A convertible note subscription agreement is a legally binding document that outlines the terms and conditions for individuals or entities wishing to invest in a startup or company located in Phoenix, Arizona. This agreement serves as a means for investors to convert their debt into equity at a later point in time. The Phoenix Arizona Convertible Note Subscription Agreement includes various essential details, such as the names and addresses of both the investor and the company, the amount of investment being made, and the terms of repayment. Additionally, it outlines the interest rate, maturity date, conversion price, and any other specific provisions agreed upon by both parties. In Phoenix, Arizona, there may be different types of convertible note subscription agreements tailored to specific situations or industries. Some of these variations include: 1. Seed Financing Convertible Note Subscription Agreement: This type of agreement is commonly used when a startup is in its early stages and requires funding for development. It often includes provisions favorable to early-stage investors, such as discount rates or warrant coverage. 2. Bridge Financing Convertible Note Subscription Agreement: Bridge financing agreements are used when a company needs immediate financial assistance between larger funding rounds. This agreement usually includes a shorter maturity date and higher interest rates. 3. Growth Financing Convertible Note Subscription Agreement: As a company begins to grow and expand, they may require additional funding to support their operations. This type of agreement is often used for larger investment amounts and can have varying terms based on the company's current financial state. 4. Industry-Specific Convertible Note Subscription Agreement: Certain industries in Phoenix, Arizona, may have unique requirements or regulations, leading to the creation of industry-specific convertible note subscription agreements. These agreements may include additional clauses or provisions tailored to specific sectors like technology, healthcare, or real estate. Overall, the Phoenix Arizona Convertible Note Subscription Agreement provides a structured framework for investors and companies to enter into a mutually beneficial financial arrangement. By clearly outlining the terms, conditions, and conversion options, this legally binding document ensures transparency and fairness for all parties involved.

