Hennepin Minnesota Term Sheet — Convertible Debt Financing refers to a comprehensive document that outlines the terms and conditions for providing convertible debt financing in Hennepin County, Minnesota. This financing option allows businesses to borrow funds that can be converted into equity at a later stage. The Hennepin Minnesota Term Sheet — Convertible Debt Financing typically includes various key elements and provisions that both the lender and the borrower need to agree on. These may include: 1. Conversion Terms: This section details the terms under which the debt can be converted into equity, such as the conversion price and conversion ratio. 2. Interest Rate: Specifies the interest rate that will be charged on the convertible debt during the term of the financing. 3. Maturity Date: Indicates the date by which the debt must be repaid or converted into equity. 4. Principal Amount: Specifies the initial amount of debt being provided. 5. pre-Roman Valuation: Refers to the valuation of the company before the convertible debt financing is issued. 6. Anti-Dilution Provisions: Includes provisions that protect the convertible debt holders from dilution in case of subsequent equity issuance sat a lower price. 7. Conversion Events: Specifies the events or triggers that allow the debt to be converted into equity, such as a subsequent funding round or an initial public offering (IPO). 8. Voting Rights: Defines the rights of the convertible debt holders to vote on certain matters related to the company. 9. Repayment Terms: Outlines the repayment terms, including any repayment schedule or potential early repayment options. 10. Governing Law: States the jurisdiction and laws that will govern the term sheet and any disputes that may arise. While there might not be different types of Hennepin Minnesota Term Sheet — Convertible Debt Financing, the content of the term sheet can vary slightly depending on the specific requirements and preferences of the lender and the borrower. However, the above-mentioned elements are typically included in most convertible debt financing term sheets.

Hennepin Minnesota Term Sheet - Convertible Debt Financing

Description

How to fill out Hennepin Minnesota Term Sheet - Convertible Debt Financing?

If you need to find a trustworthy legal document supplier to obtain the Hennepin Term Sheet - Convertible Debt Financing, consider US Legal Forms. No matter if you need to start your LLC business or take care of your asset distribution, we got you covered. You don't need to be well-versed in in law to locate and download the needed form.

- You can select from over 85,000 forms arranged by state/county and situation.

- The intuitive interface, variety of supporting materials, and dedicated support team make it simple to find and execute different papers.

- US Legal Forms is a trusted service providing legal forms to millions of users since 1997.

You can simply type to look for or browse Hennepin Term Sheet - Convertible Debt Financing, either by a keyword or by the state/county the form is created for. After locating needed form, you can log in and download it or retain it in the My Forms tab.

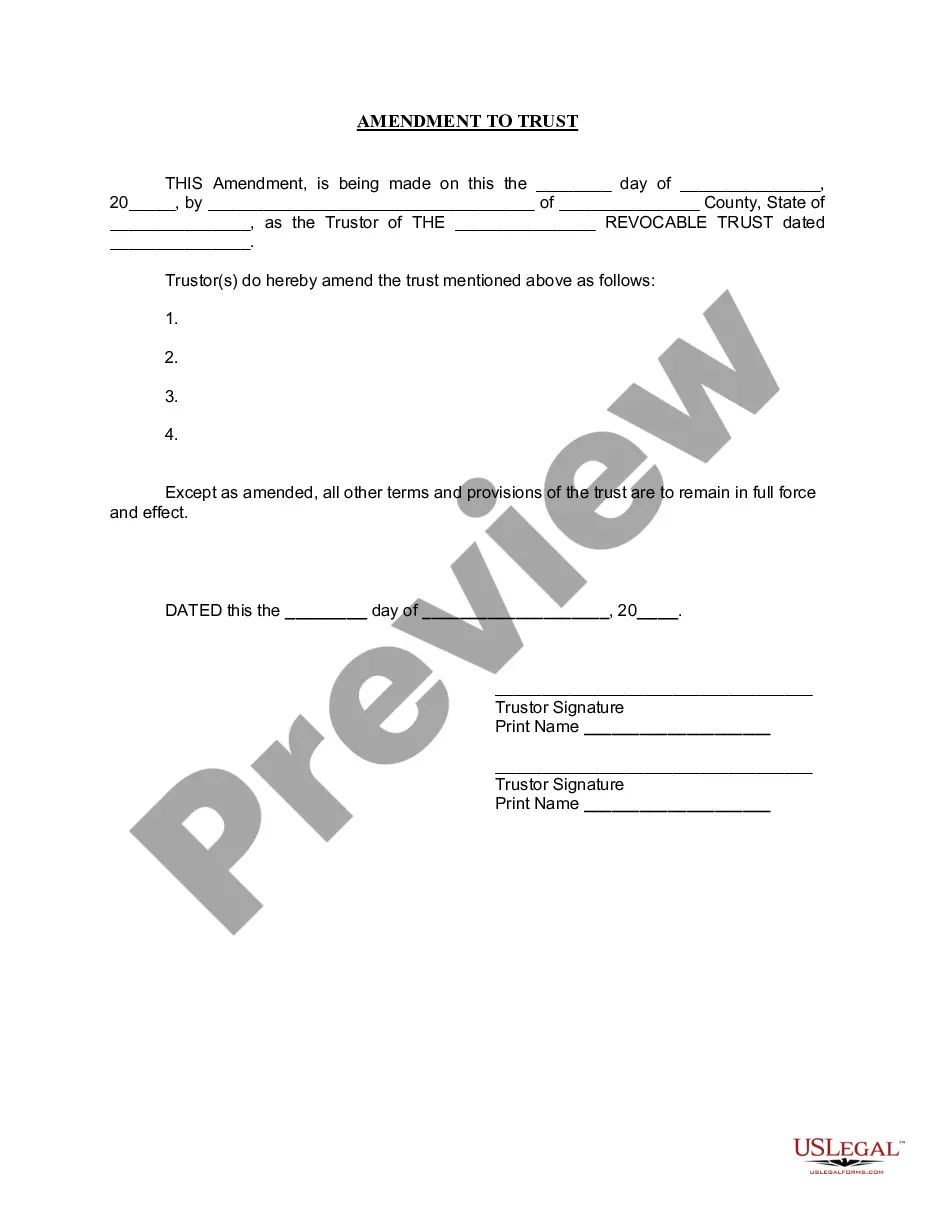

Don't have an account? It's easy to get started! Simply find the Hennepin Term Sheet - Convertible Debt Financing template and check the form's preview and description (if available). If you're confident about the template’s legalese, go ahead and click Buy now. Register an account and choose a subscription plan. The template will be instantly available for download as soon as the payment is processed. Now you can execute the form.

Handling your legal matters doesn’t have to be expensive or time-consuming. US Legal Forms is here to demonstrate it. Our extensive variety of legal forms makes these tasks less costly and more reasonably priced. Set up your first company, arrange your advance care planning, draft a real estate agreement, or complete the Hennepin Term Sheet - Convertible Debt Financing - all from the convenience of your sofa.

Join US Legal Forms now!