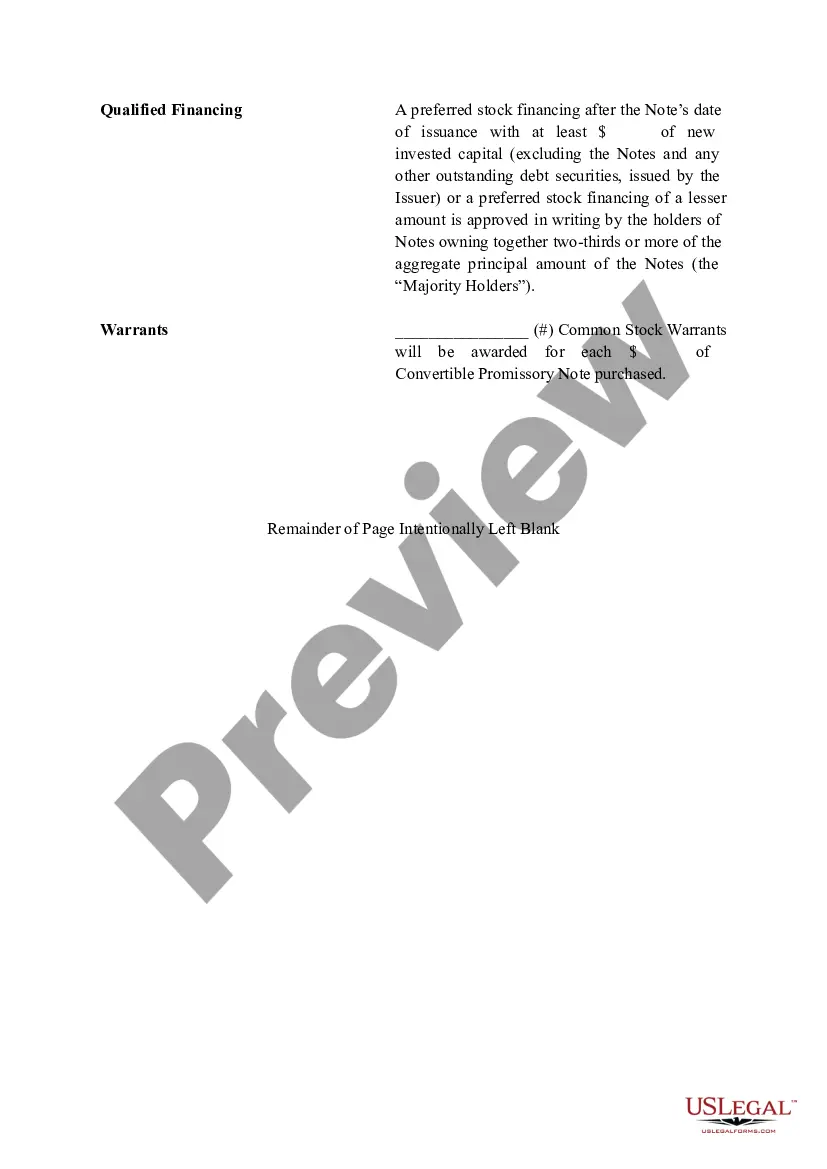

A Chicago, Illinois Term Sheet — Six Month Promissory Note is a legally binding document that outlines the terms and conditions of a loan agreement between a lender and a borrower in the city of Chicago, Illinois. This promissory note specifically pertains to a loan with a duration of six months. The purpose of a term sheet is to establish the initial agreement between the parties involved. It acts as a blueprint for the loan agreement, summarizing the key terms and conditions that will govern the loan. Typically, a term sheet provides a simple and concise summary of the essential elements of the loan. It serves as an outline for future negotiations and serves to protect the interests of both the lender and the borrower. In Chicago, Illinois, there can be various types of term sheets — Six Month Promissory Notes, depending on the specific nature of the loan agreement. Some common types may include but are not limited to: 1. Personal Loan Term Sheet: This type of term sheet outlines a loan agreement between individuals, such as friends or family members, for personal financial needs. It includes provisions for repayment terms, interest rates, and any collateral pledged. 2. Business Loan Term Sheet: This term sheet is used for loans provided to businesses operating in Chicago, Illinois. It defines the loan amount, interest rate, repayment period, and collateral requirements. Additionally, it may include specific terms related to the borrower's business operations and financial performance. 3. Real Estate Loan Term Sheet: When the purpose of the loan is to finance real estate transactions, this term sheet is used. It highlights the loan amount, interest rate, repayment schedule, and terms related to the property, such as appraisal requirements and conditions for releasing funds. 4. Bridge Loan Term Sheet: Bridge loans are typically short-term loans that bridge a financing gap until long-term financing is secured. This term sheet would outline the terms and conditions of such a loan, including duration, interest rates, and any specific requirements. In conclusion, a Chicago, Illinois Term Sheet — Six Month Promissory Note is a vital document that establishes the terms and conditions of a loan agreement within the city. There can be various types of such term sheets, such as those for personal loans, business loans, real estate loans, and bridge loans, each tailored to suit the specific needs of a borrower in Chicago, Illinois.

Chicago Illinois Term Sheet - Six Month Promissory Note

Description

How to fill out Chicago Illinois Term Sheet - Six Month Promissory Note?

How much time does it normally take you to draw up a legal document? Given that every state has its laws and regulations for every life scenario, finding a Chicago Term Sheet - Six Month Promissory Note suiting all regional requirements can be tiring, and ordering it from a professional lawyer is often costly. Many online services offer the most popular state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive online catalog of templates, collected by states and areas of use. In addition to the Chicago Term Sheet - Six Month Promissory Note, here you can find any specific document to run your business or individual deeds, complying with your county requirements. Specialists check all samples for their validity, so you can be sure to prepare your documentation correctly.

Using the service is fairly easy. If you already have an account on the platform and your subscription is valid, you only need to log in, select the required sample, and download it. You can get the file in your profile at any time in the future. Otherwise, if you are new to the website, there will be a few more steps to complete before you obtain your Chicago Term Sheet - Six Month Promissory Note:

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another document using the related option in the header.

- Click Buy Now once you’re certain in the selected file.

- Select the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Chicago Term Sheet - Six Month Promissory Note.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired document, you can locate all the samples you’ve ever saved in your profile by opening the My Forms tab. Try it out!