Travis Texas Term Sheet — Convertible Debt Financing is a legal document that outlines the terms and conditions of a funding agreement between a start-up company seeking investment and an investor. This type of financing is commonly used in the venture capital industry. The Travis Texas Term Sheet — Convertible Debt Financing typically includes crucial information such as the principal amount of the loan, interest rate, maturity date, and conversion terms. It provides a framework for both the start-up and investor to understand their obligations and responsibilities throughout the investment process. Various types of Travis Texas Term Sheet — Convertible Debt Financing may exist, including: 1. Traditional Convertible Debt Financing: This type of term sheet allows the investor to lend money to the start-up with a predetermined interest rate and maturity date. If the start-up fails to repay the loan within the specified timeframe, the debt can be converted into equity, allowing the investor to become a shareholder in the company. 2. Safe (Simple Agreement for Future Equity): The Safe is an alternative to traditional convertible debt financing and was introduced by startup accelerator Y Combinator. It simplifies the process by eliminating interest rates and maturity dates. Instead, it offers a mechanism where the investor's investment can be converted into equity during a future qualifying financing round. 3. Crowd Equity: In some cases, crowdfunding platforms facilitate convertible debt financing. Start-up companies can list their investment opportunities on these platforms, enabling many investors to provide capital in exchange for future equity conversion. 4. Institutional Convertible Debt: This type of financing is provided by institutional investors such as banks, venture capital firms, or private equity firms. Institutional convertible debt term sheets tend to be more comprehensive and complex due to the involvement of professional investors. The Travis Texas Term Sheet — Convertible Debt Financing is a critical agreement that allows start-ups to access capital while providing investors with the potential for equity ownership. By offering the flexibility of converting debt into equity, it serves as an attractive financing option for both parties involved in the investment process.

Travis Texas Term Sheet - Convertible Debt Financing

Description

How to fill out Travis Texas Term Sheet - Convertible Debt Financing?

Laws and regulations in every area vary throughout the country. If you're not an attorney, it's easy to get lost in countless norms when it comes to drafting legal paperwork. To avoid expensive legal assistance when preparing the Travis Term Sheet - Convertible Debt Financing, you need a verified template valid for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web library of more than 85,000 state-specific legal templates. It's a great solution for specialists and individuals searching for do-it-yourself templates for various life and business occasions. All the forms can be used multiple times: once you obtain a sample, it remains accessible in your profile for future use. Thus, when you have an account with a valid subscription, you can simply log in and re-download the Travis Term Sheet - Convertible Debt Financing from the My Forms tab.

For new users, it's necessary to make a few more steps to obtain the Travis Term Sheet - Convertible Debt Financing:

