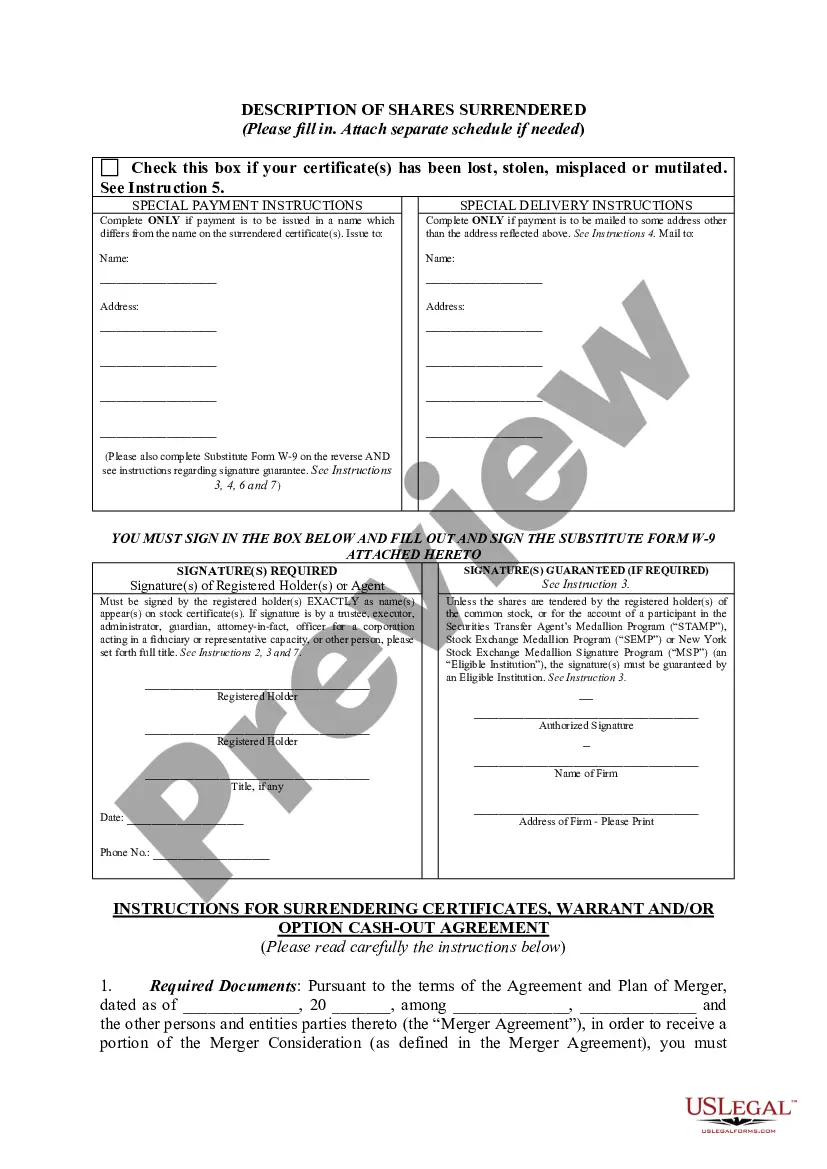

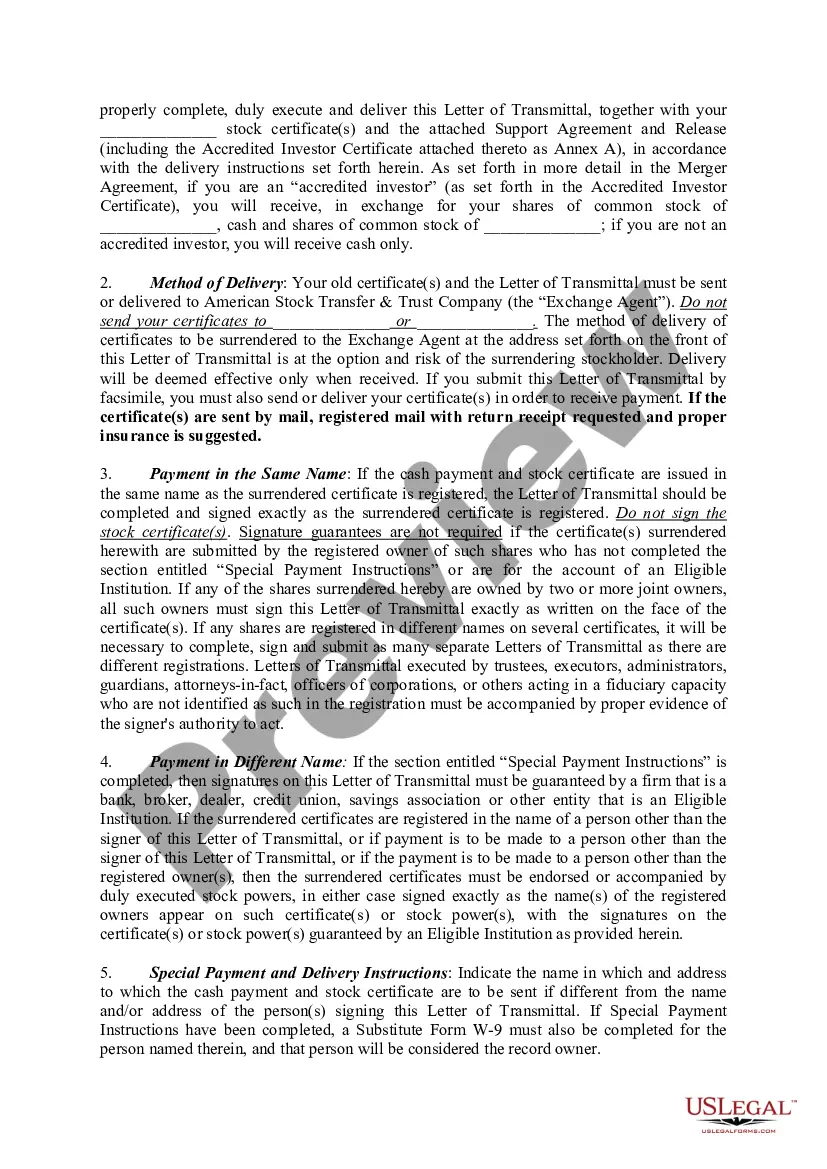

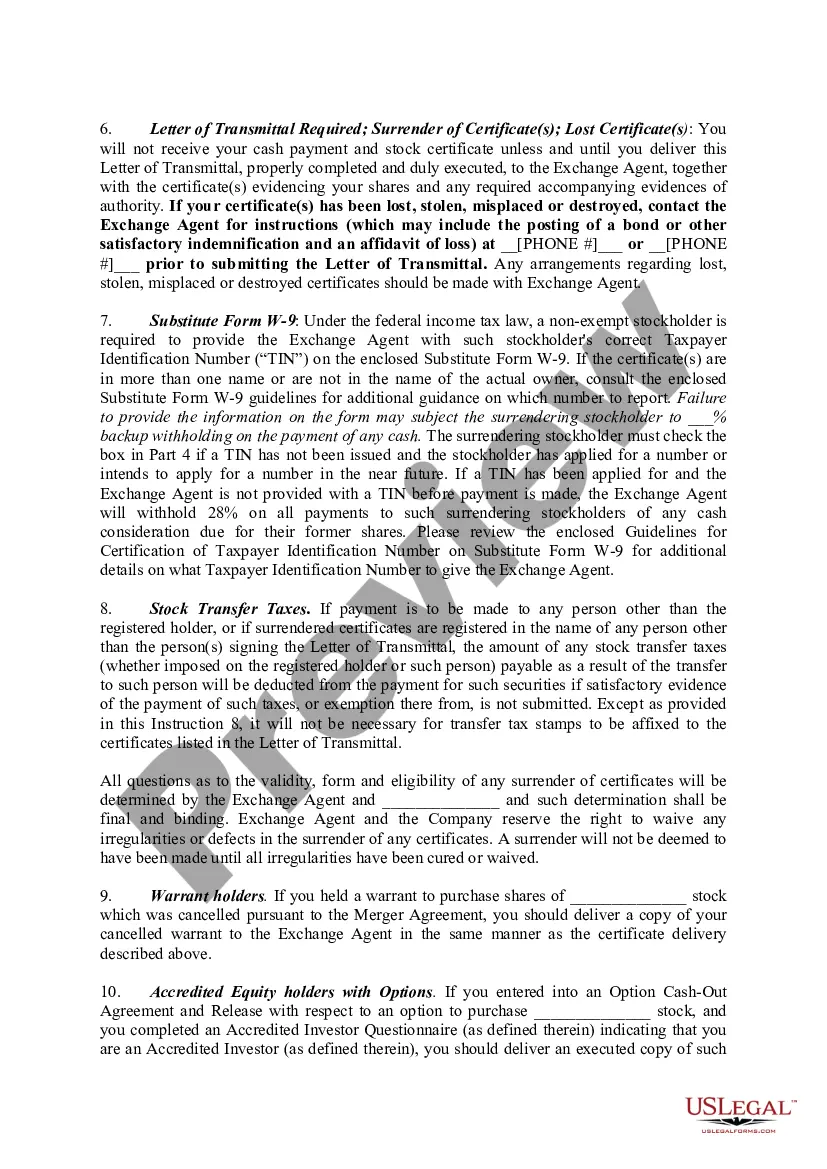

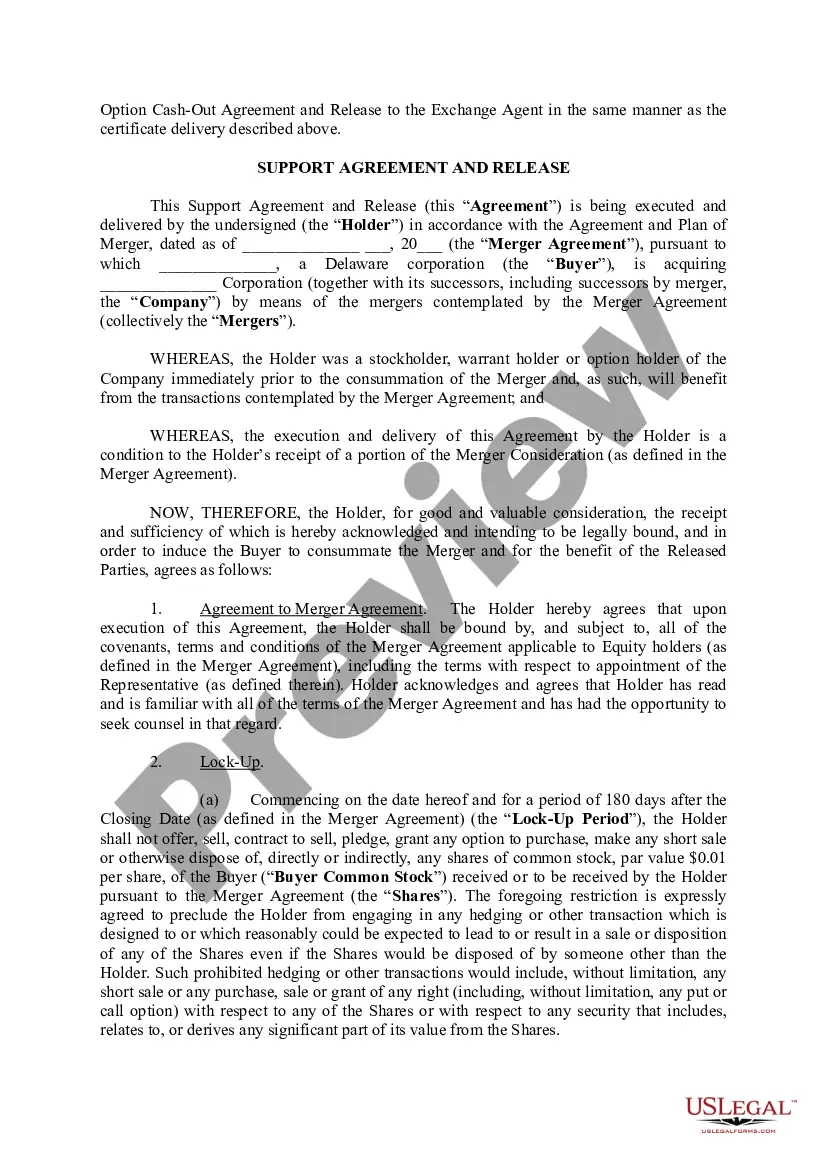

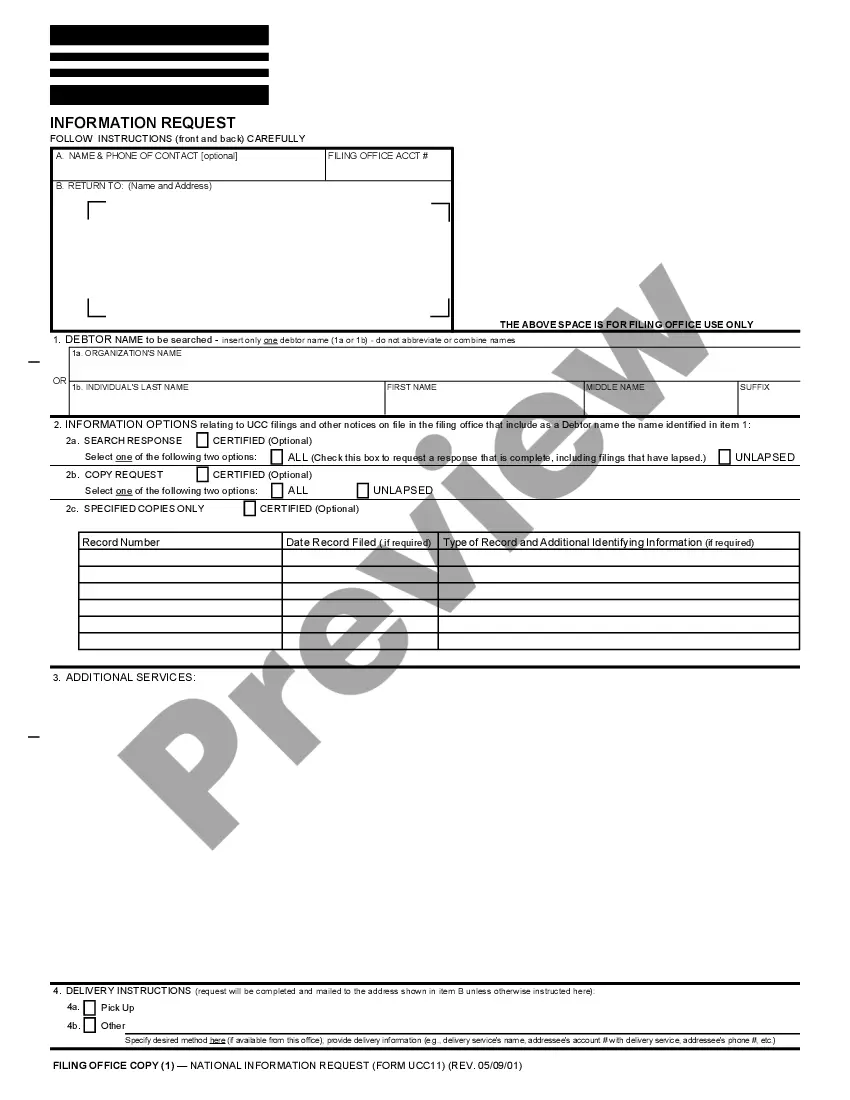

Orange, California Letter of Transmittal to Accompany Certificates of Common Stock is a crucial document for investors and shareholders in Orange, California, who wish to transfer or sell their shares of common stock in a company. This letter serves as a formal request to exchange the physical stock certificates for cash or other securities. The primary purpose of the Orange, California Letter of Transmittal is to provide detailed instructions and information necessary for the efficient and accurate processing of stock transfers. It includes relevant keywords