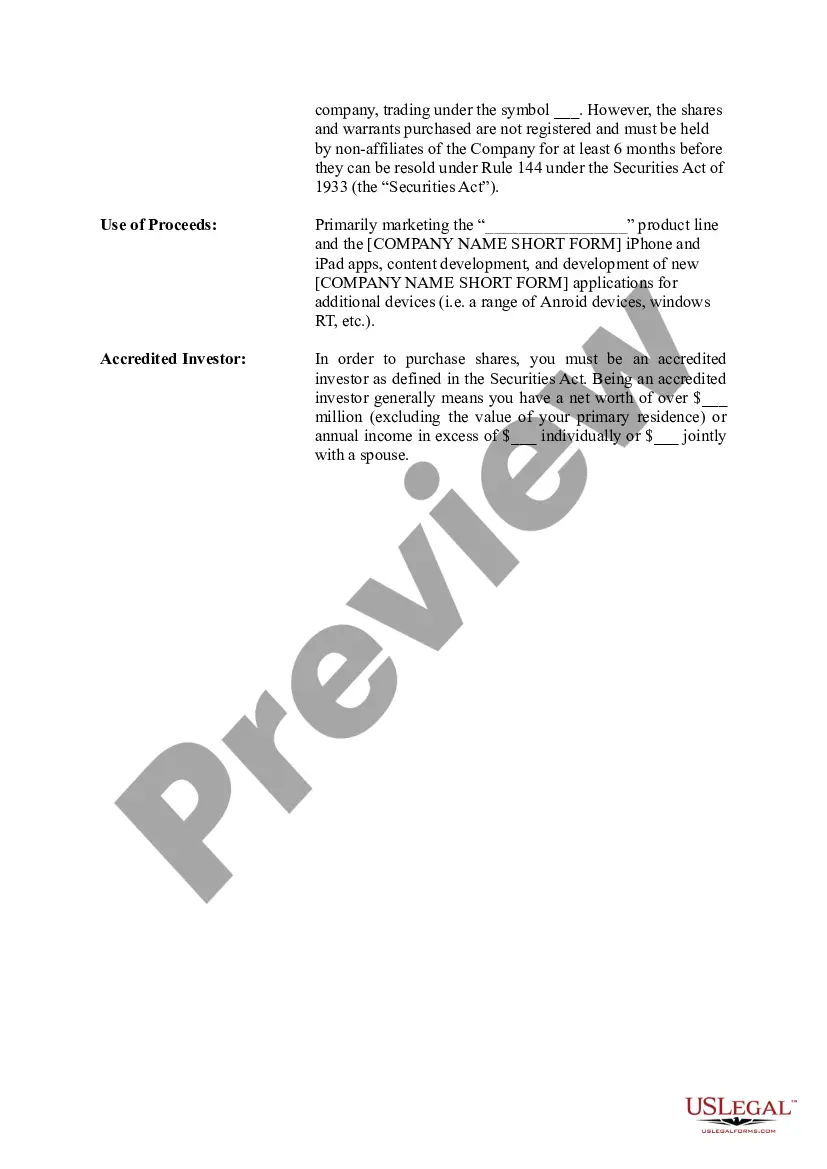

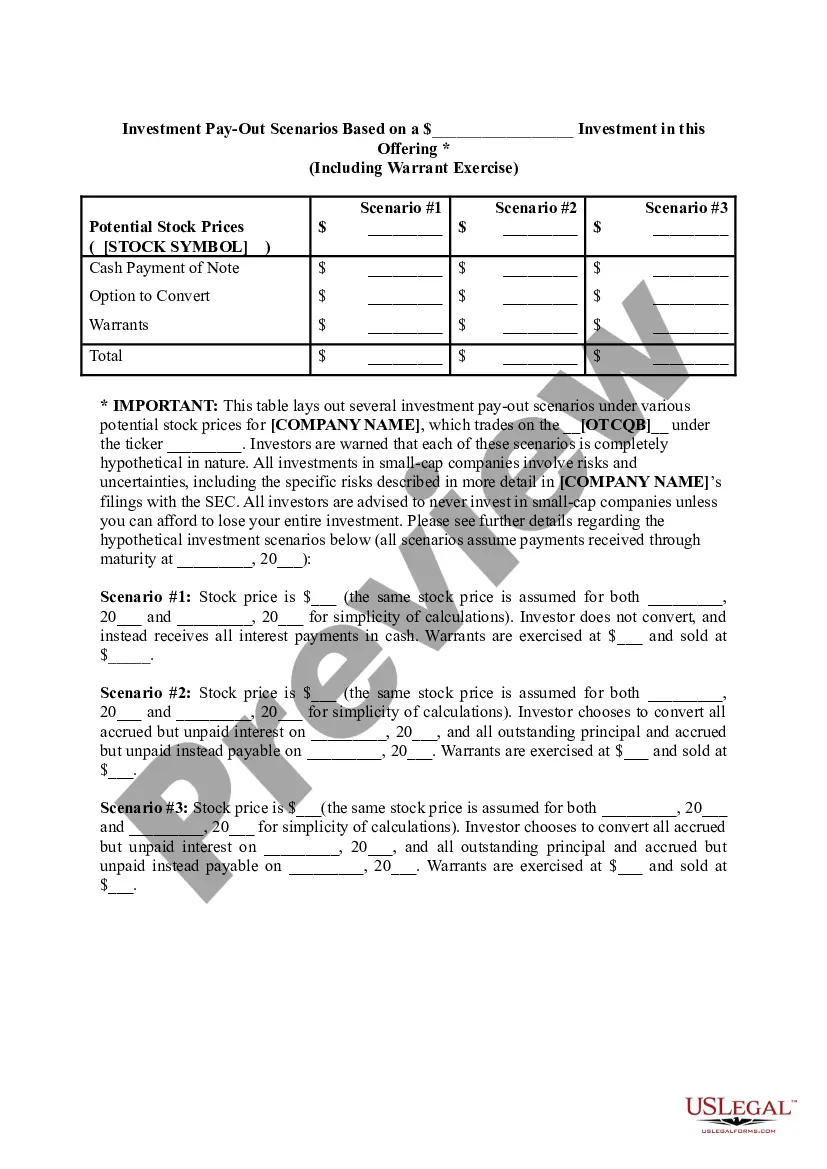

The Cuyahoga Ohio Term Sheet — Convertible Debt Financing is a legal document that outlines the terms and conditions associated with a specific type of financing available to businesses in the Cuyahoga Ohio area. This financing option involves the issuance of convertible debt, which provides the opportunity for debt holders to convert their loans into equity (ownership) shares of the company at a predetermined conversion price and conversion ratio. This term sheet serves as an agreement between the company seeking financing and potential investors or lenders. It covers crucial details such as the principal amount of the debt, interest rates, maturity date, conversion terms, and other terms that may be negotiated between the parties involved. The Cuyahoga Ohio Term Sheet — Convertible Debt Financing can be categorized into different types based on specific terms and conditions. Some common variations include: 1. Traditional Convertible Debt: This type of term sheet outlines the standard terms and conditions associated with convertible debt financing, including the conversion ratio, conversion price, interest rates, and maturity date. 2. Participating Convertible Debt: In this type, the term sheet may include provisions that allow the holders of the convertible debt to participate in the company's future growth and financial success, such as receiving additional payments upon an acquisition or an initial public offering (IPO). 3. Discounted Convertible Debt: This term sheet may offer a discount to the conversion price of the debt, providing an incentive for early conversion by debt holders. This discount typically offsets the risks associated with investing in convertible debt. 4. Preferred Convertible Debt: This type of term sheet may designate the convertible debt as preferred, granting debt holders certain preferential rights, such as priority in payment or additional voting power compared to other shareholders. 5. Secured Convertible Debt: This term sheet may provide certain assets of the company as collateral for the convertible debt, offering additional security to the debt holders. 6. Unsecured Convertible Debt: Unlike secured convertible debt, this type of term sheet does not require any specific assets to be pledged as collateral. Instead, it relies solely on the company's ability to repay the debt. It is important for businesses seeking convertible debt financing in Cuyahoga Ohio to review and negotiate the specific terms outlined in the term sheet to ensure that they align with their financial goals and needs. Additionally, consulting with legal and financial professionals is highly recommended to fully understand the implications and legal obligations associated with this form of financing.

