Maricopa, Arizona Subscription Agreement & Shareholders' Agreement: Explained The Maricopa, Arizona Subscription Agreement and Shareholders' Agreement are legal documents that govern certain aspects of business operations, ownership rights, and relationships within companies operating in Maricopa, Arizona. These agreements are formulated to establish clear guidelines, rights, and obligations for both shareholders and subscribers, ensuring smooth business operations and protecting the interests of all parties involved. Subscription Agreement: 1. Share Subscription Agreement: This type of agreement establishes the terms and conditions for new shareholders to subscribe and acquire shares in a company. It outlines the number of shares to be subscribed, the subscription price, payment terms, transferability restrictions, and other relevant provisions. 2. Convertible Note Subscription Agreement: This agreement is specific to investments made through convertible notes. It outlines the terms under which the note holders can convert their outstanding debt into equity shares. It also covers aspects such as interest rates, maturity dates, conversion mechanisms, and any additional rights or privileges associated with the convertible notes. Shareholders' Agreement: 1. Founders' Shareholders' Agreement: This agreement is typically created among the founders of a startup or newly established company. It addresses matters such as the allocation of shares among the founders, decision-making processes, restrictions on share transfers, vesting schedules, and any other provisions relevant to the founders' relationship and ongoing responsibilities. 2. Voting Shareholders' Agreement: This agreement focuses on the rights and obligations of shareholders specifically related to voting matters. It covers topics including voting rights, procedures for shareholder meetings, decision-making rules, shareholder voting thresholds, and any provisions for proxy voting or voting agreements. 3. Shareholders' Buy-Sell Agreement: This agreement outlines the terms and conditions for the sale or transfer of shares among existing shareholders. It can address scenarios such as shareholder exit strategies, right of first refusal, drag-along rights, tag-along rights, valuation methods, and dispute resolution mechanisms to provide clear guidelines for share transfers or buyouts. These agreements serve as essential legal tools for companies operating in Maricopa, Arizona, as they ensure transparency, protect shareholder rights, and establish a solid foundation for business operations. It is crucial for businesses to seek legal advice while drafting or entering into such agreements to ensure compliance with local laws and to address specific needs or concerns pertaining to their unique business situation.

Maricopa Arizona Subscription Agreement and Shareholders' Agreement

Description

How to fill out Maricopa Arizona Subscription Agreement And Shareholders' Agreement?

A document routine always accompanies any legal activity you make. Staring a business, applying or accepting a job offer, transferring property, and lots of other life scenarios require you prepare official documentation that varies throughout the country. That's why having it all collected in one place is so valuable.

US Legal Forms is the largest online collection of up-to-date federal and state-specific legal forms. On this platform, you can easily find and download a document for any individual or business purpose utilized in your region, including the Maricopa Subscription Agreement and Shareholders' Agreement.

Locating samples on the platform is amazingly simple. If you already have a subscription to our service, log in to your account, find the sample through the search bar, and click Download to save it on your device. Afterward, the Maricopa Subscription Agreement and Shareholders' Agreement will be accessible for further use in the My Forms tab of your profile.