such as "Orange, California," "Letter of Transmittal," "Certificates of Common Stock," and "shareholders." This ensures that search engines and readers can easily identify and understand the content's relevance. There may be different types of Orange, California Letter of Transmittal to Accompany Certificates of Common Stock, depending on specific circumstances or requirements. Some variations could include: 1. Standard Orange, California Letter of Transmittal: This is the most common type, used when shareholders want to sell their common stock and receive cash in return. It typically includes instructions for providing necessary identification and contact information, along with the stock certificate details. 2. Orange, California Letter of Transmittal for Stock Exchange: In cases where a company undergoes a merger, acquisition, or reorganization, existing shareholders might need to exchange their common stock for shares in the new entity. This type of letter includes additional information regarding the stock exchange process and any required documentation. 3. Orange, California Letter of Transmittal for Stock Dividend: When a company declares a dividend payable in common stock rather than cash, shareholders receive additional shares based on their existing holdings. The letter for this type of transaction would provide instructions on how to submit the stock certificates to receive the dividend shares. 4. Orange, California Letter of Transmittal for Securities Conversion: In certain situations, a company allows shareholders to convert their common stock into a different class of securities, such as preferred stock or bonds. The letter accompanying this conversion would contain all the necessary information about the process, conversion rates, and any relevant deadline. Overall, the Orange, California Letter of Transmittal to Accompany Certificates of Common Stock ensures a smooth transfer process and helps maintain an accurate record of share ownership. It acts as a reliable communication tool between shareholders and the company, safeguarding the interests of both parties.

Orange California Letter of Transmittal to Accompany Certificates of Common Stock

Description

How to fill out Orange California Letter Of Transmittal To Accompany Certificates Of Common Stock?

