Maricopa Arizona Term Sheet — Convertible Debt Financing is a comprehensive financial agreement that outlines the terms and conditions of borrowing money in the form of convertible debt in Maricopa, Arizona. This type of financing provides a flexible option for businesses or individuals seeking funds. The term sheet acts as a preliminary agreement before the completion of a detailed loan or investment agreement. Keyword: Maricopa Arizona Term Sheet — Convertible Debt Financing 1. Purpose: The Maricopa Arizona Term Sheet — Convertible Debt Financing serves as a blueprint outlining the necessary details and terms for both the lender and borrower. It clarifies the conditions and requirements for borrowing and offers flexibility for the debt to be converted into equity in the future. 2. Key terms: The term sheet explains the key terms of the convertible debt financing, such as the principal amount of the loan, interest rate, maturity date, conversion ratio, and conversion price. These terms are crucial to understanding the financial implications of the agreement. 3. Conversion option: One of the primary features of Maricopa Arizona Term Sheet — Convertible Debt Financing is the conversion option. This provision allows the lender to convert the debt into equity, usually in the form of shares or stocks, at a predetermined conversion price or ratio, giving them the potential to become shareholders in the company. 4. Interest rate: The term sheet also specifies the interest rate that will be applied to the loan. It may include details on whether the interest is simple or compound, the frequency of interest payments, and any contingencies related to changes in the interest rate. 5. Maturity date: The term sheet clearly states the maturity date, which signifies the due date when the borrower is expected to repay the loan in full or convert it into equity. It is essential to understand this date to avoid any penalties or breaches of the agreement. 6. Conversion price and ratio: The conversion price and ratio are crucial components of convertible debt financing. The conversion price determines the price at which the debt can be converted into equity, while the conversion ratio sets the number of shares or stocks the debt can be exchanged for. These terms significantly impact the potential equity ownership of the lender. 7. Additional terms: Different types of Maricopa Arizona Term Sheet — Convertible Debt Financing may have additional terms or clauses, such as anti-dilution provisions, prepayment options, penalties for default, voting rights, and information rights. These terms can vary depending on the specific needs or preferences of both parties involved. Overall, the Maricopa Arizona Term Sheet — Convertible Debt Financing offers a flexible and attractive funding option for businesses or individuals seeking financial support. By understanding the terms and conditions outlined in the term sheet, both the lender and borrower can make informed decisions before finalizing the loan agreement.

