Philadelphia Pennsylvania Letter of Transmittal

Description

How to fill out Philadelphia Pennsylvania Letter Of Transmittal?

How much time does it usually take you to create a legal document? Since every state has its laws and regulations for every life scenario, locating a Philadelphia Letter of Transmittal meeting all regional requirements can be tiring, and ordering it from a professional attorney is often pricey. Many web services offer the most common state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive web catalog of templates, grouped by states and areas of use. In addition to the Philadelphia Letter of Transmittal, here you can get any specific form to run your business or individual deeds, complying with your regional requirements. Professionals check all samples for their actuality, so you can be sure to prepare your documentation correctly.

Using the service is remarkably straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the required sample, and download it. You can get the document in your profile at any time in the future. Otherwise, if you are new to the platform, there will be a few more steps to complete before you obtain your Philadelphia Letter of Transmittal:

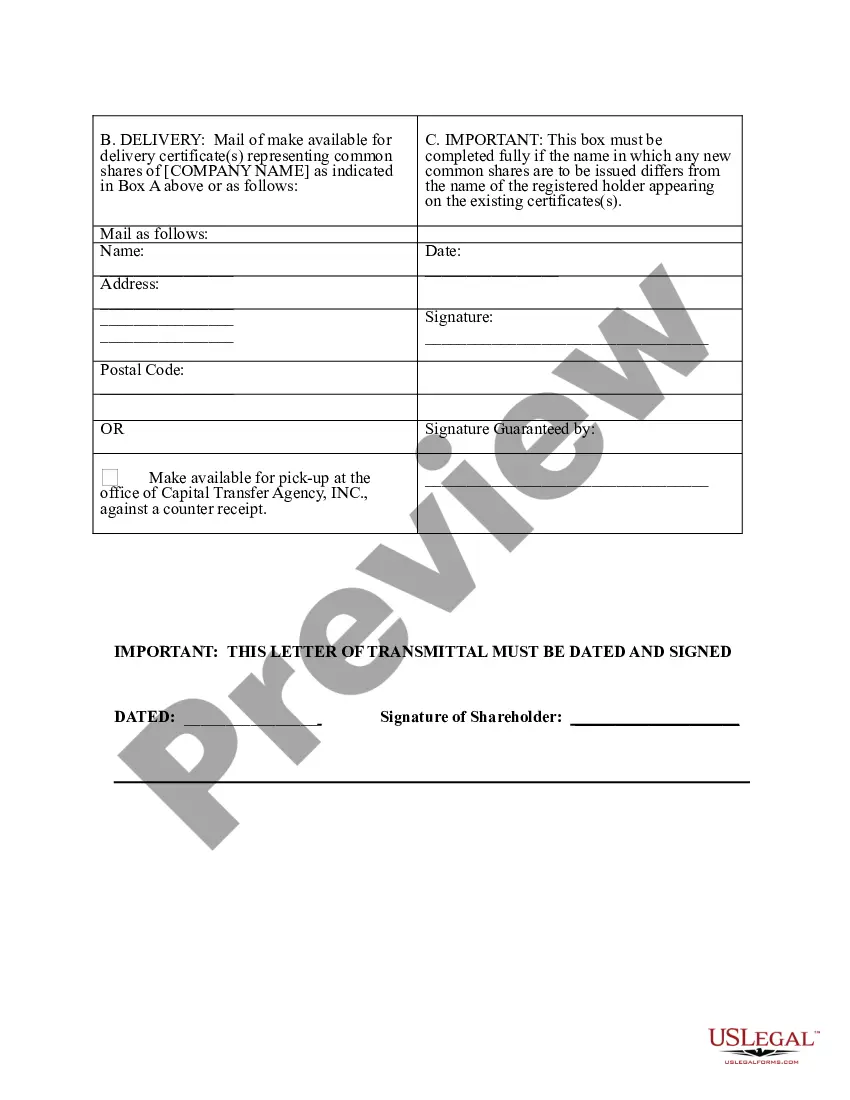

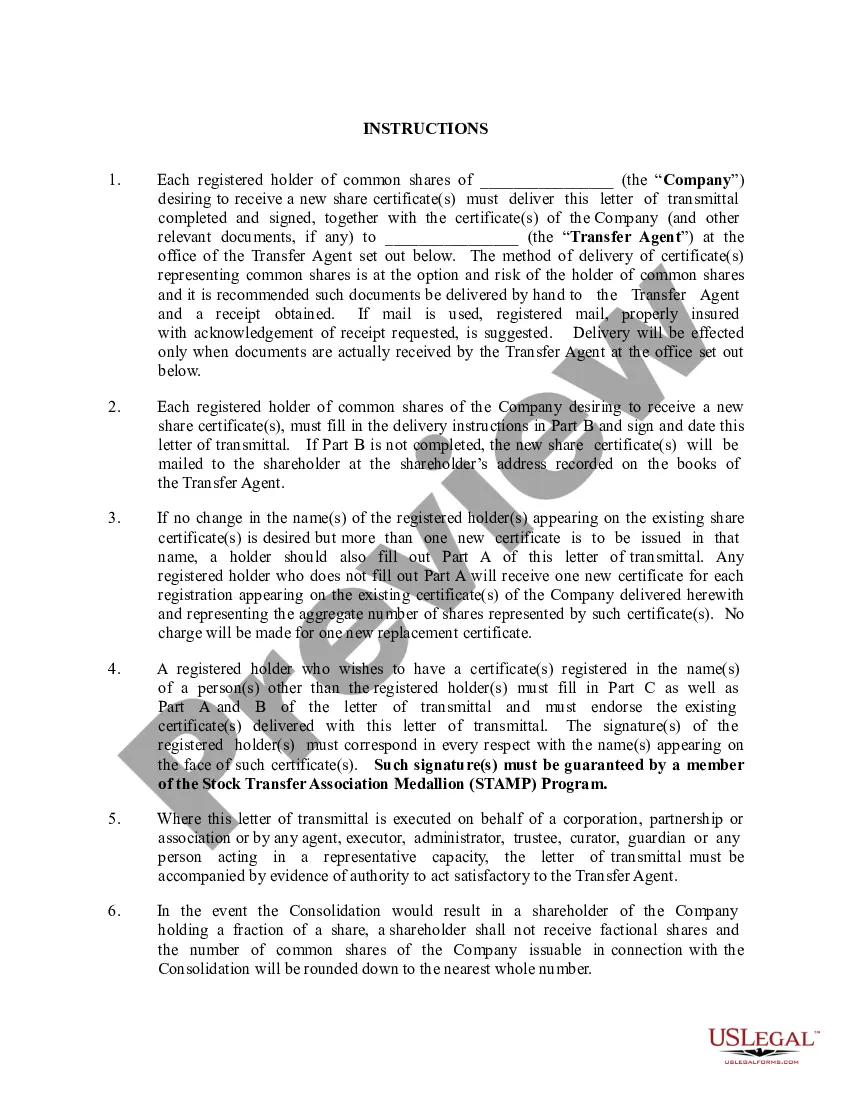

- Check the content of the page you’re on.

