Phoenix Arizona Accredited Investor Self-Certification Attachment D is a crucial document designed to verify an individual's eligibility as an accredited investor in the state of Phoenix, Arizona, according to the regulations set by the United States Securities and Exchange Commission (SEC). This self-certification attachment, often required by financial institutions, private funds, or investment opportunities, ensures compliance with the regulations under Rule 506(c) of Regulation D of the Securities Act of 1933. Accredited investors are individuals or entities who possess a certain level of financial sophistication and net worth, which allows them to participate in unregistered securities offerings. The SEC defines an accredited investor as someone who meets specific income or net worth criteria. By submitting the Phoenix Arizona Accredited Investor Self-Certification Attachment D, individuals provide necessary information, under penalty of perjury, to confirm their eligibility. The self-certification form may include various sections to collect pertinent information from the investor. These sections may cover: 1. Personal Information: This section requires the individual's full name, address, contact details, and Social Security number or tax identification number. 2. Income Verification: Here, the investor must detail their annual income and provide supporting documentation such as tax returns, W-2 forms, or other applicable financial statements. 3. Net Worth Assessment: This section addresses the individual's net worth, including assets, liabilities, and equity. It may require documentation such as bank statements, brokerage statements, property valuations, and mortgage details. 4. Entity Information (if applicable): In cases where an entity, such as a corporation or partnership, is applying for accredited investor status, this section requires the necessary entity details, including its legal structure, principal place of business, and identification numbers. 5. Accredited Investor Representation: The final section is for the investor to make representations and warranties acknowledging their understanding of their accredited investor status and the associated risks. While there may not be different types of Phoenix Arizona Accredited Investor Self-Certification Attachment D specifically, the content and requirements of similar certification forms may vary between institutions or organizations requesting them. It is vital for potential investors to carefully review the specific criteria and guidelines outlined in the attachment they are provided to ensure accurate completion. To summarize, Phoenix Arizona Accredited Investor Self-Certification Attachment D is an essential form that investors submit to certify their eligibility as accredited investors in Phoenix, Arizona. By supplying detailed personal and financial information, individuals satisfy regulatory requirements and gain access to investment opportunities otherwise restricted to non-accredited investors.

Phoenix Arizona Accredited Investor Self-Certification Attachment D

Description

How to fill out Phoenix Arizona Accredited Investor Self-Certification Attachment D?

Drafting papers for the business or personal needs is always a huge responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's essential to take into account all federal and state laws and regulations of the specific region. However, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it burdensome and time-consuming to create Phoenix Accredited Investor Self-Certification Attachment D without expert help.

It's possible to avoid wasting money on attorneys drafting your documentation and create a legally valid Phoenix Accredited Investor Self-Certification Attachment D on your own, using the US Legal Forms online library. It is the largest online collection of state-specific legal templates that are professionally verified, so you can be sure of their validity when choosing a sample for your county. Earlier subscribed users only need to log in to their accounts to download the required form.

In case you still don't have a subscription, adhere to the step-by-step guideline below to obtain the Phoenix Accredited Investor Self-Certification Attachment D:

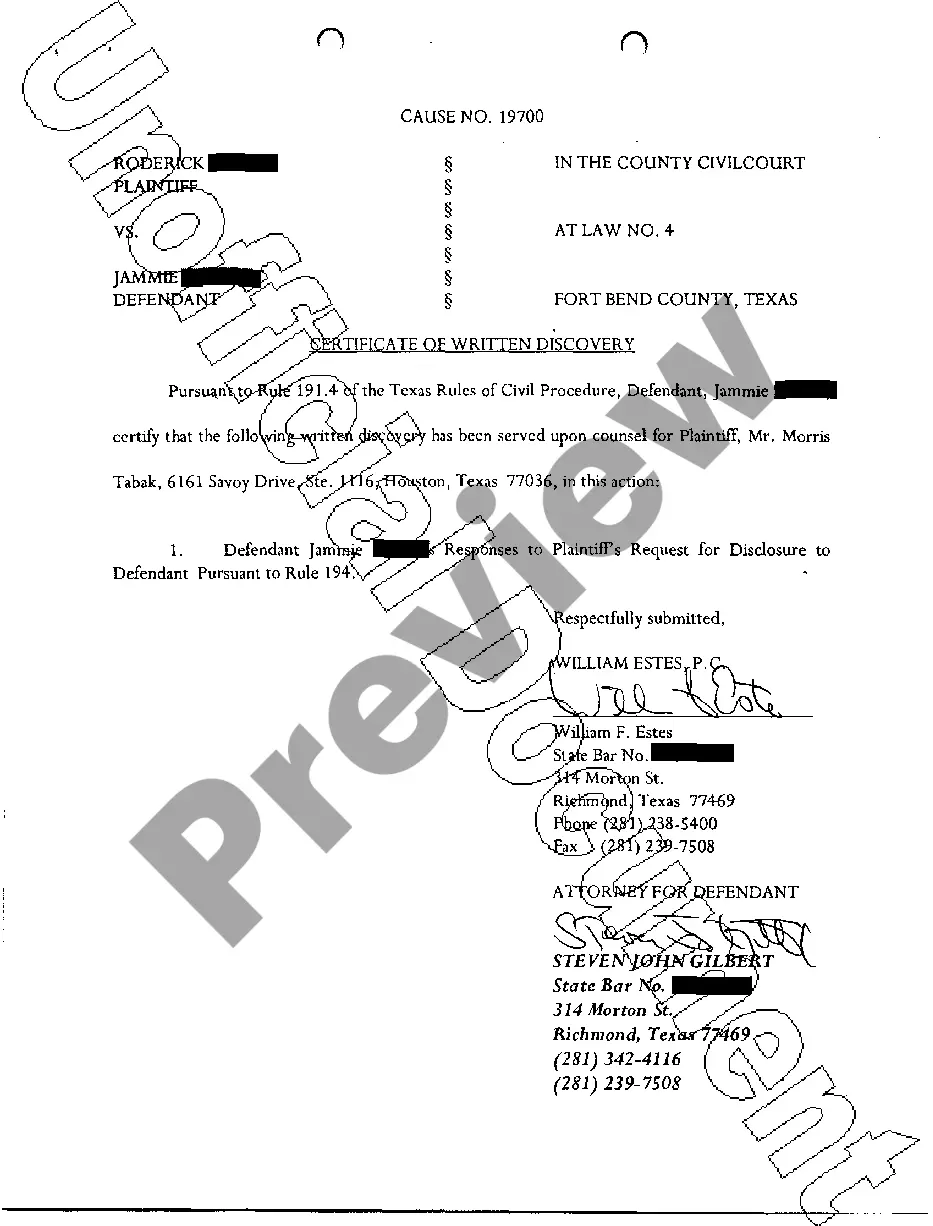

- Examine the page you've opened and verify if it has the sample you need.

- To achieve this, use the form description and preview if these options are available.

- To locate the one that satisfies your needs, use the search tab in the page header.

- Double-check that the template complies with juridical standards and click Buy Now.

- Opt for the subscription plan, then log in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever obtained never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and easily obtain verified legal forms for any use case with just a couple of clicks!