Maricopa Arizona Term Sheet - Convertible Debt Financing

Description

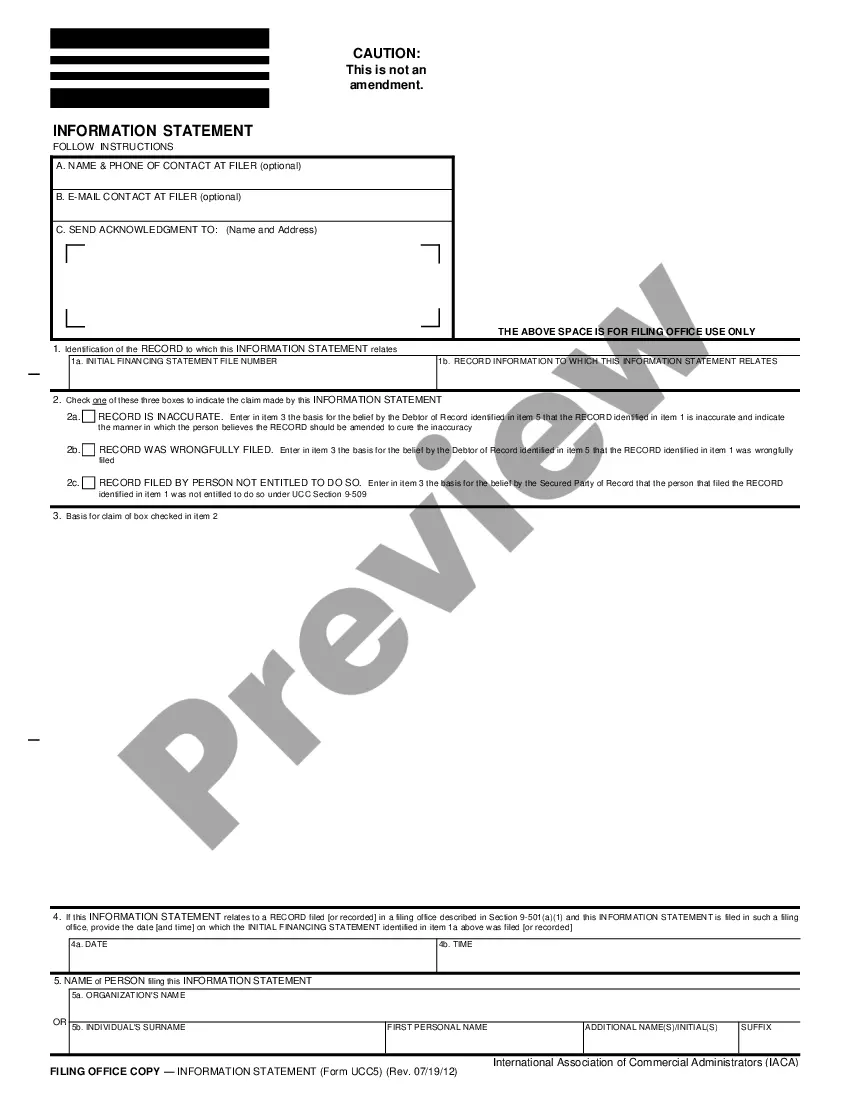

How to fill out Maricopa Arizona Term Sheet - Convertible Debt Financing?

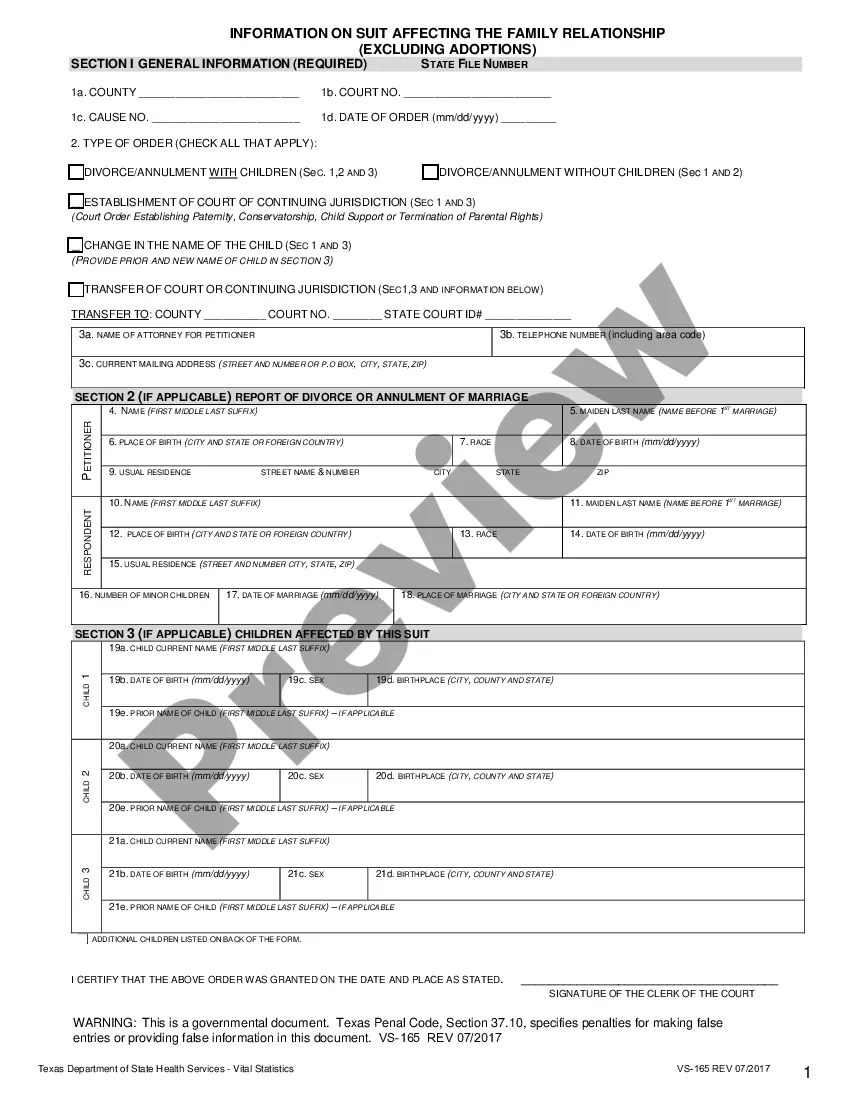

Preparing legal paperwork can be cumbersome. In addition, if you decide to ask a legal professional to write a commercial contract, papers for proprietorship transfer, pre-marital agreement, divorce papers, or the Maricopa Term Sheet - Convertible Debt Financing, it may cost you a fortune. So what is the best way to save time and money and create legitimate forms in total compliance with your state and local laws? US Legal Forms is a great solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is biggest online catalog of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any use case accumulated all in one place. Therefore, if you need the recent version of the Maricopa Term Sheet - Convertible Debt Financing, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Maricopa Term Sheet - Convertible Debt Financing:

- Look through the page and verify there is a sample for your region.

- Examine the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - search for the right one in the header.

- Click Buy Now when you find the required sample and pick the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a payment with a credit card or through PayPal.

- Opt for the file format for your Maricopa Term Sheet - Convertible Debt Financing and download it.

When done, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the documents ever obtained many times - you can find your templates in the My Forms tab in your profile. Try it out now!