San Antonio Texas Term Sheet — Convertible Debt Financing is a legal document outlining the terms and conditions of a financial agreement between a debtor and a lender in the city of San Antonio, Texas. This type of financing is commonly used by startups and early-stage companies looking to raise capital to fund their business operations and growth initiatives. The San Antonio Texas Term Sheet — Convertible Debt Financing typically includes the following key elements: 1. Principal amount: This denotes the initial loan amount provided by the lender to the borrower. 2. Interest rate: The interest rate determines the cost of borrowing and is usually calculated based on a fixed percentage of the principal amount. It may be fixed or variable depending on the agreement. 3. Maturity date: This specifies the date by which the borrower must repay the loan in full, including any outstanding interest. 4. Conversion feature: A unique aspect of convertible debt financing, this provision allows the lender to convert the loan into equity (shares or stock) of the company at a future date if certain predefined conditions are met. This feature provides flexibility to the lender and potential for future ownership in the borrower's business. 5. Conversion ratio: This defines the number of shares that the lender can convert the loan into. It is typically determined using a predetermined formula stated in the term sheet. 6. Valuation cap: When applicable, this sets the maximum value at which the convertible debt can be converted into equity, safeguarding the lender's potential investment. 7. Use of funds: The term sheet may outline the purpose for which the borrowed funds can be used, such as research and development, marketing, hiring, or working capital. 8. Repayment options: The term sheet may include provisions for repayment options such as principal repayment with or without accrued interest, early repayment penalties, or installment plans. 9. Events of default: These are specific conditions under which the borrower would be considered in default, such as failure to make payments, breach of the term sheet, or insolvency. The consequences of default may also be outlined in the term sheet. 10. Governing law and jurisdiction: This section specifies the laws of the State of Texas and the jurisdiction (usually San Antonio) that will govern any disputes arising from the term sheet. While there may be various types of San Antonio Texas Term Sheet — Convertible Debt Financing specific to different industries or sectors, the overall structure and key elements mentioned above apply universally. The specific details and terms within the term sheet can vary depending on the negotiations between the borrower and the lender and the unique characteristics of the financing agreement.

San Antonio Texas Term Sheet - Convertible Debt Financing

Description

How to fill out San Antonio Texas Term Sheet - Convertible Debt Financing?

Laws and regulations in every area vary throughout the country. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal documentation. To avoid high priced legal assistance when preparing the San Antonio Term Sheet - Convertible Debt Financing, you need a verified template valid for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal templates. It's a great solution for specialists and individuals looking for do-it-yourself templates for different life and business scenarios. All the documents can be used many times: once you obtain a sample, it remains accessible in your profile for future use. Thus, if you have an account with a valid subscription, you can just log in and re-download the San Antonio Term Sheet - Convertible Debt Financing from the My Forms tab.

For new users, it's necessary to make a couple of more steps to get the San Antonio Term Sheet - Convertible Debt Financing:

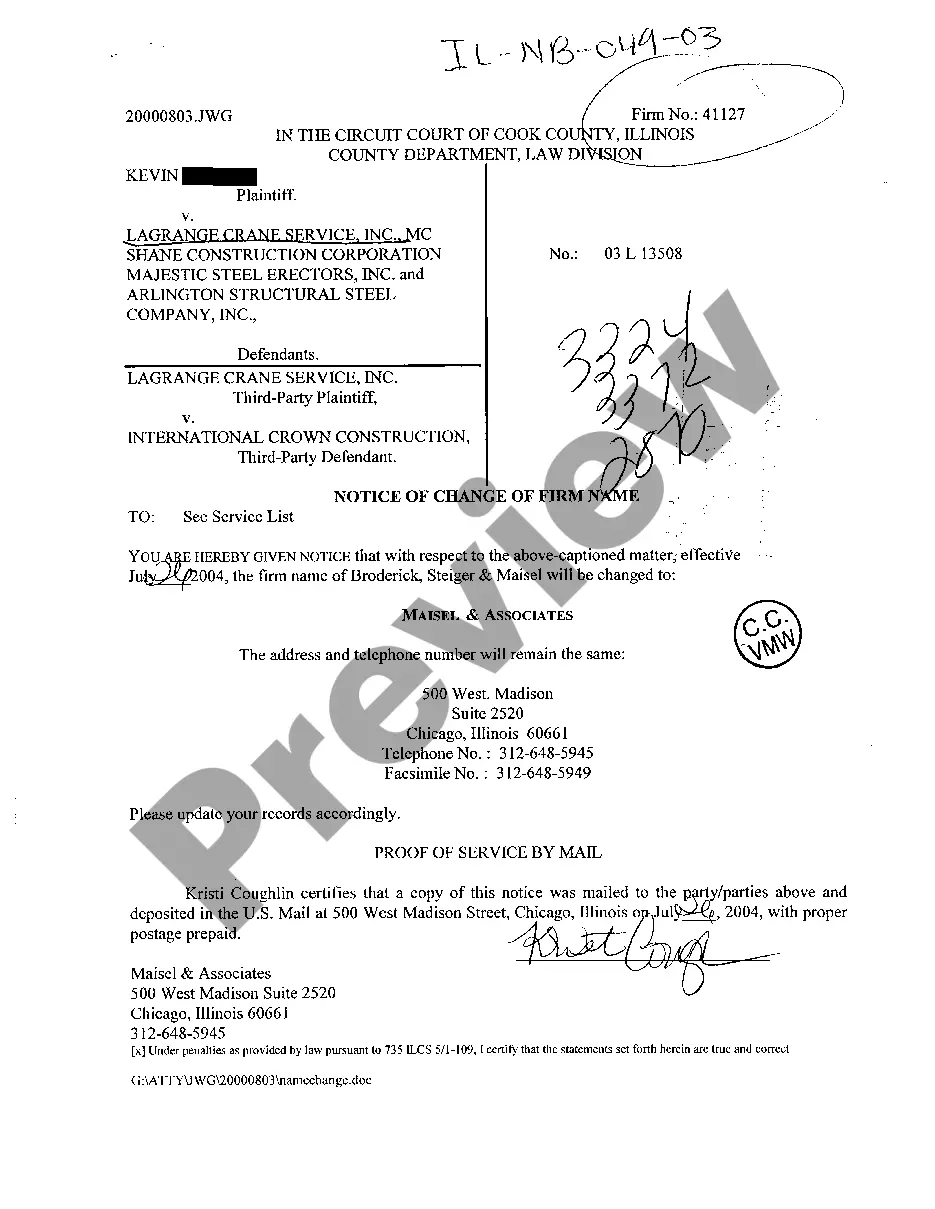

- Analyze the page content to ensure you found the appropriate sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to obtain the template once you find the proper one.

- Choose one of the subscription plans and log in or create an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Complete and sign the template on paper after printing it or do it all electronically.

That's the easiest and most cost-effective way to get up-to-date templates for any legal scenarios. Find them all in clicks and keep your paperwork in order with the US Legal Forms!