A Fulton Georgia Convertible Note Subscription Agreement is a legally binding document used in investment transactions involving convertible notes. It outlines the terms and conditions agreed upon between the issuer (usually a startup company) and the investor. The Fulton Georgia Convertible Note Subscription Agreement includes essential information such as the principal amount of the note, the interest rate, the conversion terms, and the maturity date. It also specifies the rights and obligations of both parties. This type of agreement is commonly used in Fulton, Georgia, for various investment purposes. Whether it is a local tech startup seeking funding or a real estate development project in Fulton County, the Convertible Note Subscription Agreement provides a structured framework for investment. Different types of Fulton Georgia Convertible Note Subscription Agreements include: 1. Standard Convertible Note Subscription Agreement: This is the most common type, where the investor loans money to the issuer which will convert into equity or stock ownership at a later date. 2. Safe Convertible Note Subscription Agreement: "Safe" stands for "Simple Agreement for Future Equity," which is a modified version of a convertible note. It allows for a simplified investment structure without specifying an interest rate or maturity date. The conversion happens when a specific triggering event occurs, such as the issuer raising additional funding. 3. Convertible Note Subscription Agreement with Valuation Cap: This agreement sets a maximum valuation at which the convertible note will convert into equity. It assures the investor that they will receive a certain percentage of ownership regardless of the company's future valuation. 4. Discounted Convertible Note Subscription Agreement: This type of agreement offers the investor a discount on the conversion price when the note converts into equity. It incentivizes early investment by providing a preferential rate. 5. Qualified Financing Convertible Note Subscription Agreement: This agreement includes a provision that triggers the automatic conversion of the note if the issuer raises a certain amount of funding in a subsequent financing round (often referred to as a "qualified financing"). In Fulton, Georgia, these various types of Convertible Note Subscription Agreements are utilized by companies and investors as a means to attract investment, secure funding, and provide investors with an opportunity to participate in the company's growth and success. It is important for both parties to carefully review and negotiate the terms of the agreement to ensure a fair and mutually beneficial investment arrangement.

Fulton Georgia Convertible Note Subscription Agreement

Description

How to fill out Fulton Georgia Convertible Note Subscription Agreement?

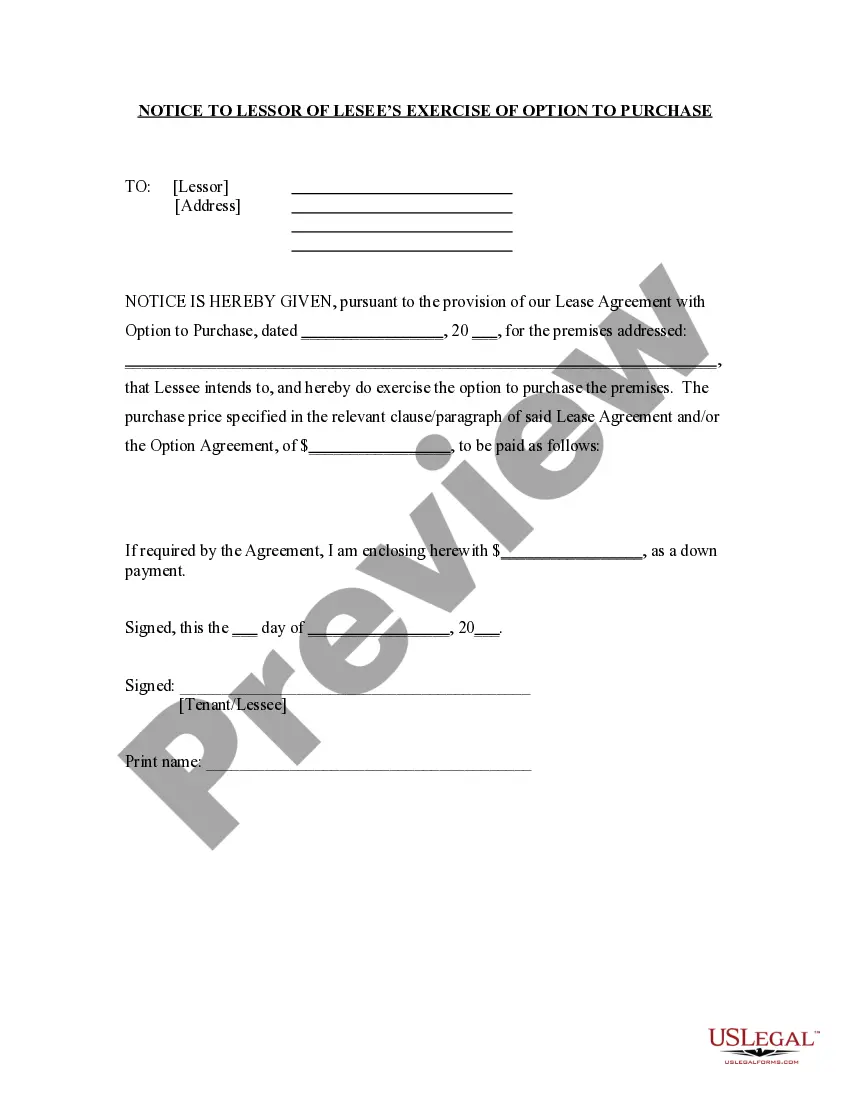

Do you need to quickly create a legally-binding Fulton Convertible Note Subscription Agreement or maybe any other form to take control of your own or corporate matters? You can go with two options: hire a professional to write a legal paper for you or draft it completely on your own. Luckily, there's another solution - US Legal Forms. It will help you receive neatly written legal papers without having to pay unreasonable prices for legal services.

US Legal Forms offers a rich catalog of more than 85,000 state-compliant form templates, including Fulton Convertible Note Subscription Agreement and form packages. We provide documents for an array of use cases: from divorce papers to real estate documents. We've been on the market for over 25 years and got a rock-solid reputation among our customers. Here's how you can become one of them and obtain the necessary document without extra troubles.

- First and foremost, double-check if the Fulton Convertible Note Subscription Agreement is adapted to your state's or county's regulations.

- In case the form includes a desciption, make sure to check what it's suitable for.

- Start the searching process over if the template isn’t what you were looking for by utilizing the search bar in the header.

- Select the subscription that is best suited for your needs and move forward to the payment.

- Choose the file format you would like to get your form in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, find the Fulton Convertible Note Subscription Agreement template, and download it. To re-download the form, simply go to the My Forms tab.

It's stressless to buy and download legal forms if you use our catalog. In addition, the documents we provide are reviewed by industry experts, which gives you greater peace of mind when writing legal affairs. Try US Legal Forms now and see for yourself!