Broward Florida Information Checklist — Accredited Investor Certifications Under Rule 501 When it comes to understanding the requirements and regulations surrounding accredited investor certifications in Broward County, Florida, it is essential to familiarize yourself with the detailed checklist under Rule 501. This checklist serves as a comprehensive guide to help ensure individuals meet the necessary criteria to be classified as an accredited investor in Broward County. 1. Net Worth Certification: Under Rule 501, an individual can qualify as an accredited investor in Broward County, Florida, if they have a net worth exceeding $1 million, either individually or jointly with a spouse. This includes the net value of their primary residence, but any mortgage or other liabilities on that primary residence must be deducted from the overall net worth calculation. 2. Income Certification: To be considered an accredited investor in Broward County, one can also meet the criteria through income certification. As per Rule 501, an investor can qualify if their income is consistent and exceeds $200,000 individually, or $300,000 jointly with a spouse, for the previous two years. The expectation for the current year's income to meet the same threshold is also applicable. 3. Entity Accredited Investor Certification: Entities, including corporations, partnerships, and trusts, can also qualify as accredited investors. To do so, they must meet specific criteria provided in Rule 501. For instance, a corporation may be considered an accredited investor if it has total assets exceeding $5 million. Similarly, partnerships or trusts that are not formed for the specific purpose of acquiring the securities being offered can also be classified as accredited investors under certain conditions. It is crucial for individuals or entities conducting investment activities in Broward County, Florida, to carefully review and understand the detailed guidelines and requirements outlined in Rule 501. By doing so, potential investors can ensure compliance with the necessary criteria to be regarded as accredited investors within the county. Furthermore, it is recommended to consult legal and financial professionals who specialize in securities laws and regulations while pursuing accredited investor certifications in Broward County. They can provide invaluable guidance to ensure adherence to the specific rules, helping investors navigate the certification process smoothly and avoid any potential pitfalls. In conclusion, Broward Florida Information Checklist — Accredited Investor Certifications Under Rule 501 serves as a crucial tool for individuals and entities looking to establish their status as accredited investors in Broward County. By meeting the net worth or income criteria, as well as understanding the specific requirements for entities, investors can confidently engage in investment opportunities that are restricted to accredited individuals or entities.

Broward Florida Information Checklist - Accredited Investor Certifications Under Rule 501 of Regulation D

Description

How to fill out Broward Florida Information Checklist - Accredited Investor Certifications Under Rule 501 Of Regulation D?

Creating legal forms is a must in today's world. However, you don't always need to seek professional help to create some of them from scratch, including Broward Information Checklist - Accredited Investor Certifications Under Rule 501 of, with a platform like US Legal Forms.

US Legal Forms has over 85,000 templates to pick from in various types ranging from living wills to real estate paperwork to divorce documents. All forms are arranged according to their valid state, making the searching process less frustrating. You can also find information materials and guides on the website to make any activities associated with paperwork execution straightforward.

Here's how to find and download Broward Information Checklist - Accredited Investor Certifications Under Rule 501 of.

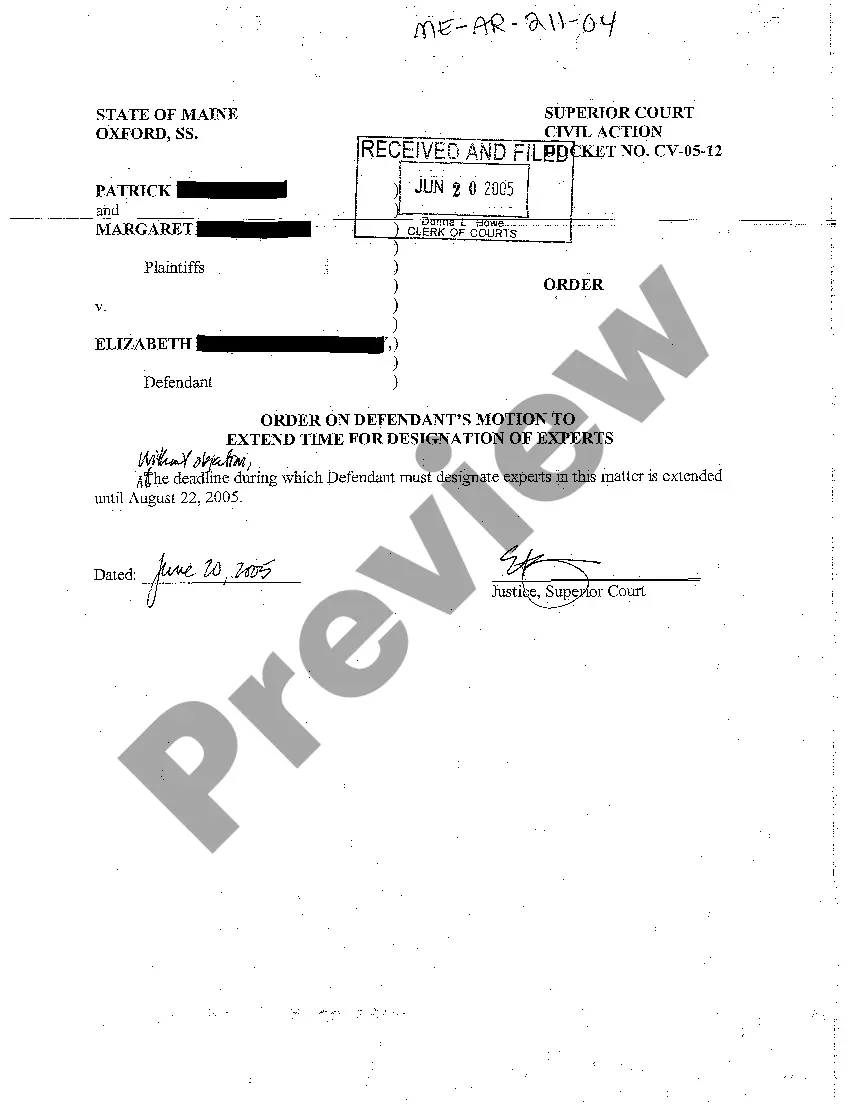

- Take a look at the document's preview and description (if provided) to get a general idea of what you’ll get after downloading the document.

- Ensure that the document of your choosing is specific to your state/county/area since state laws can impact the validity of some documents.

- Check the similar forms or start the search over to locate the correct document.

- Click Buy now and create your account. If you already have an existing one, choose to log in.

- Pick the pricing {plan, then a needed payment method, and purchase Broward Information Checklist - Accredited Investor Certifications Under Rule 501 of.

- Select to save the form template in any offered file format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the needed Broward Information Checklist - Accredited Investor Certifications Under Rule 501 of, log in to your account, and download it. Needless to say, our website can’t take the place of an attorney completely. If you have to cope with an extremely difficult case, we advise using the services of a lawyer to check your form before executing and submitting it.

With more than 25 years on the market, US Legal Forms became a go-to platform for many different legal forms for millions of customers. Become one of them today and purchase your state-specific documents with ease!