Queens New York Partnership Agreement is a legal contract that establishes a formal arrangement between two or more parties who mutually agree to collaborate and work together to achieve common goals in the context of business or nonprofit endeavors within the Queens area of New York City. This partnership agreement outlines the terms and conditions under which the partnership operates, including the rights, responsibilities, and contributions of each partner involved. There are different types of Queens New York Partnership Agreements, that cater to various partnership structures and objectives. Some of these types include: 1. General Partnership Agreement: This is the most common form of partnership agreement where all partners are equally responsible for the business's liabilities, debts, and management decisions. 2. Limited Partnership Agreement: This type of agreement consists of both general partners who have unlimited liability and limited partners who have limited liability and contribute capital but do not actively participate in day-to-day business operations. 3. Limited Liability Partnership (LLP) Agreement: LLP agreement offers partners limited liability while maintaining flexibility in managing the business. It protects partners from being personally held accountable for the partnership's liabilities and debts caused by other partners. 4. Limited Liability Company (LLC) Partnership Agreement: Queens New York allows LCS, and this agreement defines the terms under which the LLC operates as a partnership, including the distribution of profits and losses among the members. The Queens New York Partnership Agreement typically includes several key components. These may encompass: 1. Identification of Partners: The agreement lists the names, addresses, and roles of each partner involved. 2. Purpose and Scope: It outlines the primary goals, activities, and objectives that the partnership intends to pursue. 3. Contributions and Capital: The agreement specifies the capital contributions made by each partner, including monetary investments, property, or services rendered. 4. Profit and Loss Sharing: It defines how the partnership's profits and losses are allocated among partners, typically based on their respective contributions or agreed-upon terms. 5. Management and Decision-Making: The agreement determines how the partnership will be managed, including the roles and responsibilities of each partner. 6. Dissolution and Termination: It outlines the conditions in which the partnership may be dissolved or terminated, along with the procedures for winding up its affairs and distributing assets. By entering into a Queens New York Partnership Agreement, businesses and organizations can establish clear guidelines and expectations, thereby fostering a cooperative and mutually beneficial working relationship while protecting the interests of all involved parties.

Queens New York Partnership Agreement

Description

How to fill out Queens New York Partnership Agreement?

Creating legal forms is a must in today's world. Nevertheless, you don't always need to seek qualified assistance to draft some of them from the ground up, including Queens Partnership Agreement, with a platform like US Legal Forms.

