The Clark Nevada Convertible Secured Promissory Note is a legal document used in financial transactions, specifically in the field of corporate finance. It is a debt instrument that outlines the terms and conditions of a loan agreement between the lender and borrower. This note offers a sense of security to both parties involved by stipulating the collateral used to secure the loan amount. Additionally, it provides an option to convert the loan into equity at a later stage, presenting potential benefits to the lender. One type of Clark Nevada Convertible Secured Promissory Note is the Traditional Convertible Secured Promissory Note, which follows the standard structure and provisions commonly found in similar financial agreements. This type is often utilized in various industries, including technology startups, real estate development, and manufacturing ventures. Its terms and conditions typically address repayment schedules, interest rates, default clauses, conversion ratios, and valuation methodologies. Another type of Clark Nevada Convertible Secured Promissory Note is the Real Estate Convertible Secured Promissory Note. This variant caters specifically to the real estate industry, where lenders seek extra security by obtaining a mortgage on the property being financed. This type ensures that, in case of default, the lender has a legal claim to the property, which helps mitigate their potential losses. The Clark Nevada Convertible Secured Promissory Note offers several advantages for both parties. For borrowers, it provides an opportunity to secure funding while potentially allowing them to convert the loan into equity, thereby reducing their immediate financial burden. It also offers the potential for future funding rounds with the same investors. Lenders, on the other hand, have the assurance of collateral, ensuring the potential to recoup their investment in case of default. Additionally, the possibility of converting the debt into equity grants them the potential for future gains if the borrower succeeds and the company's valuation increases. When drafting a Clark Nevada Convertible Secured Promissory Note, it is crucial to enlist the assistance of legal professionals experienced in corporate finance and securities law. They can help ensure that the note accurately reflects the intentions of the parties involved and complies with all relevant regulations. By carefully considering the terms and conditions, both the lender and borrower can reach an agreement that suits their specific needs and requirements, fostering a positive and mutually beneficial financial relationship.

Clark Nevada Convertible Secured Promissory Note

Description

How to fill out Clark Nevada Convertible Secured Promissory Note?

A document routine always goes along with any legal activity you make. Creating a business, applying or accepting a job offer, transferring ownership, and lots of other life situations require you prepare formal documentation that varies from state to state. That's why having it all collected in one place is so beneficial.

US Legal Forms is the largest online library of up-to-date federal and state-specific legal templates. On this platform, you can easily find and download a document for any personal or business objective utilized in your county, including the Clark Convertible Secured Promissory Note.

Locating templates on the platform is extremely simple. If you already have a subscription to our service, log in to your account, find the sample through the search bar, and click Download to save it on your device. Afterward, the Clark Convertible Secured Promissory Note will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this quick guideline to get the Clark Convertible Secured Promissory Note:

- Make sure you have opened the proper page with your localised form.

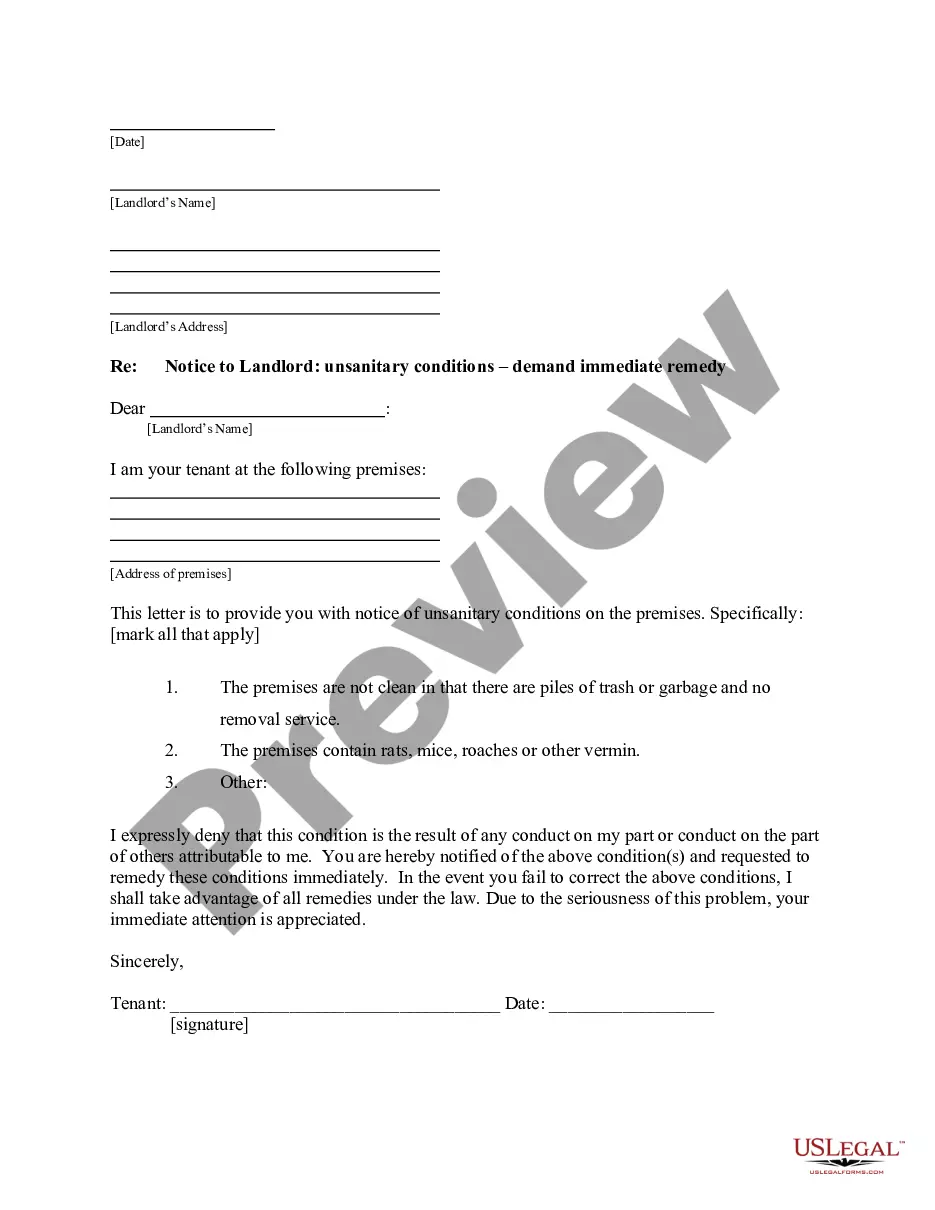

- Make use of the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the template satisfies your requirements.

- Look for another document via the search tab if the sample doesn't fit you.

- Click Buy Now once you locate the necessary template.

- Decide on the appropriate subscription plan, then sign in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and save the Clark Convertible Secured Promissory Note on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most reliable way to obtain legal documents. All the templates available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs effectively with the US Legal Forms!