Fairfax Virginia Term Sheet — Convertible Debt Financing is a legal document outlining the terms and conditions associated with providing funding through convertible debt financing in Fairfax, Virginia. This type of financing is commonly used by startups and early-stage companies to obtain capital while offering potential investors the option to convert the invested amount into equity in the future. The Fairfax Virginia Term Sheet generally covers several key elements, including: 1. Principal Amount: The total amount of debt being offered to investors, which will be convertible into equity at a later stage. 2. Interest Rate: The interest rate applied to the convertible debt, which is typically lower than traditional loans. 3. Maturity Date: The date at which the convertible debt is due to be repaid, either through conversion into equity or as a cash payment. 4. Conversion Terms: Specifies the conditions under which the convertible debt can be converted into equity. This section may outline factors such as the conversion price, conversion ratio, and any adjustments to the conversion terms based on future funding rounds. 5. Equity Terms: Describes the rights and privileges associated with the converted equity, such as voting rights, preferential treatment, and participation in future funding rounds. 6. Default Terms: Outlines the consequences and remedies in case of default, including potential penalties and the right of investors to convert their debt into equity. In addition to the general Fairfax Virginia Term Sheet — Convertible Debt Financing, there may be variations or specific types based on the needs and preferences of the parties involved. Some different types of Fairfax Virginia Term Sheet — Convertible Debt Financing include: 1. Seed Round Term Sheet: Specifically designed for early-stage startups seeking initial funding to develop their products or services. 2. Bridge Financing Term Sheet: Intended to provide temporary capital between funding rounds, allowing companies to sustain operations until securing a larger investment. 3. Growth Stage Term Sheet: Tailored for more established companies looking to fuel expansion or scale their operations. 4. Mezzanine Financing Term Sheet: A hybrid debt-equity instrument often used during later-stage funding rounds, offering investors the option to convert their debt into equity during a subsequent financing round. 5. Recapitalization Term Sheet: Used when restructuring a company's capital structure by converting existing debt into equity or new debt instruments. These various types of term sheets offer flexibility to both companies seeking financing and investors looking for investment opportunities in Fairfax, Virginia. Each type can be customized to meet specific funding goals and align with the expectations of the involved parties, ensuring a mutually beneficial agreement.

Fairfax Virginia Term Sheet - Convertible Debt Financing

Description

How to fill out Fairfax Virginia Term Sheet - Convertible Debt Financing?

