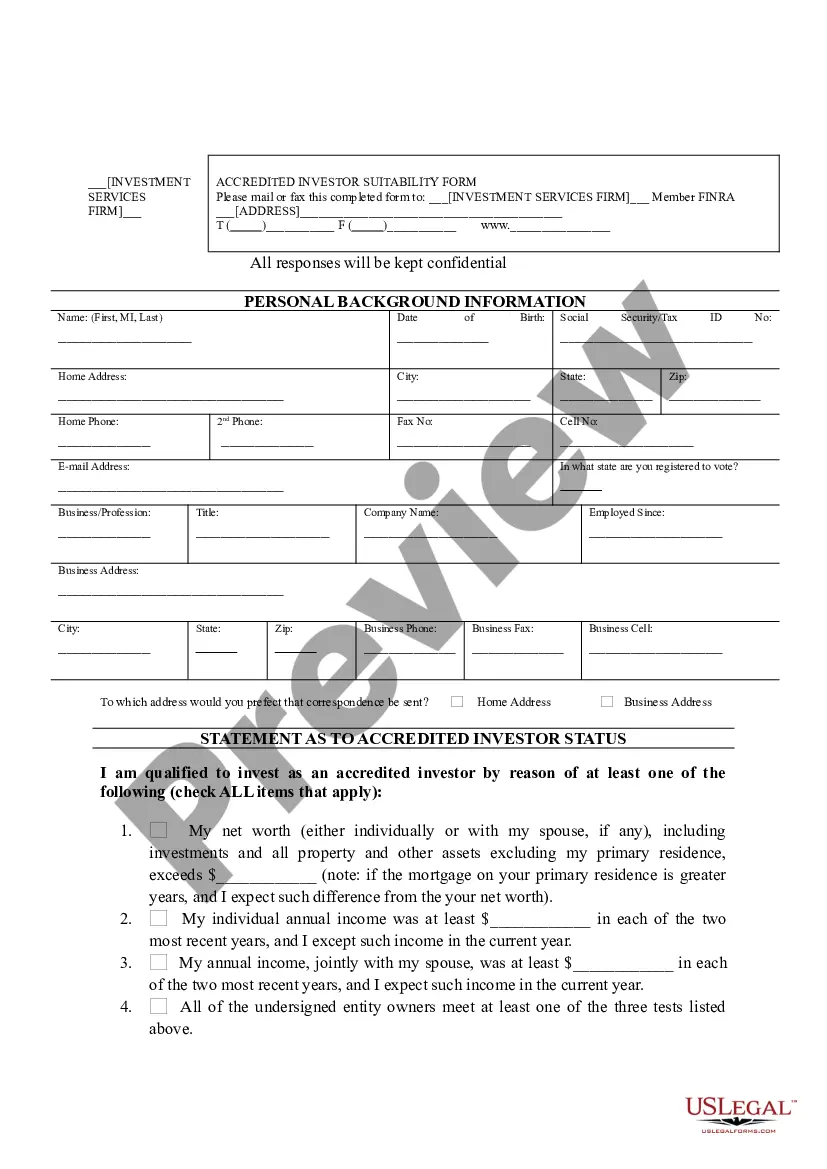

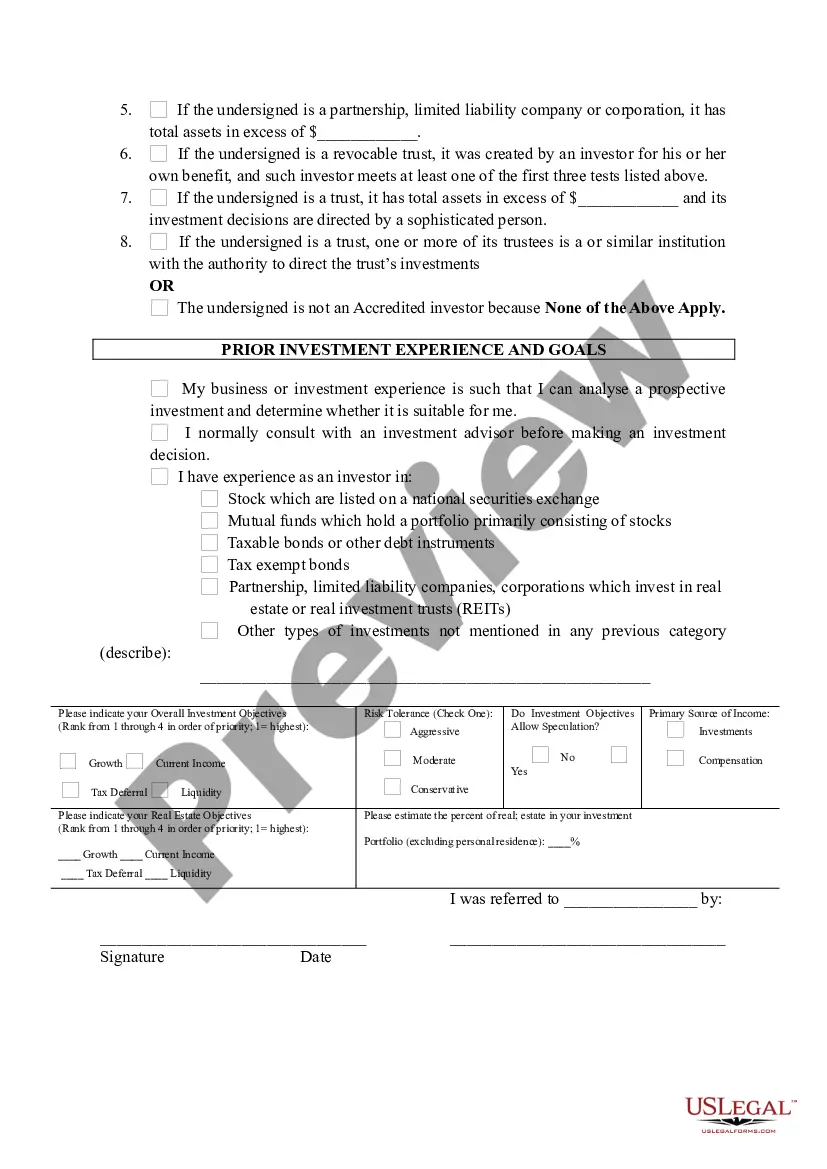

Chicago Illinois Accredited Investor Suitability refers to the regulations and criteria that determine whether an individual or entity is eligible to become an accredited investor in Chicago, Illinois. Accredited investor suitability requirements are established by the U.S. Securities and Exchange Commission (SEC) and are vital to protecting investors and ensuring the integrity of the financial markets. The term "accredited investor" typically applies to individuals or entities with a certain level of financial sophistication or net worth. In Chicago, Illinois, to qualify as an accredited investor, one must meet specific criteria outlined by the SEC. These criteria include having a high income or net worth, professional experience in finance, or holding certain professional certifications. The purpose of these criteria is to ensure that only individuals or entities capable of understanding and bearing the potential risks associated with certain investment opportunities can participate. There are different types of Chicago Illinois Accredited Investor Suitability, each catering to specific investor profiles. These include: 1. Individual Accredited Investors: These are individuals who meet the income or net worth requirements defined by the SEC. To qualify, an individual must have an annual income exceeding $200,000 (or $300,000 jointly with a spouse) in the past two years, with the expectation of maintaining the same income level in the current year. Alternatively, an individual can qualify if their net worth exceeds $1 million (excluding the value of their primary residence). 2. Institutional Accredited Investors: Institutional investors, such as banks, insurance companies, registered investment companies, and employee benefit plans with assets surpassing $5 million, are deemed accredited investors based on their institutional status and financial resources. These entities have the expertise and necessary resources to navigate complex investments. 3. Private Funds Investors: This category includes individuals or entities investing in private funds, such as hedge funds, venture capital funds, or private equity funds. To participate as an accredited investor in these funds, specific criteria under Regulation D of the Securities Act of 1933 must be met. 4. Trusts and Estate Accredited Investors: Certain trusts, estates, and other legal entities can also qualify as accredited investors based on their total assets. These types of investors create opportunities for wealth preservation and growth through sophisticated investment strategies. It is important to note that while meeting the accredited investor suitability requirements grants individuals or entities access to a wider range of investment opportunities, it also implies taking on higher risks. Chicago Illinois Accredited Investor Suitability aims to ensure that those who can bear these risks responsibly have the chance to participate in potentially lucrative investments. Compliance with these regulations protects investors from fraudulent schemes and promotes a fair and transparent financial market ecosystem in Chicago, Illinois.