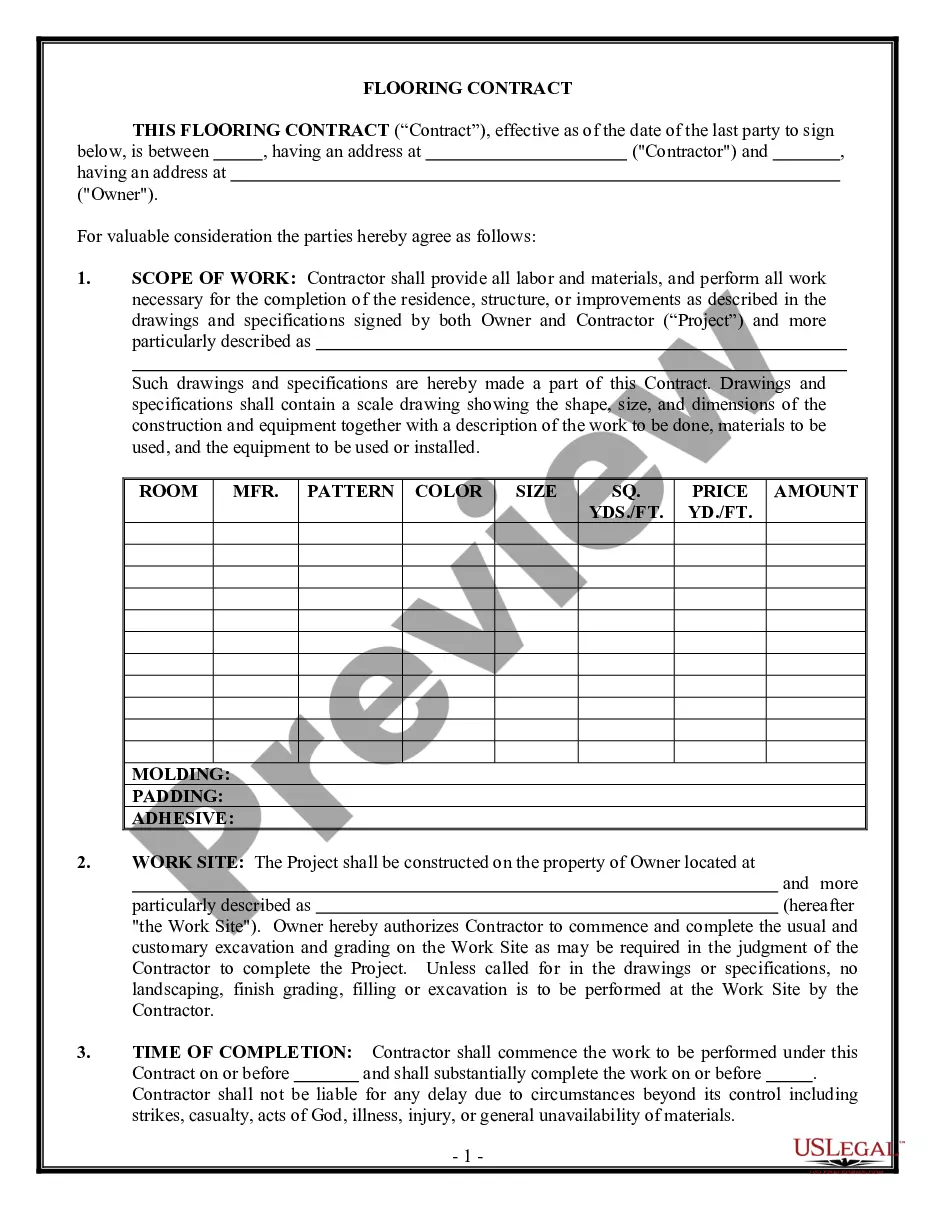

If you are using US Legal Forms for the first time, follow this quick guideline to obtain the Maricopa Subscription Agreement and Shareholders' Agreement:

- Make sure you have opened the right page with your local form.

- Use the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the template corresponds to your requirements.

- Search for another document using the search tab if the sample doesn't fit you.

- Click Buy Now once you find the required template.

- Select the suitable subscription plan, then sign in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and save the Maricopa Subscription Agreement and Shareholders' Agreement on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most trustworthy way to obtain legal paperwork. All the templates provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs effectively with the US Legal Forms!

