Fulton Georgia Accredited Investor Self-Certification Attachment D is a legal document used by investors located in Fulton County, Georgia, to certify their accredited investor status according to the guidelines provided by the U.S. Securities and Exchange Commission (SEC). This self-certification attachment is crucial when participating in certain investment opportunities that are only available to accredited investors. The purpose of Accredited Investor Self-Certification Attachment D is to ensure compliance with SEC regulations and to verify that an investor meets the criteria required to be considered an accredited investor. An accredited investor is an individual or entity that possesses a certain level of financial sophistication, experience, and access to higher-risk investment opportunities. Fulton Georgia offers different types of Accredited Investor Self-Certification Attachment D to cater to various investor classifications: 1. Individual Accredited Investor Self-Certification Attachment D: This form is specifically designed for individuals who meet the SEC's requirements for accredited investor status. Individuals must demonstrate annual income exceeding $200,000 (or $300,000 jointly with a spouse) for the past two years, with a high expectation of the same in the current year. Alternatively, individuals may qualify if they possess a net worth exceeding $1 million, either alone or jointly with a spouse, excluding the value of their primary residence. 2. Entity Accredited Investor Self-Certification Attachment D: This version of the form is intended for legal entities such as corporations, partnerships, limited liability companies, and certain trusts and employee benefit plans. Entities can qualify as accredited investors by demonstrating assets in excess of $5 million or by being entirely owned by accredited investors. By completing Fulton Georgia Accredited Investor Self-Certification Attachment D, investors affirm their eligibility to participate in exclusive investment opportunities, such as private placements or offerings that involve securities not registered with the SEC. It is important to note that the information provided within Fulton Georgia Accredited Investor Self-Certification Attachment D must be accurate and verifiable. False certification or misrepresentation of accredited investor status can have serious legal and financial consequences. Investors located in Fulton County should always consult with legal and financial professionals to ensure they understand the implications and obligations associated with claiming accredited investor status. Additionally, they should stay informed about any updates or changes to the SEC's guidelines to guarantee ongoing compliance with applicable regulations. In summary, Fulton Georgia Accredited Investor Self-Certification Attachment D is a vital document that enables investors to certify their accredited investor status and participate in exclusive investment opportunities. It serves as a means to maintain transparency, regulatory compliance, and protect the rights and interests of both the investors and investment issuers.

Fulton Georgia Accredited Investor Self-Certification Attachment D

Description

How to fill out Fulton Georgia Accredited Investor Self-Certification Attachment D?

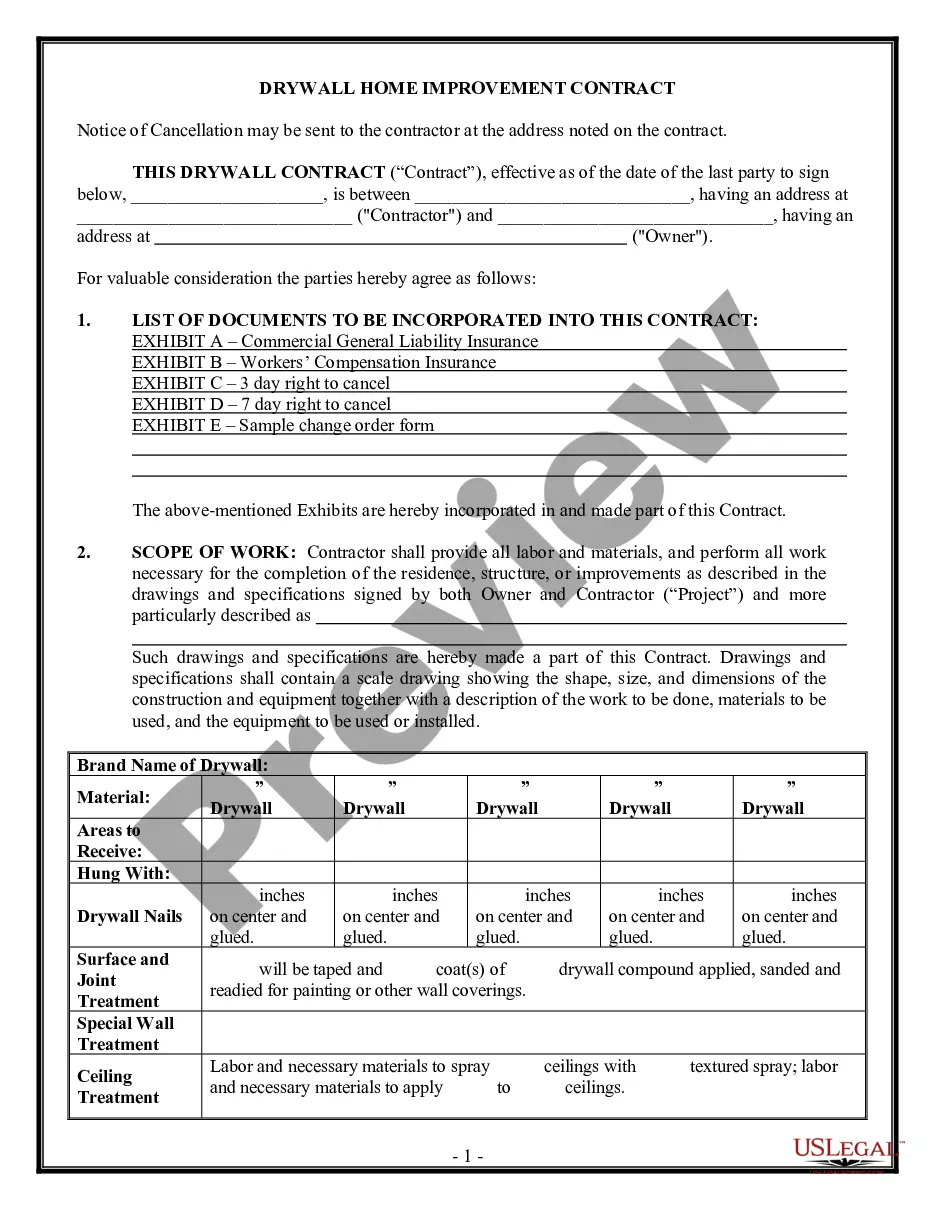

How much time does it usually take you to create a legal document? Because every state has its laws and regulations for every life sphere, locating a Fulton Accredited Investor Self-Certification Attachment D meeting all regional requirements can be stressful, and ordering it from a professional lawyer is often pricey. Many online services offer the most common state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive online collection of templates, collected by states and areas of use. Aside from the Fulton Accredited Investor Self-Certification Attachment D, here you can get any specific document to run your business or personal affairs, complying with your regional requirements. Experts verify all samples for their actuality, so you can be certain to prepare your documentation correctly.

Using the service is fairly simple. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the needed form, and download it. You can get the document in your profile anytime later on. Otherwise, if you are new to the platform, there will be some extra actions to complete before you obtain your Fulton Accredited Investor Self-Certification Attachment D:

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another document using the corresponding option in the header.

- Click Buy Now once you’re certain in the chosen document.

- Choose the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Fulton Accredited Investor Self-Certification Attachment D.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased template, you can find all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!