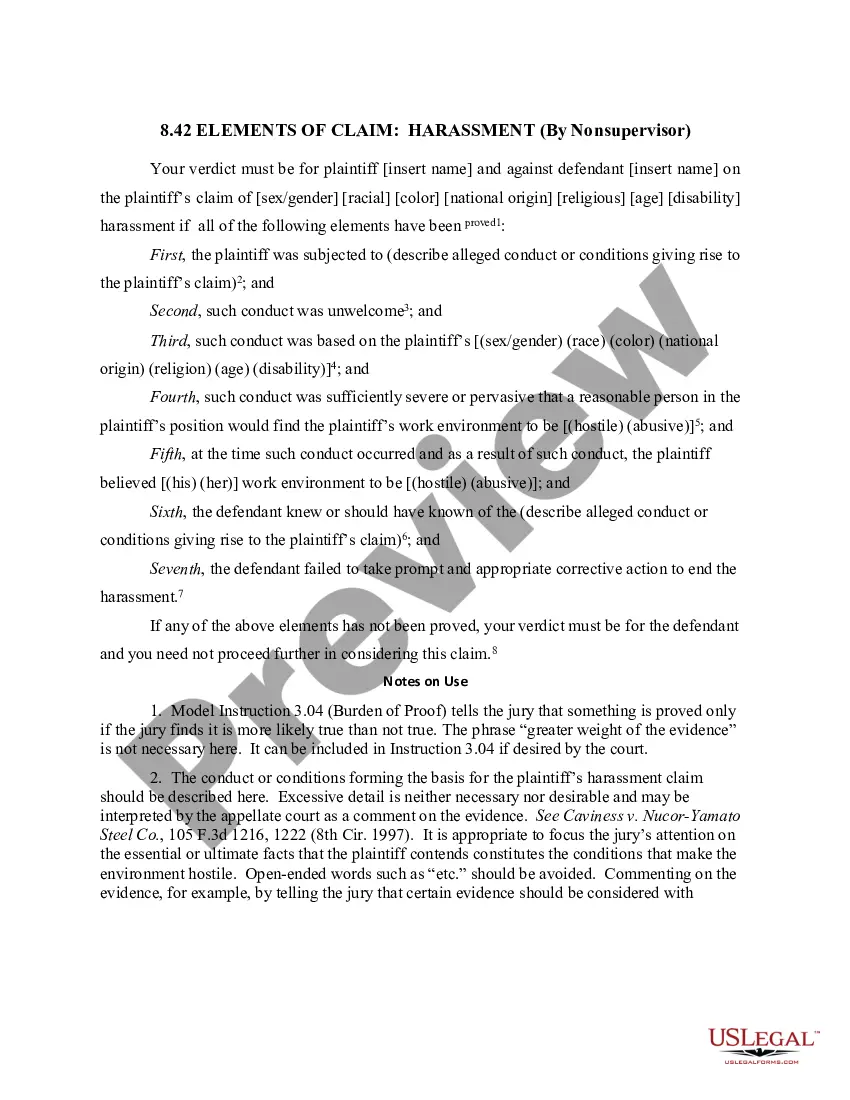

San Antonio Texas Senior Debt Term Sheet is a financial document that outlines the terms and conditions for senior debt financing in the city of San Antonio, Texas. It serves as a crucial agreement between a borrower and a lender, typically in the context of a real estate project or business venture. This term sheet provides detailed information about the loan, its repayment terms, and the rights and obligations of both parties involved. The San Antonio Texas Senior Debt Term Sheet contains several key components, including: 1. Loan Amount: This specifies the total amount of senior debt being provided by the lender to the borrower. It may vary based on the specific project or business requirements. 2. Interest Rate: The term sheet includes the agreed-upon interest rate for the senior debt. This rate determines the cost of borrowing for the borrower and the potential return for the lender. 3. Maturity Date: This indicates the date by which the senior debt must be repaid in full, including principal and interest. It represents the overall duration of the loan. 4. Collateral: The term sheet outlines any collateral or assets that the borrower pledges as security for the senior debt. This ensures that the lender has recourse in case of default. 5. Loan Structure: It details the specific structure of the senior debt, such as whether it's a fixed-rate loan, adjustable-rate loan, or a combination of both. This section may also cover any grace periods or balloon payments. 6. Payment Terms: This outlines how the borrower is expected to repay the senior debt. It includes information on the frequency of payments, any additional fees or charges, and the preferred method of payment. 7. Covenants and Restrictions: The term sheet specifies any covenants and restrictions imposed on the borrower, such as maintaining certain financial ratios, obtaining necessary insurance, or seeking lender approval for major financial decisions. 8. Events of Default: It outlines the conditions under which the borrower may be considered in default and the potential consequences, such as penalties, increased interest rates, or acceleration of the loan. 9. Guarantees: If applicable, the term sheet details any personal or corporate guarantees required from the borrower or its affiliated entities. Types of San Antonio Texas Senior Debt Term Sheets may include Commercial Real Estate Senior Debt Term Sheet, Small Business Senior Debt Term Sheet, Real Estate Development Senior Debt Term Sheet, or Construction Senior Debt Term Sheet. Each type may have specific provisions that cater to the unique requirements and risks associated with the respective projects or businesses. In conclusion, the San Antonio Texas Senior Debt Term Sheet is a vital financial document that provides a comprehensive overview of the terms and conditions of senior debt financing in San Antonio, Texas. It ensures transparency and clarity between the borrower and the lender, mitigating potential conflicts and protecting the interests of both parties.

San Antonio Texas Senior Debt Term Sheet

Description

How to fill out San Antonio Texas Senior Debt Term Sheet?

Are you looking to quickly draft a legally-binding San Antonio Senior Debt Term Sheet or maybe any other form to manage your personal or corporate affairs? You can select one of the two options: contact a legal advisor to write a legal paper for you or create it entirely on your own. Thankfully, there's a third option - US Legal Forms. It will help you get neatly written legal paperwork without paying unreasonable fees for legal services.

US Legal Forms offers a huge collection of over 85,000 state-compliant form templates, including San Antonio Senior Debt Term Sheet and form packages. We provide templates for a myriad of life circumstances: from divorce paperwork to real estate documents. We've been out there for over 25 years and got a spotless reputation among our customers. Here's how you can become one of them and obtain the needed template without extra troubles.

- First and foremost, double-check if the San Antonio Senior Debt Term Sheet is tailored to your state's or county's laws.

- If the document includes a desciption, make sure to check what it's suitable for.

- Start the search again if the form isn’t what you were seeking by using the search box in the header.

- Choose the plan that best suits your needs and proceed to the payment.

- Select the format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can easily log in to it, locate the San Antonio Senior Debt Term Sheet template, and download it. To re-download the form, simply go to the My Forms tab.

It's easy to find and download legal forms if you use our catalog. Additionally, the templates we provide are updated by industry experts, which gives you greater peace of mind when writing legal matters. Try US Legal Forms now and see for yourself!