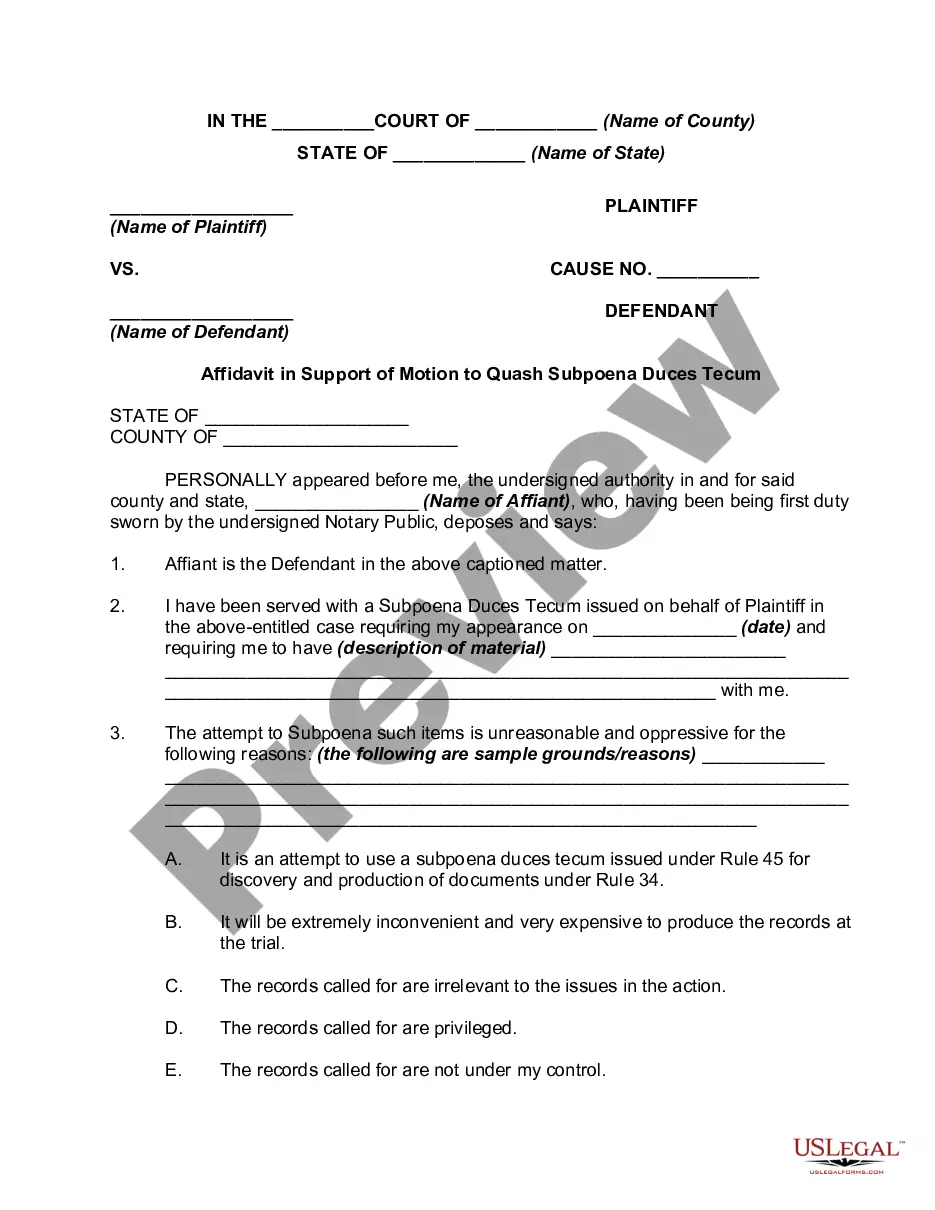

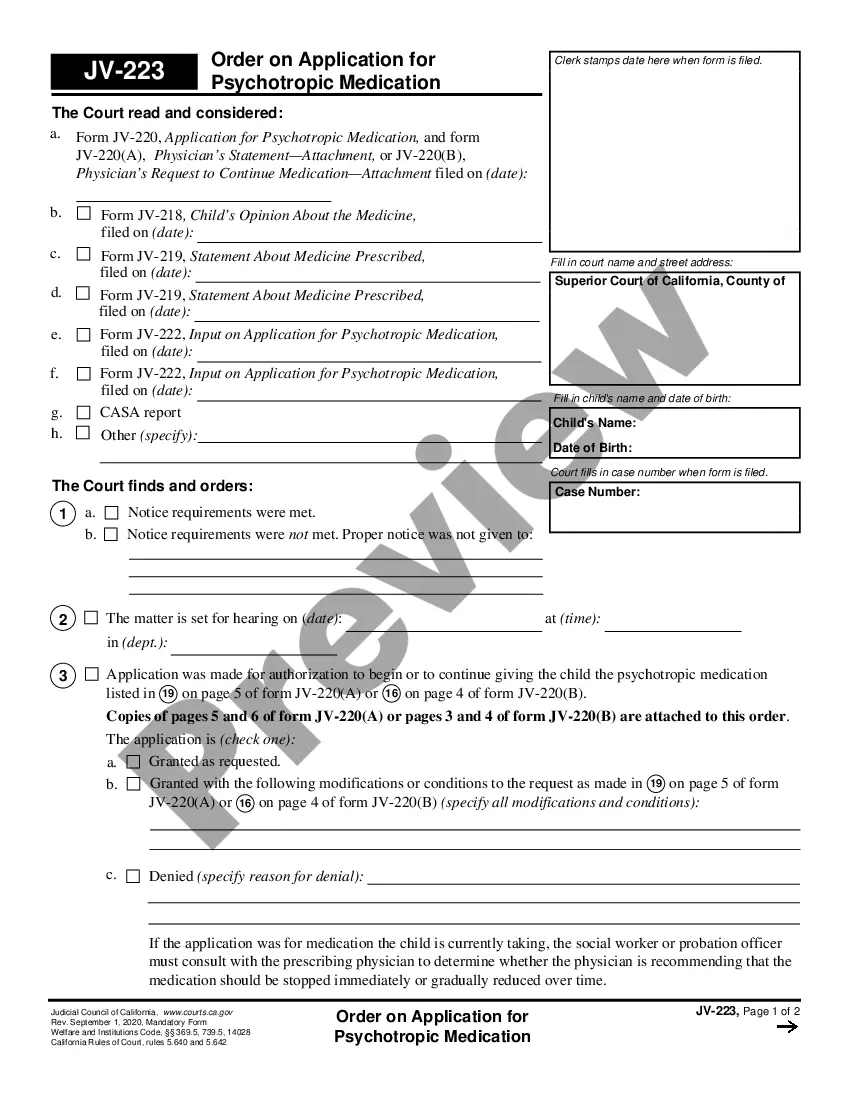

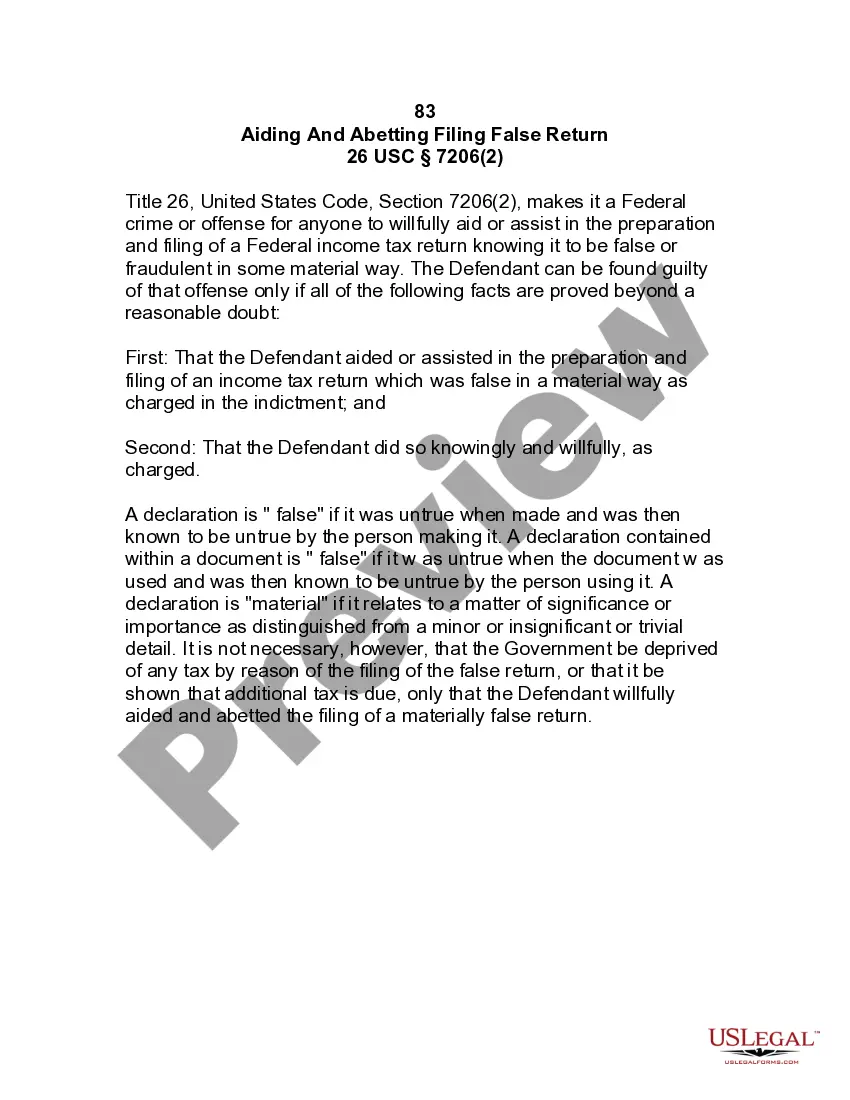

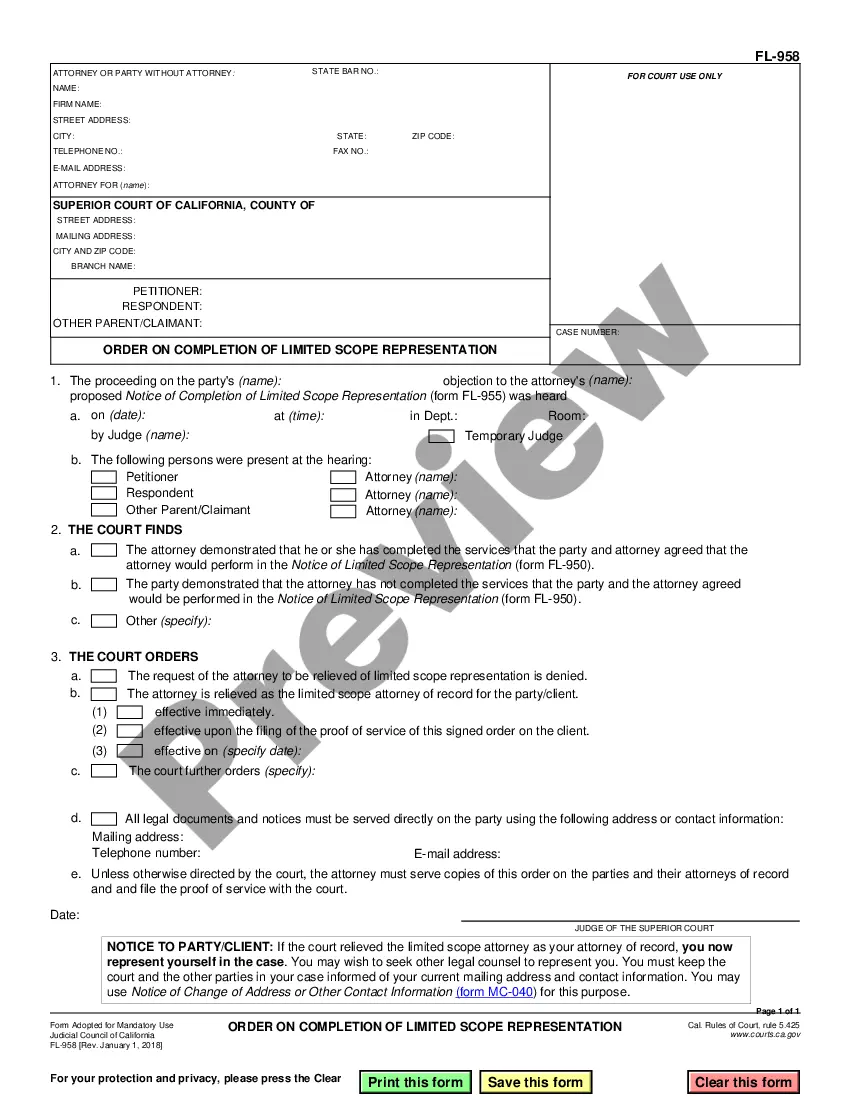

- Take a look at the page content to ensure you found the right sample.

- Take advantage of the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to obtain the document once you find the correct one.

- Choose one of the subscription plans and log in or create an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Fill out and sign the document on paper after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

FAQ

You organize the information in three sections according to the formula: assets equal liabilities plus equity. Subdivide assets and liabilities into sections for current and long-term items. Convertible bonds are long-term liabilities grouped in the bonds payable account.

