A Collin Texas Partnership Agreement is a legally binding contract between two or more parties formed to establish and govern a partnership business in Collin County, Texas. This agreement outlines various aspects of the partnership, including the rights, responsibilities, and obligations of each partner, the sharing of profits and losses, decision-making processes, and how the partnership will be managed and dissolved if necessary. Collin Texas Partnership Agreements are tailored to meet the specific needs and requirements of partners embarking on a business venture in Collin County. By clearly defining the terms and conditions of the partnership, this agreement ensures a smooth functioning of the business and mitigates conflicts or disputes that may arise. There are different types of Collin Texas Partnership Agreements, depending on the nature of the business and the objectives of the partners. Some common types include: 1. General Partnership Agreement: This is the simplest form of partnership agreement where two or more individuals or entities join together to carry out a business venture. In this agreement, all partners are equally responsible for the decision-making, management, and financial obligations of the partnership. 2. Limited Partnership Agreement: In a limited partnership, there are two types of partners: general partners and limited partners. General partners have unlimited liability and are actively involved in the daily operations of the business, while limited partners have limited liability and contribute capital but do not participate in the management of the partnership. 3. Limited Liability Partnership Agreement: A limited liability partnership (LLP) is a popular choice for certain professional service businesses, such as law firms or accounting firms. The LLP agreement limits the personal liability of partners to their own actions and protects them from being held responsible for the negligence or misconduct of other partners. Each type of partnership agreement has its own set of advantages and disadvantages, which should be carefully considered based on the specific circumstances of the partnership. Consulting with an attorney specializing in business law is highly recommended ensuring all legal requirements are met and to draft a comprehensive Collin Texas Partnership Agreement that safeguards the interests of all partners involved.

Collin Texas Partnership Agreement

Description

How to fill out Collin Texas Partnership Agreement?

Whether you intend to start your company, enter into a deal, apply for your ID renewal, or resolve family-related legal concerns, you must prepare specific paperwork meeting your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and checked legal templates for any personal or business occasion. All files are collected by state and area of use, so opting for a copy like Collin Partnership Agreement is fast and simple.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you a few more steps to get the Collin Partnership Agreement. Follow the guide below:

- Make certain the sample meets your individual needs and state law requirements.

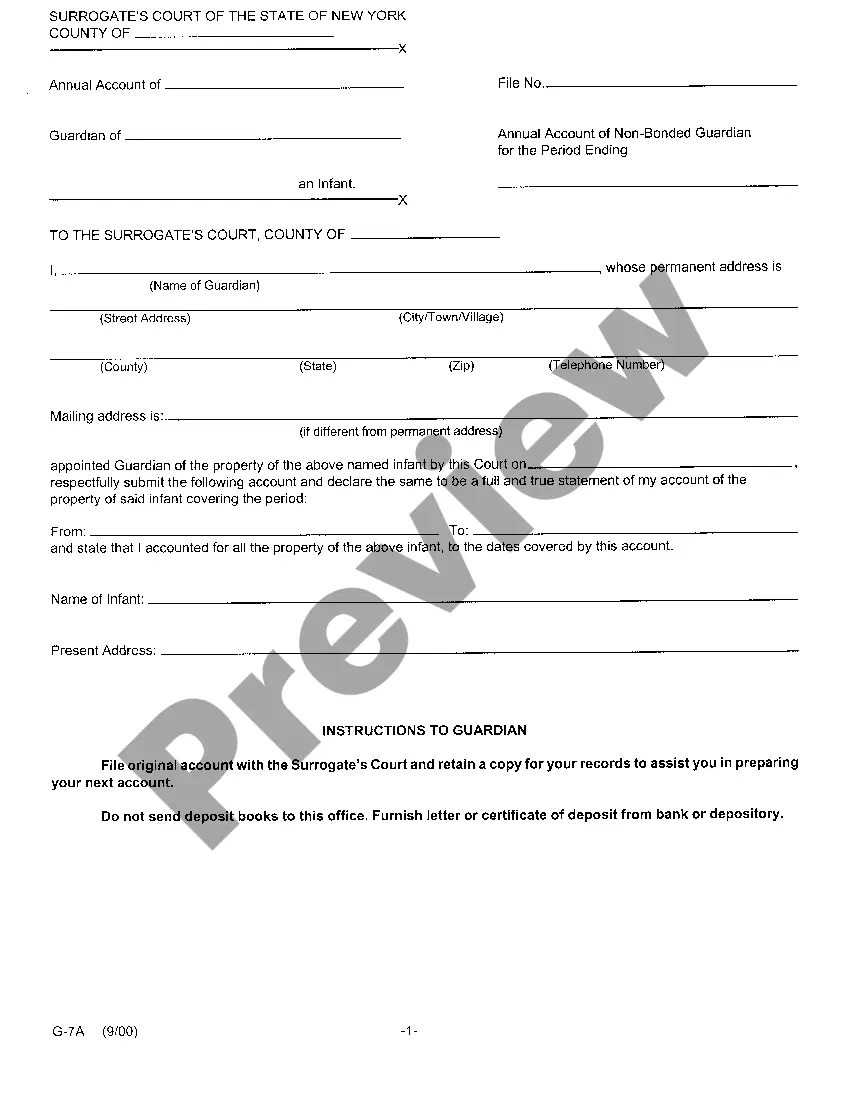

- Look through the form description and check the Preview if there’s one on the page.

- Make use of the search tab providing your state above to locate another template.

- Click Buy Now to obtain the sample when you find the proper one.

- Opt for the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Collin Partnership Agreement in the file format you prefer.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our website are multi-usable. Having an active subscription, you are able to access all of your previously acquired paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documentation. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!

Form popularity

More info

Collin offers degrees in the humanities, social sciences and the sciences, along with a concentration in nursing. The Collin campus is located in west Fort Worth, Texas, approximately 35 miles northeast of downtown Dallas on the east side of I-635. A commuter rail line to downtown Dallas is also nearby. In addition to residential facilities, there are offices, laboratories, community centers, sports fields, academic buildings, public parks and a library. Collin's students come from many walks of life, are of diverse ages, races and ethnicities, and come from all over the world, including over 100 countries. Collin offers a vibrant, engaged community and a place of intellectual engagement. Find out why almost 1 in 7 Collin students is admitted to college every year.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.