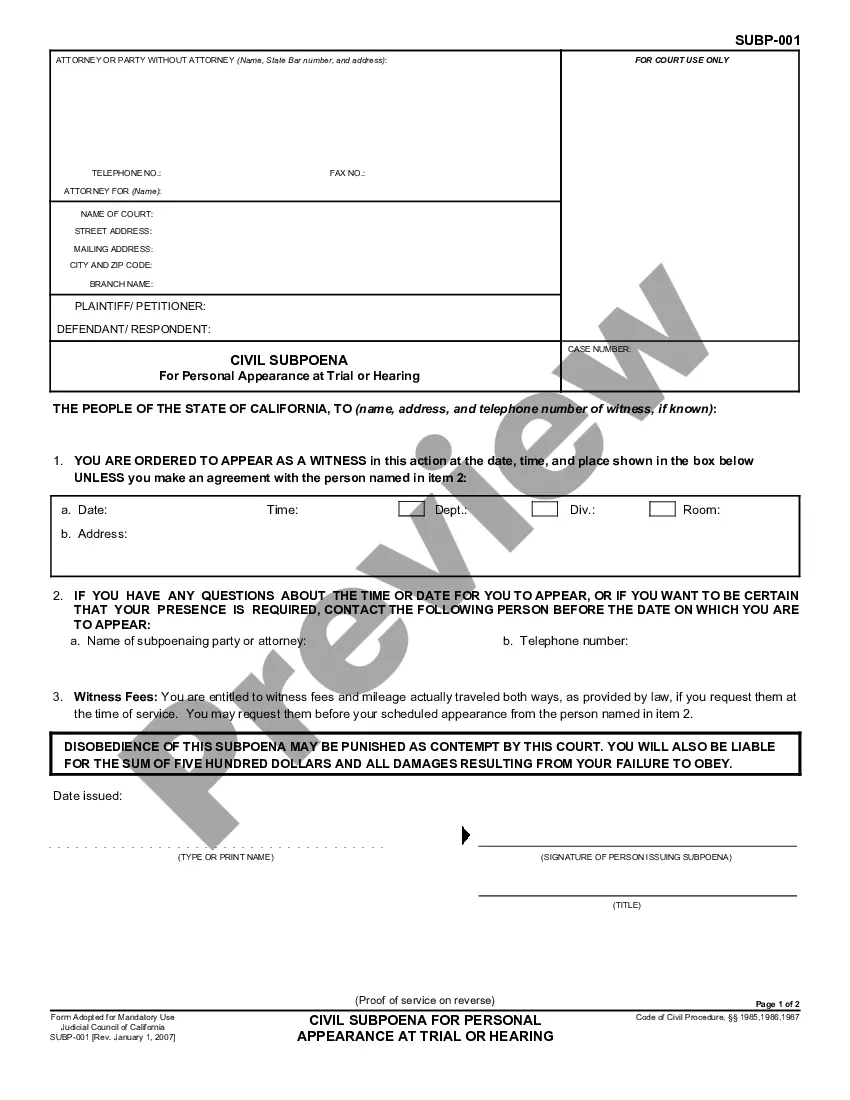

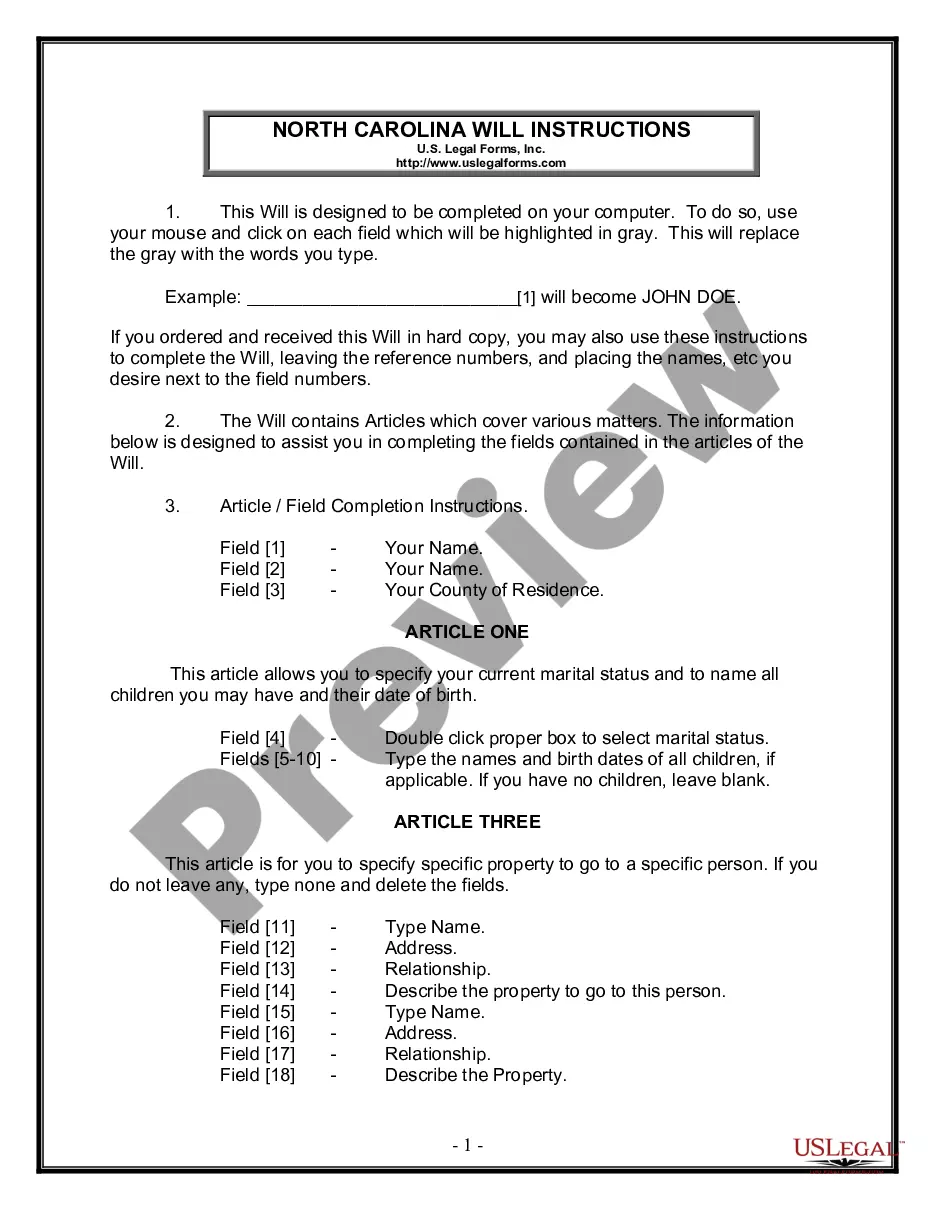

- Read the description of the sample or Preview it (if available).

- Look for another form using the related option in the header.

- Click Buy Now when you’re certain in the selected document.

- Decide on the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Philadelphia Letter of Transmittal.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased document, you can find all the files you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!

Form popularity

FAQ

How to pay File a return by mail. Mail your return to: Philadelphia Dept. of Revenue. P.O. Box 1660.Pay by mail. Mail all payments with a payment coupon to: Philadelphia Dept. of Revenue. P.O. Box 1393.Request a refund by email. Mail your return and refund request to: Philadelphia Dept. of Revenue. P.O. Box 1137.

Every resident, part-year resident or nonresident individual must file a Pennsylvania Income Tax Return (PA-40) when he or she realizes income generating $1 or more in tax, even if no tax is due (e.g., when an employee receives compensation where tax is withheld).

Where the IRS grants you extension of time for filing the federal return, the Philadelphia Department of Revenue will automatically grant a matching extension for filing BIRT and NPT. If you're granted the federal extension, you don't need to take any additional action to receive the Philadelphia extension.

There are no extensions for tax payments, but you can apply for an extension to file your return. Your Commercial Activity License can be suspended or revoked if you don't pay your taxes. For-profit businesses are not allowed to operate in Philadelphia if they don't have an active Commercial Activity License.