Chicago Illinois Accredited Investor Suitability

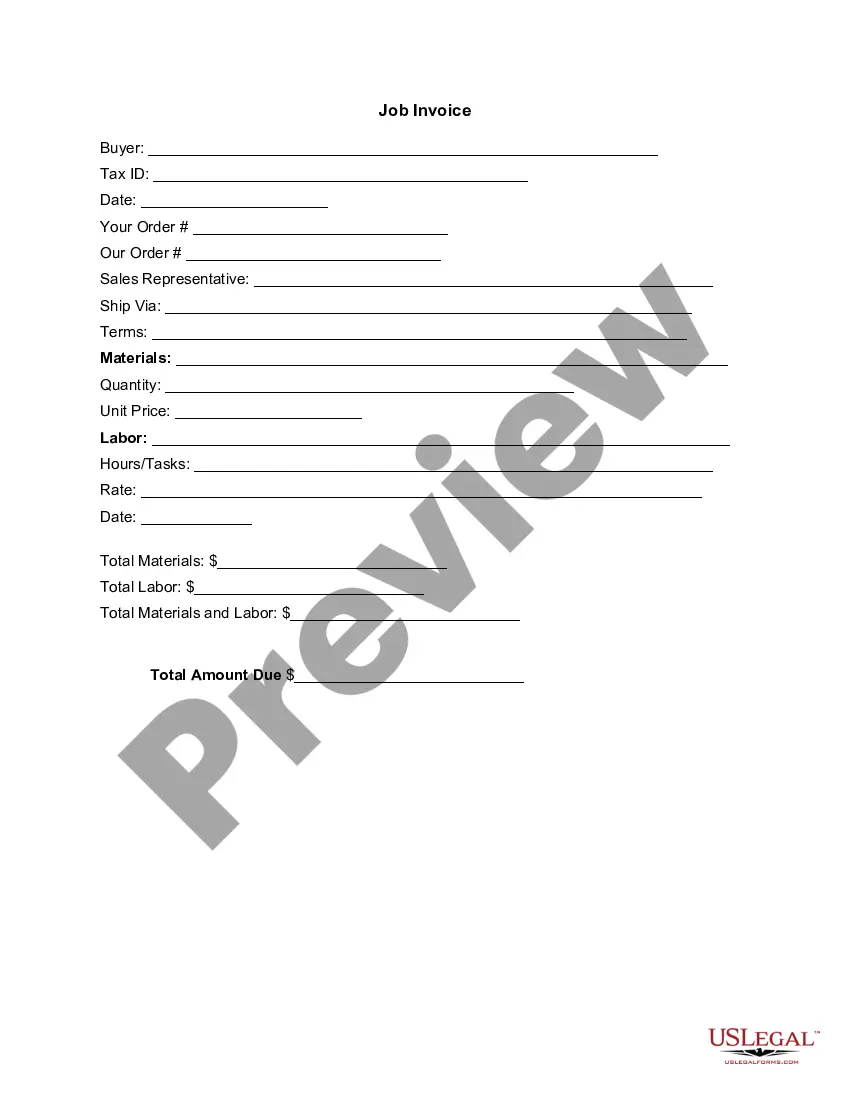

Description

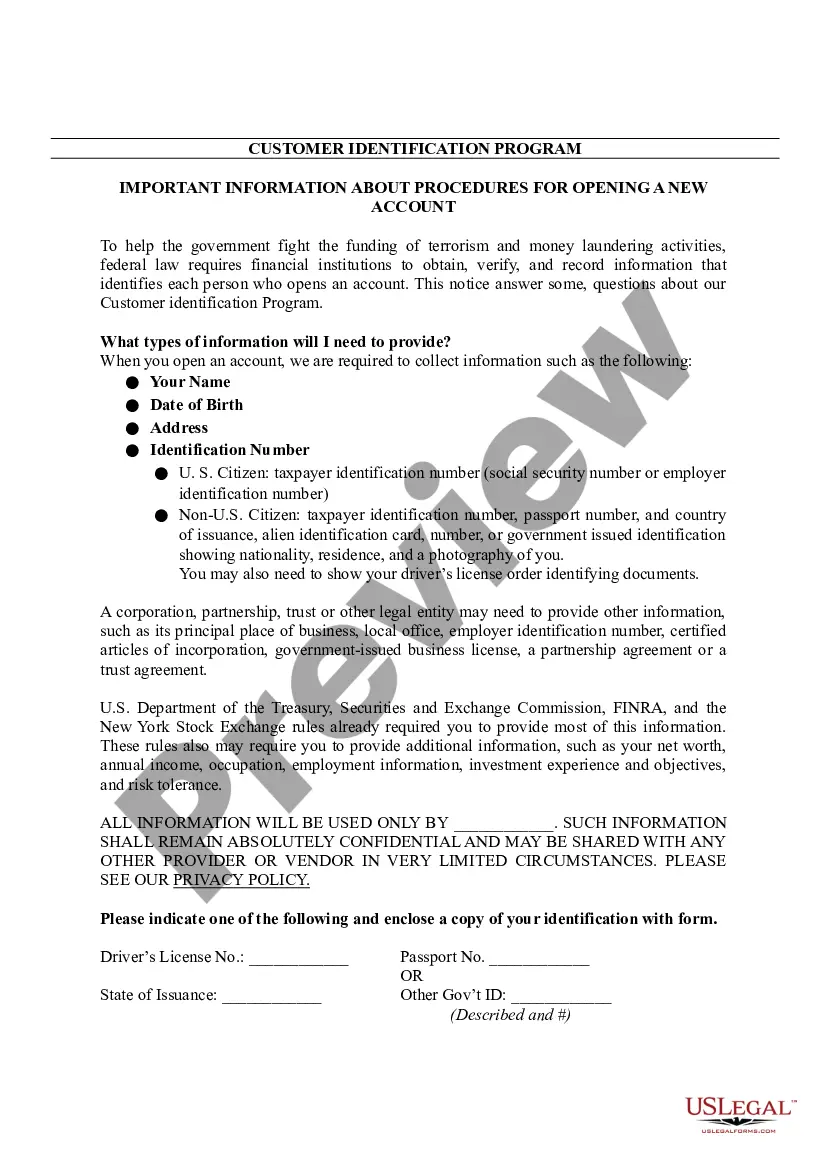

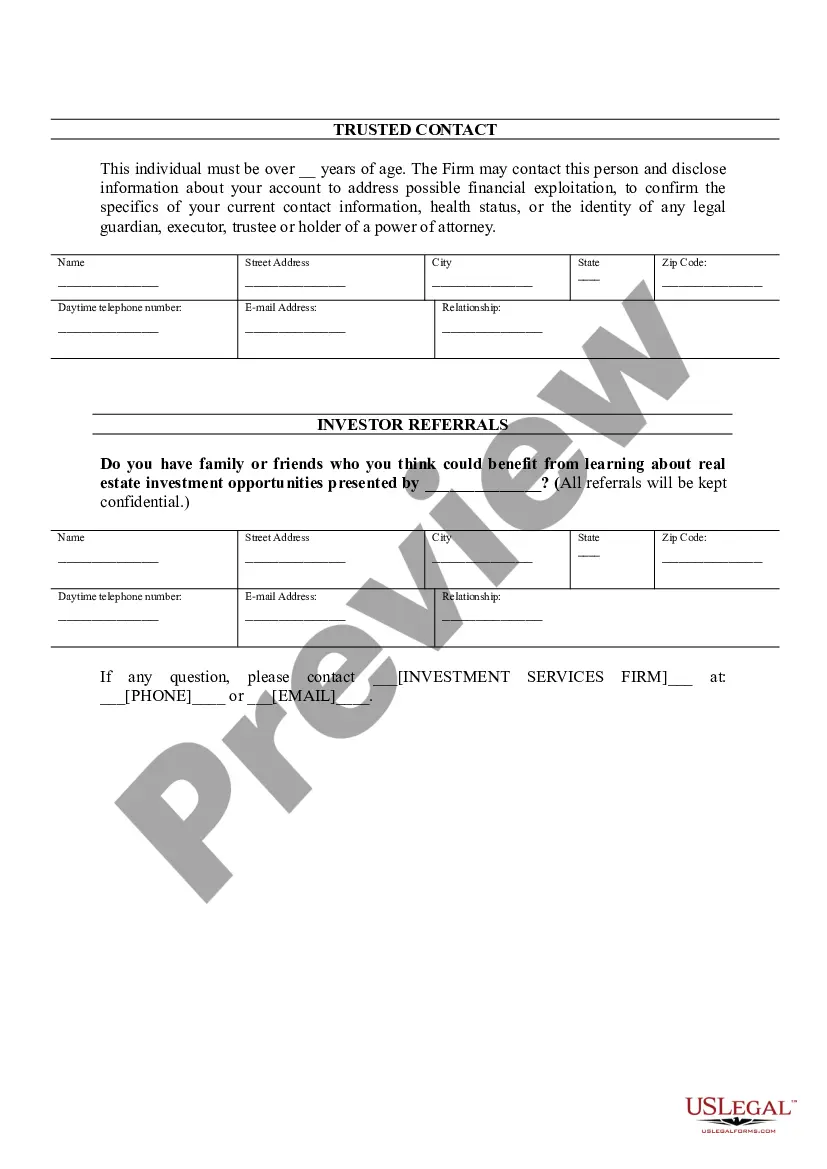

How to fill out Chicago Illinois Accredited Investor Suitability?

Dealing with legal forms is a must in today's world. However, you don't always need to look for qualified assistance to draft some of them from scratch, including Chicago Accredited Investor Suitability, with a service like US Legal Forms.

US Legal Forms has over 85,000 forms to pick from in various types varying from living wills to real estate paperwork to divorce papers. All forms are organized based on their valid state, making the searching experience less challenging. You can also find detailed materials and tutorials on the website to make any tasks related to document completion straightforward.

Here's how you can find and download Chicago Accredited Investor Suitability.

- Take a look at the document's preview and outline (if provided) to get a basic information on what you’ll get after getting the document.

- Ensure that the document of your choice is adapted to your state/county/area since state regulations can impact the legality of some records.

- Examine the related forms or start the search over to locate the right document.

- Hit Buy now and register your account. If you already have an existing one, select to log in.

- Pick the pricing {plan, then a suitable payment method, and purchase Chicago Accredited Investor Suitability.

- Select to save the form template in any offered file format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the needed Chicago Accredited Investor Suitability, log in to your account, and download it. Needless to say, our website can’t take the place of a lawyer entirely. If you need to cope with an exceptionally challenging case, we advise using the services of an attorney to review your document before signing and submitting it.

With more than 25 years on the market, US Legal Forms became a go-to provider for many different legal forms for millions of users. Join them today and purchase your state-compliant documents with ease!