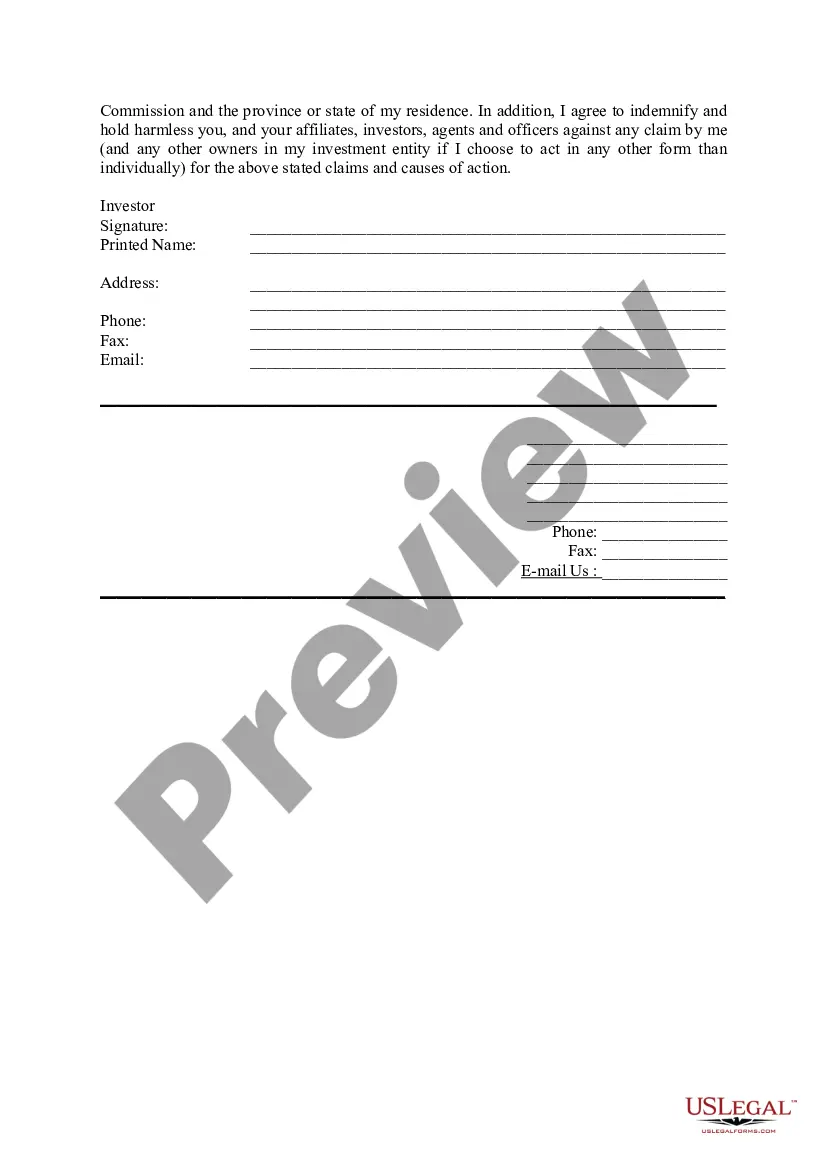

Suffolk New York Qualified Investor Certification and Waiver of Claims is an essential legal document that enables individuals or entities residing in Suffolk County, New York, to qualify as accredited or qualified investors as defined by the U.S. Securities and Exchange Commission (SEC). This certification plays a crucial role in granting investors certain privileges and opportunities in investment markets. To be considered a qualified investor in Suffolk New York, individuals or entities must meet strict requirements defined under federal securities laws and regulations. These requirements typically involve possessing a certain net worth or annual income that exceeds specific thresholds. The purpose of this certification is to protect investors by ensuring that they possess the necessary financial means and understanding bearing the risks associated with certain investments. The Suffolk New York Qualified Investor Certification acts as a mechanism for investors to indicate their financial sophistication and ability to evaluate potential investments. By meeting the criteria, investors can gain access to various investment opportunities that are typically limited to qualified investors. These opportunities may include private equity funds, venture capital deals, hedge funds, and other sophisticated investment vehicles. Moreover, alongside the certification, investors are required to sign a Waiver of Claims. This waiver is a legal document that recognizes and acknowledges the potential risks associated with investment activities. By signing this document, investors accept sole responsibility for any investment losses incurred and fully understand that they would not be able to seek legal remedies if the investment does not yield their expected results. This waiver acts as a protective measure for investment firms, ensuring that investors are aware of the inherent risks and are willing to bear the consequences of their investment decisions. In Suffolk New York, there may be different types of qualified investor certifications and waivers of claims based on specific investment strategies or types of investments. These variations may arise in the case of hedge funds, private equity funds, or certain specialized investment funds designed for accredited investors who possess expertise in specific industries or sectors. Each type of certification and waiver typically comes with its unique set of criteria and disclosures, tailored to the specific investment opportunities it offers. In summary, the Suffolk New York Qualified Investor Certification and Waiver of Claims is a critical legal document that allows individuals or entities to establish their eligibility as qualified investors within Suffolk County. By meeting the stringent qualification requirements and signing the waiver, investors can access exclusive investment opportunities while acknowledging the potential risks associated with their investments.

Suffolk New York Qualified Investor Certification and Waiver of Claims

Description

How to fill out Suffolk New York Qualified Investor Certification And Waiver Of Claims?

Laws and regulations in every sphere vary throughout the country. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal paperwork. To avoid expensive legal assistance when preparing the Suffolk Qualified Investor Certification and Waiver of Claims, you need a verified template valid for your region. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal forms. It's an excellent solution for professionals and individuals searching for do-it-yourself templates for various life and business scenarios. All the documents can be used multiple times: once you pick a sample, it remains accessible in your profile for subsequent use. Therefore, if you have an account with a valid subscription, you can simply log in and re-download the Suffolk Qualified Investor Certification and Waiver of Claims from the My Forms tab.

For new users, it's necessary to make a couple of more steps to obtain the Suffolk Qualified Investor Certification and Waiver of Claims:

- Take a look at the page content to ensure you found the appropriate sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Click on the Buy Now button to obtain the document once you find the appropriate one.

- Opt for one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Fill out and sign the document on paper after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your documentation in order with the US Legal Forms!