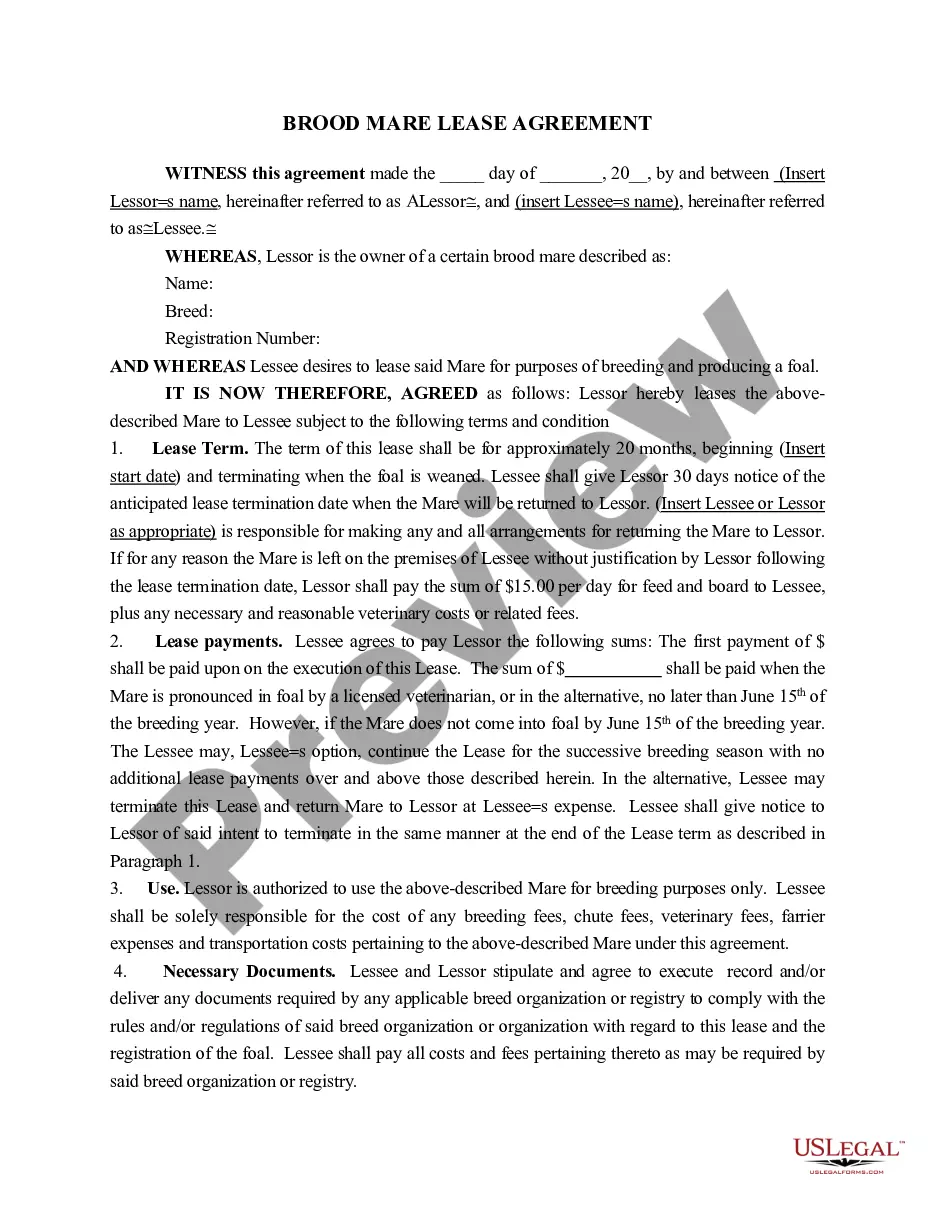

Kings New York Term Sheet — Convertible Debt Financing is a financial agreement that provides an overview of the terms and conditions of a convertible debt financing deal offered by Kings New York, a prominent financial institution. This type of financing allows borrowers to obtain capital while offering potential investors the option to convert their debt into equity at a later date. The Kings New York Term Sheet — Convertible Debt Financing typically includes key information such as the loan amount, interest rate, maturity date, conversion terms, and any special provisions. It serves as a preliminary agreement, outlining the basic terms of the financing, laying the foundation for a more detailed legal document. Different types of Kings New York Term Sheet — Convertible Debt Financing may include: 1. Traditional Convertible Debt Financing Term Sheet: This type of term sheet provides standard terms and conditions for convertible debt financing, offering investors the option to convert their debt into equity shares in the company at a predetermined conversion price. 2. Preferred Convertible Debt Financing Term Sheet: This variation of the term sheet may include additional provisions, such as offering investors preferred stock to common stock upon conversion. This preference can entail higher voting rights or preferential dividend payments. 3. Bridge Convertible Debt Financing Term Sheet: This type of term sheet is commonly used when a company needs short-term financing to bridge a financial gap between larger funding rounds. It outlines the conditions under which the debt can be converted into equity in subsequent funding rounds. 4. Participating Convertible Debt Financing Term Sheet: This variant may include a provision that allows investors to participate in both the debt and equity aspects of the financing. It grants the investor the option to convert their debt into equity while still retaining their initial debt position. 5. Secured Convertible Debt Financing Term Sheet: This type of term sheet may include provisions to secure the debt by pledging specific company assets. This provides additional protection for the lender, should the borrower default on the loan. In summary, Kings New York Term Sheet — Convertible Debt Financing provides a comprehensive overview of the terms and conditions associated with obtaining financing from Kings New York. Different types of Kings New York Term Sheets may exist, each tailored to specific financing scenarios or investor preferences. Understanding the key terms and provisions of these term sheets is crucial for all parties involved in the convertible debt financing process.

Kings New York Term Sheet - Convertible Debt Financing

Description

How to fill out Kings New York Term Sheet - Convertible Debt Financing?

Laws and regulations in every sphere differ from state to state. If you're not an attorney, it's easy to get lost in various norms when it comes to drafting legal paperwork. To avoid high priced legal assistance when preparing the Kings Term Sheet - Convertible Debt Financing, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal templates. It's a perfect solution for professionals and individuals looking for do-it-yourself templates for various life and business situations. All the documents can be used many times: once you pick a sample, it remains accessible in your profile for subsequent use. Thus, when you have an account with a valid subscription, you can simply log in and re-download the Kings Term Sheet - Convertible Debt Financing from the My Forms tab.

