The Kings New York Shareholders Agreement is a legally binding document that outlines the rights and obligations of shareholders in a specific company. This agreement serves to establish a set of rules and guidelines to govern the relationship between the shareholders, ensuring transparency, efficiency, and fairness in the company's operations. The purpose of the Kings New York Shareholders Agreement is to provide clarity and protection to all parties involved, including shareholders, directors, and other stakeholders. It covers various aspects of shareholder rights, management duties, share transfers, decision-making processes, dispute resolution mechanisms, and more. There are different types of Kings New York Shareholders Agreements that may be tailored to meet the unique needs of each company. These could include: 1. Standard Agreement: This is a typical Shareholders Agreement that covers the essential provisions required by law. It establishes the general rights and responsibilities of shareholders, outlines procedures for share transfers, addresses decision-making processes, and provides mechanisms for resolving disputes. 2. Protective Agreement: This type of agreement is more comprehensive, offering enhanced protection to certain shareholders or groups of shareholders. It may include provisions that restrict share transfers to specific parties or require consent from a designated group of shareholders for major decisions affecting the company. 3. Founder's Agreement: This agreement is specifically designed for startups or companies in their early stages. It sets out the rights, responsibilities, and obligations of the founding shareholders, as well as provisions on intellectual property, founder vesting, and other crucial matters. 4. Investors Agreement: This type of agreement is crafted when external investors, such as venture capitalists or angel investors, inject capital into a company. It typically includes provisions concerning investment terms, management control, liquidation preferences, and exit strategies. 5. Buy-Sell Agreement: This agreement comes into play when specific events occur, such as a shareholder's death, retirement, or desire to sell their shares. It establishes a framework for the fair valuation of shares and provides mechanisms for the remaining shareholders to purchase the shares of the exiting shareholder. In summary, the Kings New York Shareholders Agreement is a vital legal document that aims to establish the rights, obligations, and procedures governing shareholders in a company. By specifying the respective roles and responsibilities of the parties involved, it helps ensure smooth operations, conflict resolution, and protection for all shareholders.

Kings New York Shareholders Agreement

Description

How to fill out Kings New York Shareholders Agreement?

Drafting paperwork for the business or individual demands is always a huge responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's crucial to take into account all federal and state laws of the particular region. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these details make it burdensome and time-consuming to create Kings Shareholders Agreement without expert assistance.

It's easy to avoid wasting money on attorneys drafting your documentation and create a legally valid Kings Shareholders Agreement on your own, using the US Legal Forms web library. It is the most extensive online catalog of state-specific legal templates that are professionally cheched, so you can be sure of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to save the needed document.

If you still don't have a subscription, adhere to the step-by-step instruction below to obtain the Kings Shareholders Agreement:

