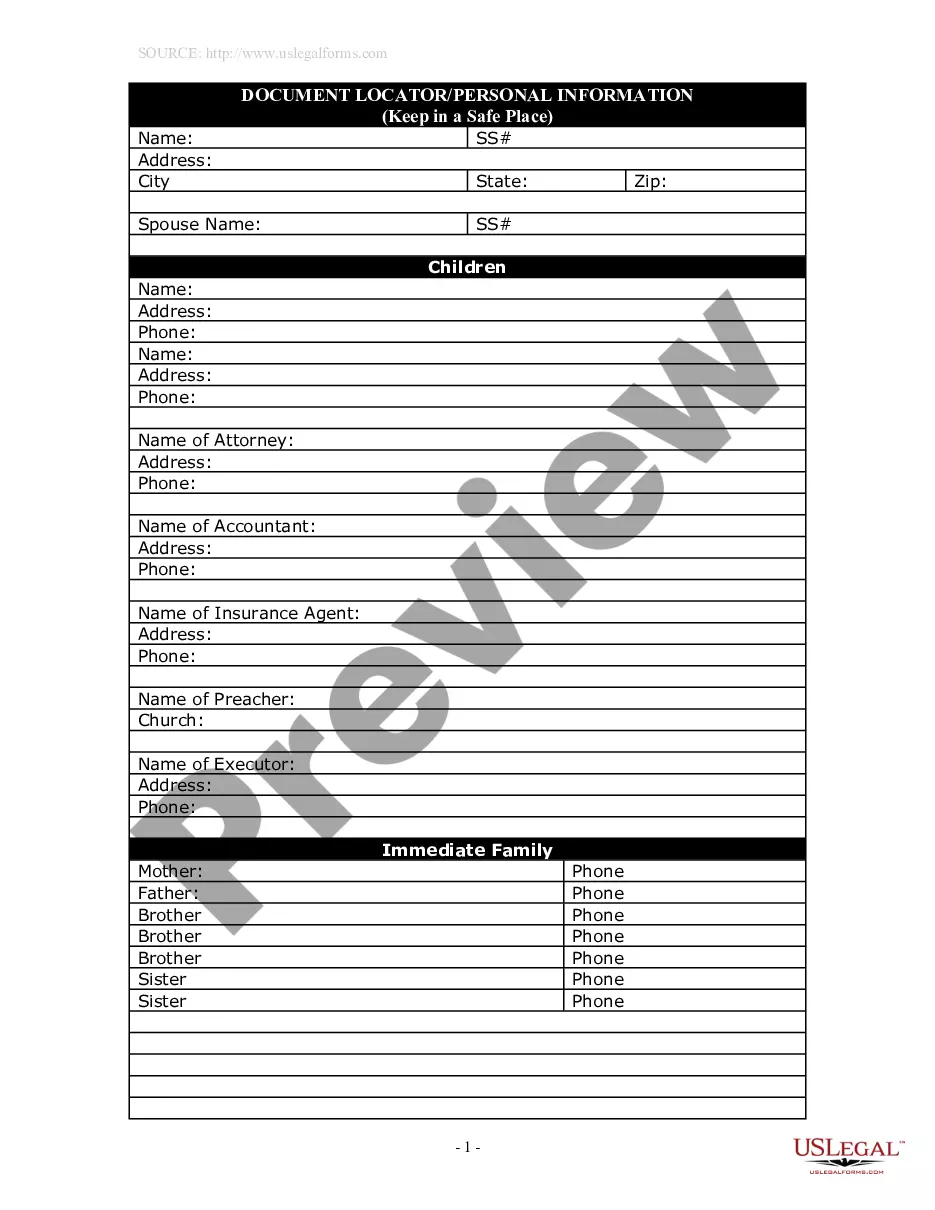

The San Diego California Accredited Investor Verification Letter — Individual Investor is a document that serves as proof of an individual's status as an accredited investor in the state of California, specifically in San Diego. This letter is essential for individuals seeking to participate in certain investment opportunities that are only available to accredited investors. An accredited investor is an individual who meets specific wealth or income criteria set by the Securities and Exchange Commission (SEC), making them eligible to participate in certain private capital markets and investment opportunities that are not available to the public. The San Diego California Accredited Investor Verification Letter — Individual Investor typically includes the following details: 1. Personal Information: The letter will include the individual investor's full name, address, contact details, and any relevant identification numbers (such as Social Security or tax identification number). 2. Accreditation Status: The letter will clearly state that the individual is an accredited investor, indicating their compliance with the SEC's criteria. This may include meeting income thresholds (e.g., annual income over $200,000 for individuals or $300,000 for married couples) or having significant net worth (e.g., over $1 million excluding the value of the primary residence). 3. Accreditation Verification: The letter will specify how the individual's accredited investor status was verified. This may involve self-certification by the investor, documentation review by a professional financial advisor, or the investor being associated with a recognized financial organization. 4. Compliance Statement: The letter may include a statement confirming that the investor understands their rights and responsibilities as an accredited investor and acknowledges the potential risks associated with certain investment opportunities. In addition to the standard San Diego California Accredited Investor Verification Letter — Individual Investor, there may be different types categorized based on the purpose or specific requirements: 1. Accredited Investor Verification — Real Estate Investments: This letter variation specifically focuses on accredited investors intending to invest in real estate projects, such as real estate funds, development projects, or syndication in San Diego, California. 2. Accredited Investor Verification — Private Equity Investments: This version of the letter caters to individuals seeking to invest in private equity funds or start-ups, typically with a higher investment threshold, in San Diego, California. 3. Accredited Investor Verification — Hedge Fund Investments: This variation is customized for individuals interested in investing in hedge funds, which often require a certain level of financial sophistication and higher minimum investment amounts, in San Diego, California. 4. Accredited Investor Verification — Venture Capital Investments: This type of letter specifically targets those individuals wishing to invest in venture capital funds or start-ups, highlighting expertise in evaluating and supporting high-growth potential businesses in San Diego, California. It is essential for individuals seeking San Diego California Accredited Investor Verification Letters to ensure they meet the specific requirements of the investment opportunity they are interested in and consult with legal and financial professionals for accurate and up-to-date information.

San Diego California Accredited Investor Veri?cation Letter - Individual Investor

Description

How to fill out San Diego California Accredited Investor Veri?cation Letter - Individual Investor?

How much time does it normally take you to create a legal document? Because every state has its laws and regulations for every life sphere, finding a San Diego Accredited Investor Veri?cation Letter - Individual Investor meeting all local requirements can be exhausting, and ordering it from a professional attorney is often expensive. Numerous online services offer the most popular state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive online catalog of templates, collected by states and areas of use. In addition to the San Diego Accredited Investor Veri?cation Letter - Individual Investor, here you can find any specific document to run your business or individual deeds, complying with your county requirements. Experts check all samples for their actuality, so you can be certain to prepare your paperwork properly.

Using the service is remarkably straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the required form, and download it. You can get the document in your profile at any moment in the future. Otherwise, if you are new to the website, there will be a few more actions to complete before you get your San Diego Accredited Investor Veri?cation Letter - Individual Investor:

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another document utilizing the related option in the header.

- Click Buy Now when you’re certain in the chosen document.

- Decide on the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the San Diego Accredited Investor Veri?cation Letter - Individual Investor.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased document, you can find all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!