A Nassau New York Shareholders Agreement is a legally binding document that outlines the rights, responsibilities, and obligations of shareholders in a company registered in Nassau County, New York. This agreement is crucial for small and medium-sized businesses as it helps protect the interests of both majority and minority shareholders, while promoting transparency and limiting disputes. The main purpose of the Nassau New York Shareholders Agreement is to establish a clear framework for decision-making, profit-sharing, and management of the company. It covers various important aspects such as the allocation of voting rights, distribution of dividends, transfer of shares, appointment of directors, and resolution of conflicts. In terms of different types, there can be specific agreements tailored to accommodate the unique circumstances and requirements of different companies. Some common types of Nassau New York Shareholders Agreements include: 1. Majority Shareholders Agreement: This type of agreement is designed to protect the rights and interests of majority shareholders who hold a significant portion of the company's shares. It may include provisions that give them more decision-making power or veto rights over important matters. 2. Minority Shareholders Agreement: This agreement is aimed at safeguarding the rights of minority shareholders who own a smaller percentage of shares. It may contain clauses that ensure their voices are heard in key decisions, protect them against unfair treatment, and provide mechanisms to address concerns related to dilution of their shares. 3. Buy-Sell Agreement: A Buy-Sell Agreement, sometimes incorporated within the Shareholders Agreement, outlines the process and terms for buying or selling shares among the shareholders. It may include options for both voluntary and forced sale of shares, as well as mechanisms for valuation and dispute resolution. 4. Voting Agreement: A Voting Agreement focuses specifically on the allocation of voting rights within the company. It may include provisions on voting thresholds, voting by proxy, and rules for voting on specific matters, ensuring fair decision-making processes. 5. Non-Disclosure Agreement (NDA): While not directly a Shareholders Agreement, an NDA can be included as an annex or a separate agreement to protect sensitive information shared among shareholders. This agreement ensures that confidential business information, trade secrets, or intellectual property rights are not disclosed to unauthorized parties. It is essential to consult legal professionals familiar with New York corporate law to tailor the Nassau Shareholders Agreement to the specific needs and goals of a company. Adhering to such an agreement can help ensure a smooth and harmonious relationship among shareholders and promote the overall success and longevity of the business.

Nassau New York Shareholders Agreement

Description

How to fill out Nassau New York Shareholders Agreement?

A document routine always goes along with any legal activity you make. Creating a company, applying or accepting a job offer, transferring property, and many other life situations require you prepare formal paperwork that varies throughout the country. That's why having it all accumulated in one place is so helpful.

US Legal Forms is the largest online library of up-to-date federal and state-specific legal templates. On this platform, you can easily locate and get a document for any personal or business objective utilized in your region, including the Nassau Shareholders Agreement.

Locating templates on the platform is amazingly simple. If you already have a subscription to our library, log in to your account, find the sample through the search bar, and click Download to save it on your device. Following that, the Nassau Shareholders Agreement will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this simple guideline to obtain the Nassau Shareholders Agreement:

- Ensure you have opened the proper page with your localised form.

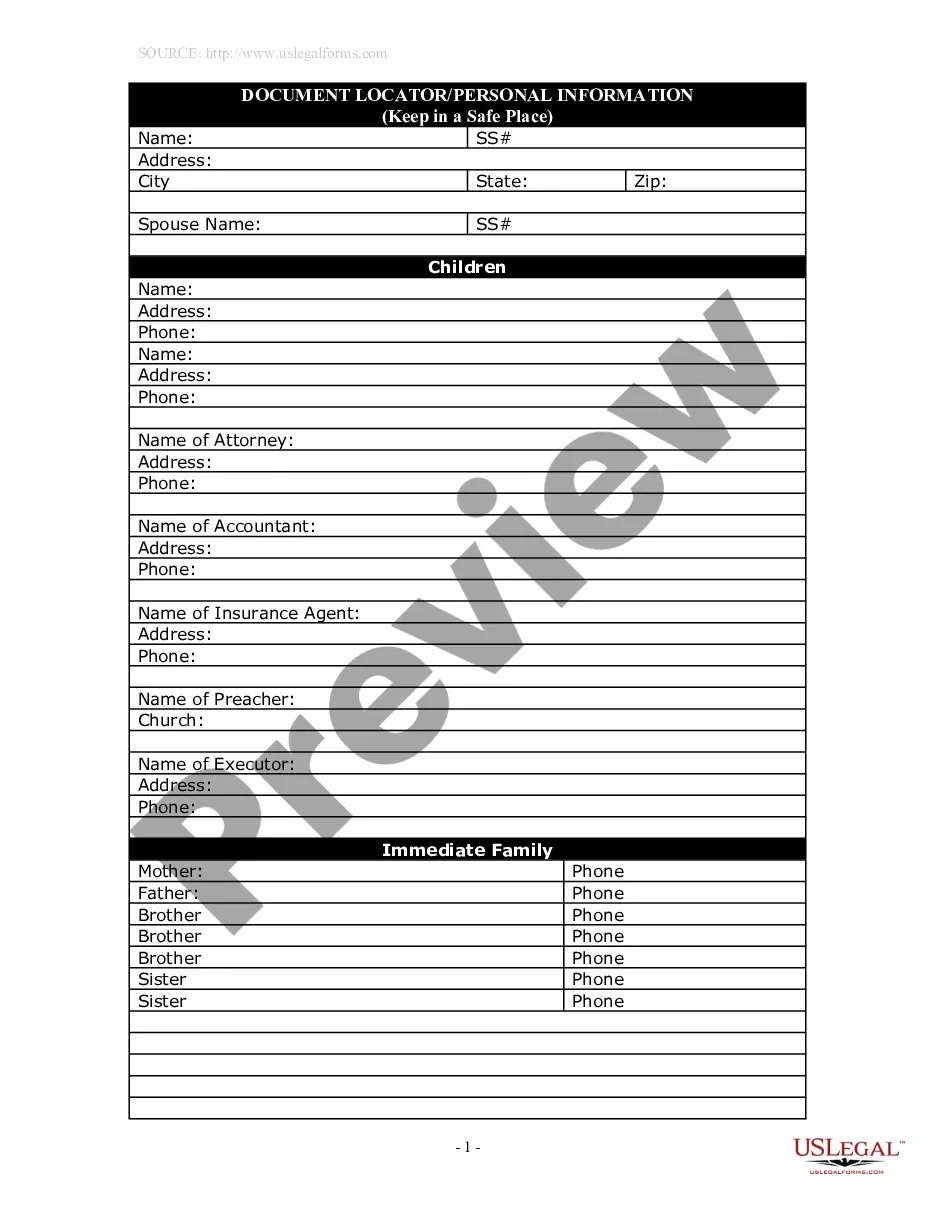

- Make use of the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the form meets your needs.

- Look for another document using the search tab if the sample doesn't fit you.

- Click Buy Now once you locate the required template.

- Decide on the appropriate subscription plan, then sign in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and save the Nassau Shareholders Agreement on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most reliable way to obtain legal paperwork. All the samples available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs properly with the US Legal Forms!