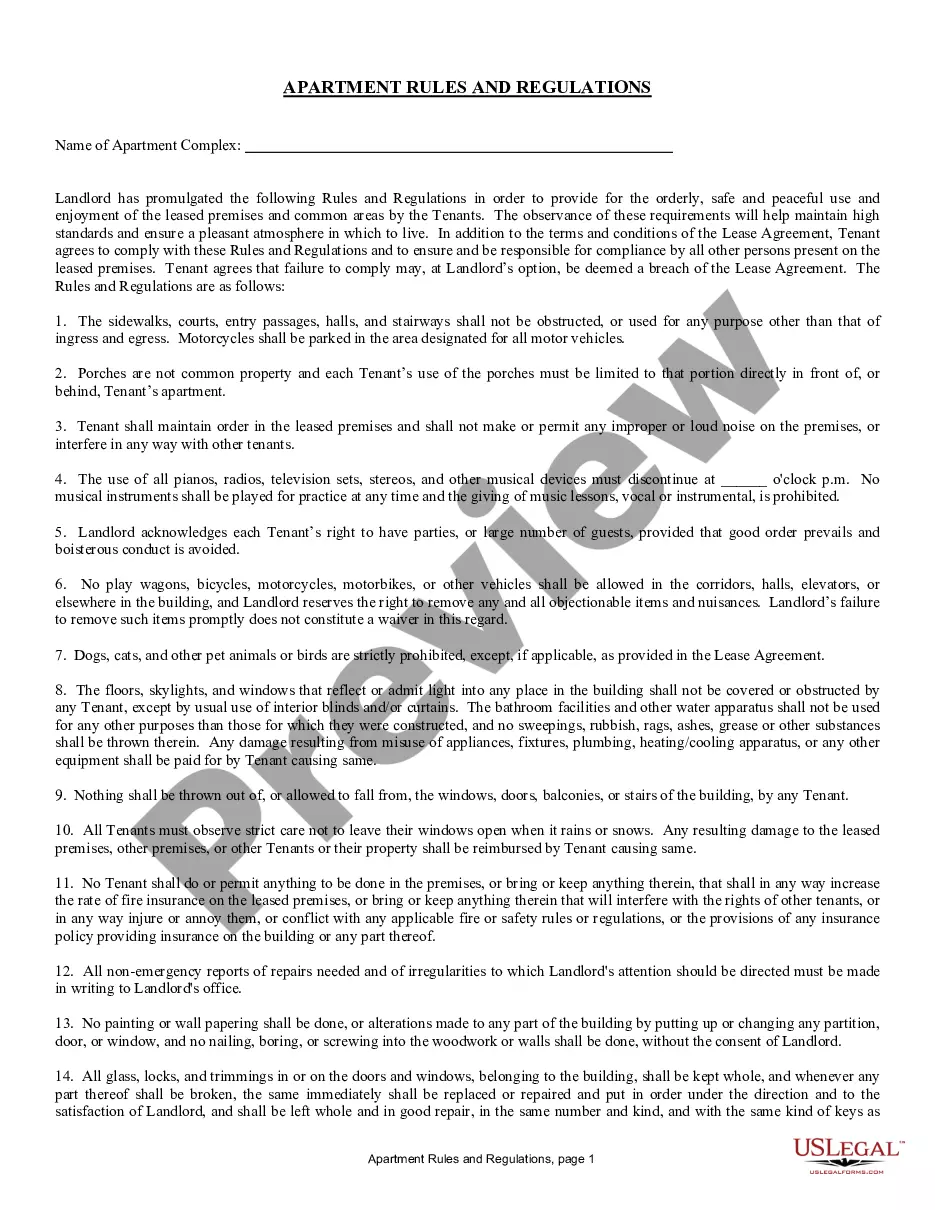

- Look through the page you've opened and check if it has the document you require.

- To accomplish this, use the form description and preview if these options are presented.

- To find the one that suits your needs, utilize the search tab in the page header.

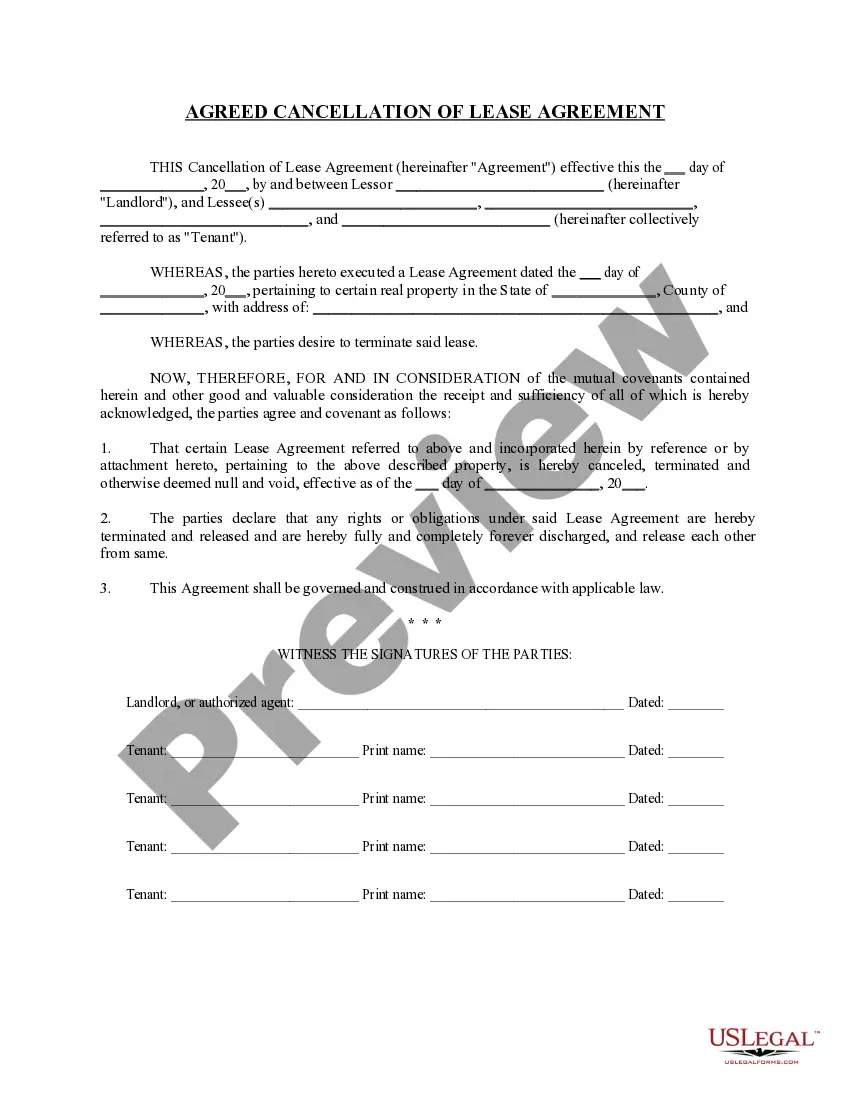

- Double-check that the template complies with juridical standards and click Buy Now.

- Pick the subscription plan, then sign in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and easily obtain verified legal forms for any scenario with just a few clicks!