All Philadelphia residents owe the City Wage Tax, regardless of where they work. Non-residents who work in Philadelphia must also pay the Wage Tax. Effective July 1, 2021, the rate for residents is 3.8398 percent, and the rate for non-residents is 3.4481 percent.

How to file City taxes Filing returns online. All Philadelphia taxes can be filed online.Filing returns through Modernized e-Filing (MeF) You can use the IRS Modernized e-Filing program to file some City of Philadelphia taxes.Filing paper returns.

How to file City taxes Filing returns online. All Philadelphia taxes can be filed online.Filing returns through Modernized e-Filing (MeF) You can use the IRS Modernized e-Filing program to file some City of Philadelphia taxes.Filing paper returns.

Every individual, partnership, association, limited liability company (LLC), and corporation engaged in a business, profession, or other activity for profit within the City of Philadelphia must fb01le a Business Income & Receipts Tax (BIRT) return.

How to pay File a return by mail. Mail your return to: Philadelphia Dept. of Revenue. P.O. Box 1660.Pay by mail. Mail all payments with a payment coupon to: Philadelphia Dept. of Revenue. P.O. Box 1393.Request a refund by email. Mail your return and refund request to: Philadelphia Dept. of Revenue. P.O. Box 1137.

Sign the return, enclose W-2 forms, PA Schedule SP (if applicable) and mail to: Philadelphia Department of Revenue, P.O. Box 1648, Philadelphia, PA 19105-1648.