Form popularity

FAQ

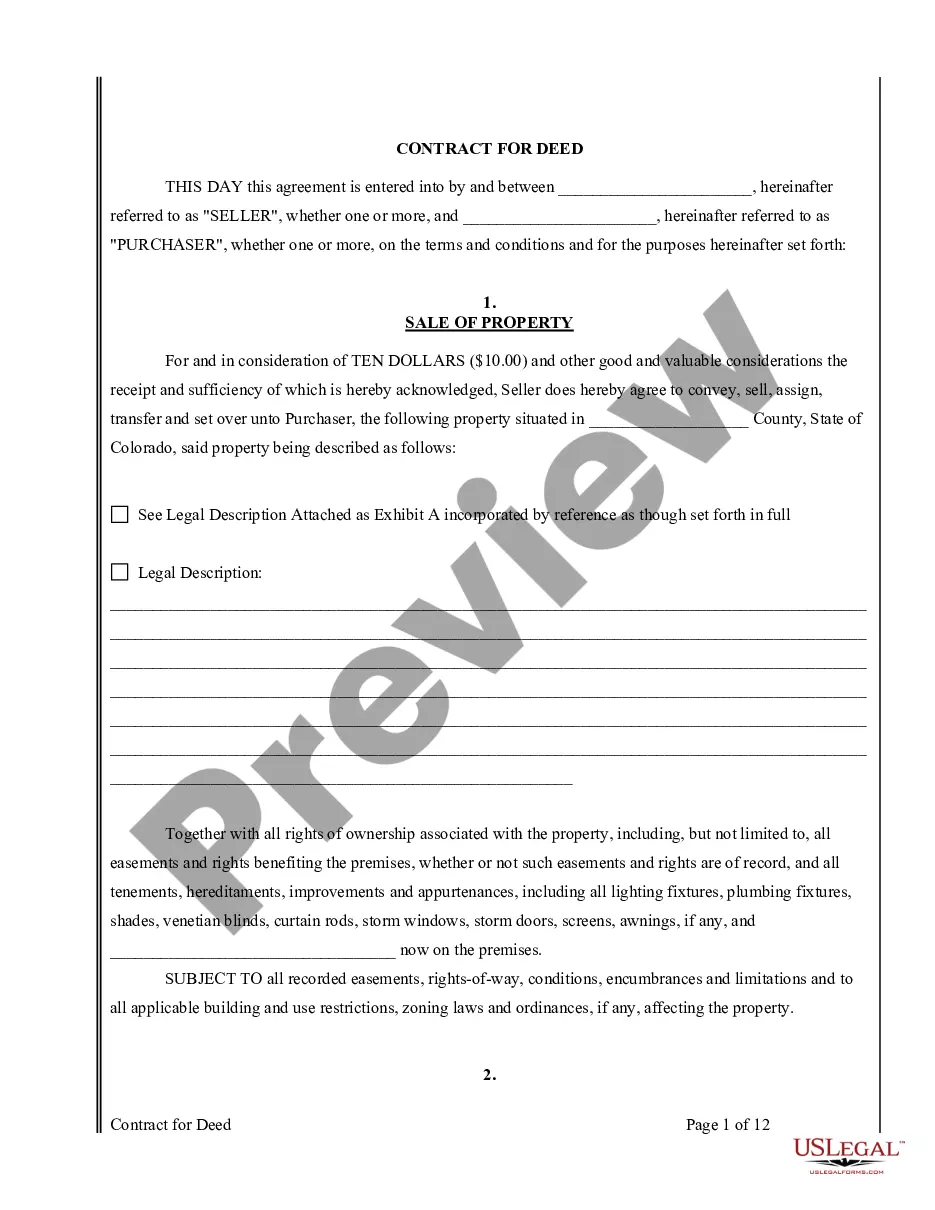

Also known as a subscription agreement. The purchase agreement is the principal agreement between the issuer and the investor, or between the issuer and the initial purchasers, in a private placement of debt or equity securities.

The agreement typically describes in detail the rights and obligations of each shareholders and the legitimate pricing of shares. One of the differences between share subscription agreement and shareholders agreement is that the shareholders' agreement is drafted in greater detail.

A Share Subscription Agreement (SSA) as the name indicates is related to subscription of new shares of the company by a set of existing or new shareholders. Points to note: SSA is executed when a company is raising an investment from investors in lieu of shares issued by the company to the investors.

A company executes a Share subscription agreement (SSA) in case of a fresh issue of shares. A shareholders' agreement (SHA) is a contract that contains the rights and obligations of the shareholders in a company.

A subscription agreement is a formal agreement between a company and an investor to buy shares of a company at an agreed-upon price. It contains all the details of such an agreement, including Outstanding Shares, Shares Ownership, and Payouts.

When an investor commits to funding the company, he enters into a Share Subscription and Shareholders Agreement with the founders and the company. Both agreements are often combined into one, and the abbreviation SHA is often used to refer to both the share subscription and the shareholders agreement.

A shareholders' agreement (sometimes referred to in the U.S. as a stockholders' agreement) (SHA) is an agreement amongst the shareholders or members of a company. In practical effect, it is analogous to a partnership agreement.

A subscription is a type of contract, and, therefore, the remedies for its breach are the same as those for breach of contract and include damages and Specific Performance. West's Encyclopedia of American Law, edition 2.

A share purchase agreement differs from a share subscription agreement because a share purchase agreement has a seller that is not the business itself. In a subscription agreement, the business agrees to sell shares to a subscriber.

A subscription agreement is an agreement that defines the terms for a party's investment into a private placement offering or a limited partnership (LP). Rules for subscription agreements are generally defined in SEC Rule 506(b) and 506(c) of Regulation D.