The Kings New York Convertible Note Subscription Agreement is a legal document that outlines the terms and conditions for investors to subscribe to convertible notes issued by Kings New York, a reputed financial institution. This agreement serves as a framework for both parties, providing clarity and protection throughout the investment process. The convertible note subscription agreement includes several crucial components, such as the investor's right to purchase a specific amount of convertible notes, the conversion terms, maturity date, interest rate, and the company's right to redeem or convert the notes under certain circumstances. One type of Kings New York Convertible Note Subscription Agreement is the Fixed Conversion Price Agreement. Under this agreement, the conversion price remains fixed throughout the life of the investment, ensuring the investor a pre-determined conversion rate regardless of any changes in the company's valuation. Another type of agreement is the Variable Conversion Price Agreement. Here, the conversion price is determined by a pre-defined formula that takes into account the company's valuation at the time of conversion. This allows for potential adjustments to the conversion price based on market conditions and the company's performance. The agreement also specifies the investor's rights and protections, including anti-dilution provisions, which safeguard the investor in case the company issues additional shares or securities that may dilute the value of the convertible notes. Furthermore, the Kings New York Convertible Note Subscription Agreement typically includes representations and warranties from both parties, ensuring that each party possesses the necessary authority to enter into the agreement and that all information provided is accurate and complete to the best of their knowledge. Additionally, the agreement may include specific provisions related to events of default, remedies, and dispute resolution mechanisms, outlining the steps both parties should take in case of non-compliance with the agreement or any disagreements that may arise. Overall, the Kings New York Convertible Note Subscription Agreement is a vital legal instrument that facilitates investment in convertible notes issued by Kings New York. It establishes the terms and conditions under which investors participate in the company's financial offerings and provides a comprehensive framework for a mutually beneficial relationship between the investor and the company.

Kings New York Convertible Note Subscription Agreement

Description

How to fill out Kings New York Convertible Note Subscription Agreement?

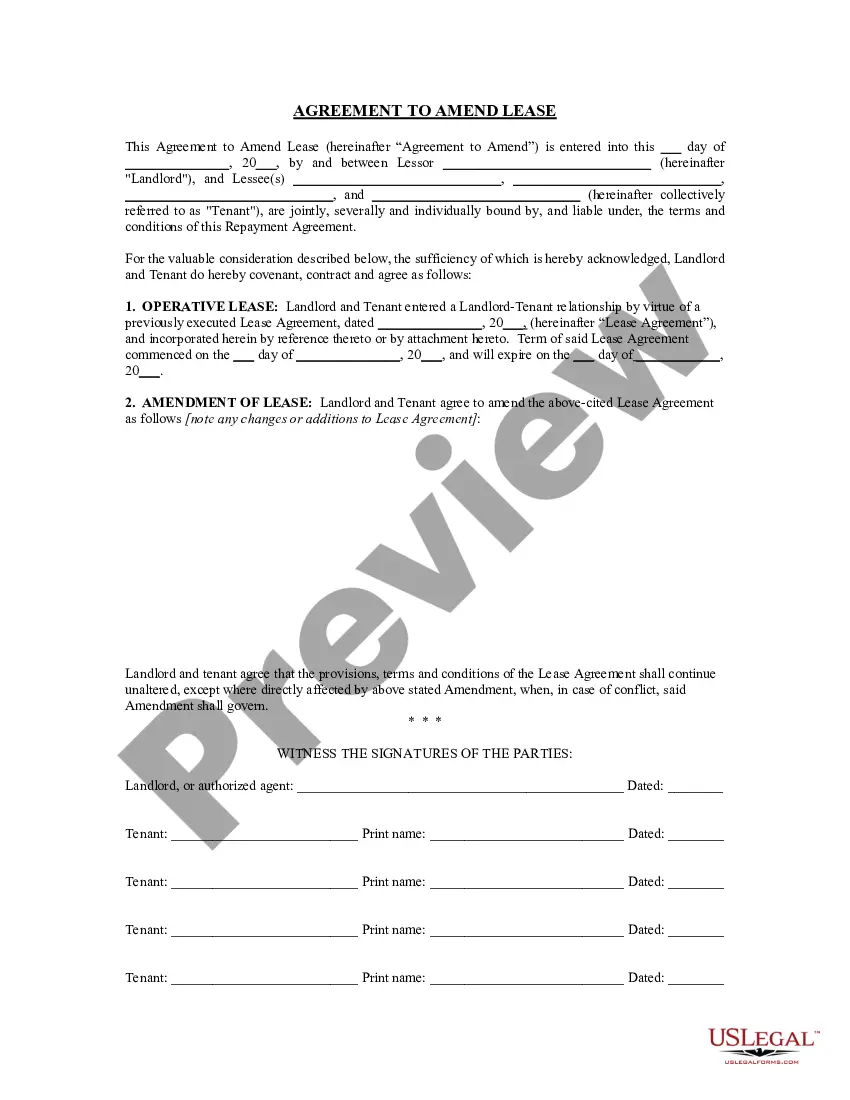

Are you looking to quickly draft a legally-binding Kings Convertible Note Subscription Agreement or maybe any other document to manage your own or corporate affairs? You can select one of the two options: contact a legal advisor to draft a valid document for you or create it completely on your own. Thankfully, there's a third option - US Legal Forms. It will help you get professionally written legal papers without having to pay sky-high prices for legal services.

US Legal Forms offers a huge collection of over 85,000 state-compliant document templates, including Kings Convertible Note Subscription Agreement and form packages. We offer documents for an array of life circumstances: from divorce paperwork to real estate document templates. We've been out there for more than 25 years and gained a spotless reputation among our customers. Here's how you can become one of them and get the needed template without extra hassles.

- First and foremost, carefully verify if the Kings Convertible Note Subscription Agreement is adapted to your state's or county's regulations.

- In case the document includes a desciption, make sure to verify what it's intended for.

- Start the searching process again if the template isn’t what you were looking for by using the search box in the header.

- Select the subscription that best fits your needs and proceed to the payment.

- Choose the file format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already set up an account, you can simply log in to it, locate the Kings Convertible Note Subscription Agreement template, and download it. To re-download the form, just head to the My Forms tab.

It's effortless to find and download legal forms if you use our services. Additionally, the documents we provide are reviewed by industry experts, which gives you greater peace of mind when writing legal affairs. Try US Legal Forms now and see for yourself!