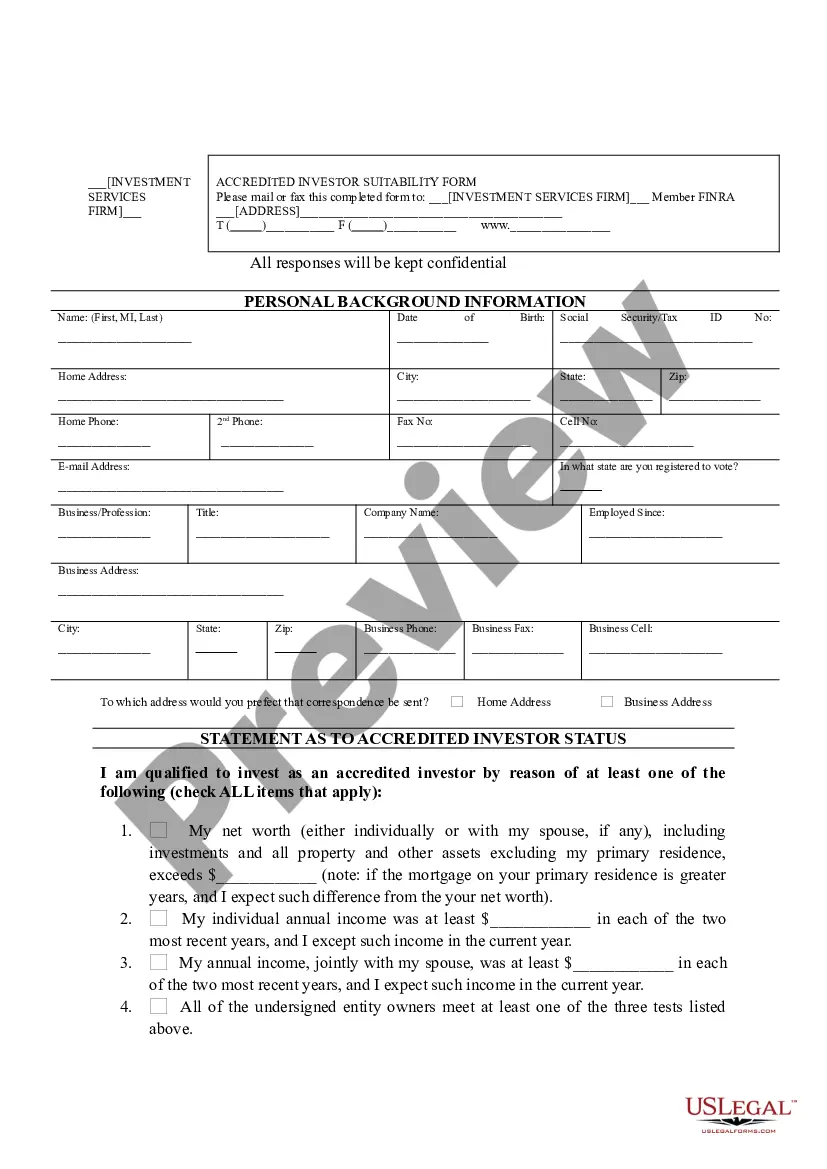

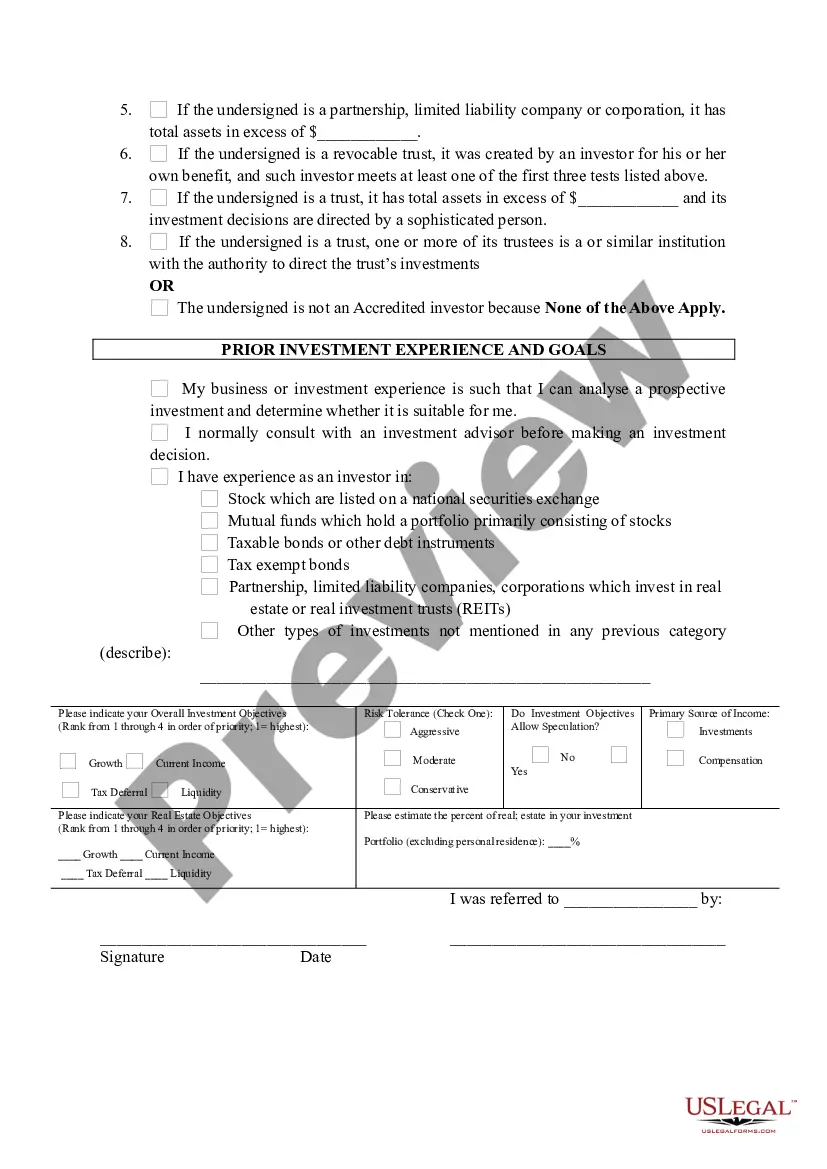

San Antonio, Texas Accredited Investor Suitability is a critical aspect of the investment process in the city. Accredited Investor Suitability refers to the evaluation and determination of an individual or entity's eligibility to invest in certain opportunities or securities that are limited to accredited investors. As per the guidelines set by the U.S. Securities and Exchange Commission (SEC) and the Texas State Securities Board (TSS), an individual or entity must meet specific criteria to qualify as an accredited investor. These criteria typically include having a high net worth, substantial income, or professional experience in the financial industry. Meeting these requirements demonstrates the investor's ability to assess and bear potential financial risks associated with certain investment opportunities. In San Antonio, Texas, there are various types of Accredited Investor Suitability options available to individuals and entities. These include: 1. Individuals with High Net Worth: This category includes individuals who have a net worth exceeding $1 million, either individually or jointly with a spouse. The net worth calculation excludes the value of their primary residence. Such individuals are considered sophisticated investors capable of understanding and assuming higher risks associated with certain investments. 2. Individuals with High Income: Individuals who have an annual income surpassing $200,000 for the past two years (or $300,000 jointly with a spouse) are also eligible to be classified as accredited investors. This category acknowledges that those with substantial income have the means to withstand potential financial losses that might arise from riskier investment opportunities. 3. Entities such as Corporations, Partnerships, and LCS: Accredited investor suitability also extends to various types of organizations. Corporations, partnerships, and limited liability companies (LCS) with assets exceeding $5 million are eligible to qualify as accredited investors. It is important to note that Accredited Investor Suitability in San Antonio, Texas, is crucial not only for protecting investors but also for allowing businesses to raise capital from sophisticated investors. This framework helps ensure that investments are made by individuals and entities capable of understanding the risks involved, reducing the likelihood of fraudulent activities. Investment opportunities restricted to accredited investors often include private equity offerings, hedge funds, venture capital funds, and certain types of securities offerings. San Antonio, as a prominent financial hub, offers a diverse range of investment opportunities catering to accredited investors. To ensure compliance with applicable securities laws, investors in San Antonio, Texas, should consult with financial professionals or legal advisors who specialize in Accredited Investor Suitability. These experts can assist in evaluating an individual's eligibility as an accredited investor and offer guidance on suitable investment options available in the region.

