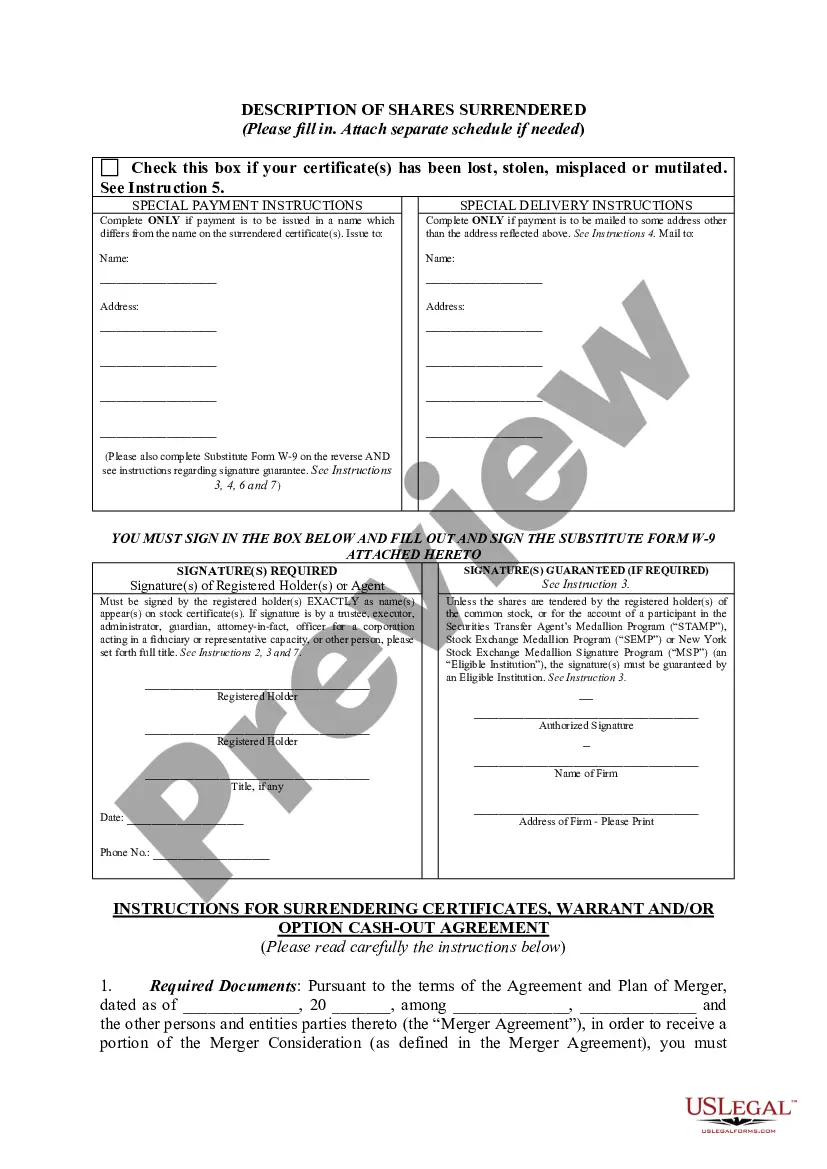

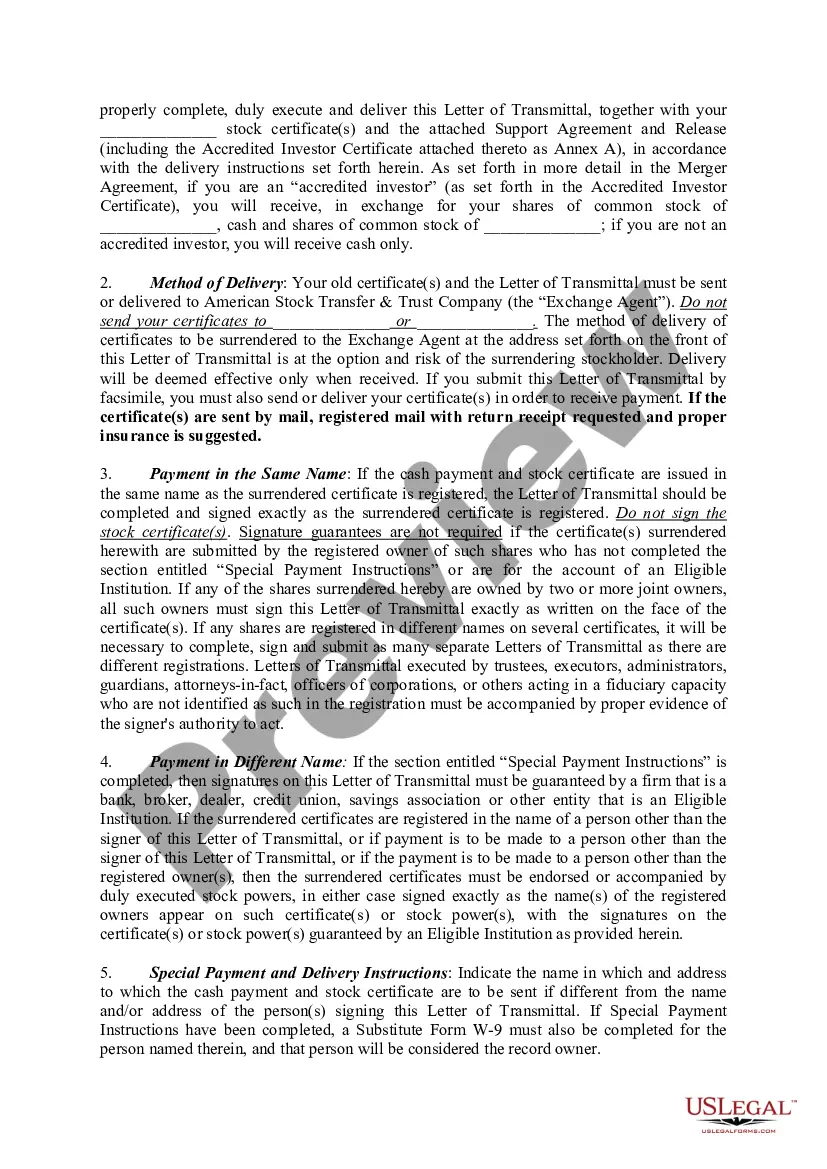

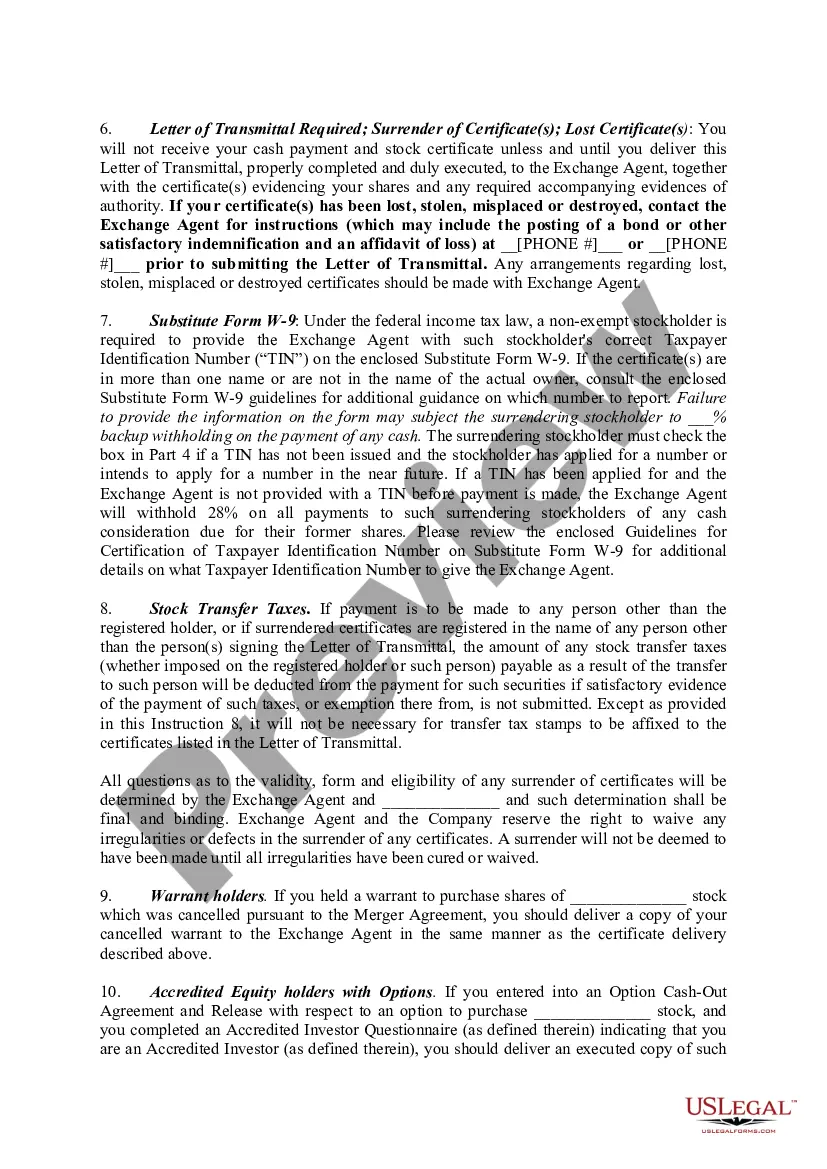

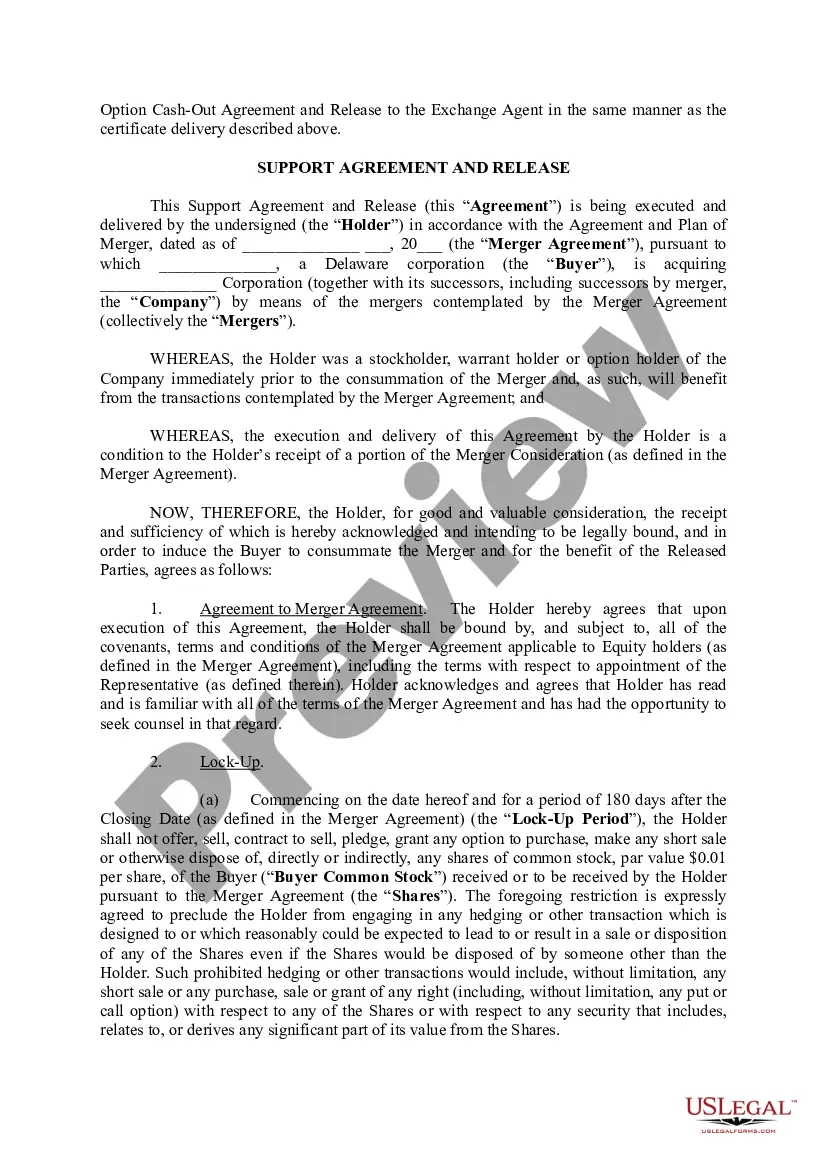

Contra Costa County, located in the state of California, requires a Letter of Transmittal to Accompany Certificates of Common Stock for various transactions related to common stock holdings. This legal document serves as an official notice to transfer ownership rights of stock certificates and includes relevant information about the shareholders and the stock being transferred. The Contra Costa California Letter of Transmittal is commonly used for multiple purposes, such as transferring common stock ownership due to the sale of shares, inheritance, gifting, or other changes in ownership. It ensures that the proper procedures are followed and that the ownership transfer is legally valid and recognized by relevant authorities. Keywords: Contra Costa County, California, Letter of Transmittal, Certificates of Common Stock, stock ownership transfer, legal document, shareholders, stock certificates, ownership rights transfer, sale of