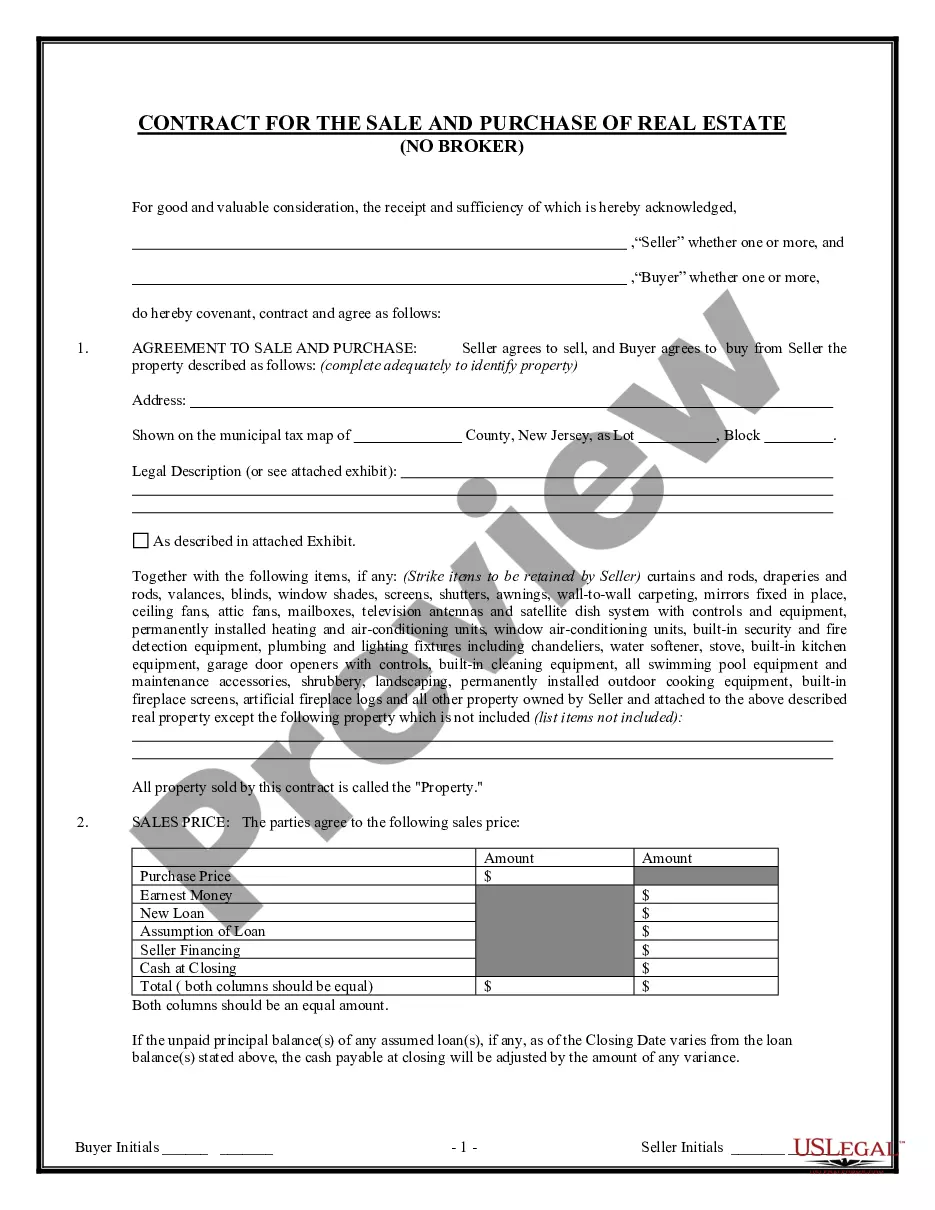

US Legal Forms has more than 85,000 forms to choose from in various types varying from living wills to real estate paperwork to divorce documents. All forms are arranged according to their valid state, making the searching experience less overwhelming. You can also find information materials and guides on the website to make any activities associated with paperwork execution simple.

Here's how to find and download Queens Partnership Agreement.

- Go over the document's preview and outline (if available) to get a basic information on what you’ll get after downloading the document.

- Ensure that the document of your choosing is adapted to your state/county/area since state laws can affect the validity of some records.

- Examine the related forms or start the search over to find the appropriate file.

- Hit Buy now and register your account. If you already have an existing one, select to log in.

- Choose the pricing {plan, then a needed payment method, and buy Queens Partnership Agreement.

- Select to save the form template in any offered file format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the appropriate Queens Partnership Agreement, log in to your account, and download it. Of course, our platform can’t take the place of an attorney completely. If you have to deal with an extremely difficult case, we recommend getting a lawyer to review your form before signing and submitting it.

With over 25 years on the market, US Legal Forms proved to be a go-to platform for various legal forms for millions of customers. Join them today and get your state-specific paperwork with ease!

Form popularity

FAQ

It is vital therefore to have a written partnership agreement in place to override any unsuitable provisions of the Partnership Act 1890. A written partnership agreement can specify the decisions which need the unanimous consent of all the partners, or decisions which need a special majority.

To file for a domestic partnership in New York, you'll need to complete an affidavit, which you can find online at the city clerk's office website. Then, you and your partner will need to bring the application and your IDs to the clerk's office.

Written partnership agreements protect the company and each partner's investment in it. If there is no written partnership agreement, partners are not allowed to draw a salary. Instead, they share the profits and losses in the business equally.

Here are the steps you should take to form a partnership in California: Choose a business name. File a fictitious business name statement with the county clerk. Draft and sign a partnership agreement. Obtain licenses, permits, and zoning clearances. Obtain an Employer Identification Number.

While there are no formal filing or registration requirements needed to create a partnership, partnerships should follow certain formation steps applicable to any business. To do business in the name of the partnership, file a certificate of fictitious business name.

You do not need to register a general partnership in New York. However, you will need to file a Certificate of Assumed Name for any additional business names. You will also need to register for state and federal taxes and meet all licensing, permitting, and clearance requirements.

A partnership agreement is not a mandatory legal requirement for establishing a partnership. However, it is a very important step to ensure there are no misunderstandings between you and your partners. A well-drafted partnership agreement will help you decide in advance how to handle certain situations.

You don't have to file any paperwork to establish a partnership -- you can create a partnership simply by agreeing to go into business with another person. Choose a business name. Register a fictitious business name. Draft and sign a partnership agreement. Comply with tax and regulatory requirements. Obtain Insurance.

General Partnership A Certificate of Assumed Name (following an agreement of the partners) with the clerk of the county/ies in which the business is conducted. Personal liability is joint and individual for the general partners who are responsible for the obligations of the partnership.

If you are a business owner, looking to draft your own partnership agreement, you can do so using free templates available online. It is advisable to contact a business lawyer or a partnership agreement lawyer to ensure that the agreement follows the federal, state and local laws.