How to Account for Convertible Debt (IFRS) - YouTube YouTube Start of suggested clip End of suggested clip So we're going to use something called the residual method. And that's going to require us to doMoreSo we're going to use something called the residual method. And that's going to require us to do this we're going to take the fair value of the convertible. Debt on the date of issuance.

The equity & liability portion for the convertible bonds can be calculated using the Residual Approach. This approach assumes that the value of the equity portion is equal to the difference between the total amount received from the proceeds of the bonds and the present value of future cash flows.

Convertible debt issued at a substantial premium could result in the instrument being treated entirely as an equity instrument for tax purposes, with no tax consequences during its term or upon redemption.

Convertible Notes are loans so they are recorded on the Balance Sheet of a company as a liability when they are made. Depending on the debt's maturity date, they can either be shown as a current liability (loans maturing within 12 months) or as a Long-term liability (loans maturing over 12 months).

Because convertible bonds have a maturity of greater than one year, they appear under the long-term liabilities section of the balance sheet.

A convertible note should be classified as a Long Term Liability that then converts to Equity as stipulated from the contract (usually a new fundraising round).

As the name implies, 'convertible notes' usually result in debt funding being converted into equity, providing the investor with upside returns.

When the convertible bonds have been issued and sold, the business will take in cash, which will boost assets. On the other side of the balance sheet, liabilities will increase by the same amount, since a convertible bond is a liability.