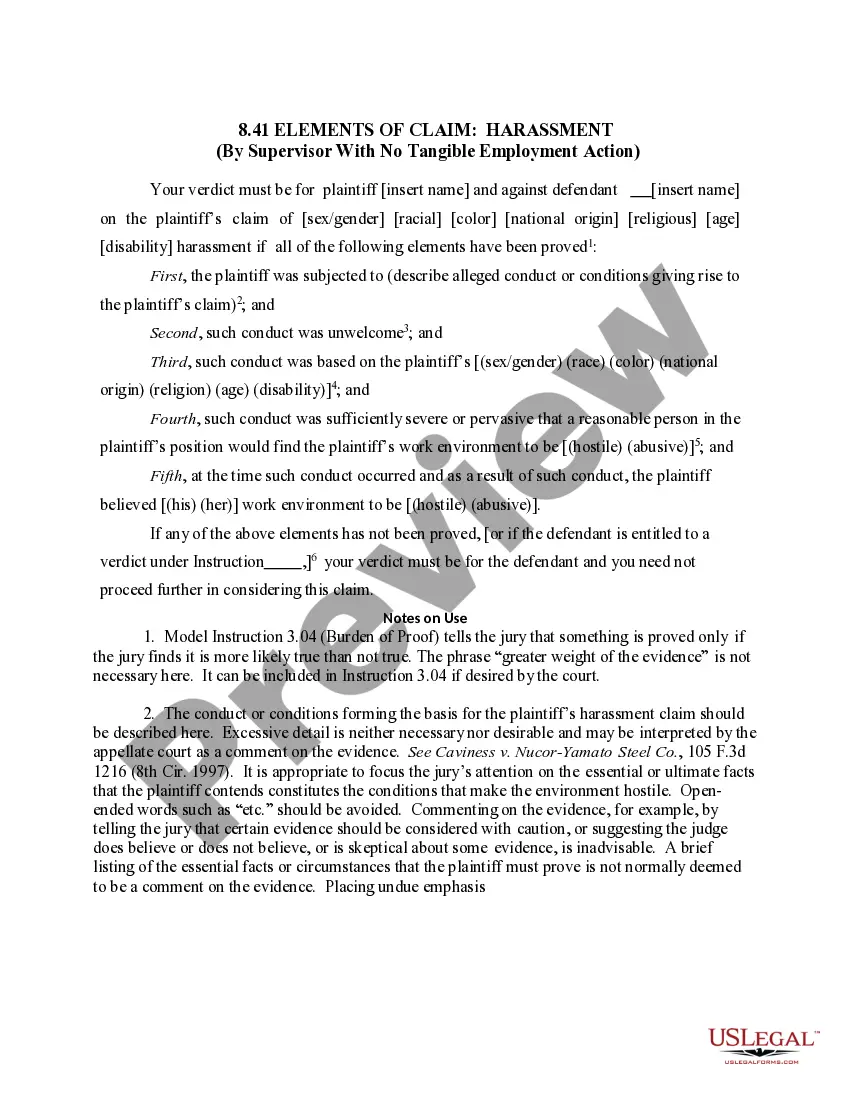

San Antonio Texas Accredited Investor Suitability

Description

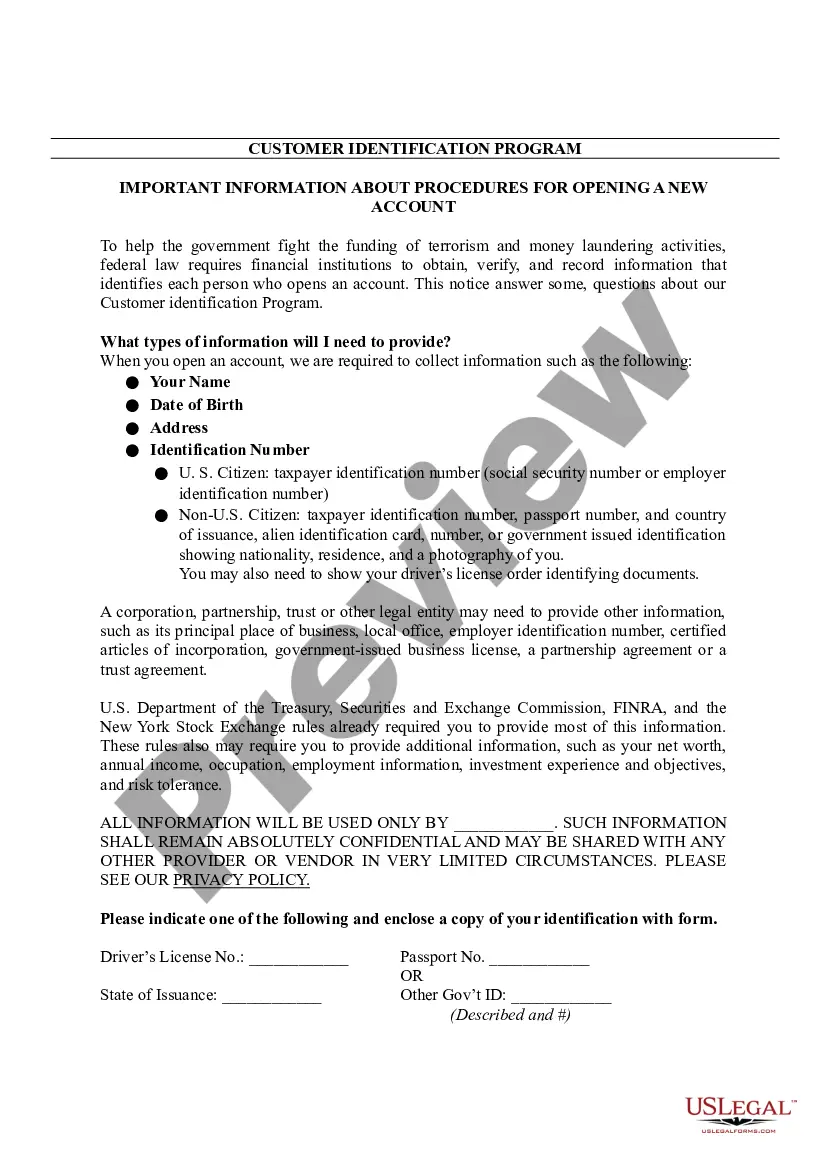

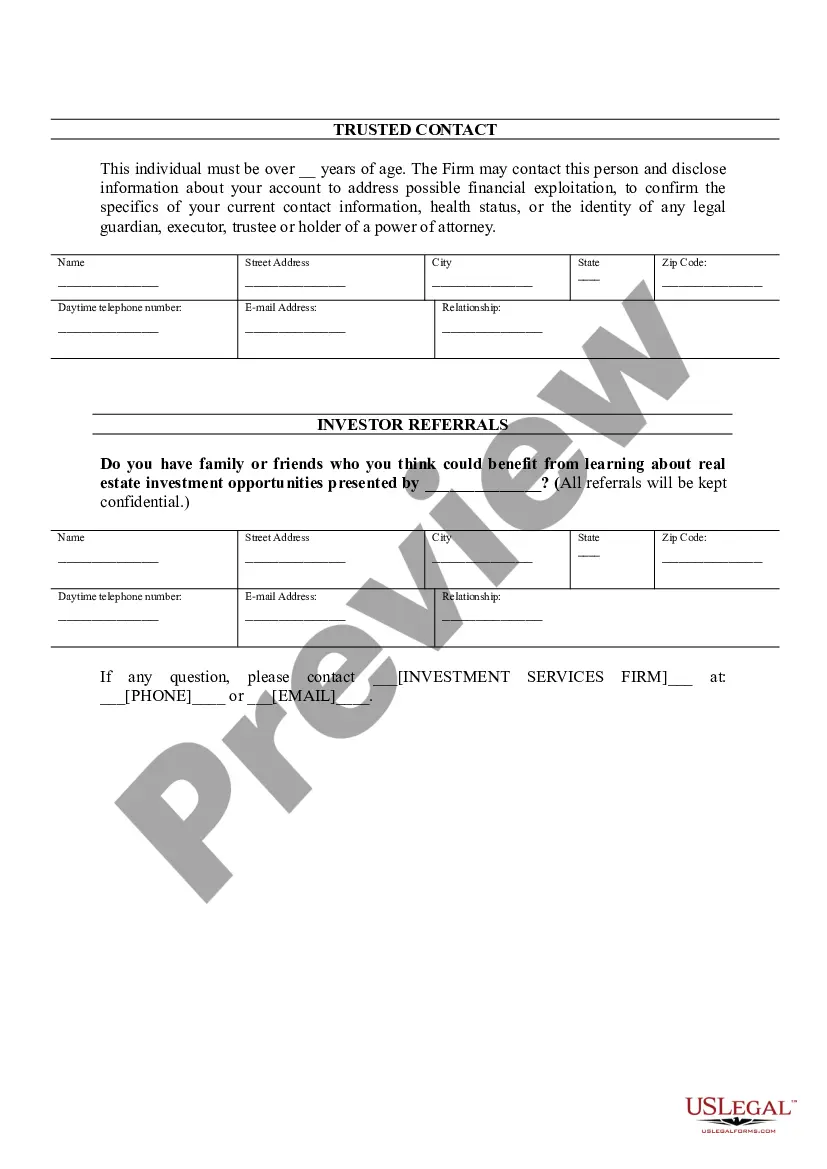

How to fill out San Antonio Texas Accredited Investor Suitability?

How much time does it typically take you to draft a legal document? Given that every state has its laws and regulations for every life situation, locating a San Antonio Accredited Investor Suitability suiting all local requirements can be stressful, and ordering it from a professional lawyer is often costly. Many web services offer the most popular state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive web collection of templates, grouped by states and areas of use. Apart from the San Antonio Accredited Investor Suitability, here you can get any specific form to run your business or personal deeds, complying with your regional requirements. Specialists check all samples for their actuality, so you can be certain to prepare your documentation correctly.

Using the service is pretty straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the required form, and download it. You can retain the document in your profile at any time in the future. Otherwise, if you are new to the platform, there will be some extra actions to complete before you obtain your San Antonio Accredited Investor Suitability:

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another form using the corresponding option in the header.

- Click Buy Now when you’re certain in the selected document.

- Choose the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the San Antonio Accredited Investor Suitability.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired template, you can locate all the samples you’ve ever saved in your profile by opening the My Forms tab. Try it out!