For new users, it's necessary to make several more steps to obtain the Kings Term Sheet - Convertible Debt Financing:

- Analyze the page content to ensure you found the appropriate sample.

- Take advantage of the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Utilize the Buy Now button to get the document when you find the correct one.

- Choose one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Fill out and sign the document in writing after printing it or do it all electronically.

That's the easiest and most cost-effective way to get up-to-date templates for any legal reasons. Locate them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

FAQ

Convertible bonds typically carry lower interest rates payments than straight corporate bondsthe savings in interest expense can be significant. Investors accept the lower interest payments because the conversion option offers the opportunity to benefit from increases in the stock price.

With convertible debt, a business borrows money from a lender where both parties enter the agreement with the intent (from the outset) to repay all (or part) of the loan by converting it into a certain number of its common shares at some point in the future.

Because convertible bonds have a maturity of greater than one year, they appear under the long-term liabilities section of the balance sheet.

Convertible bonds are typically issued by companies that have high expectations for growth and less-than-stellar credit ratings. The companies get access to money for expansion at a lower cost than they would have to pay for conventional bonds.

A convertible is a bond, preferred share, or another financial instrument that can be converted by the shareholder into common stock. Convertible securities are not classified as debt or equity; instead, they are considered to be a hybrid of the two categories, possessing cash flow features of both bonds and stocks.

Standard convertible note terms are parameters for a specific form of short-term business debt. A convertible note will convert into equity at a future date, meaning that the investor loans money to an entrepreneur and receives equity in the company rather than payments on the principal plus interest.

Within venture capital financing, a convertible note is a type of short-term debt financing that's used in early-stage capital raises. In other words, convertible notes are loans to early-stage startups from investors who are expecting to be paid back when their note comes due.

A Convertible Note Term Sheet is the summary outline of the key terms for a convertible debt seed financing. As you approach potential investors, the term sheet will be a critical part of your seed financing toolkit, together with the executive summary and investor pitch deck.

Convertible Notes are loans so they are recorded on the Balance Sheet of a company as a liability when they are made. Depending on the debt's maturity date, they can either be shown as a current liability (loans maturing within 12 months) or as a Long-term liability (loans maturing over 12 months).

Convertible notes are debt instruments that include terms like a maturity date, an interest rate, etc., but that will convert into equity if a future equity round is raised. The conversion typically occurs at a discount to the price per share of the future round.