Orange California Information Checklist - Accredited Investor Certifications Under Rule 501 of Regulation D

Description

To become an accredited investor the (SEC) requires certain wealth, income or knowledge requirements. The investor must fall into one of three categories. Firms selling unregistered securities must put investors through their own screening process to determine if investors can be considered an accredited investor.

The Verifying Individual or Entity should take reasonable steps to verify and determined that an Investor is an "accredited investor" as such term is defined in Rule 501 of the Securities Act, and hereby provides written confirmation. This letter serves to help the Entity determine status, take Investor statements regarding information, and waiver of claims.

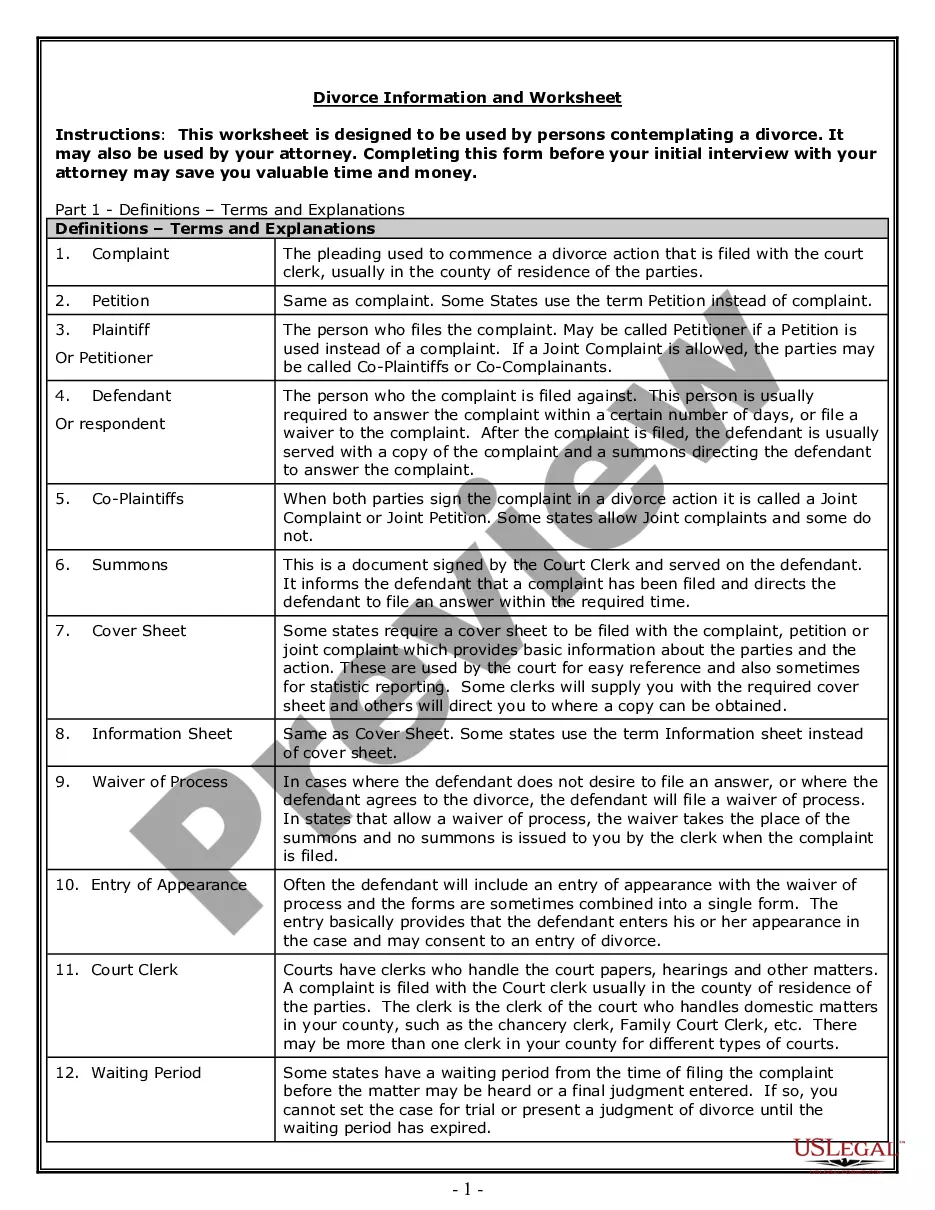

How to fill out Orange California Information Checklist - Accredited Investor Certifications Under Rule 501 Of Regulation D?

Are you looking to quickly draft a legally-binding Orange Information Checklist - Accredited Investor Certifications Under Rule 501 of or probably any other document to handle your own or business matters? You can go with two options: hire a professional to write a valid document for you or draft it entirely on your own. Thankfully, there's an alternative solution - US Legal Forms. It will help you receive professionally written legal paperwork without paying unreasonable fees for legal services.

US Legal Forms offers a huge collection of over 85,000 state-specific document templates, including Orange Information Checklist - Accredited Investor Certifications Under Rule 501 of and form packages. We offer documents for a myriad of use cases: from divorce paperwork to real estate documents. We've been out there for more than 25 years and gained a spotless reputation among our clients. Here's how you can become one of them and obtain the needed document without extra hassles.

- First and foremost, carefully verify if the Orange Information Checklist - Accredited Investor Certifications Under Rule 501 of is adapted to your state's or county's laws.

- If the document has a desciption, make sure to verify what it's intended for.

- Start the searching process again if the form isn’t what you were looking for by utilizing the search bar in the header.

- Choose the plan that best fits your needs and move forward to the payment.