shares, inheritance, gifting, changes in ownership, procedures, valid transfer, relevant authorities. Different types of Contra Costa California Letter of Transmittal to Accompany Certificates of Common Stock can be categorized based on the purpose of the stock transfer. Some common variations include: 1. Sale Letter of Transmittal — Used when transferring common stock ownership after a sale transaction, whether between individuals or entities. 2. Inheritance Letter of Transmittal — Utilized when transferring common stock ownership from a deceased shareholder to their legal heirs or beneficiaries, as per the provisions stated in the will or as governed by probate laws. 3. Gift Letter of Transmittal — Employed when gifting common stock to another individual or entity without any monetary consideration. 4. Name Change Letter of Transmittal — Applied when there is a change in legal name, due to marriage, divorce, or any other reasons, requiring a corresponding change in the stock ownership records. 5. Merger/Acquisition Letter of Transmittal — Utilized in cases of corporate mergers or acquisitions, where common stock ownership is transferred according to the terms of the agreement between the involved companies. 6. Divestiture Letter of Transmittal — Used when a company divests its assets or business divisions, resulting in the transfer of common stock ownership to another entity. These variations ensure that the Contra Costa California Letter of Transmittal is tailored to meet the specific requirements and circumstances of the stock transfer, providing a clear legal framework for the change in ownership.

Contra Costa California Letter of Transmittal to Accompany Certificates of Common Stock

Description

How to fill out Contra Costa California Letter Of Transmittal To Accompany Certificates Of Common Stock?

Preparing legal documentation can be cumbersome. Besides, if you decide to ask a legal professional to write a commercial contract, papers for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Contra Costa Letter of Transmittal to Accompany Certificates of Common Stock, it may cost you a lot of money. So what is the most reasonable way to save time and money and create legitimate forms in total compliance with your state and local regulations? US Legal Forms is a perfect solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is largest online library of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any use case collected all in one place. Consequently, if you need the recent version of the Contra Costa Letter of Transmittal to Accompany Certificates of Common Stock, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Contra Costa Letter of Transmittal to Accompany Certificates of Common Stock:

- Glance through the page and verify there is a sample for your area.

- Examine the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - look for the right one in the header.

- Click Buy Now once you find the needed sample and select the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a payment with a credit card or via PayPal.

- Choose the document format for your Contra Costa Letter of Transmittal to Accompany Certificates of Common Stock and save it.

Once finished, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the paperwork ever acquired multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!