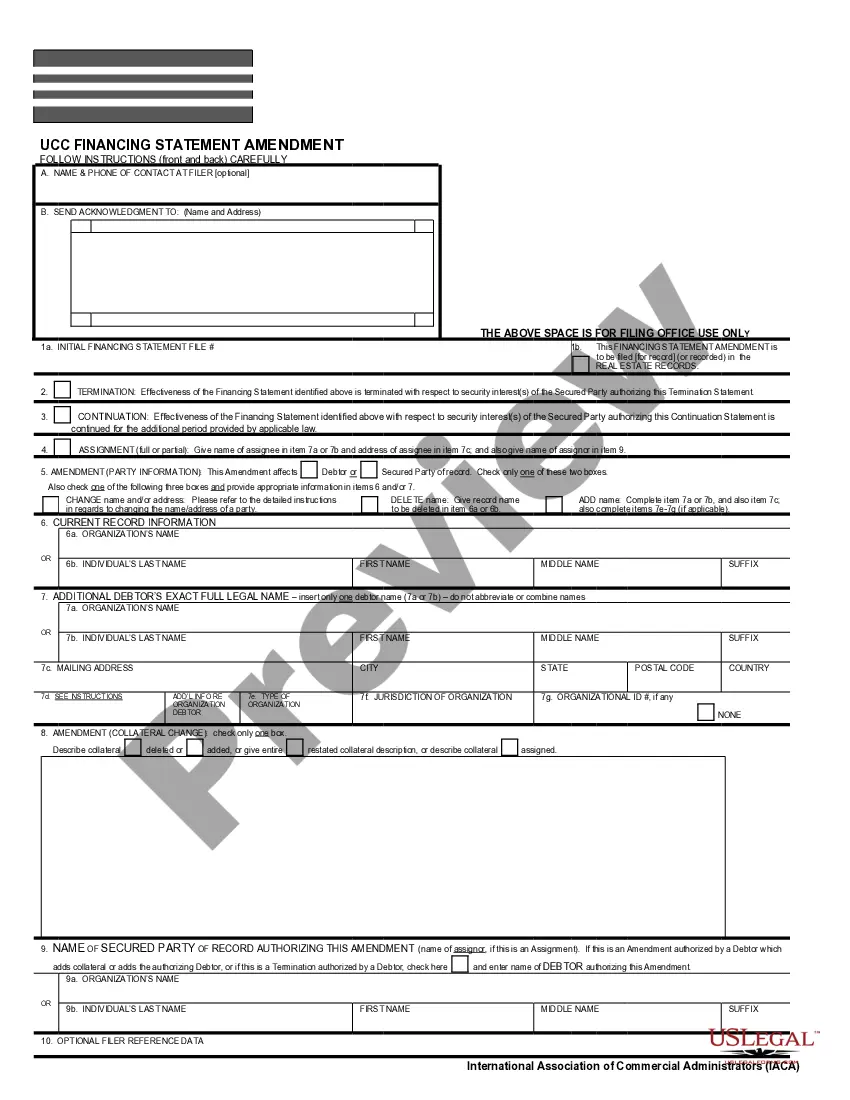

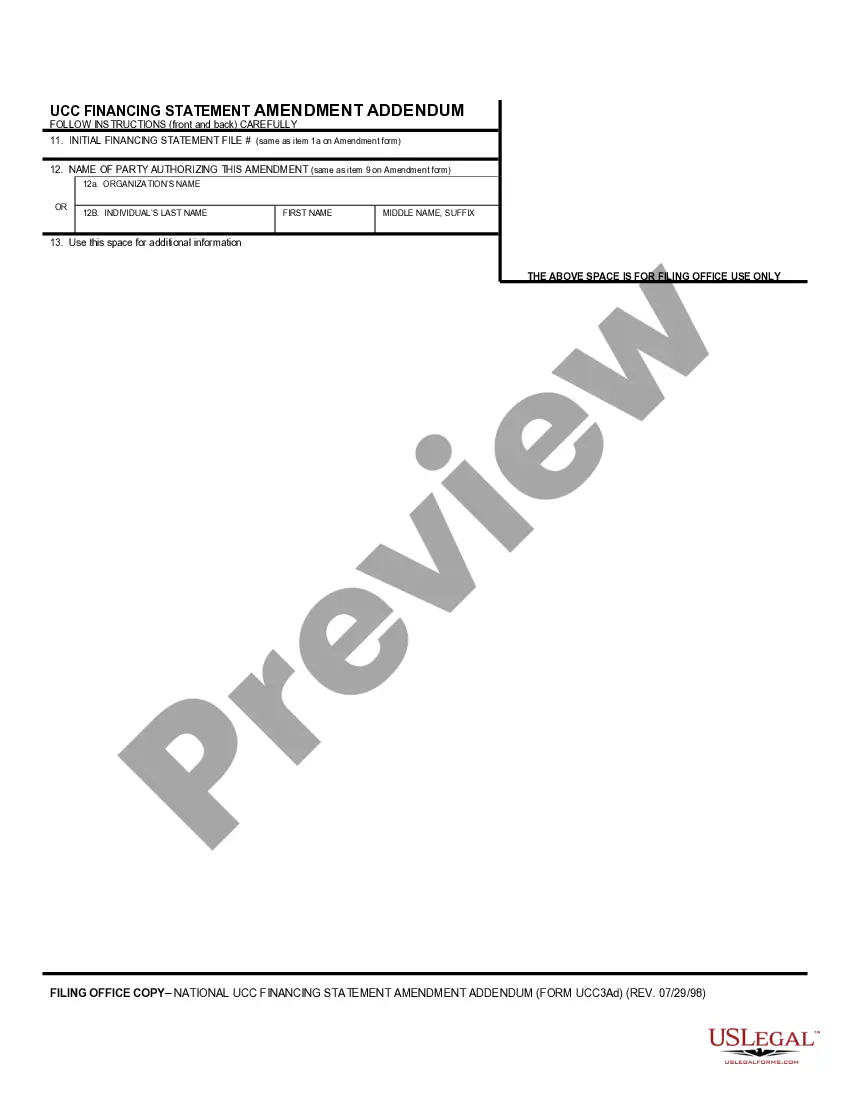

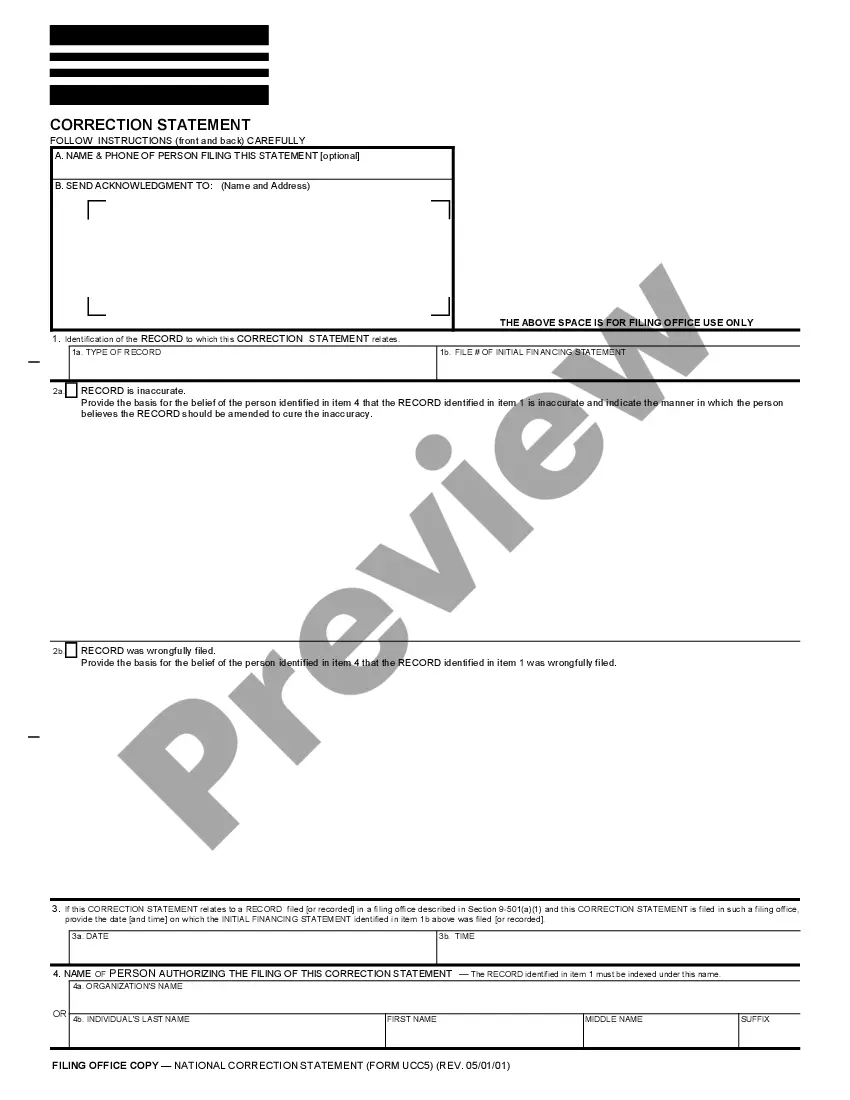

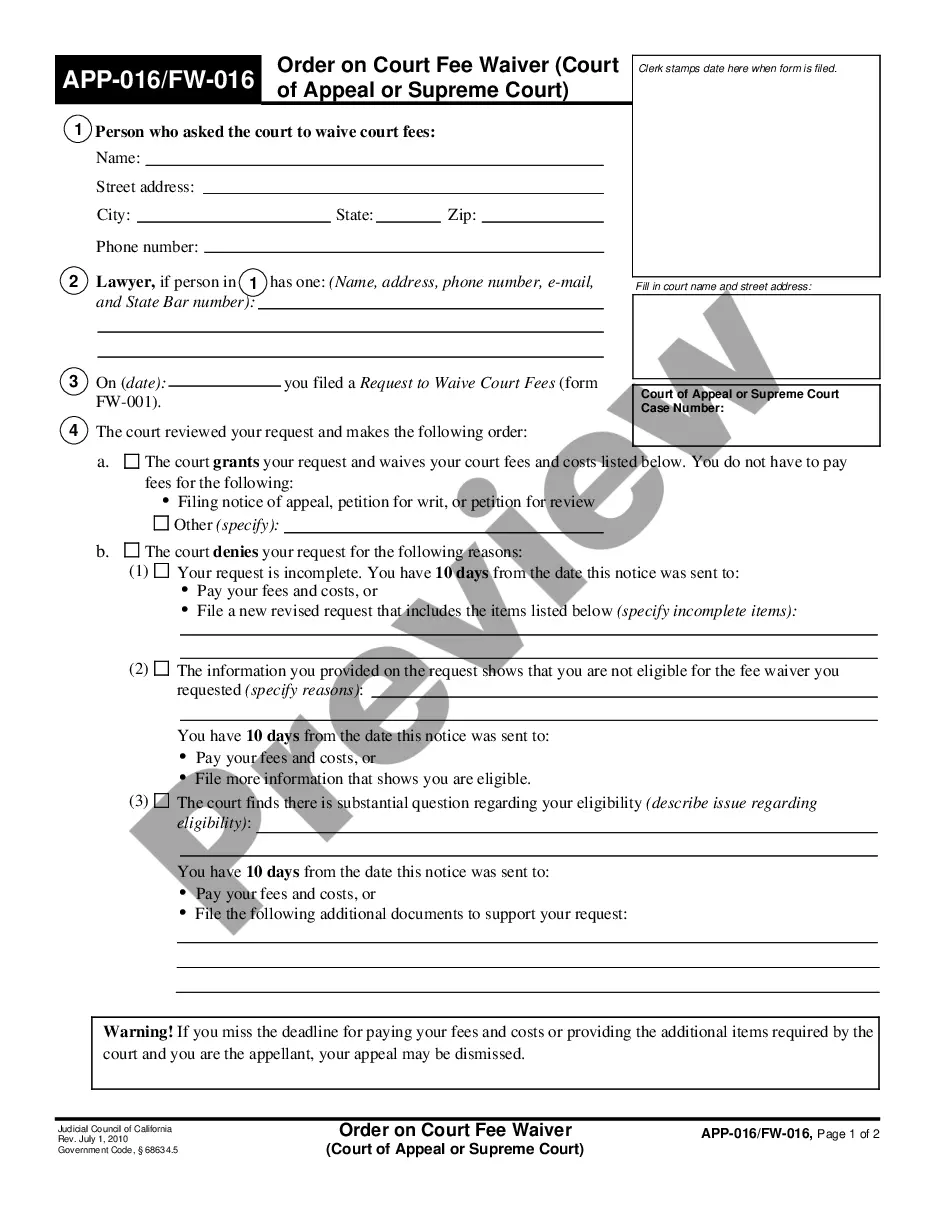

Preparing legal documentation can be burdensome. In addition, if you decide to ask a legal professional to write a commercial contract, papers for proprietorship transfer, pre-marital agreement, divorce papers, or the Orange Letter of Transmittal to Accompany Certificates of Common Stock, it may cost you a fortune. So what is the most reasonable way to save time and money and draft legitimate forms in total compliance with your state and local laws and regulations? US Legal Forms is an excellent solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is the most extensive online library of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any scenario gathered all in one place. Therefore, if you need the latest version of the Orange Letter of Transmittal to Accompany Certificates of Common Stock, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample using the Download button. If you haven't subscribed yet, here's how you can get the Orange Letter of Transmittal to Accompany Certificates of Common Stock:

- Look through the page and verify there is a sample for your area.

- Examine the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't suit your requirements - look for the correct one in the header.

- Click Buy Now when you find the required sample and choose the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a payment with a credit card or through PayPal.

- Choose the document format for your Orange Letter of Transmittal to Accompany Certificates of Common Stock and save it.

When finished, you can print it out and complete it on paper or import the samples to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the documents ever obtained multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!