- Select the file format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already set up an account, you can simply log in to it, find the Orange Information Checklist - Accredited Investor Certifications Under Rule 501 of template, and download it. To re-download the form, just head to the My Forms tab.

It's effortless to buy and download legal forms if you use our services. Additionally, the paperwork we offer are updated by law professionals, which gives you greater peace of mind when writing legal matters. Try US Legal Forms now and see for yourself!

Form popularity

FAQ

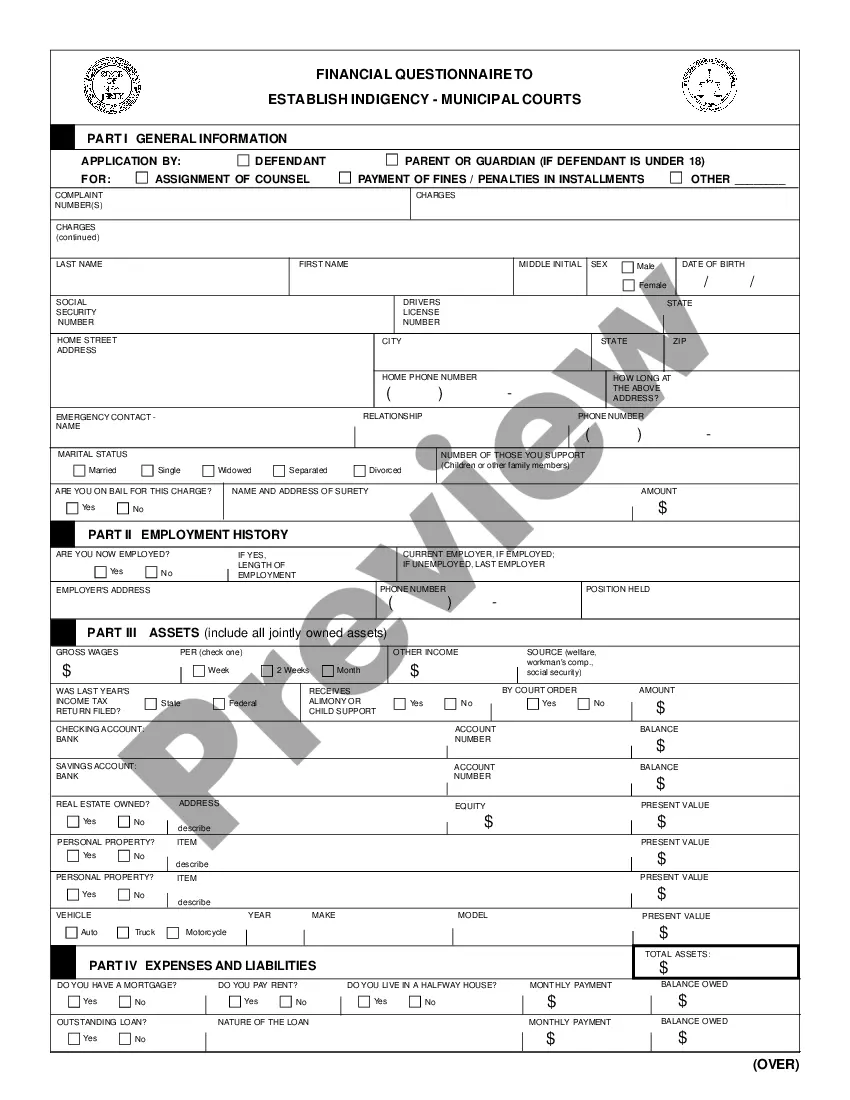

How to Qualify as an Accredited Investor Provide a detailed questionnaire for the potential investor to complete. Request verification of financial information via financial statements, tax returns or other documents to determine whether income or net worth standards are met.

The series 65 is an exam administered by the Financial Industry Regulatory Authority (FINRA) and provides individuals' license to act as investment advisers in the U.S. After you pass the test and receive your license, you also need to be in good standing to meet the accredited investor definition as per the SEC.

The SEC defines an accredited investor as either: an individual with gross income exceeding $200,000 in each of the two most recent years or joint income with a spouse or partner exceeding $300,000 for those years and a reasonable expectation of the same income level in the current year.

The SEC defines an accredited investor as either: an individual with gross income exceeding $200,000 in each of the two most recent years or joint income with a spouse or partner exceeding $300,000 for those years and a reasonable expectation of the same income level in the current year.

Some documents that can prove an investor's accredited status include: Tax filings or pay stubs; A letter from an accountant or employer confirming their actual and expected annual income; or. IRS Forms like W-2s, 1040s, 1099s, K-1s or other tax documentation that report income.

Do You Have to Prove You Are an Accredited Investor? The burden of proving that you are an accredited investor does not fall directly on you but rather the investment vehicle you would like to invest in. An investment vehicle, such as a fund, would have to determine that you qualify as an accredited investor.

Repercussions for lying about being an accredited investor It's the company's responsibility to comply, so a false statement from a non-accredited investor does not absolve them of responsibility for these violations of both federal and state or provincial securities laws.

Rule 506(c) permits issuers to broadly solicit and generally advertise an offering, provided that: all purchasers in the offering are accredited investors. the issuer takes reasonable steps to verify purchasers' accredited investor status and. certain other conditions in Regulation D are satisfied.

The SEC has discussed allowing persons with other professional credentials or licenses to qualify as accredited investors. Those with CFA and CFP designations have been considered as have licensed CPAs and attorneys.

accredited investor, therefore, is anyone making less than $200,000 annually (less than $300,000 including a spouse) that also has a total net worth of less than $1 million when their primary residence is excluded.