Phoenix Arizona Convertible Note Subscription Agreement

Description

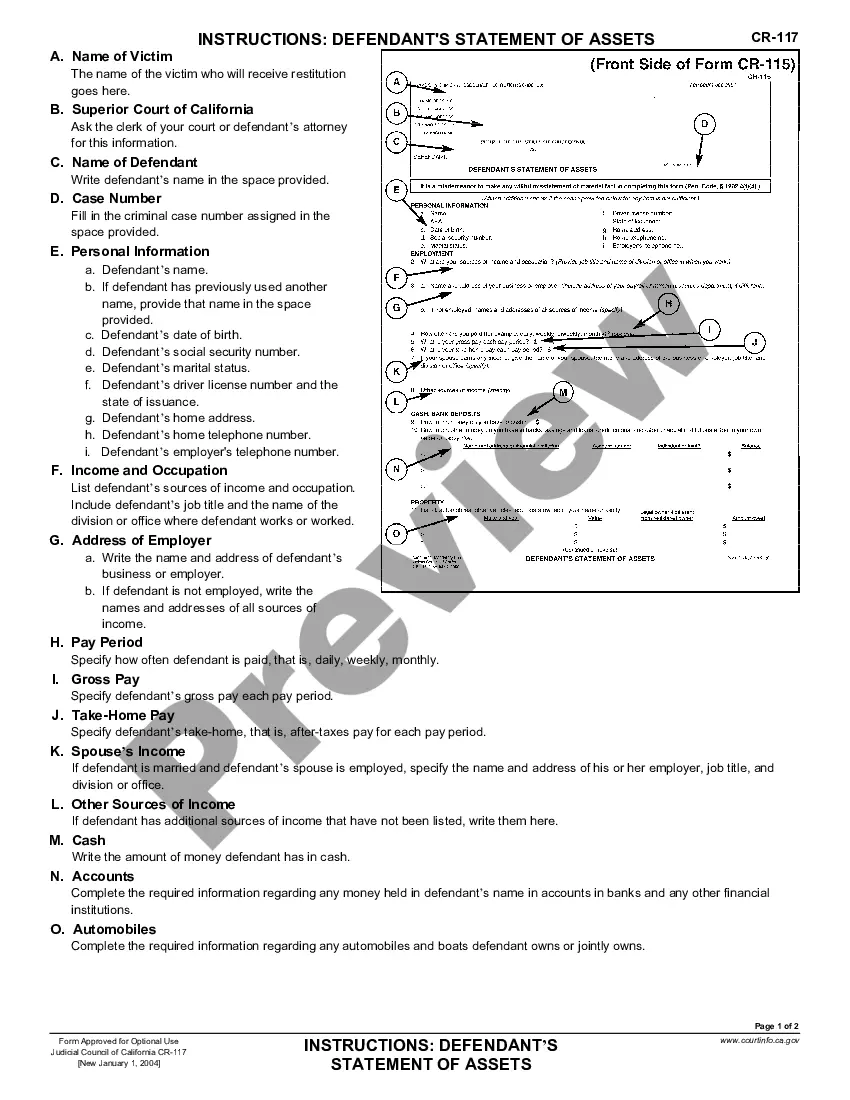

How to fill out Phoenix Arizona Convertible Note Subscription Agreement?

Dealing with legal forms is a necessity in today's world. Nevertheless, you don't always need to seek professional help to create some of them from scratch, including Phoenix Convertible Note Subscription Agreement, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 templates to choose from in various categories varying from living wills to real estate paperwork to divorce documents. All forms are arranged according to their valid state, making the searching process less frustrating. You can also find information resources and guides on the website to make any tasks associated with document execution simple.

Here's how you can purchase and download Phoenix Convertible Note Subscription Agreement.

- Go over the document's preview and description (if available) to get a general information on what you’ll get after downloading the form.

- Ensure that the document of your choice is adapted to your state/county/area since state laws can affect the validity of some records.

- Check the related document templates or start the search over to find the appropriate file.

- Hit Buy now and create your account. If you already have an existing one, select to log in.

- Choose the pricing {plan, then a suitable payment method, and purchase Phoenix Convertible Note Subscription Agreement.

- Choose to save the form template in any offered file format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the appropriate Phoenix Convertible Note Subscription Agreement, log in to your account, and download it. Needless to say, our platform can’t replace an attorney completely. If you have to cope with an exceptionally difficult situation, we advise getting an attorney to examine your form before signing and filing it.

With over 25 years on the market, US Legal Forms proved to be a go-to platform for various legal forms for millions of customers. Join them today and purchase your state-compliant documents with ease!

Form popularity

FAQ

If a startup raises capital on a note and then fails, the investors become creditors and receive their money before any shareholders or creditors who do not have security or statutory preference. Convertible noteholders in these cases are usually always fortunate to get pennies on the dollar.

Effectively this permits an investor to convert the principal amount of their loan (plus any accrued interest) into shares of stock at a discount to the purchase price paid by investors in that round. Discounts range from 0% to as high as 35% with 20% being common.

Effectively this permits an investor to convert the principal amount of their loan (plus any accrued interest) into shares of stock at a discount to the purchase price paid by investors in that round. Discounts range from 0% to as high as 35% with 20% being common.

A convertible note is a short-term debt that eventually converts into equity. Convertible notes operate as loans and are typically issued in conjunction with future financing rounds.

The basic concept for valuing a convertible note is the same in theory as the valuation of any other financial asset. The value of the note is equal to the present value of the future income that the convertible note will receive, discounted to the present value based on its associated risk.

Convertible Note Subscription Agreements means, collectively, those certain subscription agreements to be entered into between the Issuer and the Convertible Note Investors, pursuant to which such Convertible Note Investors will agree to purchase up to $125,000,000 in aggregate principal amount of Convertible Notes in

Convertible notes are just like any other form of debt ? you'll need to pay back the principal plus interest. In an ideal world, a startup would never pay back a convertible note in cash. However, if the maturity date hits prior to a Series A financing, investors can choose to demand their money back.

Key Takeaways. A subscription agreement is an agreement that defines the terms for a party's investment into a private placement offering or a limited partnership (LP). Rules for subscription agreements are generally defined in SEC Rule 506(b) and 506(c) of Regulation D.

Most convertible notes, like other forms of debt, provide that they are due at the maturity date, usually 18 to 24 months. Occasionally, convertible notes will provide that at maturity they automatically convert to equity, or convert to equity at the option of the lender.

What is a discount? To complicate things a little bit, sometimes a SAFE will have a discount. Because the SAFE comes before any investor later on, the SAFE investor might want the SAFE to convert to equity at a discount to the later round of financing. Discounts typically range from 10?30%.