Cuyahoga Ohio Senior Debt Term Sheet is a legal document outlining the terms and conditions of a senior debt agreement in Cuyahoga County, Ohio. This term sheet serves as a preliminary agreement between the borrower and the lender, providing a detailed summary of the loan agreement's key provisions. It is an essential document in the financial sector, particularly for individuals or companies seeking senior debt financing in Cuyahoga County. KEYWORDS: Cuyahoga Ohio, Senior Debt, Term Sheet, legal document, terms and conditions, senior debt agreement, Cuyahoga County, loan agreement, key provisions, financing. Different types of Cuyahoga Ohio Senior Debt Term Sheet may exist based on the specific nature of the financing or the involved parties. Some potential variations include: 1. Corporate Senior Debt Term Sheet: This type of Cuyahoga Ohio Senior Debt Term Sheet is designed specifically for corporations in Cuyahoga County seeking senior debt financing. It outlines the terms, interest rates, repayment schedule, and collateral requirements applicable to the borrowing entity. 2. Municipal Senior Debt Term Sheet: Municipalities in Cuyahoga County may require senior debt financing for public infrastructure projects, such as roads, bridges, or utilities. The Municipal Senior Debt Term Sheet outlines the terms, bond types, and debt service requirements specific to public finance projects in Cuyahoga County. 3. Real Estate Senior Debt Term Sheet: For individuals or companies involved in real estate transactions in Cuyahoga County, a Real Estate Senior Debt Term Sheet provides details on the terms, interest rates, repayment structure, and collateral requirements for financing real estate ventures. 4. Nonprofit Senior Debt Term Sheet: Nonprofit organizations in Cuyahoga County seeking funding for various social or community projects may require senior debt financing. The Nonprofit Senior Debt Term Sheet outlines the terms, interest rates, repayment schedule, and any specific conditions applicable to nonprofit borrowers in Cuyahoga County. 5. Renewable Energy Senior Debt Term Sheet: Cuyahoga County encourages renewable energy projects. Therefore, a Renewable Energy Senior Debt Term Sheet highlights specific terms, conditions, loan structures, and repayment schedules for financing renewable energy initiatives, such as solar farms or wind power projects in Cuyahoga County. In summary, a Cuyahoga Ohio Senior Debt Term Sheet is a comprehensive document that outlines the terms and conditions of a senior debt agreement in the county. Different variations exist to cater to various borrowers' needs, including corporate, municipal, real estate, nonprofit, and renewable energy financing.

Cuyahoga Ohio Senior Debt Term Sheet

Description

How to fill out Cuyahoga Ohio Senior Debt Term Sheet?

Laws and regulations in every area differ around the country. If you're not a lawyer, it's easy to get lost in a variety of norms when it comes to drafting legal documents. To avoid pricey legal assistance when preparing the Cuyahoga Senior Debt Term Sheet, you need a verified template valid for your county. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal templates. It's a great solution for specialists and individuals looking for do-it-yourself templates for different life and business situations. All the forms can be used many times: once you pick a sample, it remains accessible in your profile for further use. Therefore, if you have an account with a valid subscription, you can just log in and re-download the Cuyahoga Senior Debt Term Sheet from the My Forms tab.

For new users, it's necessary to make several more steps to get the Cuyahoga Senior Debt Term Sheet:

