Cook Illinois is a well-known transportation company in the United States that provides services for schools, government agencies, and private organizations. They offer a variety of debt financing options to support their operations and expansion plans. One crucial aspect of their financial strategy is the Cook Illinois Senior Debt Term Sheet, which outlines the terms and conditions for borrowing funds. The Cook Illinois Senior Debt Term Sheet is a legal document that specifies the key details of a senior debt financing arrangement. It is typically prepared by Cook Illinois in collaboration with lenders or financial institutions. This term sheet is an essential tool for both parties as it sets the foundation for the loan agreement and serves as a basis for further negotiations. The Cook Illinois Senior Debt Term Sheet provides a comprehensive overview of the loan, including its purpose, principal amount, interest rate, maturity date, and repayment terms. It also outlines any collateral requirements, guarantees, and covenants that may be attached to the loan. Furthermore, it highlights the rights and obligations of both Cook Illinois and the lender, ensuring transparency and clarity in the financial arrangement. There may be variations of the Cook Illinois Senior Debt Term Sheet depending on the specific type of debt financing. Some common types include: 1. Term Loans: These are loans with a fixed term and a predetermined repayment schedule. Cook Illinois may opt for term loans to fund a specific project or to manage cash flow requirements. 2. Revolving Credit Facility: This type of loan provides Cook Illinois with access to a predetermined credit limit that they can borrow from as needed. It offers flexibility by allowing them to borrow, repay, and borrow again within the specified limit during the term of the facility. 3. Asset-Based Loans: Cook Illinois may secure a loan against specific assets, such as their fleet of vehicles or other tangible assets. These loans are ideal for companies with substantial collateral and can offer more favorable terms compared to unsecured loans. 4. Mezzanine Debt: Mezzanine debt typically sits between senior debt and equity in the creditor hierarchy. Cook Illinois may choose this option if they need additional funding beyond what senior debt alone can provide. Mezzanine debt often offers higher interest rates but may come with conversion rights or warrants that can be converted into equity. Overall, the Cook Illinois Senior Debt Term Sheet is a critical contractual document that outlines the terms and conditions of a loan between Cook Illinois and lenders. It ensures transparency, mitigates risks, and contributes to maintaining a mutually beneficial financial relationship.

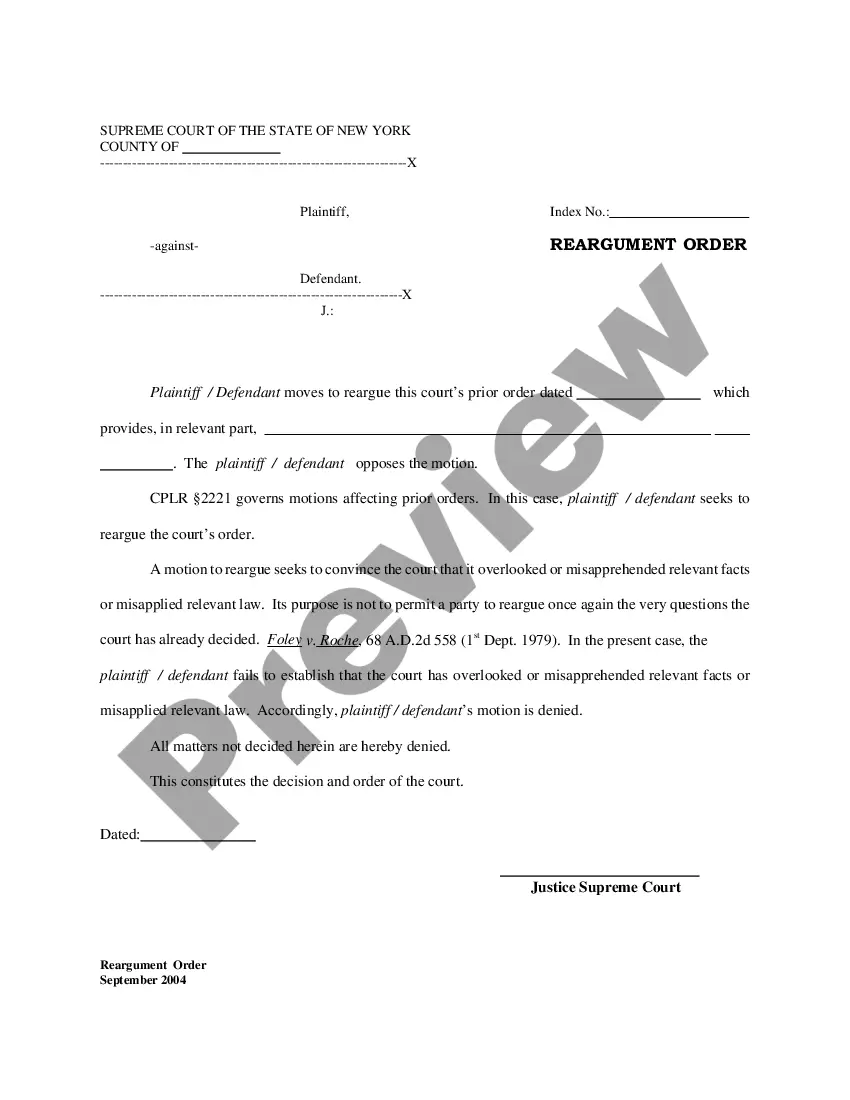

Cook Illinois Senior Debt Term Sheet

Description

How to fill out Cook Illinois Senior Debt Term Sheet?

A document routine always goes along with any legal activity you make. Creating a business, applying or accepting a job offer, transferring ownership, and lots of other life scenarios require you prepare formal documentation that differs throughout the country. That's why having it all accumulated in one place is so valuable.

US Legal Forms is the biggest online collection of up-to-date federal and state-specific legal templates. On this platform, you can easily locate and download a document for any individual or business purpose utilized in your region, including the Cook Senior Debt Term Sheet.

Locating forms on the platform is remarkably straightforward. If you already have a subscription to our service, log in to your account, find the sample using the search bar, and click Download to save it on your device. After that, the Cook Senior Debt Term Sheet will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this simple guide to get the Cook Senior Debt Term Sheet:

- Ensure you have opened the right page with your localised form.

- Make use of the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the template satisfies your requirements.

- Search for another document using the search tab in case the sample doesn't fit you.

- Click Buy Now when you locate the necessary template.

- Select the appropriate subscription plan, then log in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and save the Cook Senior Debt Term Sheet on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most trustworthy way to obtain legal documents. All the samples provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs efficiently with the US Legal Forms!