A Chicago Illinois Senior Debt Term Sheet is a comprehensive document outlining the terms and conditions of a senior debt loan agreement within the state of Illinois, specifically in the city of Chicago. It includes crucial information about borrowing sums of money for various purposes, such as business expansions, property acquisitions, or refinancing existing debts. The term sheet is designed to provide a clear understanding between the borrower and the lender regarding the terms of the loan. It acts as a preliminary agreement before the final loan agreement is drafted. A few essential components typically found in a Chicago Illinois Senior Debt Term Sheet are: 1. Loan Amount: The term sheet specifies the principal loan amount, which is the sum borrowed by the borrower from the lender. 2. Interest Rate: The interest rate outlined in the term sheet determines the cost of borrowing the loan amount. It is usually an annual percentage provided by the lender. 3. Maturity Date: This marks the date by which the borrowed funds, along with any interest, fee, or charges, need to be repaid in full. The term sheet explicitly mentions this deadline. 4. Collateral: In many cases, senior debt loans require borrowers to provide collateral as security, which guarantees repayment in case of default. The term sheet will mention the collateral requirements, such as real estate, equipment, or accounts receivable. 5. Repayment Terms: The repayment terms entail the schedule according to which the borrower will make regular payments towards the loan. It may include details like the frequency of payments (monthly, quarterly, or annually), any grace period, and penalties for late payments. 6. Financial Covenants: These are specific financial conditions that the borrower needs to adhere to throughout the loan term. Financial covenants typically include maintaining certain financial ratios, limitations on additional debt, or meeting specific performance targets. 7. Prepayment Options: The term sheet may outline the borrower's ability to prepay the loan without incurring any penalties and any associated restrictions or fees. Types of Chicago Illinois Senior Debt Term Sheets: 1. Real Estate Senior Debt Term Sheet: This term sheet is specifically tailored for financing real estate projects in Chicago, including property acquisitions, development, or refinancing existing mortgages. 2. Business Expansion Senior Debt Term Sheet: Geared towards providing funding to businesses in Chicago for expanding operations, introducing new products or services, or investing in infrastructure. 3. Municipal Senior Debt Term Sheet: A term sheet designed for government entities in Chicago, allowing them to secure loans for public projects, infrastructure development, or other civic initiatives. Overall, a Chicago Illinois Senior Debt Term Sheet is a crucial document for borrowers and lenders to establish the terms of the loan agreement, ensuring transparency and clarity in their financial transactions.

Chicago Illinois Senior Debt Term Sheet

Description

How to fill out Chicago Illinois Senior Debt Term Sheet?

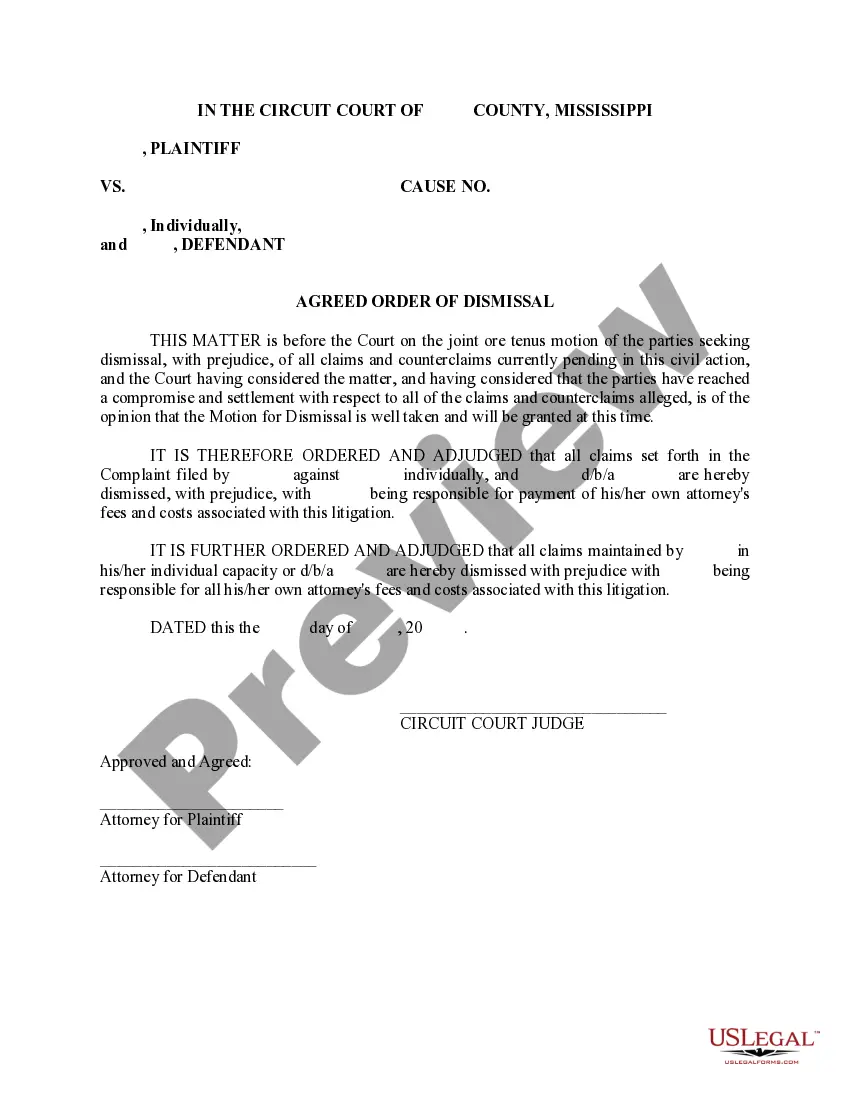

If you need to get a trustworthy legal form supplier to find the Chicago Senior Debt Term Sheet, look no further than US Legal Forms. Whether you need to start your LLC business or take care of your belongings distribution, we got you covered. You don't need to be well-versed in in law to find and download the appropriate template.

- You can browse from over 85,000 forms arranged by state/county and situation.

- The intuitive interface, variety of learning materials, and dedicated support make it easy to locate and complete various papers.

- US Legal Forms is a trusted service offering legal forms to millions of users since 1997.

Simply select to look for or browse Chicago Senior Debt Term Sheet, either by a keyword or by the state/county the document is intended for. After locating needed template, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's easy to get started! Simply locate the Chicago Senior Debt Term Sheet template and take a look at the form's preview and short introductory information (if available). If you're comfortable with the template’s terminology, go ahead and hit Buy now. Register an account and choose a subscription option. The template will be instantly available for download once the payment is processed. Now you can complete the form.

Taking care of your legal matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our extensive collection of legal forms makes these tasks less pricey and more reasonably priced. Set up your first business, arrange your advance care planning, create a real estate agreement, or complete the Chicago Senior Debt Term Sheet - all from the comfort of your home.

Join US Legal Forms now!