Cuyahoga Ohio Term Sheet - Convertible Debt Financing

Description

How to fill out Cuyahoga Ohio Term Sheet - Convertible Debt Financing?

Dealing with legal forms is a must in today's world. However, you don't always need to look for professional help to draft some of them from scratch, including Cuyahoga Term Sheet - Convertible Debt Financing, with a platform like US Legal Forms.

US Legal Forms has over 85,000 templates to select from in different categories ranging from living wills to real estate papers to divorce documents. All forms are arranged according to their valid state, making the searching experience less frustrating. You can also find detailed resources and tutorials on the website to make any activities associated with paperwork completion straightforward.

Here's how to locate and download Cuyahoga Term Sheet - Convertible Debt Financing.

- Go over the document's preview and outline (if available) to get a general information on what you’ll get after downloading the document.

- Ensure that the template of your choosing is adapted to your state/county/area since state laws can affect the legality of some records.

- Check the similar document templates or start the search over to locate the right document.

- Click Buy now and create your account. If you already have an existing one, choose to log in.

- Pick the option, then a suitable payment gateway, and buy Cuyahoga Term Sheet - Convertible Debt Financing.

- Select to save the form template in any offered format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the needed Cuyahoga Term Sheet - Convertible Debt Financing, log in to your account, and download it. Needless to say, our platform can’t take the place of a lawyer entirely. If you need to deal with an extremely complicated case, we recommend getting a lawyer to examine your document before executing and filing it.

With more than 25 years on the market, US Legal Forms became a go-to provider for various legal forms for millions of customers. Become one of them today and get your state-specific paperwork effortlessly!

Form popularity

FAQ

A convertible is a bond, preferred share, or another financial instrument that can be converted by the shareholder into common stock. Convertible securities are not classified as debt or equity; instead, they are considered to be a hybrid of the two categories, possessing cash flow features of both bonds and stocks.

Within venture capital financing, a convertible note is a type of short-term debt financing that's used in early-stage capital raises. In other words, convertible notes are loans to early-stage startups from investors who are expecting to be paid back when their note comes due.

A convertible note is a way for seed investors to invest in a startup that isn't ready for valuation. They start as short-term debt and are converted into equity in the issuing company. Investors loan money to the startup and are repaid with equity in the company rather than principal and interest.

With convertible debt, a business borrows money from a lender where both parties enter the agreement with the intent (from the outset) to repay all (or part) of the loan by converting it into a certain number of its common shares at some point in the future.

There are pros and cons to the use of convertible bonds as a means of financing by corporations. One of several advantages of this method of equity financing is a delayed dilution of common stock and earnings per share (EPS).

Given the non-legally binding nature of a Convertible Note Term Sheet, it is necessary for the parties to execute a Convertible Note Instrument or Convertible Note Subscription Agreement to record the binding terms in full.

A convertible note is a form of short-term debt that converts into equity, typically in conjunction with a future financing round; in effect, the investor would be loaning money to a startup and instead of a return in the form of principal plus interest, the investor would receive equity in the company.

A Convertible Note Term Sheet is the summary outline of the key terms for a convertible debt seed financing. As you approach potential investors, the term sheet will be a critical part of your seed financing toolkit, together with the executive summary and investor pitch deck.

Standard convertible note terms are parameters for a specific form of short-term business debt. A convertible note will convert into equity at a future date, meaning that the investor loans money to an entrepreneur and receives equity in the company rather than payments on the principal plus interest.

Convertible Notes are loans so they are recorded on the Balance Sheet of a company as a liability when they are made. Depending on the debt's maturity date, they can either be shown as a current liability (loans maturing within 12 months) or as a Long-term liability (loans maturing over 12 months).