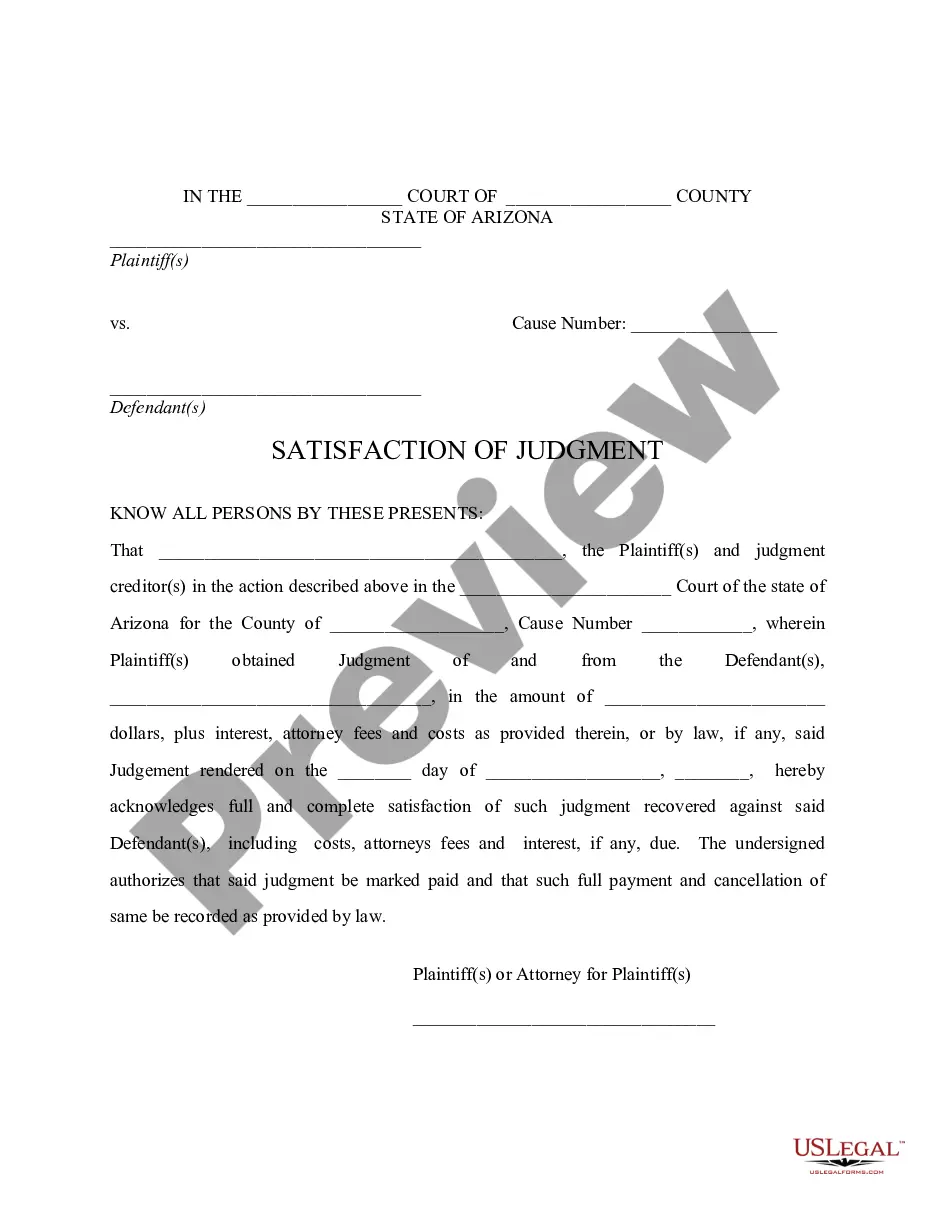

- Take a look at the page content to make sure you found the right sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Use the Buy Now button to get the template once you find the appropriate one.

- Opt for one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Complete and sign the template on paper after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

FAQ

How to Record a Deed Include a brief cover letter explaining exactly what you want done, including a telephone number. If including more than one deed, specify if they are to be recorded in a specific order. Include a check made payable to the Geauga County Recorder for the proper recording fee (See Table of Fees).

During this transition, all documents must be submitted either through US Mail/FedEx/UPS or in person at our office located at 2079 East 9th, Street (Room 4-100) Cleveland, OH 44115.

(3) All motions shall be ruled upon within one hundred twenty days from the date the moti on was filed, except as otherwi se noted on the report forms.

How to Write a Kick-Ass Motion Make an Outline.Keep Your Motion Simple.Maintain Credibility.Mind Your Citations.Focus on Facts.Keep Your Intro Short.Respect the Opposition.Write in English, Not Legalese.

You must file the motion with the Clerk of Court located in Room 35 on the ground floor of the Cuyahoga County Courthouse, 1 W. Lakeside Ave., Cleveland, Ohio 44113. You will be required to pay a ?filing fee? to the Clerk of Court at the time you file the motion.

If you wish to ask the Court to reschedule a hearing you must file a Motion for Continuance. The Court may reschedule a hearing upon the request of a party for good cause. The Motion for Continuance must be supported by an Affidavit stating the reason(s) why you need to have the hearing rescheduled.

A motion is an application to the court made by the prosecutor or defense attorney, requesting that the court make a decision on a certain issue before the trial begins. The motion can affect the trial, courtroom, defendants, evidence, or testimony. Only judges decide the outcome of motions.

Conveyance Fee: 0.4% of the sale price or value of real property being transferred. Transfer Fee: $0.50 per lot or part of lot transferred.

During this transition, all documents must be submitted either through US Mail/FedEx/UPS or in person at our office located at 2079 East 9th, Street (Room 4-100) Cleveland, OH 44115.

Please visit: . Information available to taxpayers about each property includes land and buildings data, ownership history, parcel and mailing addresses, transfer dates, purchase prices and taxes on all residential and commercial properties.