Broward Florida Accredited Investor Self-Certification Attachment D is a document specifically designed for individuals or entities residing in Broward County, Florida, who wish to assert their eligibility as accredited investors. An accredited investor is an individual or entity with a high net worth or extensive financial expertise, which allows them to participate in certain investment opportunities that are not available to the public. This self-certification attachment serves as an important part of the overall accreditation process, ensuring compliance with applicable regulations and laws. By completing and submitting Attachment D, potential investors can provide the necessary information, as stipulated by the Securities and Exchange Commission (SEC), to validate their accredited investor status. The content of Broward Florida Accredited Investor Self-Certification Attachment D may vary depending on the specific version or document provided by the relevant regulatory authorities. However, it generally requests details such as the investor's full name, contact information, and any relevant professional qualifications or certifications that support their accredited investor status. Furthermore, this self-certification attachment may also inquire about the investor's source of income, net worth, and professional experience in financial or investment-related fields. These details are crucial in determining whether an individual or entity qualifies as an accredited investor, as defined by SEC regulations. Different types or variations of Broward Florida Accredited Investor Self-Certification Attachment D may not be explicitly mentioned, as it is a standardized document typically used across Broward County. However, it is important to ensure that the self-certification attachment aligns with current regulatory guidelines and accurately captures the information required for accreditation. In summary, Broward Florida Accredited Investor Self-Certification Attachment D provides a standardized and comprehensive means for individuals and entities in Broward County, Florida, to assert their eligibility as accredited investors. By accurately completing and submitting this attachment, investors can enhance their access to specific investment opportunities and comply with relevant regulations.

Broward Florida Accredited Investor Self-Certification Attachment D

Description

How to fill out Broward Florida Accredited Investor Self-Certification Attachment D?

Laws and regulations in every sphere differ from state to state. If you're not a lawyer, it's easy to get lost in various norms when it comes to drafting legal documents. To avoid high priced legal assistance when preparing the Broward Accredited Investor Self-Certification Attachment D, you need a verified template valid for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web library of more than 85,000 state-specific legal forms. It's an excellent solution for specialists and individuals searching for do-it-yourself templates for different life and business situations. All the documents can be used multiple times: once you pick a sample, it remains available in your profile for subsequent use. Thus, if you have an account with a valid subscription, you can just log in and re-download the Broward Accredited Investor Self-Certification Attachment D from the My Forms tab.

For new users, it's necessary to make a few more steps to get the Broward Accredited Investor Self-Certification Attachment D:

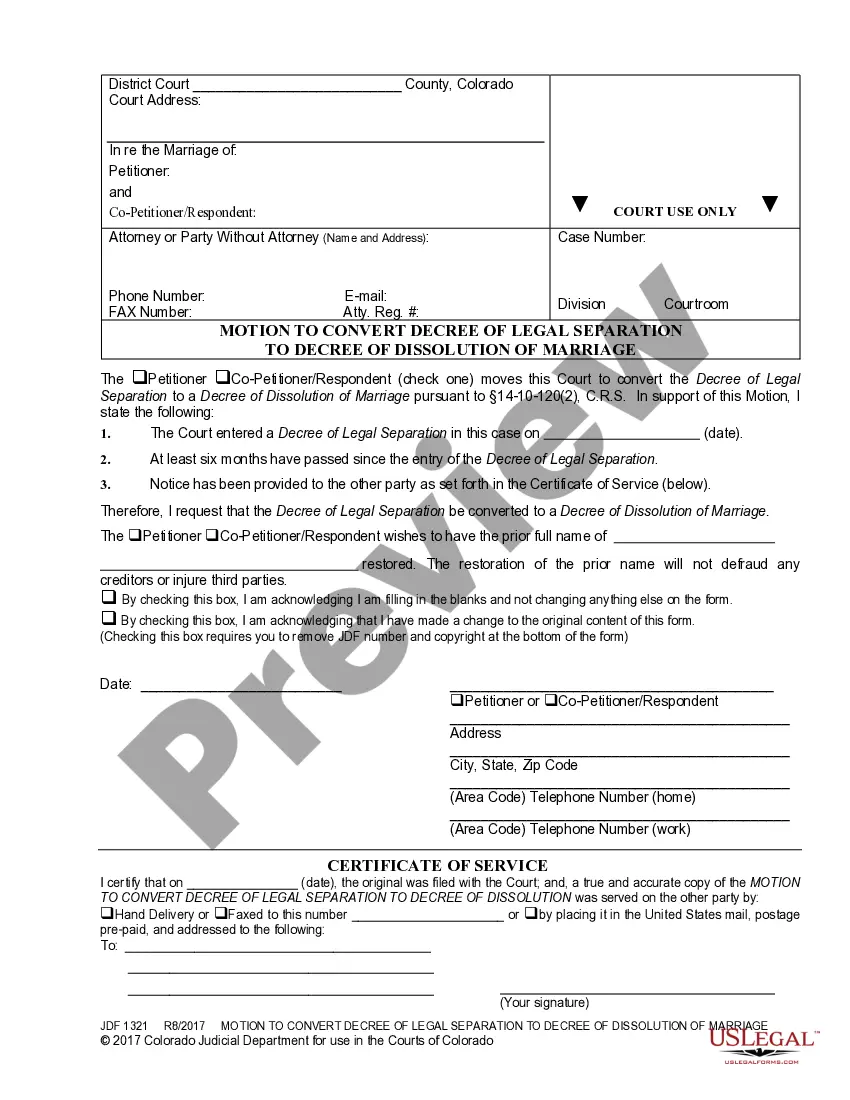

- Examine the page content to ensure you found the right sample.

- Utilize the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to get the template once you find the correct one.

- Choose one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Complete and sign the template on paper after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!