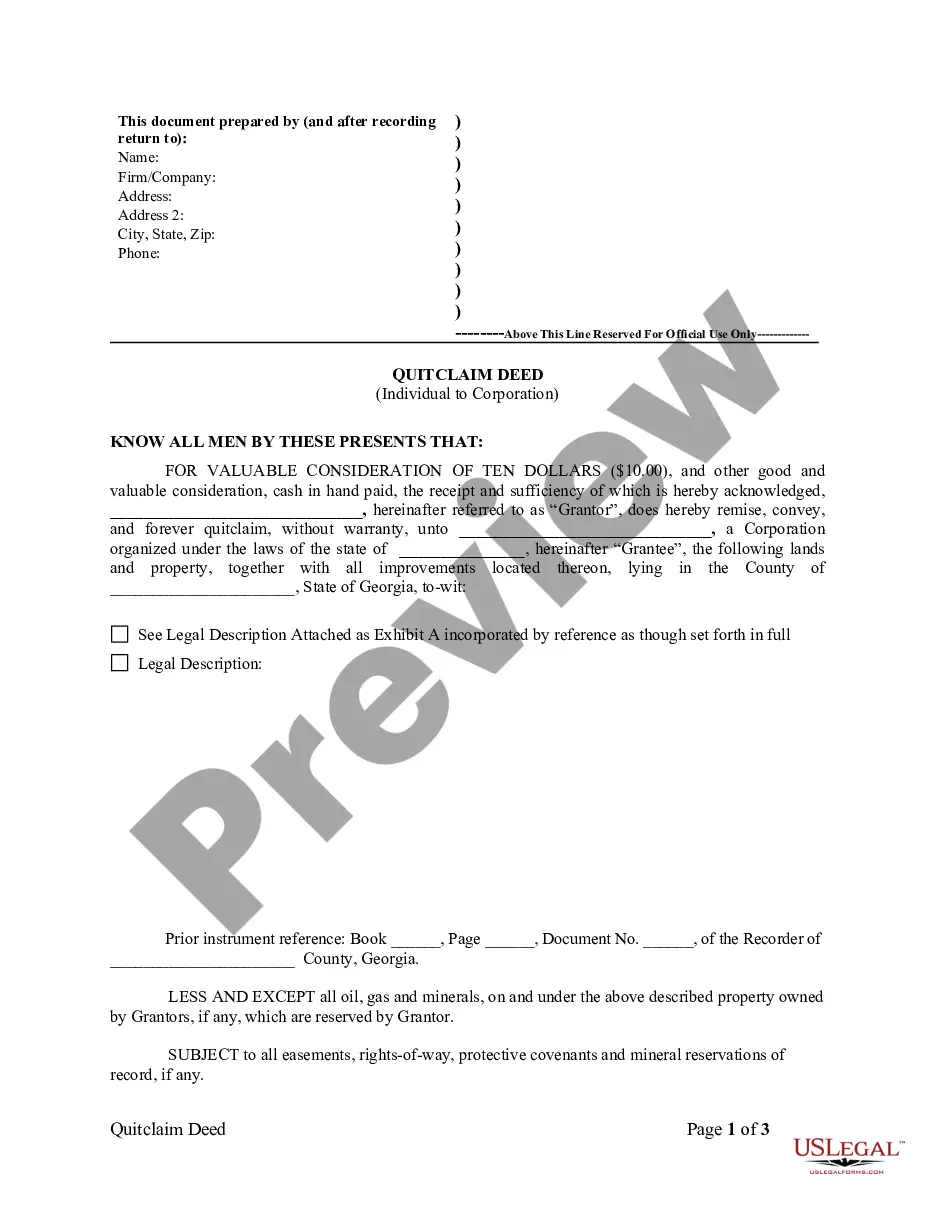

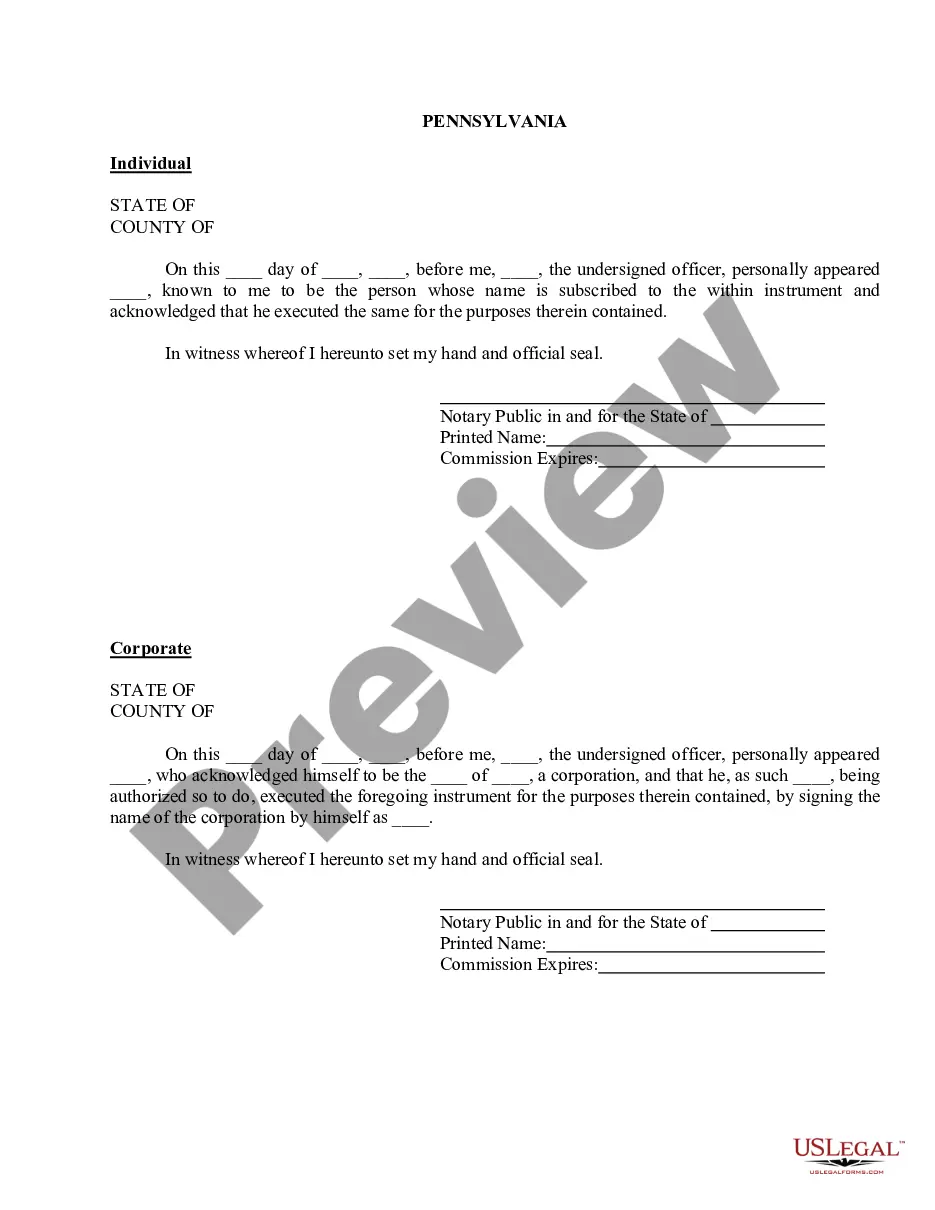

Preparing legal paperwork can be burdensome. Besides, if you decide to ask a legal professional to write a commercial agreement, documents for proprietorship transfer, pre-marital agreement, divorce papers, or the Fairfax Term Sheet - Convertible Debt Financing, it may cost you a fortune. So what is the most reasonable way to save time and money and draft legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is a great solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is biggest online collection of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any scenario accumulated all in one place. Consequently, if you need the recent version of the Fairfax Term Sheet - Convertible Debt Financing, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample with the Download button. If you haven't subscribed yet, here's how you can get the Fairfax Term Sheet - Convertible Debt Financing:

- Look through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - search for the correct one in the header.

- Click Buy Now once you find the required sample and select the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a payment with a credit card or via PayPal.

- Opt for the file format for your Fairfax Term Sheet - Convertible Debt Financing and save it.

When finished, you can print it out and complete it on paper or upload the template to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the documents ever purchased many times - you can find your templates in the My Forms tab in your profile. Give it a try now!

Form popularity

FAQ

Convertible notes are debt instruments that include terms like a maturity date, an interest rate, etc., but that will convert into equity if a future equity round is raised. The conversion typically occurs at a discount to the price per share of the future round.

Standard convertible note terms are parameters for a specific form of short-term business debt. A convertible note will convert into equity at a future date, meaning that the investor loans money to an entrepreneur and receives equity in the company rather than payments on the principal plus interest.

