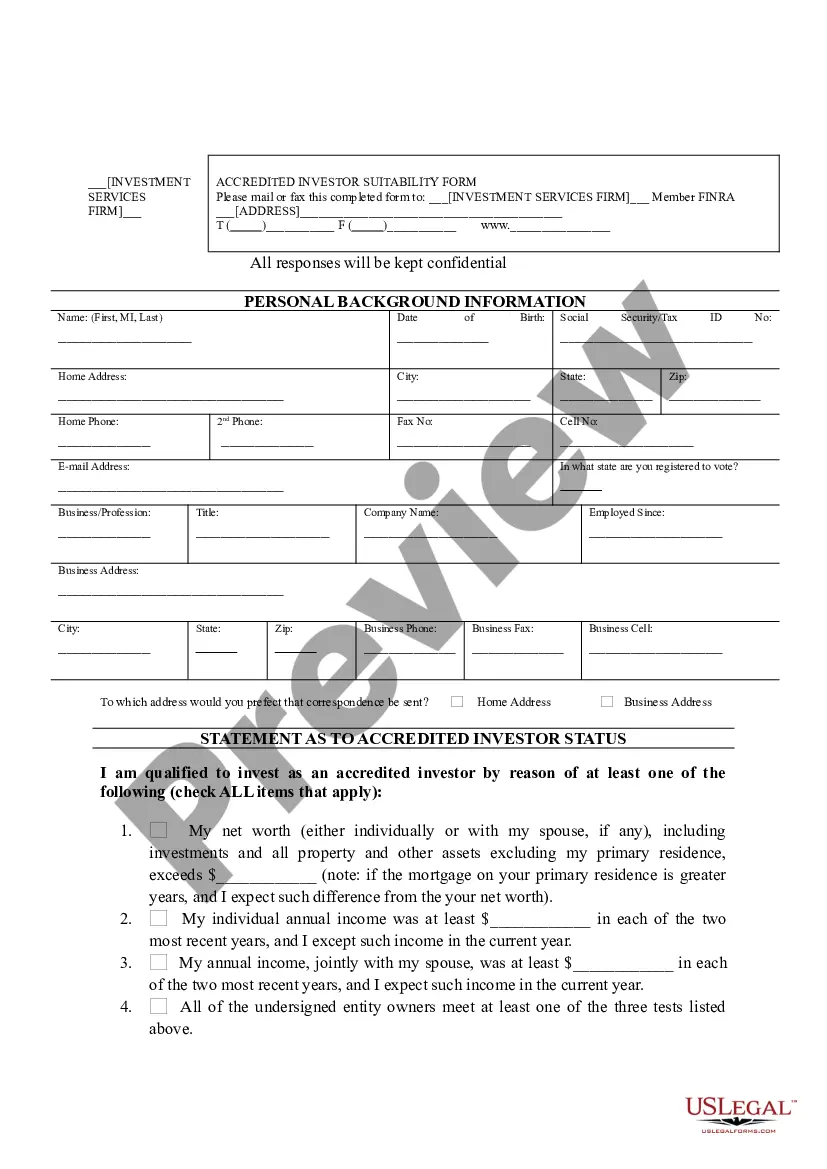

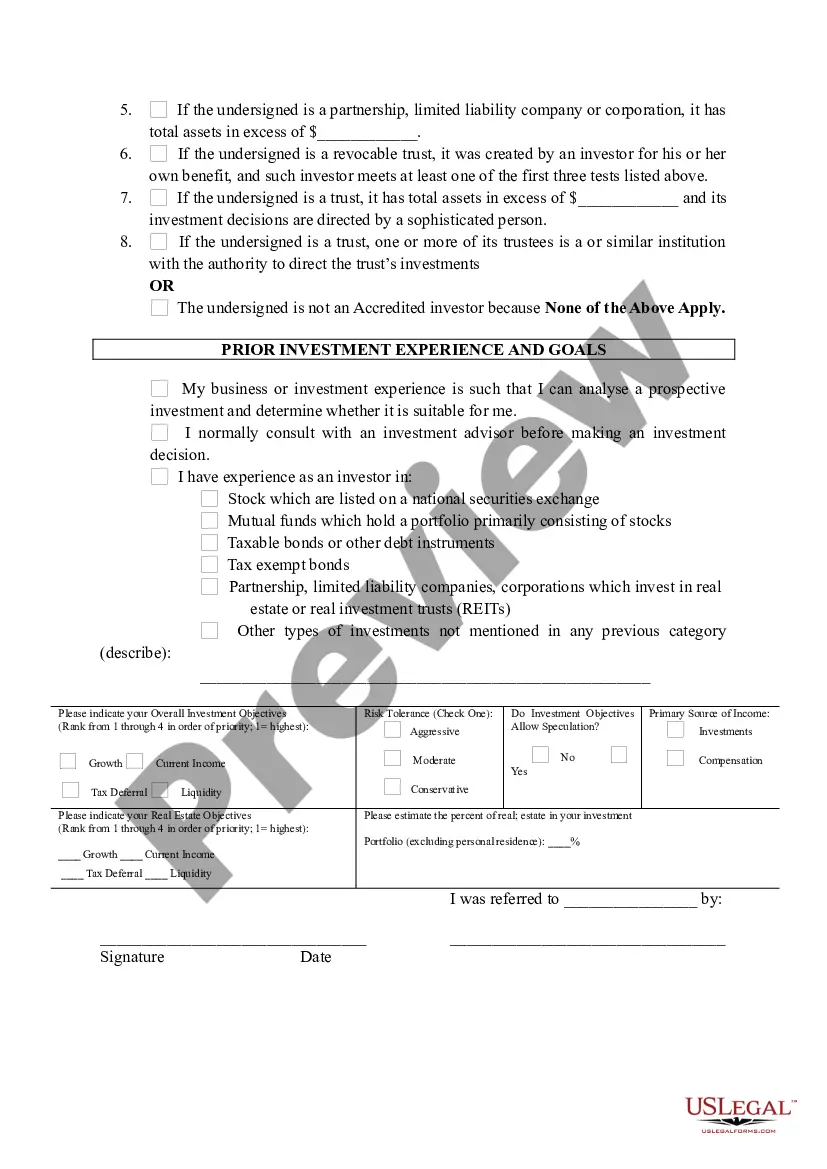

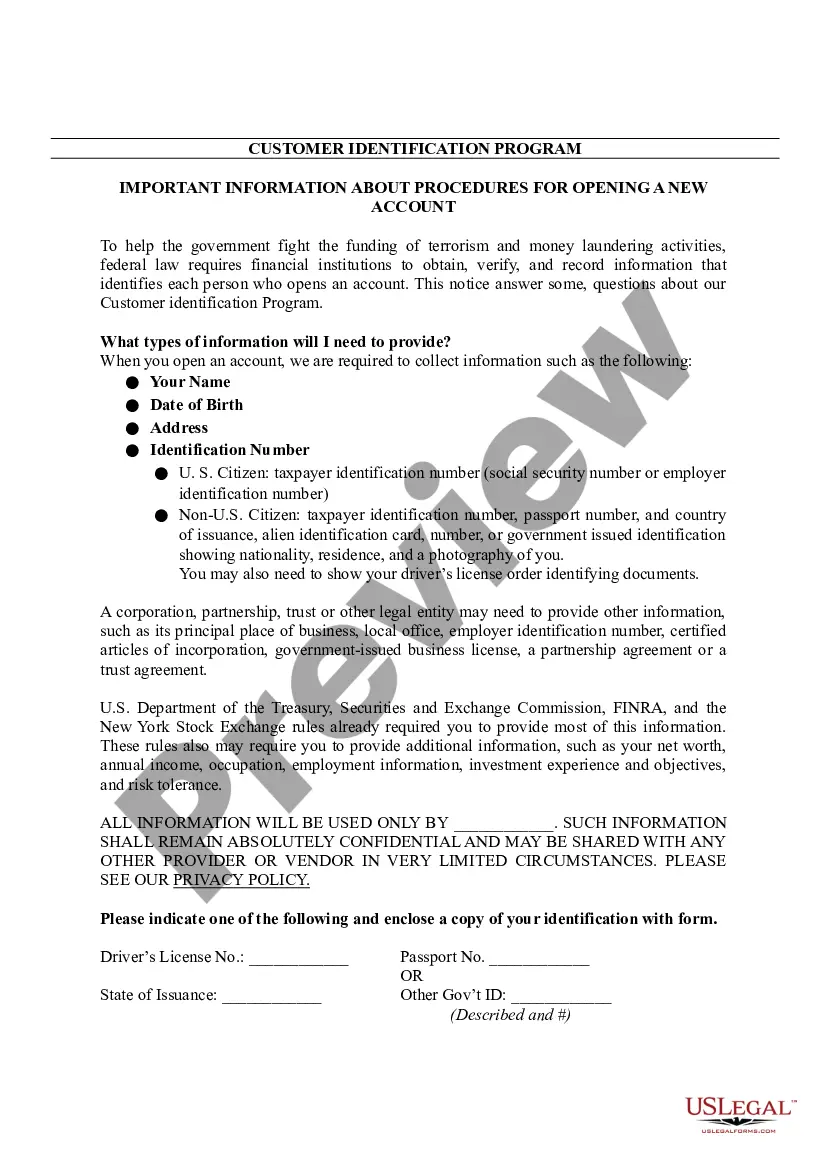

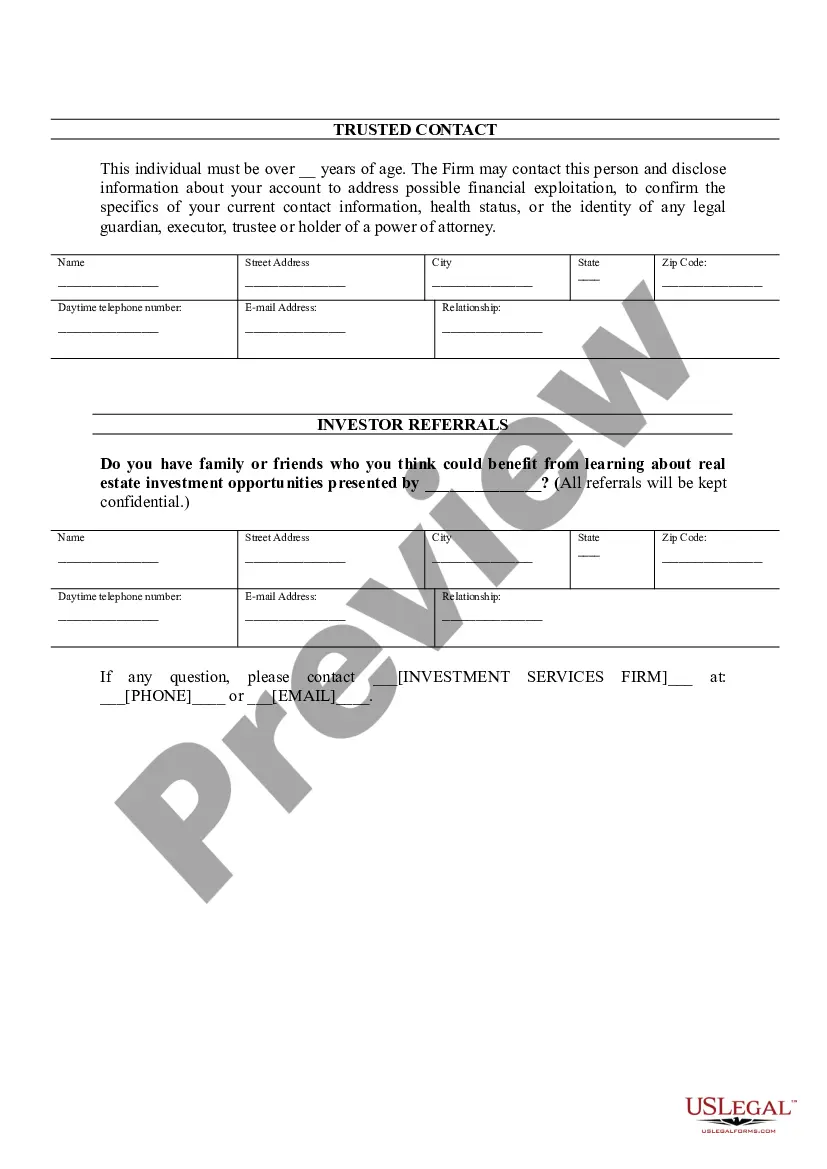

To become an accredited investor the (SEC) requires certain wealth, income or knowledge requirements. The investor must fall into one of three categories. Firms selling unregistered securities must put investors through their own screening process to determine if investors can be considered an accredited investor.

The Verifying Individual or Entity should take reasonable steps to verify and determined that an Investor is an "accredited investor" as such term is defined in Rule 501 of the Securities Act, and hereby provides written confirmation. This letter serves to help the Entity determine status.

Middlesex Massachusetts Accredited Investor Suitability refers to the criteria and regulations that determine whether an individual or entity in Middlesex County, Massachusetts, qualifies as an accredited investor. Accredited investors are individuals or institutions with a high net worth or advanced knowledge in financial matters who are deemed eligible to invest in high-risk or private equity investments. This designation is important because securities laws typically restrict certain investment