Tarrant Texas Term Sheet — Convertible Debt Financing: Explained and Variations In the world of business and finance, convertible debt financing has become an increasingly popular option for startups and established companies alike. One form of convertible debt financing specifically tailored to businesses in Tarrant, Texas, is the Tarrant Texas Term Sheet — Convertible Debt Financing. What is Convertible Debt Financing? Convertible debt financing is a type of investment where a company issues debt in the form of convertible notes to investors. These notes can be converted into equity at a later stage, typically during a subsequent funding round or an exit event, such as an initial public offering (IPO). This financing structure allows companies to raise capital while giving investors the option to convert their debt into ownership stakes in the company. The Tarrant Texas Term Sheet: The Tarrant Texas Term Sheet — Convertible Debt Financing is a document outlining the key terms and conditions of a convertible debt financing agreement specifically designed for businesses operating in Tarrant, Texas. The term sheet typically serves as the basis for negotiations between the company and potential investors before finalizing the transaction. Key Elements of the Tarrant Texas Term Sheet: 1. Principal Amount: The total amount of debt being issued by the company. 2. Interest Rate: The interest rate applicable to the convertible debt. 3. Maturity Date: The date on which the convertible notes must be repaid if not converted into equity. 4. Conversion Terms: The conversion ratio or formula used to determine the equity conversion price. 5. Valuation Cap: A maximum pre-money valuation at which the convertible debt can be converted into equity. 6. Discount Rate: The percentage discount applied to the conversion price to reward early investors. 7. Investor Rights: Any additional rights granted to the investors, such as board representation or information rights. 8. Events of Default: Circumstances under which the company is in breach of the agreement, triggering default provisions. Types of Tarrant Texas Term Sheet — Convertible Debt Financing: While the Tarrant Texas Term Sheet — Convertible Debt Financing generally follows the basic structure mentioned above, there can be different variations based on the specific needs and preferences of the parties involved. Some common types of variations include: 1. Fixed Interest Rate Convertible Debt Financing: This type of term sheet specifies a fixed interest rate that remains constant throughout the term of the convertible notes. 2. Variable Interest Rate Convertible Debt Financing: In contrast to the fixed-rate version, this type allows for an interest rate that may change over time, usually linked to a benchmark rate such as the prime rate. 3. Participating Convertible Debt Financing: A term sheet of this nature provides investors with additional rights, such as the ability to participate in future equity financings alongside new investors. 4. Secured Convertible Debt Financing: This variation involves the inclusion of collateral to secure the convertible debt, reducing risk for the investors. The specific type of Tarrant Texas Term Sheet — Convertible Debt Financing chosen will depend on various factors, including the company's financial situation, growth prospects, risk appetite, and the preferences of the investors involved. In conclusion, the Tarrant Texas Term Sheet — Convertible Debt Financing provides a framework for companies in Tarrant, Texas, to raise capital through convertible debt offerings. Understanding the key elements and various types of this term sheet allows businesses and investors to navigate and negotiate the terms of their agreements effectively.

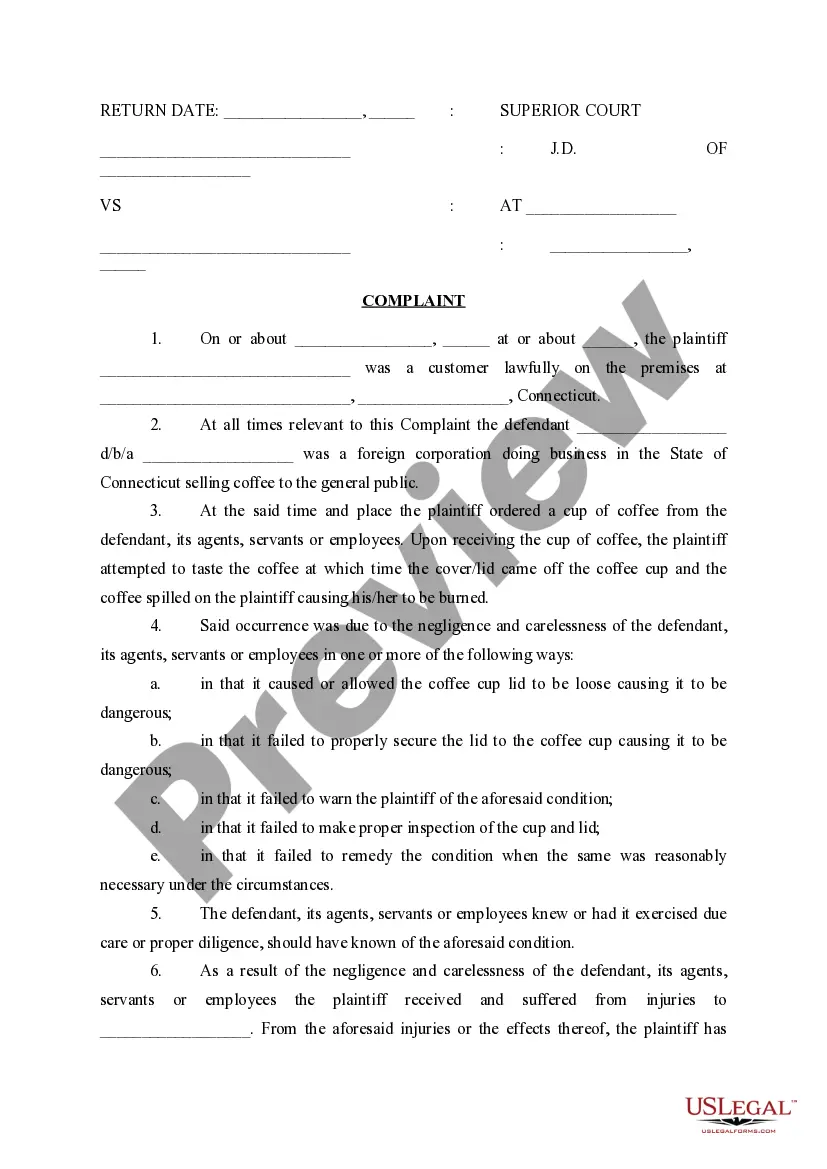

Tarrant Texas Term Sheet - Convertible Debt Financing

Description

How to fill out Tarrant Texas Term Sheet - Convertible Debt Financing?

If you need to find a trustworthy legal paperwork supplier to obtain the Tarrant Term Sheet - Convertible Debt Financing, look no further than US Legal Forms. No matter if you need to start your LLC business or take care of your asset distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the appropriate form.

- You can browse from over 85,000 forms categorized by state/county and case.

- The self-explanatory interface, variety of supporting resources, and dedicated support team make it easy to locate and execute various papers.

- US Legal Forms is a trusted service providing legal forms to millions of customers since 1997.

You can simply type to look for or browse Tarrant Term Sheet - Convertible Debt Financing, either by a keyword or by the state/county the form is intended for. After locating required form, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's easy to start! Simply find the Tarrant Term Sheet - Convertible Debt Financing template and take a look at the form's preview and description (if available). If you're confident about the template’s terminology, go ahead and click Buy now. Register an account and choose a subscription option. The template will be immediately ready for download once the payment is processed. Now you can execute the form.

Handling your legal affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to prove it. Our comprehensive collection of legal forms makes this experience less pricey and more reasonably priced. Set up your first business, arrange your advance care planning, create a real estate contract, or complete the Tarrant Term Sheet - Convertible Debt Financing - all from the comfort of your home.

Join US Legal Forms now!