The equity & liability portion for the convertible bonds can be calculated using the Residual Approach. This approach assumes that the value of the equity portion is equal to the difference between the total amount received from the proceeds of the bonds and the present value of future cash flows.

Convertible bonds are long-term liabilities grouped in the bonds payable account.

How to Account for Convertible Debt (IFRS) - YouTube YouTube Start of suggested clip End of suggested clip So we're going to use something called the residual method. And that's going to require us to doMoreSo we're going to use something called the residual method. And that's going to require us to do this we're going to take the fair value of the convertible. Debt on the date of issuance.

Because convertible bonds have a maturity of greater than one year, they appear under the long-term liabilities section of the balance sheet.

Convertible debt may become current Generally, if a liability has any conversion options that involve a transfer of the company's own equity instruments, these would affect its classification as current or non-current.

How to Account for Convertible Debt (IFRS) - YouTube YouTube Start of suggested clip End of suggested clip So international accounting standards are different than u.s gaap in that you need to separate theMoreSo international accounting standards are different than u.s gaap in that you need to separate the two components of the convertible debt you've got the debt. Itself.

A convertible note refers to a short-term debt instrument that allows an investor to convert debt to an equity stake in a company.

A Convertible Note Term Sheet is the summary outline of the key terms for a convertible debt seed financing. As you approach potential investors, the term sheet will be a critical part of your seed financing toolkit, together with the executive summary and investor pitch deck.