Kings New York Accredited Investor Self-Certification Attachment D is an essential document that is designed to establish an individual's eligibility as an accredited investor within the state of New York. This self-certification form is required by Kings New York, a reputable financial institution, in compliance with the Securities and Exchange Commission (SEC) regulations. The Kings New York Accredited Investor Self-Certification Attachment D serves as a declaration by the individual, stating their qualifications as an accredited investor. It includes various sections where specific information needs to be provided to prove the person's eligibility. It is crucial to complete this form accurately and truthfully, as any misrepresentation may have legal consequences. The primary purpose of this self-certification form is to enable Kings New York to ensure compliance with SEC guidelines regarding the issuance and sale of certain securities. By completing this document, the investor declares that they meet the requirements outlined in SEC Rule 501 of Regulation D, which defines the parameters for accredited investors. Keywords: Kings New York, Accredited Investor, Self-Certification, Attachment D, New York, financial institution, Securities and Exchange Commission, SEC regulations, eligibility, compliance, SEC guidelines, securities, investor qualifications, SEC Rule 501, Regulation D. Different types of Kings New York Accredited Investor Self-Certification Attachment D may include variations customized specifically for different investment products or programs offered by Kings New York. For example: 1. Kings New York Real Estate Investment Accredited Investor Self-Certification Attachment D: This form may be used for individuals interested in investing in real estate products offered by Kings New York, such as real estate investment trusts (Rests) or real estate development partnerships. 2. Kings New York Venture Capital Investment Accredited Investor Self-Certification Attachment D: This variant of the form is suited for individuals seeking to invest in the venture capital opportunities provided by Kings New York, such as early-stage startups or high-growth companies. 3. Kings New York Private Equity Investment Accredited Investor Self-Certification Attachment D: This type of form is specifically designed for individuals interested in private equity investments available through Kings New York, which include equity investments in privately owned businesses or funds. It is crucial to note that the availability of these variations may depend on the specific investment offerings provided by Kings New York and the regulatory requirements governing those investments. Potential investors should consult with Kings New York representatives to determine the appropriate form correlating to their desired investment vehicles.

Kings New York Accredited Investor Self-Certification Attachment D

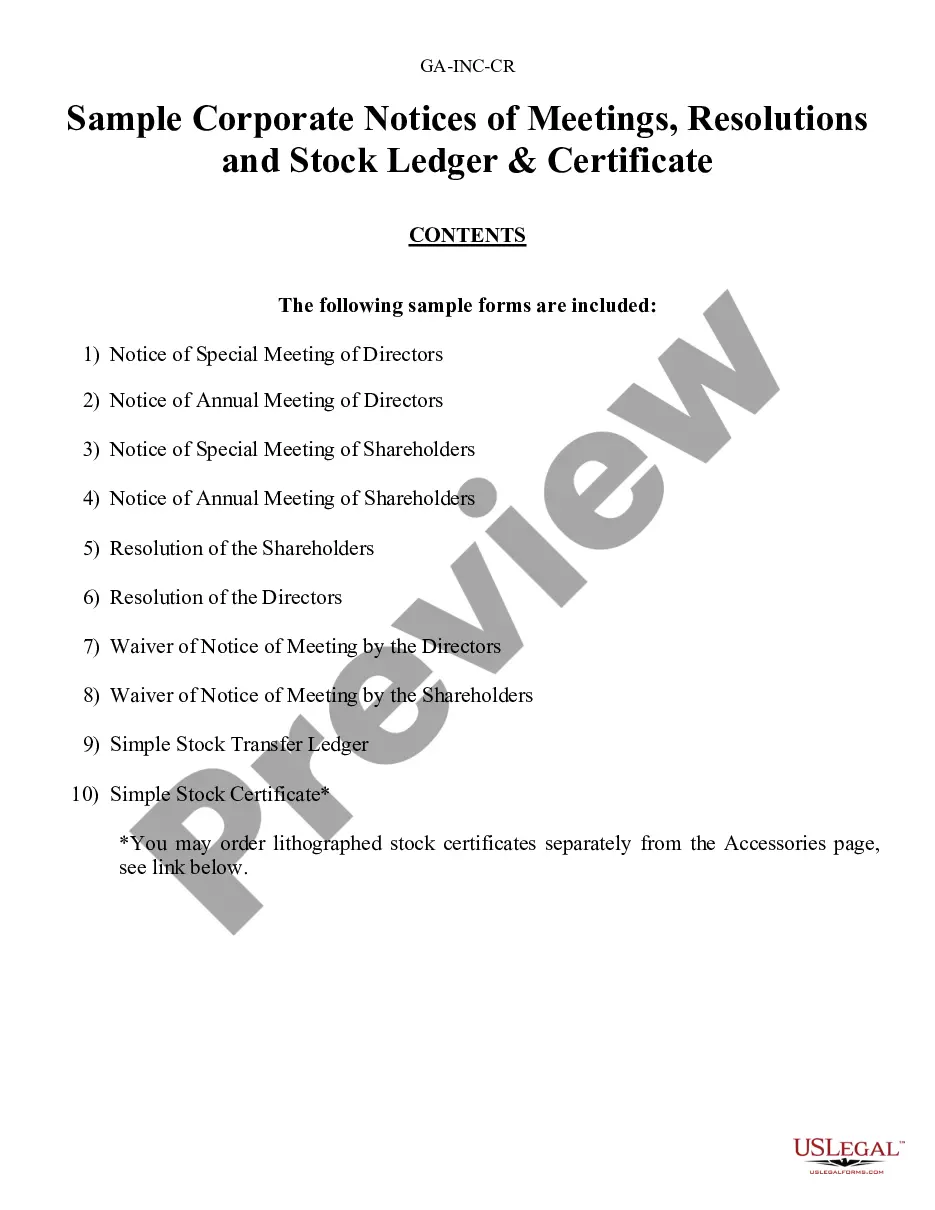

Description

How to fill out Kings New York Accredited Investor Self-Certification Attachment D?

Preparing paperwork for the business or individual demands is always a big responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's essential to consider all federal and state laws of the particular region. However, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it stressful and time-consuming to generate Kings Accredited Investor Self-Certification Attachment D without professional assistance.

It's easy to avoid wasting money on lawyers drafting your paperwork and create a legally valid Kings Accredited Investor Self-Certification Attachment D by yourself, using the US Legal Forms online library. It is the largest online catalog of state-specific legal templates that are professionally verified, so you can be certain of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to save the needed document.

In case you still don't have a subscription, adhere to the step-by-step guideline below to get the Kings Accredited Investor Self-Certification Attachment D:

- Look through the page you've opened and verify if it has the document you require.

- To accomplish this, use the form description and preview if these options are available.

- To find the one that meets your requirements, use the search tab in the page header.

- Double-check that the template complies with juridical standards and click Buy Now.

- Choose the subscription plan, then log in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and easily get verified legal templates for any situation with just a few clicks!