opportunities to accredited investors to protect those who may not have the financial resources or knowledge to handle such risks. Key criteria for Middlesex Massachusetts Accredited Investor Suitability include meeting specific financial thresholds set by the Securities and Exchange Commission (SEC). These thresholds are designed to ensure that investors possess sufficient wealth and understanding of the risks involved with investment opportunities. Individuals must typically have a net worth of at least $1 million (excluding the value of their primary residence) or have an annual income exceeding $200,000 ($300,000 for joint income) for the past two years with an expectation of the same income level going forward. There are different types of Middlesex Massachusetts Accredited Investor Suitability that cater to various entities and organizations. These include: 1. Individual Accredited Investors: These are individuals who meet the financial criteria outlined by the SEC and reside or operate within Middlesex County, Massachusetts. They must provide appropriate documentation or statements to demonstrate their eligibility. 2. Institutional Accredited Investors: This category includes entities such as banks, investment companies, insurance companies, and registered investment advisers that have at least $5 million in total assets and meet the SEC's other criteria. These institutions are considered to have sufficient financial expertise and resources to handle higher-risk investments. 3. Qualified Institutional Buyers (Ribs): A subset of institutional investors, Ribs are particularly regulated under Rule 144A of the Securities Act. To qualify, entities must own and invest at least $100 million of securities of unaffiliated issuers. Ribs have greater flexibility in investing and trading privately placed securities. 4. Family Offices: Family offices, which manage the financial affairs of wealthy families, can often qualify as accredited investors. They must have at least $5 million in assets under management and use these assets primarily for the benefit of a single family. Middlesex Massachusetts Accredited Investor Suitability is a crucial aspect of investment regulation and protection. It ensures that investors in Middlesex County, Massachusetts, have the financial capacity and knowledge necessary to make informed decisions regarding high-risk investments. Proper accreditation helps prevent unsuitable individuals or organizations from investing in ventures that may not align with their financial goals or risk tolerance.